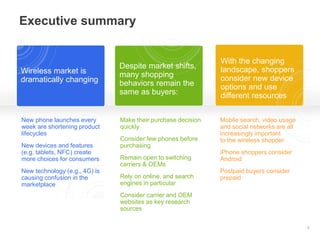

This document summarizes key findings from a study of online mobile device shopping behavior. Some of the main findings include:

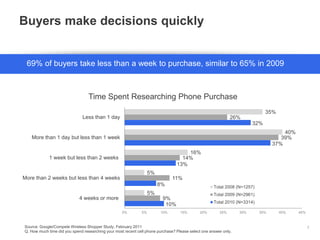

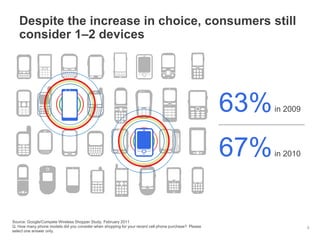

1) Despite a rapidly changing mobile landscape, many shopping behaviors remain the same, such as buyers making purchase decisions quickly after limited research and consideration of only 1-2 devices.

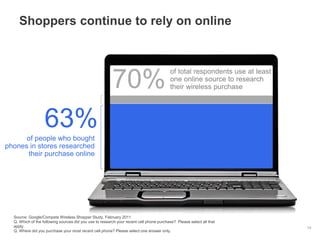

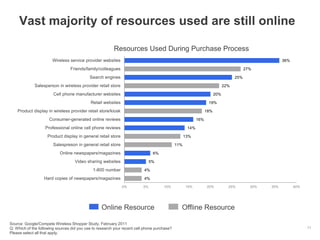

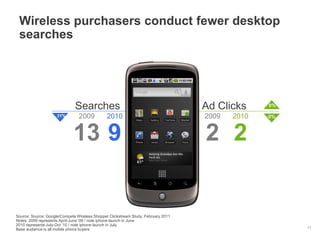

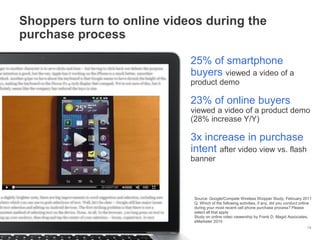

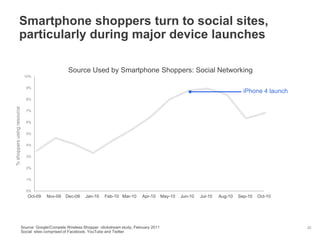

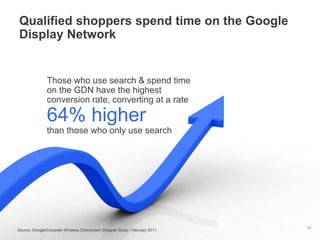

2) While online resources remain important to shoppers, they are increasingly using mobile devices and social media during their research.

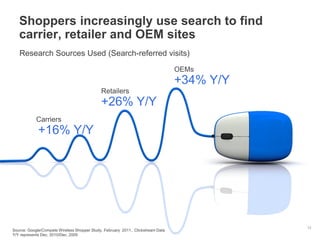

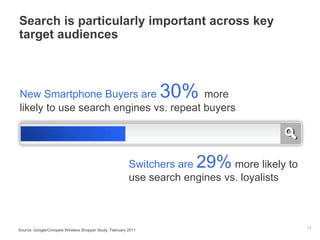

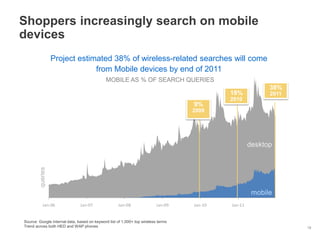

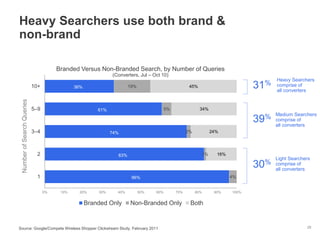

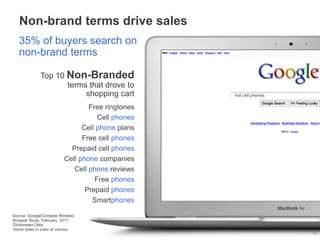

3) Search engines play a vital role throughout the purchase process, with search queries coming more from mobile. Non-branded search terms also drive in-store traffic and sales.

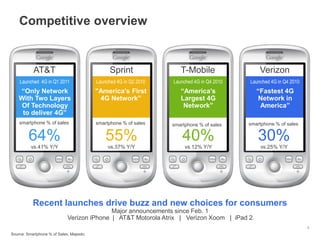

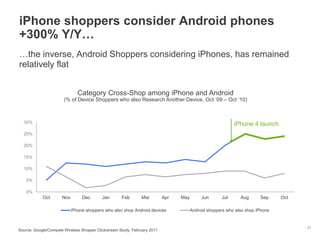

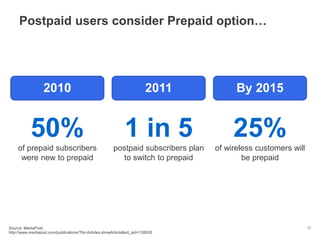

4) The market is seeing more cross-shopping between platforms as choices expand, such as iPhone shop