This document provides a summary of updates to the 2014 Form 5500 filing requirements, including:

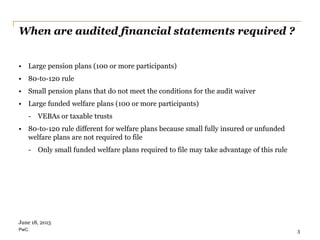

- Audited financial statements are required for plans with 100 or more participants and some small plans that do not meet audit waiver conditions.

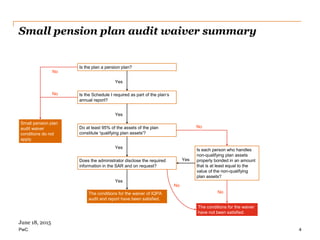

- Small pension plans may qualify for an audit waiver if certain conditions are met, including that at least 95% of assets are qualifying plan assets and any persons handling non-qualifying assets are properly bonded.

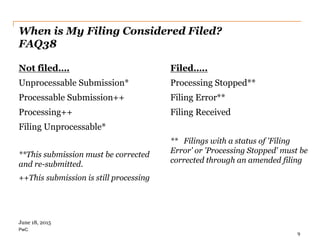

- Filers should check the status of their Form 5500 submission on the EFAST2 website after filing to ensure it was accepted. Amended filings may be required if errors are found.