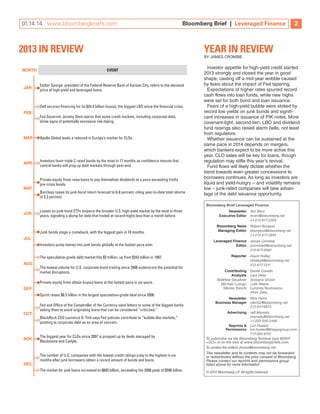

The document reviews the leveraged finance market of 2013, highlighting the significant growth in junk bonds and loans, with the speculative-grade debt market reaching $2 trillion. It notes concerns about risk-taking in credit markets and warns of potential high-yield bubbles due to record-low yields and increased issuance of risky debt. The outlook for 2014 indicates expectations for continued strong demand for leveraged loans, although the ability to sustain high issuance levels may depend on mergers and regulatory impacts.

![01.14.14 www.bloombergbriefs.com

Bloomberg Brief | Leveraged Finance

7

2014 OUTLOOK

Diversify, Be Nimble as Borrower-Friendly Terms Persist: Investors, Bankers

Diversification, risk retention and a low default rate are among the top themes for 2014, say investors and bankers. M&A is expected

to make a comeback, fuelling financing opportunity from LBOs. The trend toward increasingly borrower-friendly deal terms gives some

investors cause for concern. While some market watchers welcome the prospect of an uncharacteristically boring year for high-yield

bonds, others say that the speed and extent of Fed tapering is a macro wild card. They spoke to Bloomberg Brief’s David Holley in December. Comments have been edited and condensed.

Dan Roberts

Kevin Lockhart

John Fraser

Dan Roberts

MacKay Shields

Head of Global Fixed Income, CIO

“2014 will need to be the year of

diversification. Many strategies are too

concentrated in duration risk and too

constrained by benchmarks to adapt.

On the margin we favor high-yield bonds

over loans. We expect issuance in high

yield to decline in 2014. Issuance in the

loan market is likely to meet or even exceed 2013 levels given the high demand

for floating rate investments.”

Kevin Lockhart

Jefferies

Co-Head of Leveraged Finance

“The issuers that won’t be able to get the

covenant-light loans – the more difficult

credits – will probably have to go to the

bond market to get financing. Those are

likely to be the 10, 11 percent deals. The

loan market is going to continue to be

strong, but it will not finance all companies. The demand for high yield will still be

there for public companies and CFOs are

saying, “Why would I not do high yield at

record low interest rates?””

.

John Fraser

3i Debt Management U.S.

Managing Partner

“The trend toward increasingly borrowerfriendly deal terms, both in terms of

economics, credit agreement terms, and

capital structures is one of the things

I spend the most time worrying about.

Beyond that, it’s a lack of visibility on new

money, new issue deal flow. Right now it’s

hard to tell what kind of volume we’ll see

on the true new money side of the market

place. Next to overall credit quality, that’s

Beth MacLean

Kevin Sherlock

Ann Benjamin

Beth MacLean

Pimco

Loan Portfolio Manager

“Risk retention is going to be one of the

biggest stories. As long as there is excess

demand in the market, you’ll continue to

see cov-lite, second-lien loans, six month

call protection. We’ll continue to see

second-lien issuance because there is demand and it won’t just be from the CLOs.

When you’re in a low-default, strong credit

fundamental environment, a lot of investors are willing to take more risk and move

into that second-lien space.”

Kevin Sherlock

Deutsche Bank

Head of U.S. loans and High-Yield

Capital Markets

“High-yield investors are a bit more

tactical, more short duration than long

duration and that’s why we’re also seeing a massive amount of inflows into the

leveraged loan market as some protection

against a rising rate environment. [This

year] feels like it’s going to be a lot like

[2013], which was pockets of instability as

you go through macroeconomic numbers

and what happens with the taper.”

Ann Benjamin

Neuberger Berman

HIgh-Yield Bond, Leveraged Loan

Lead Portfolio Manager

“Defaults are going to stay low. If you

look at what’s going to mature in 2014 and

2015: In 2014 it’s $37 billion. In 2015, it’s

$66 billion. Keep in mind that the market

is roughly $1.5 trillion. Where you would

see the potential higher risk of higher default rates is in the smaller companies and

middle market companies that are used to

financing in the high-yield bond market.”](https://image.slidesharecdn.com/levfinanceyearend2013print-140115130313-phpapp01/85/Leveraged-Finance-Annual-Review-Outlook-2014-7-320.jpg)