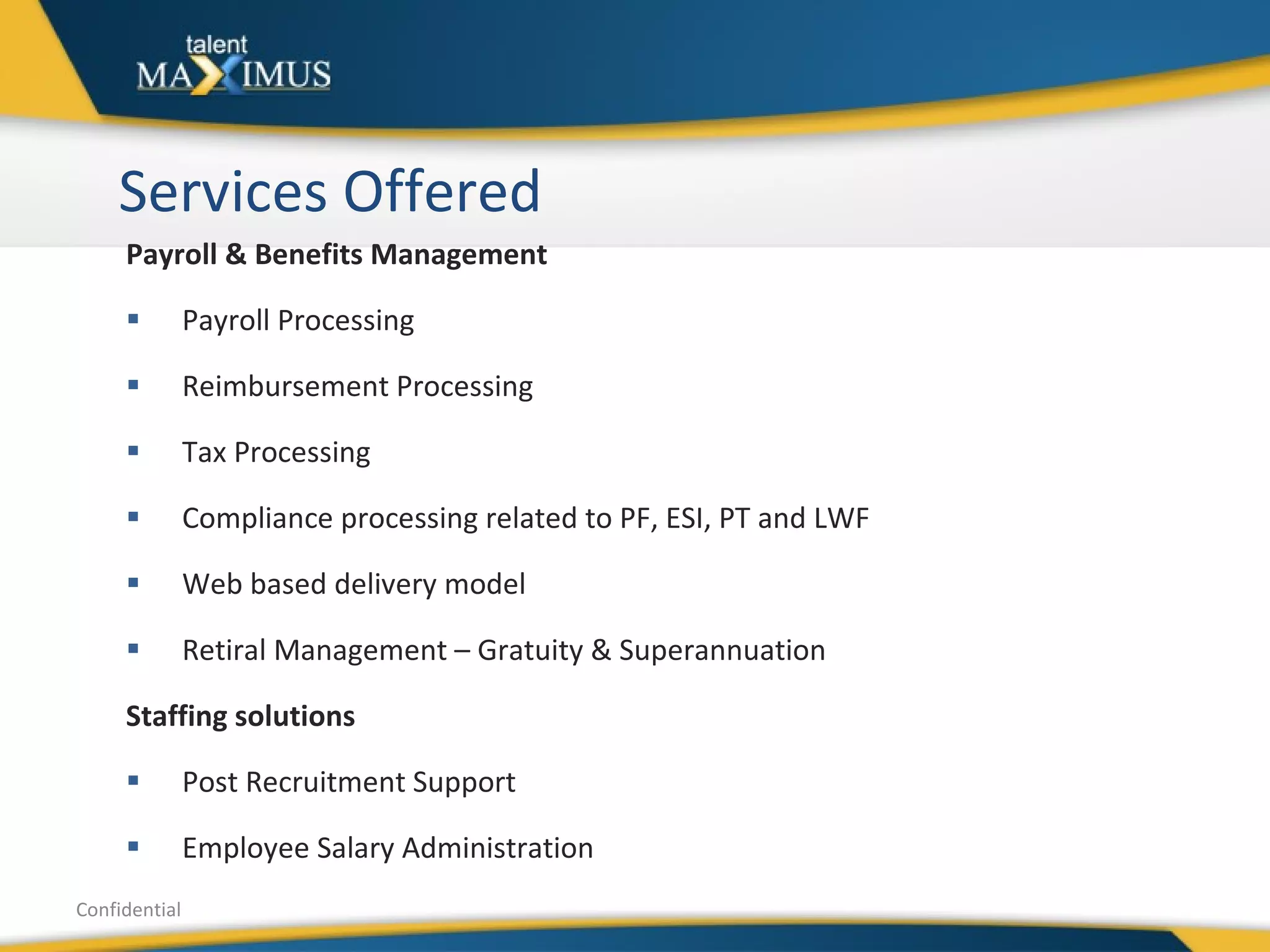

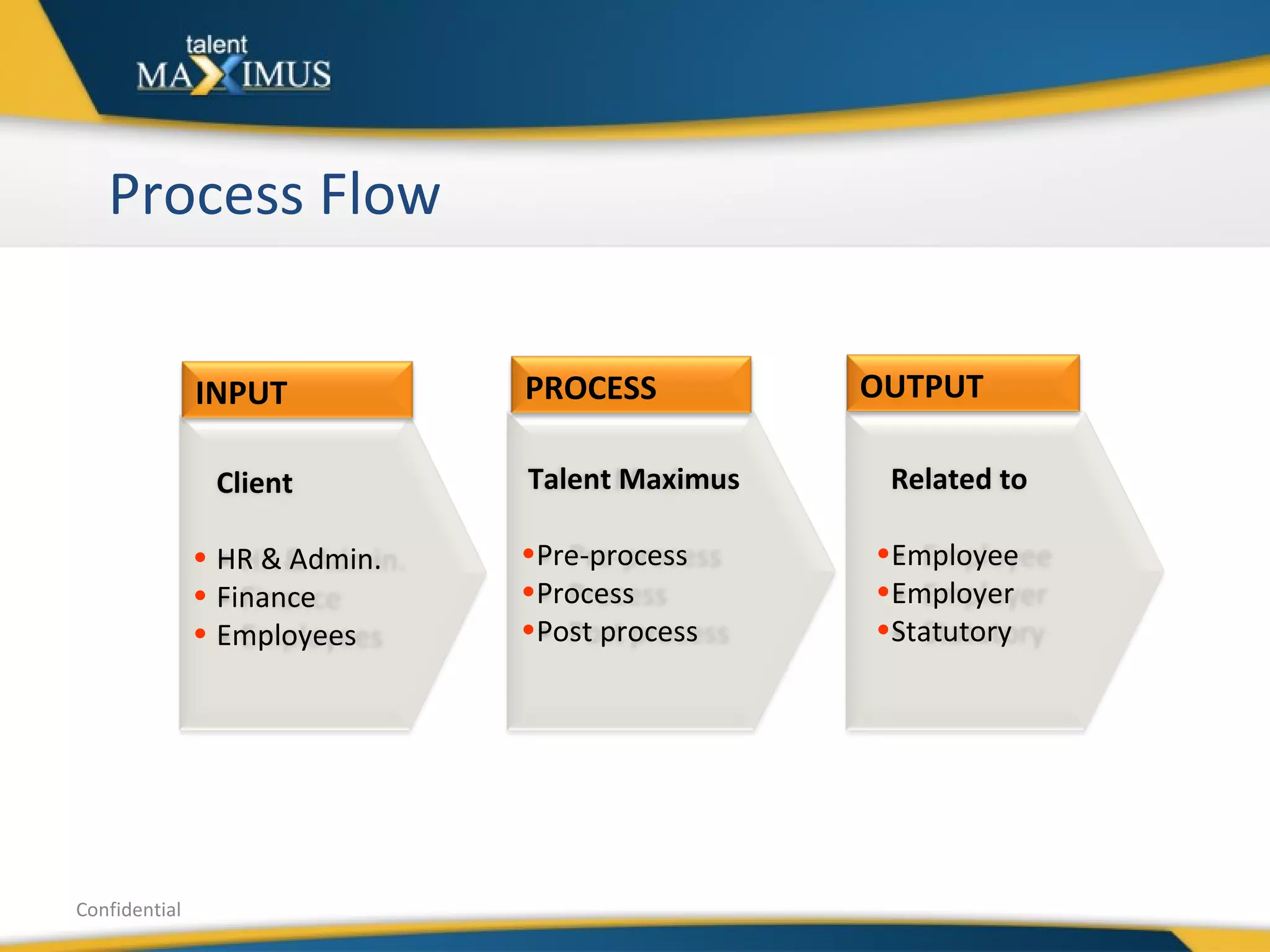

