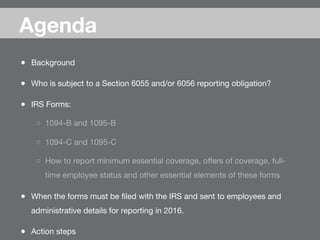

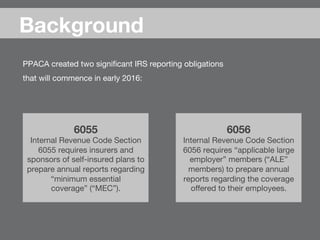

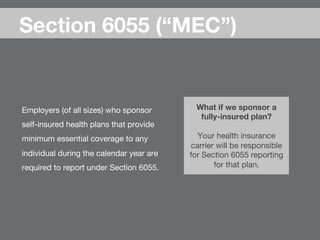

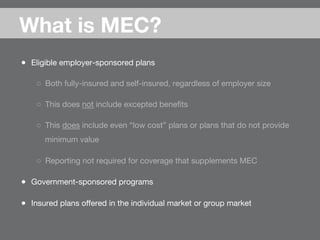

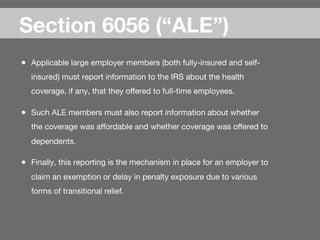

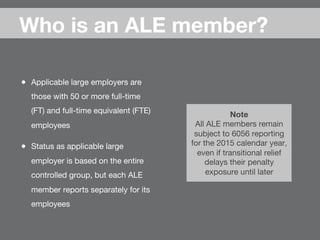

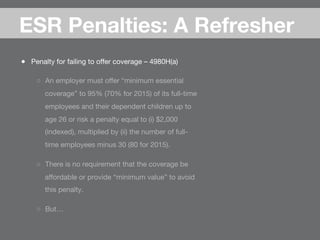

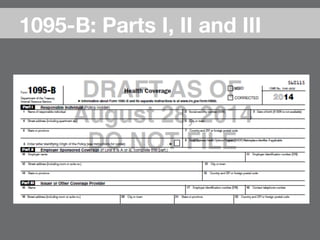

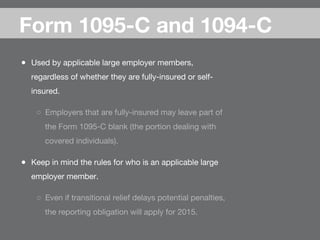

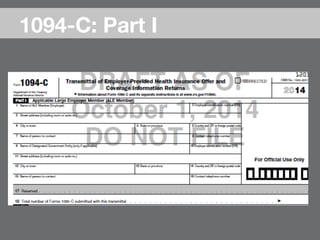

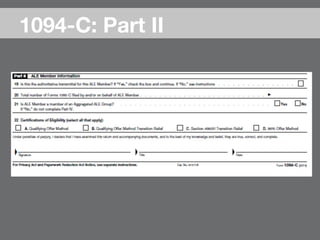

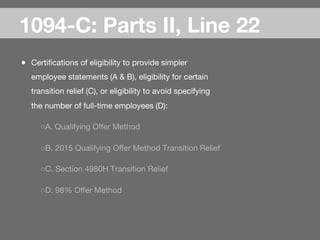

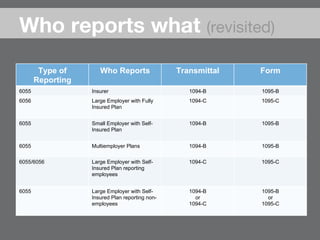

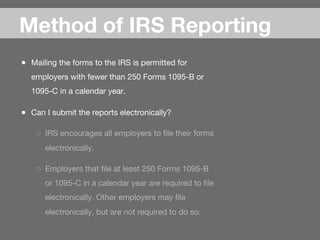

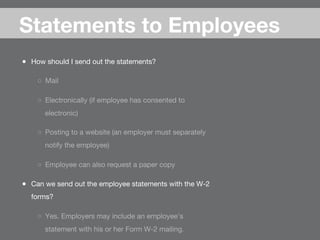

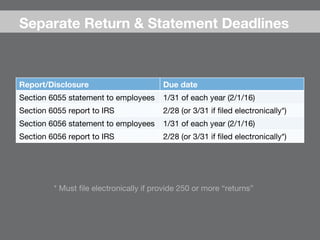

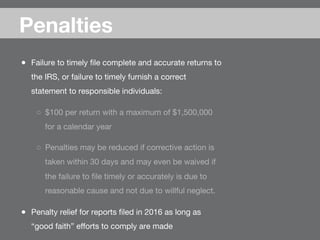

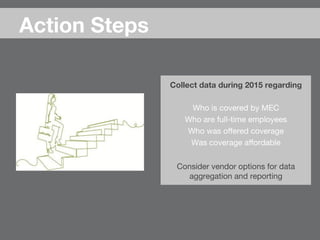

The document outlines IRS reporting obligations under sections 6055 and 6056 for employers regarding minimum essential coverage (MEC) and applicable large employers (ALE) starting in early 2016. It details the types of entities required to report, reporting mechanisms, penalties for non-compliance, and deadlines for filing with the IRS and providing statements to employees. Additional information is provided on the forms used for reporting, the responsibilities of insurers, and resources for compliance.