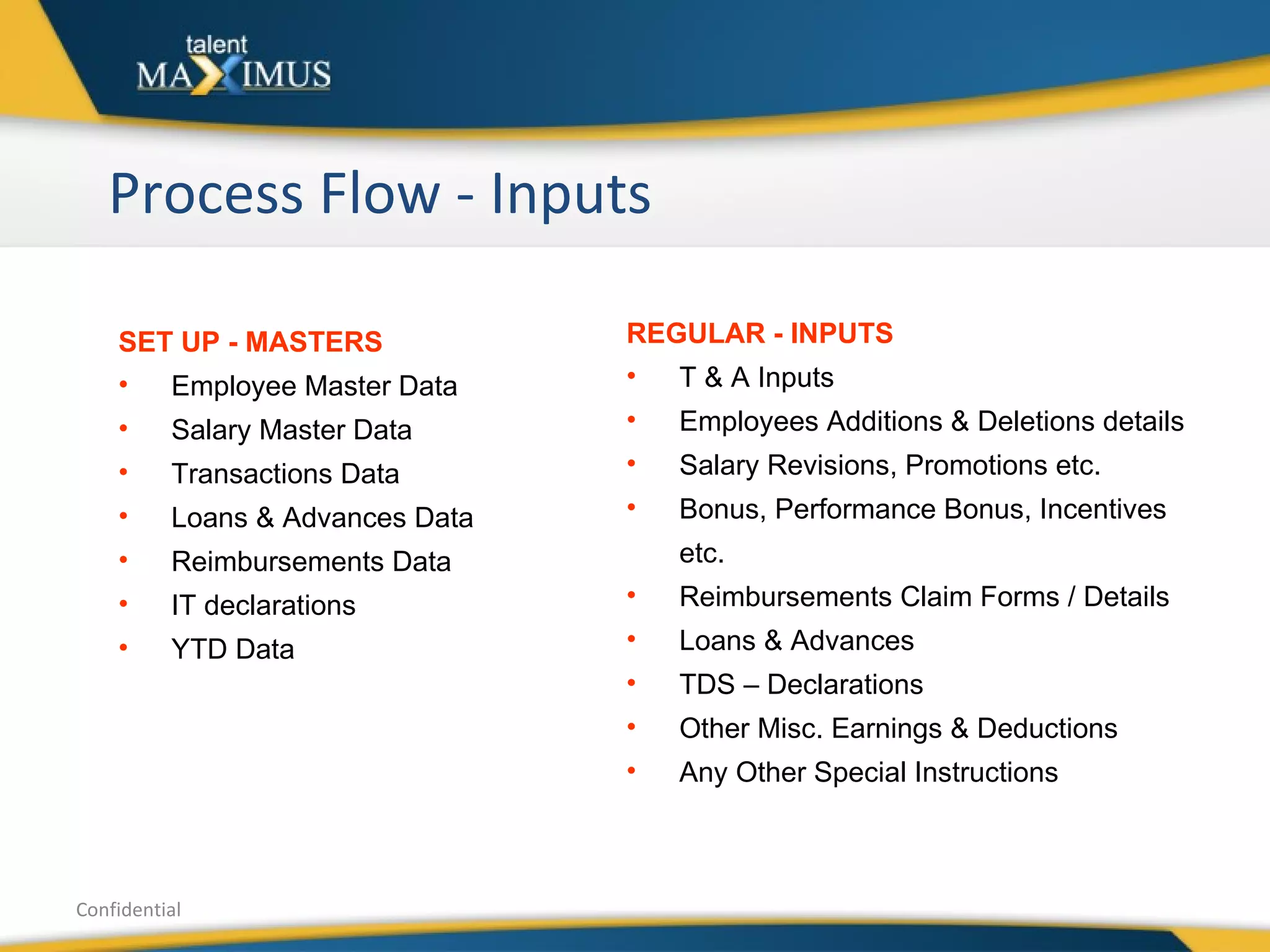

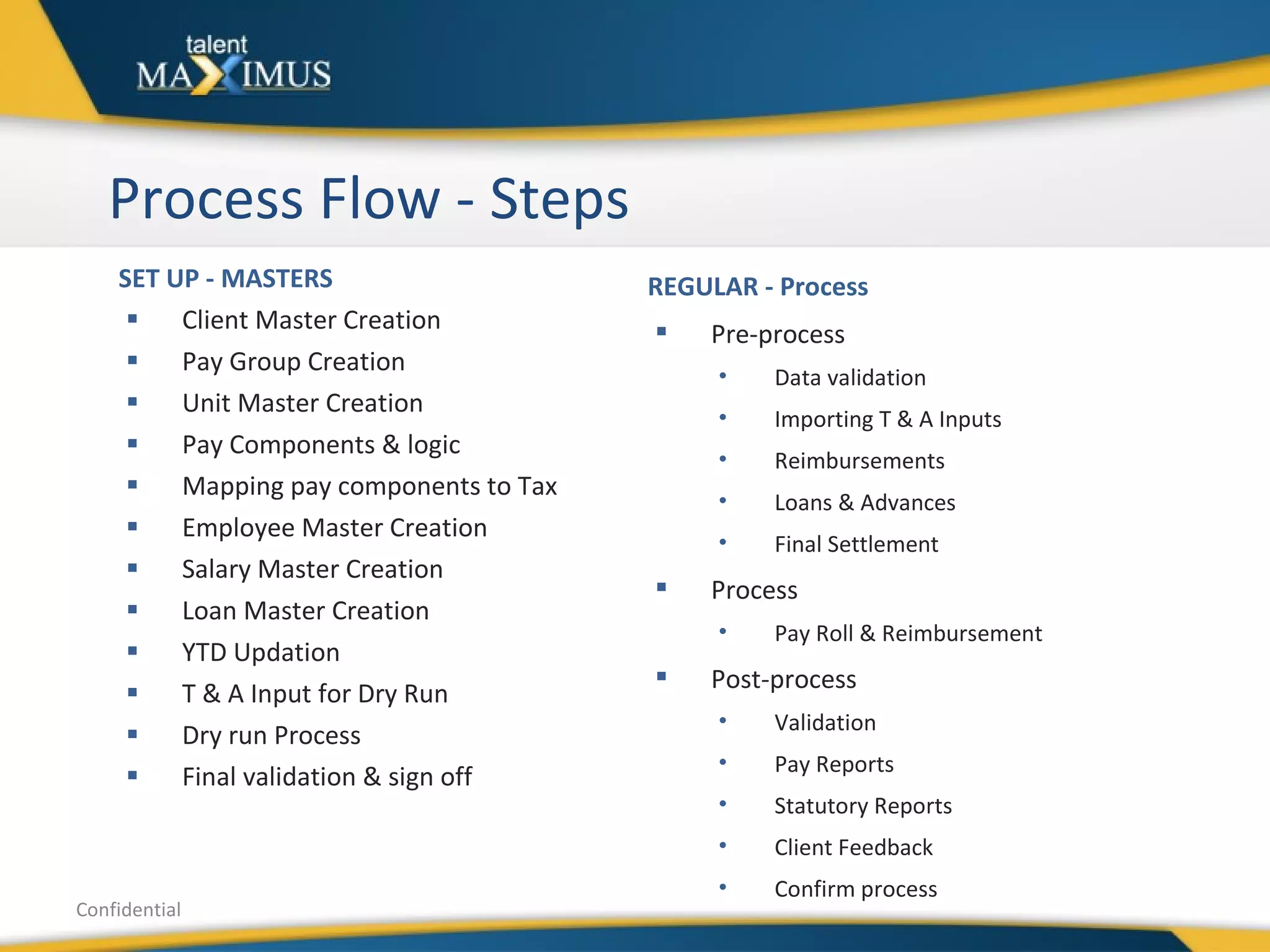

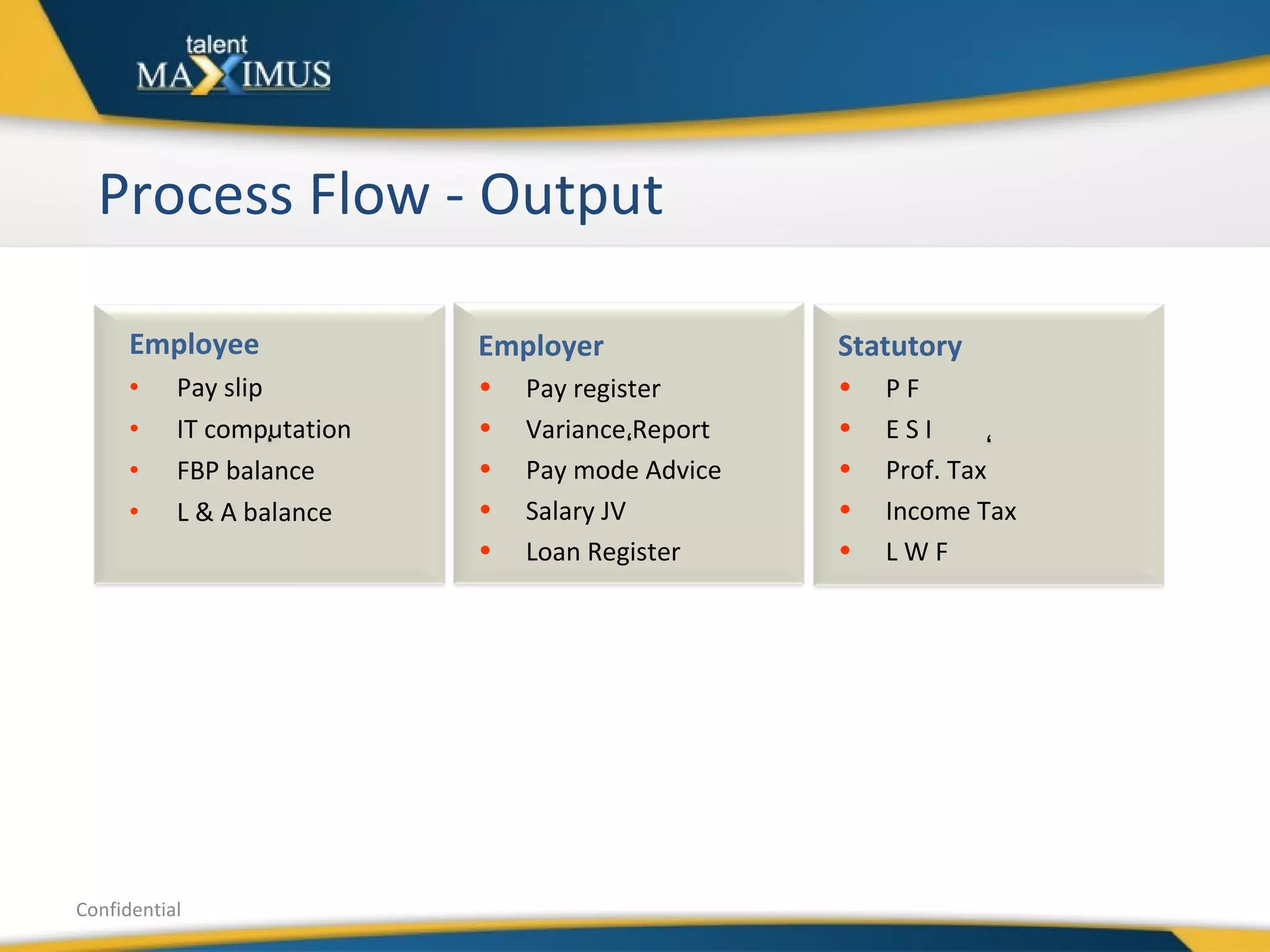

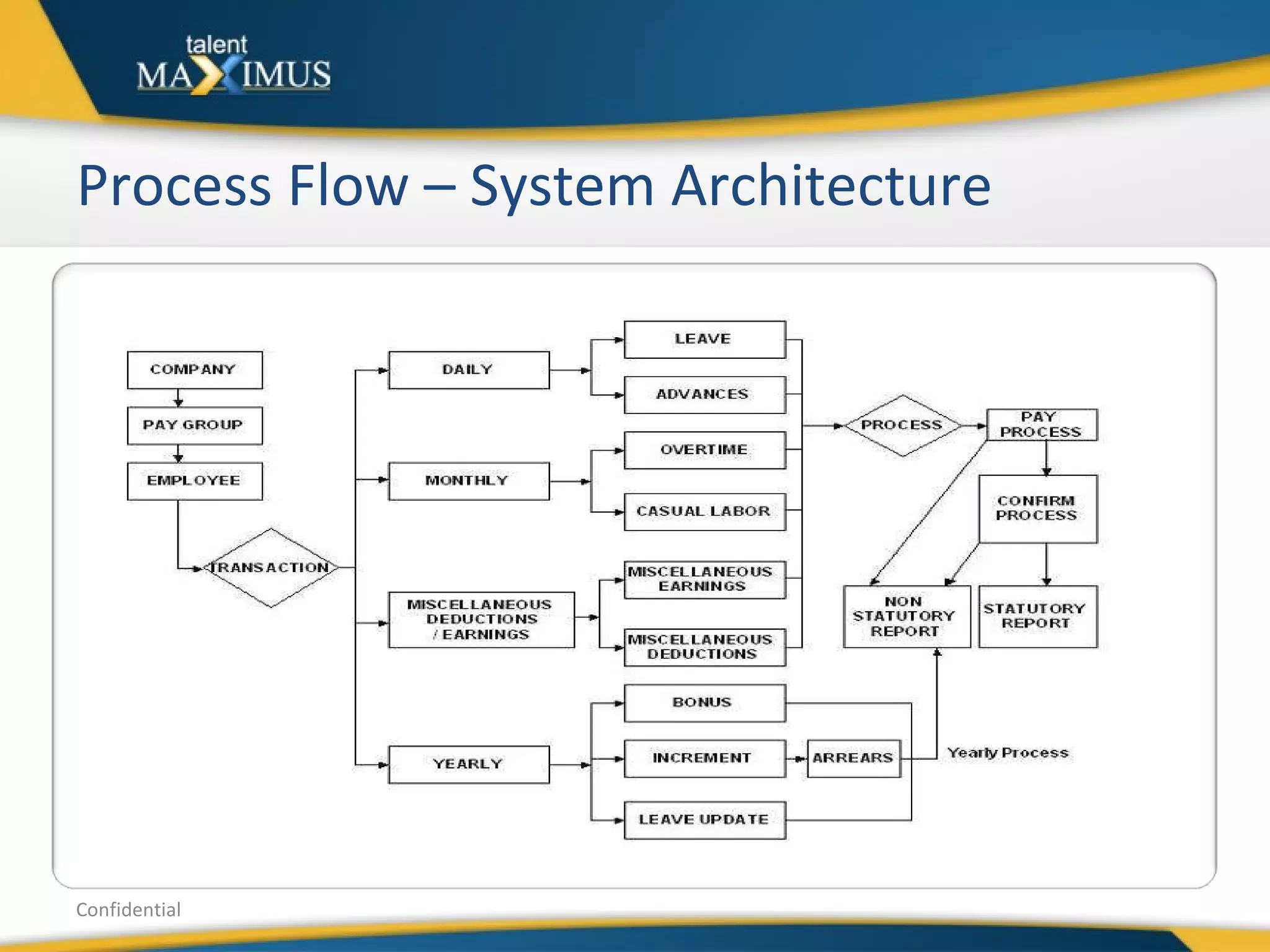

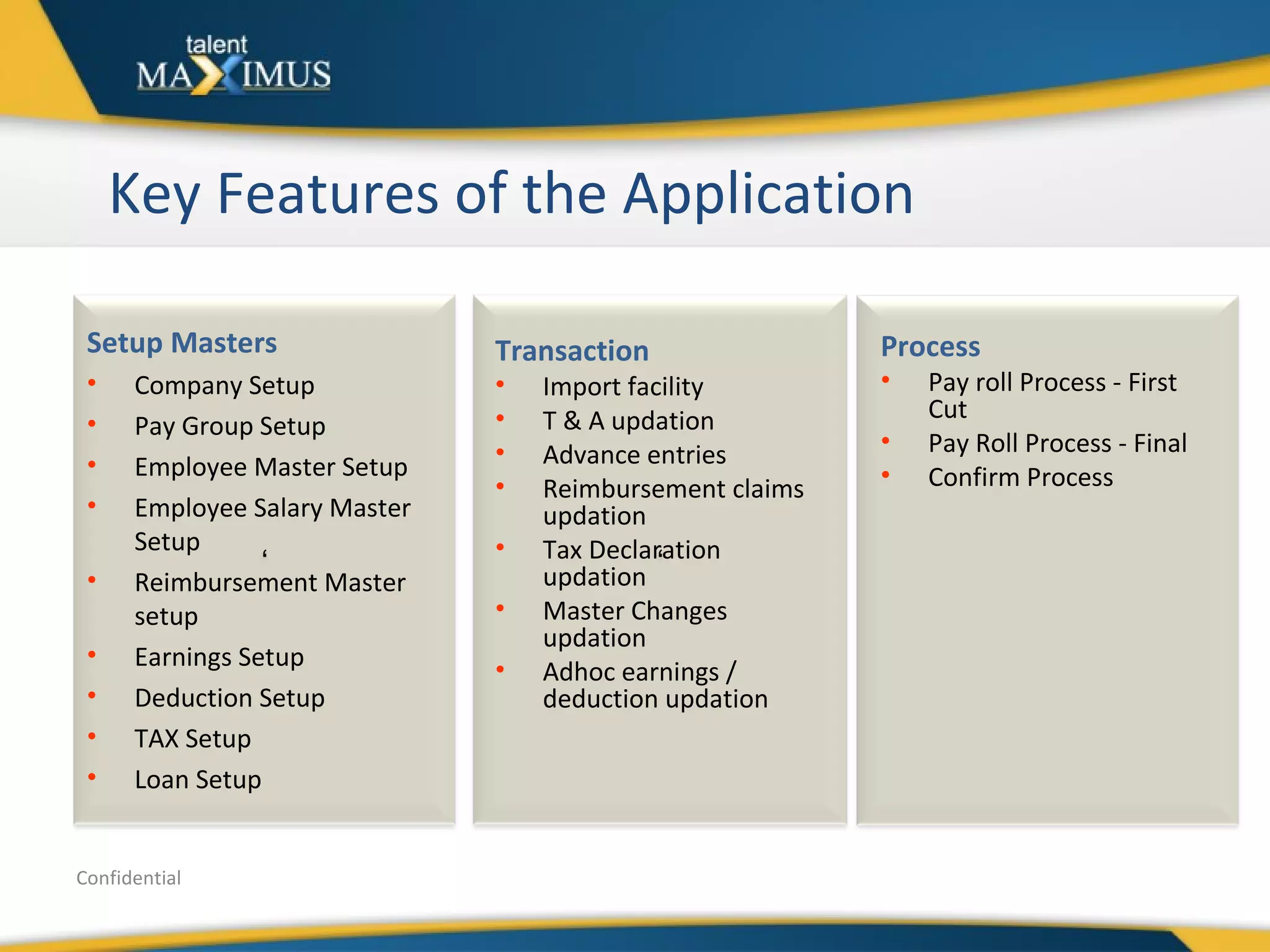

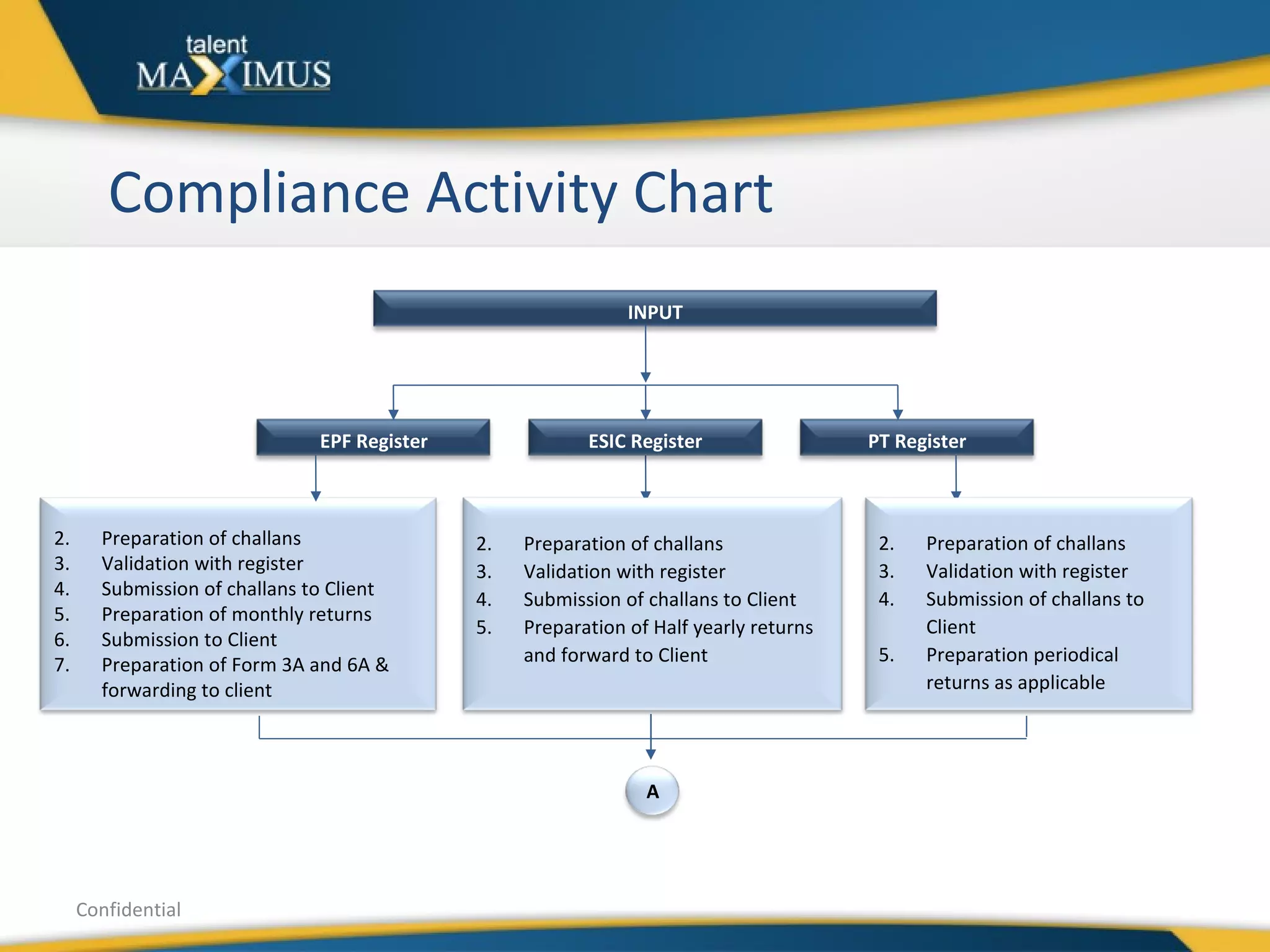

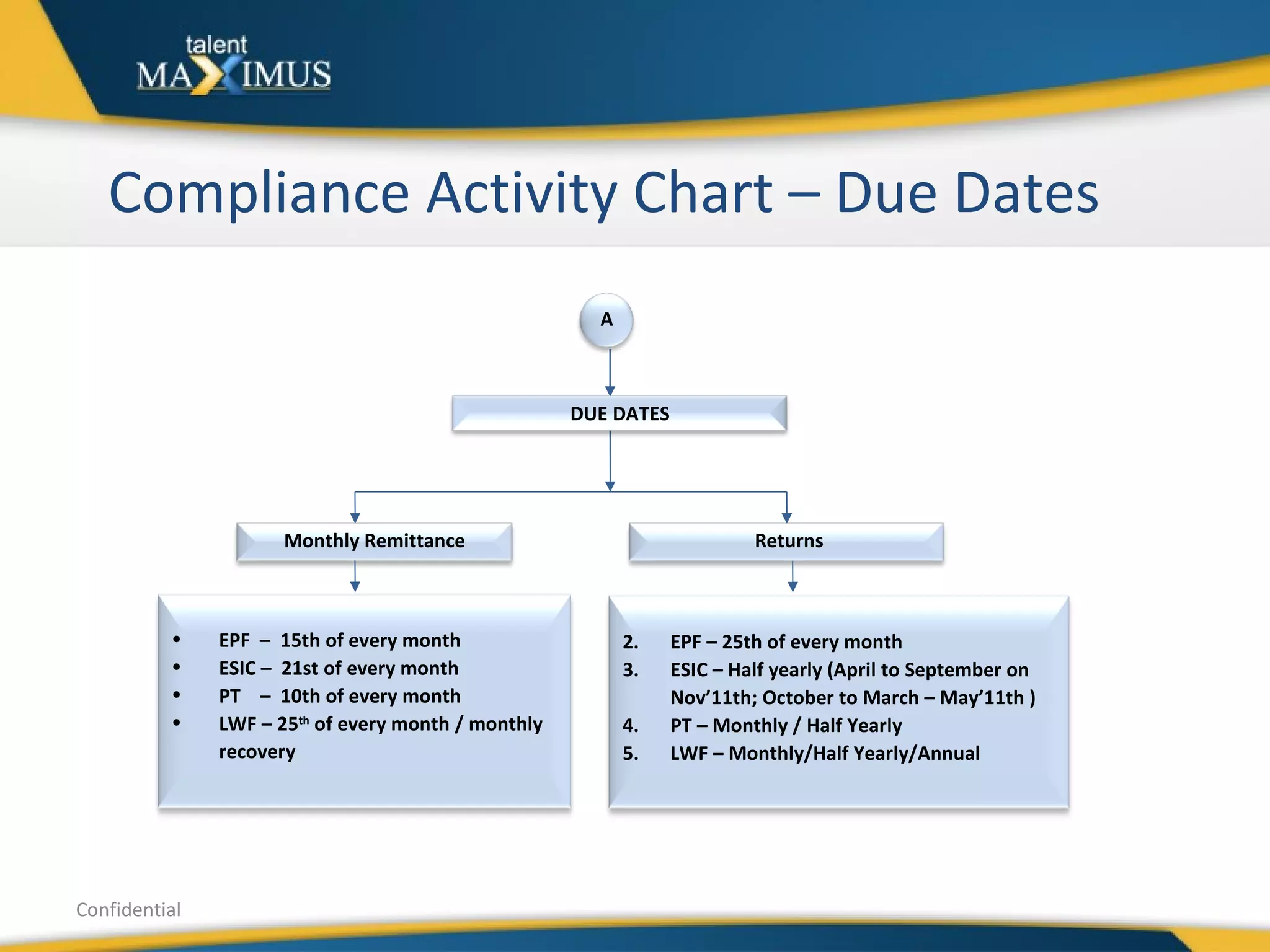

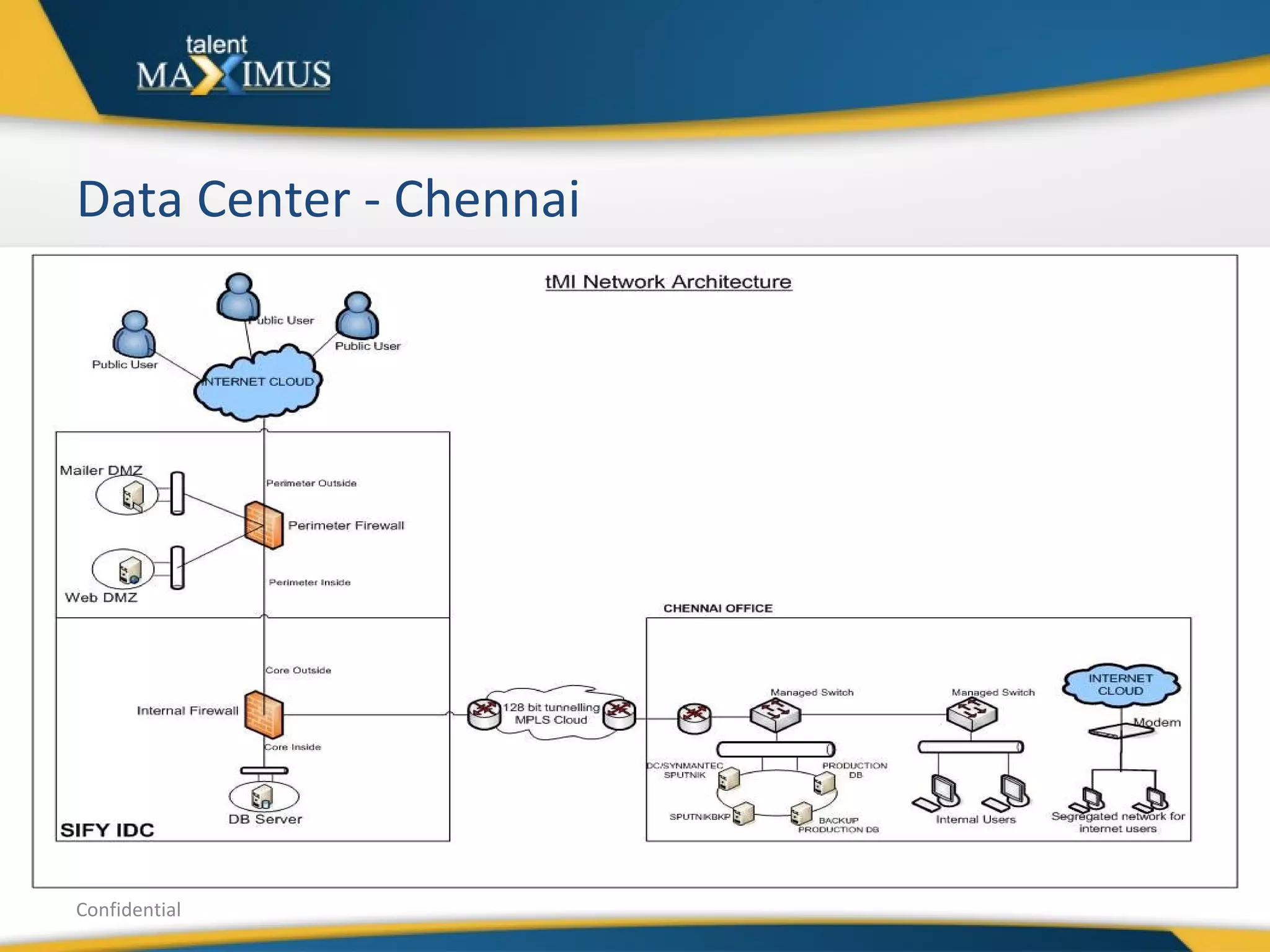

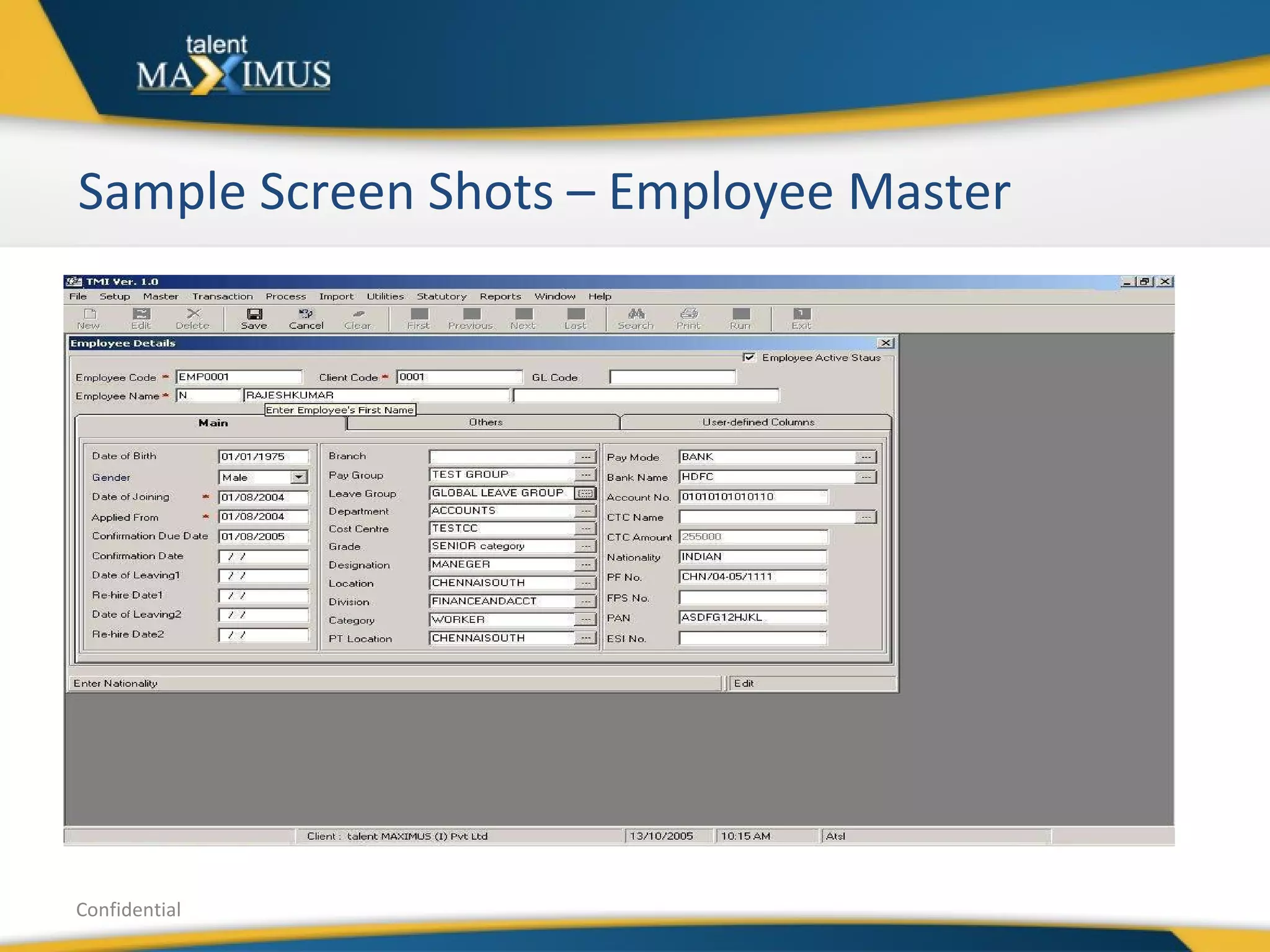

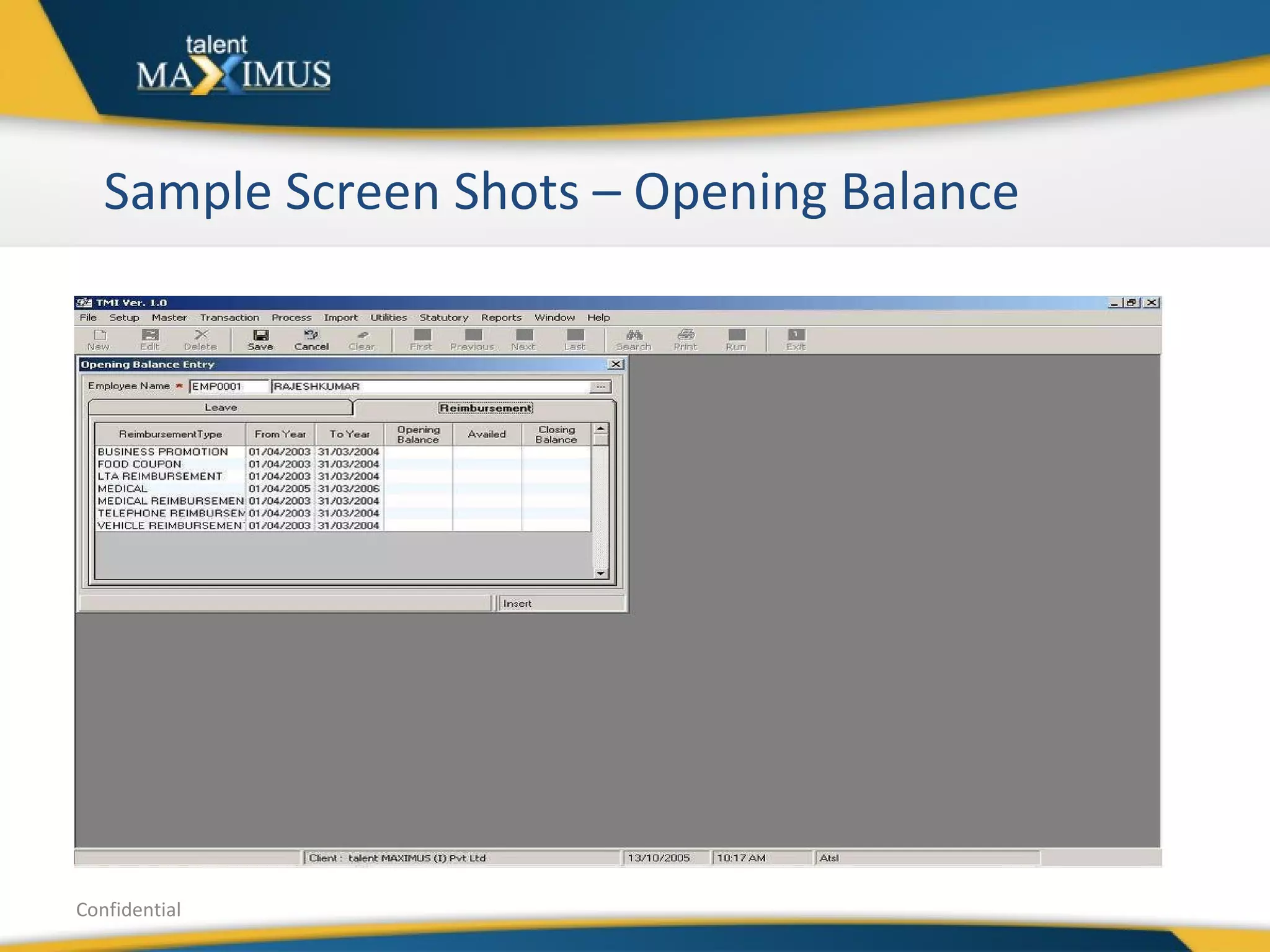

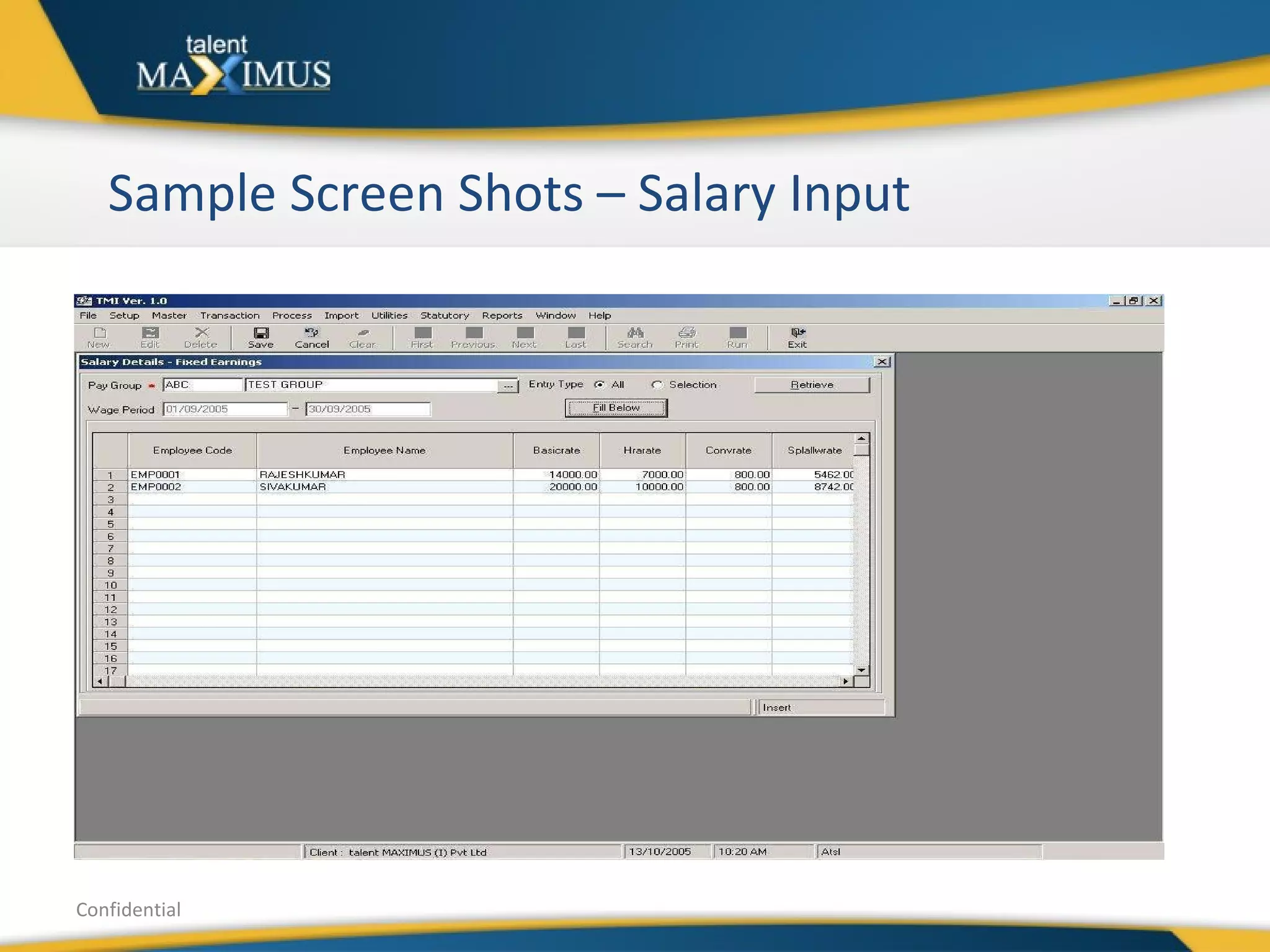

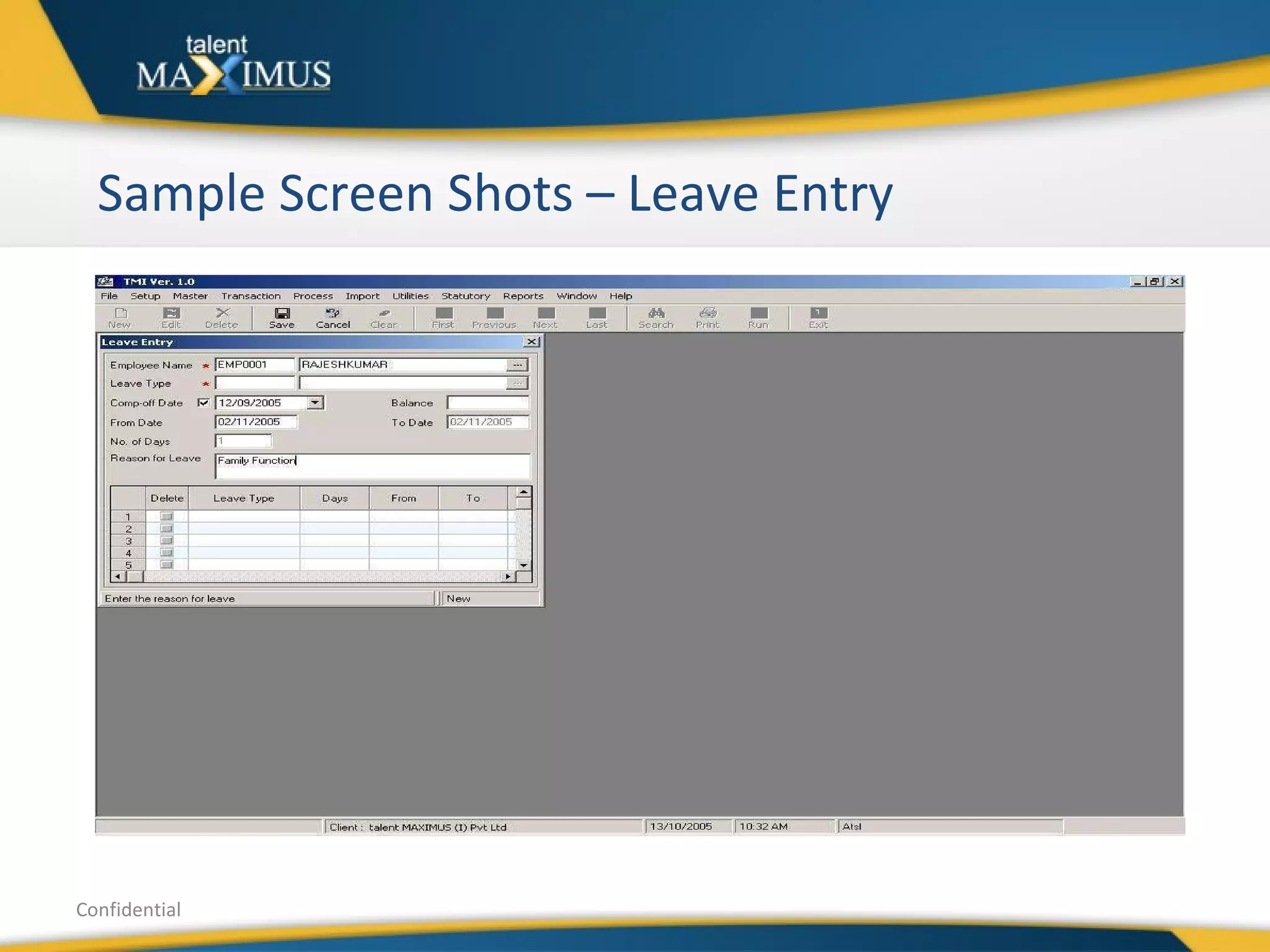

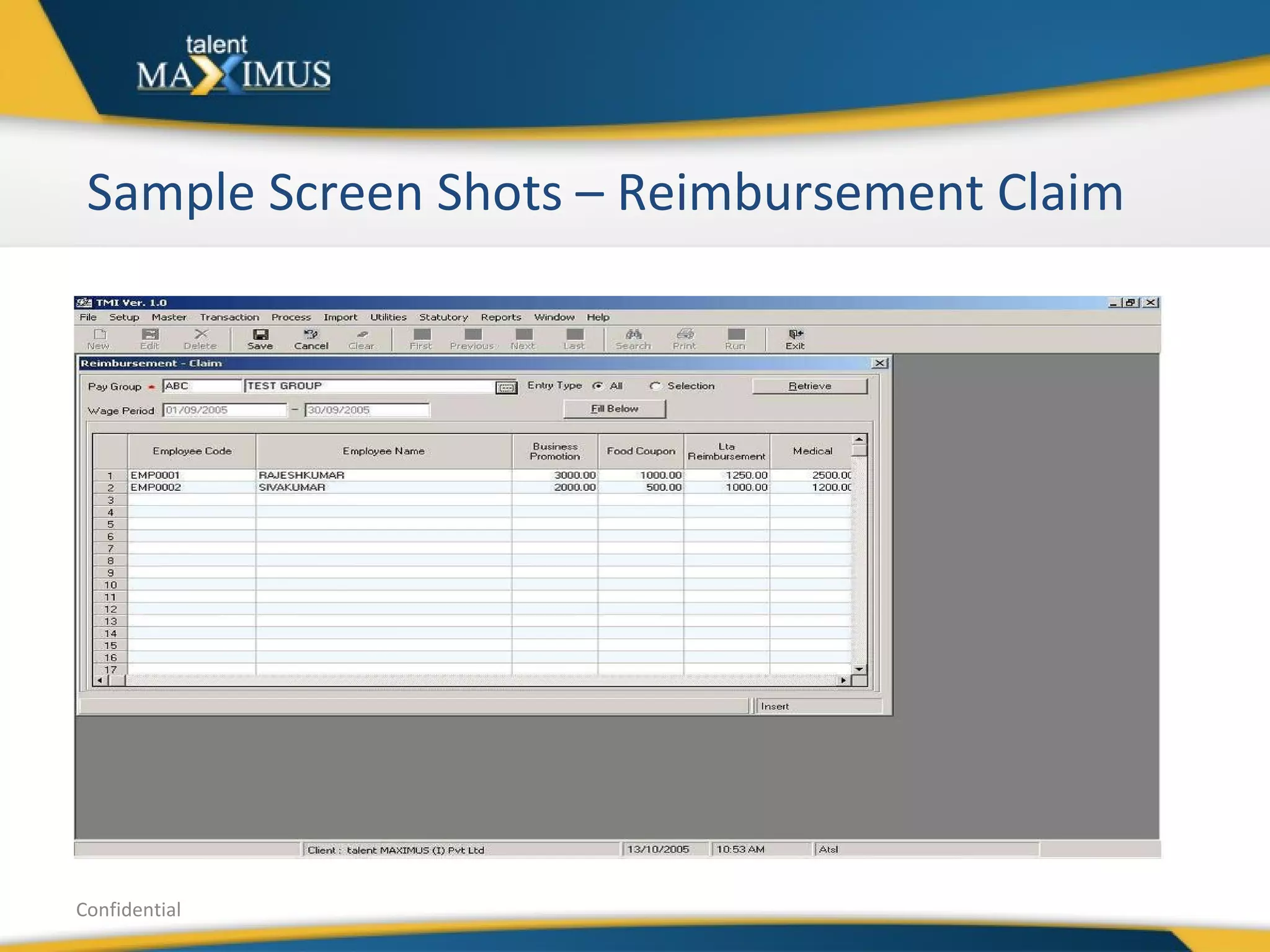

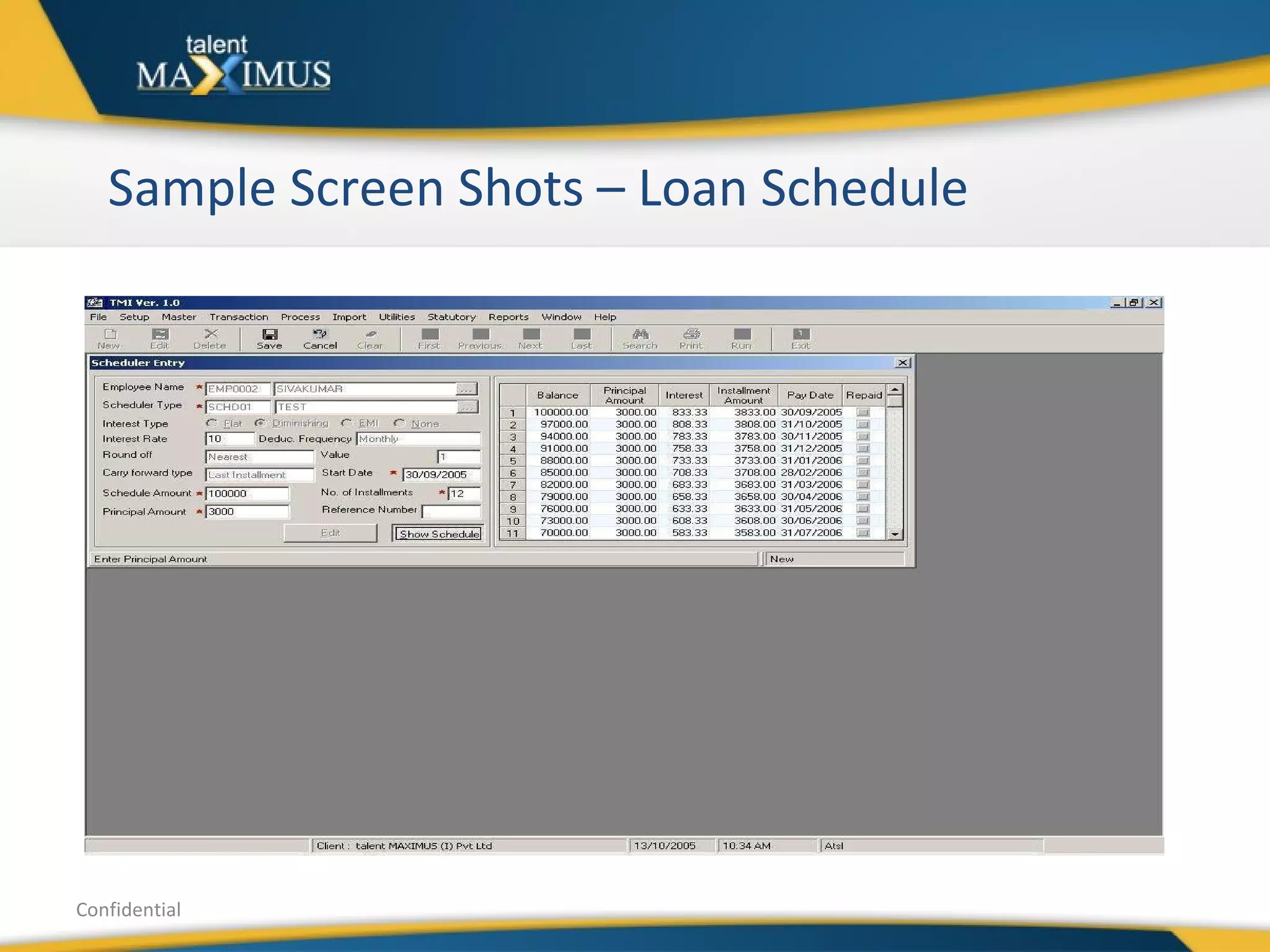

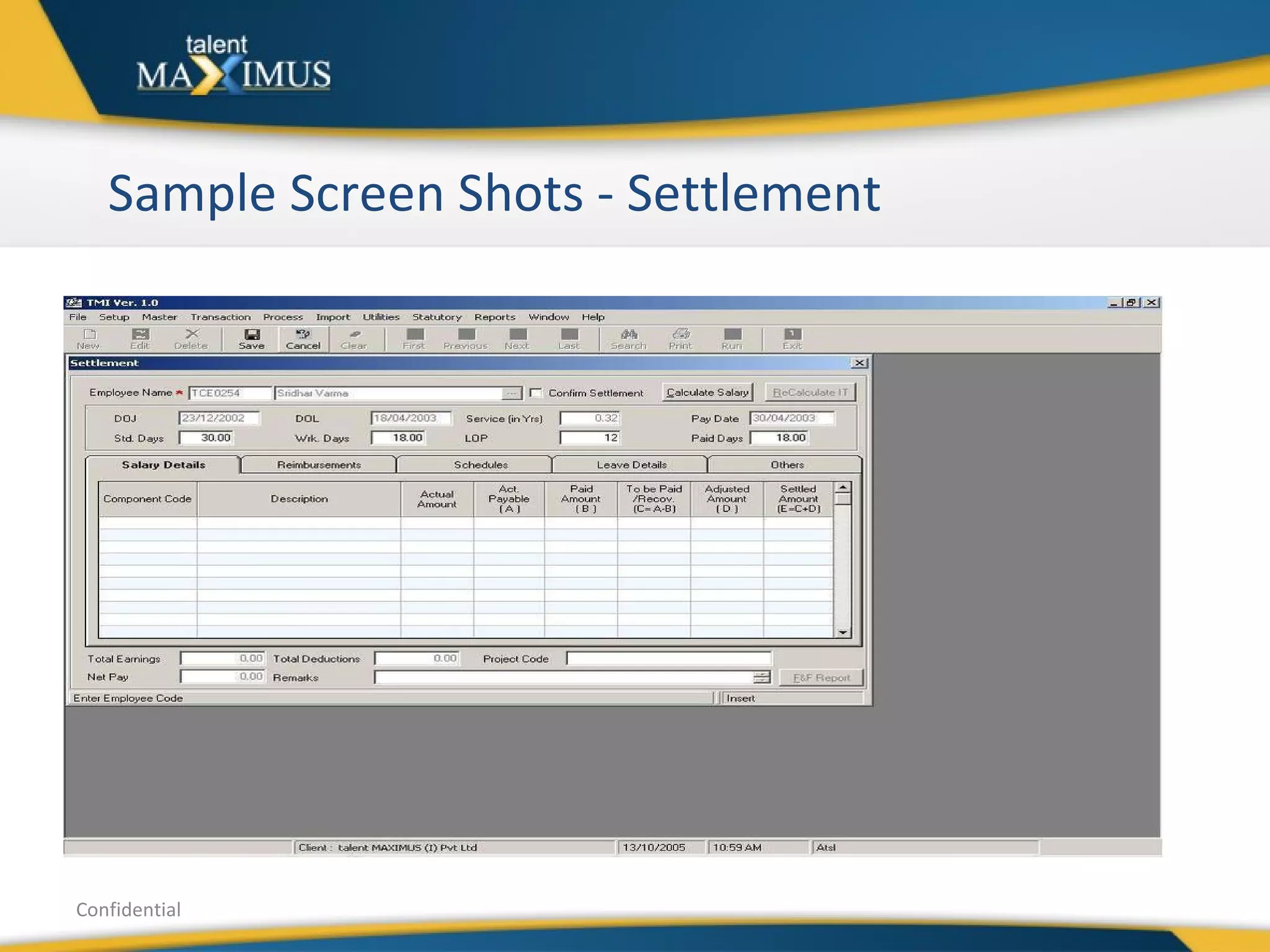

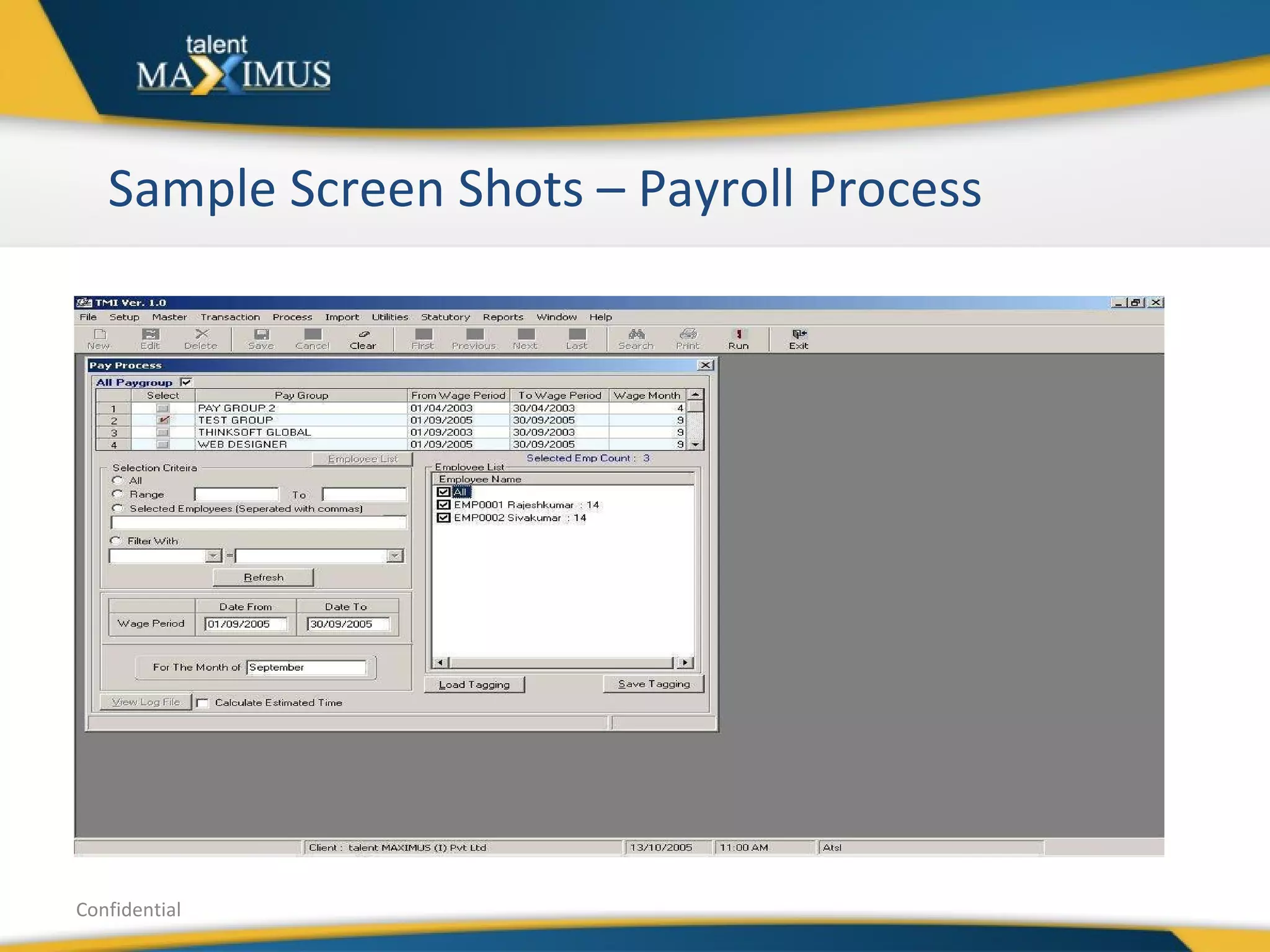

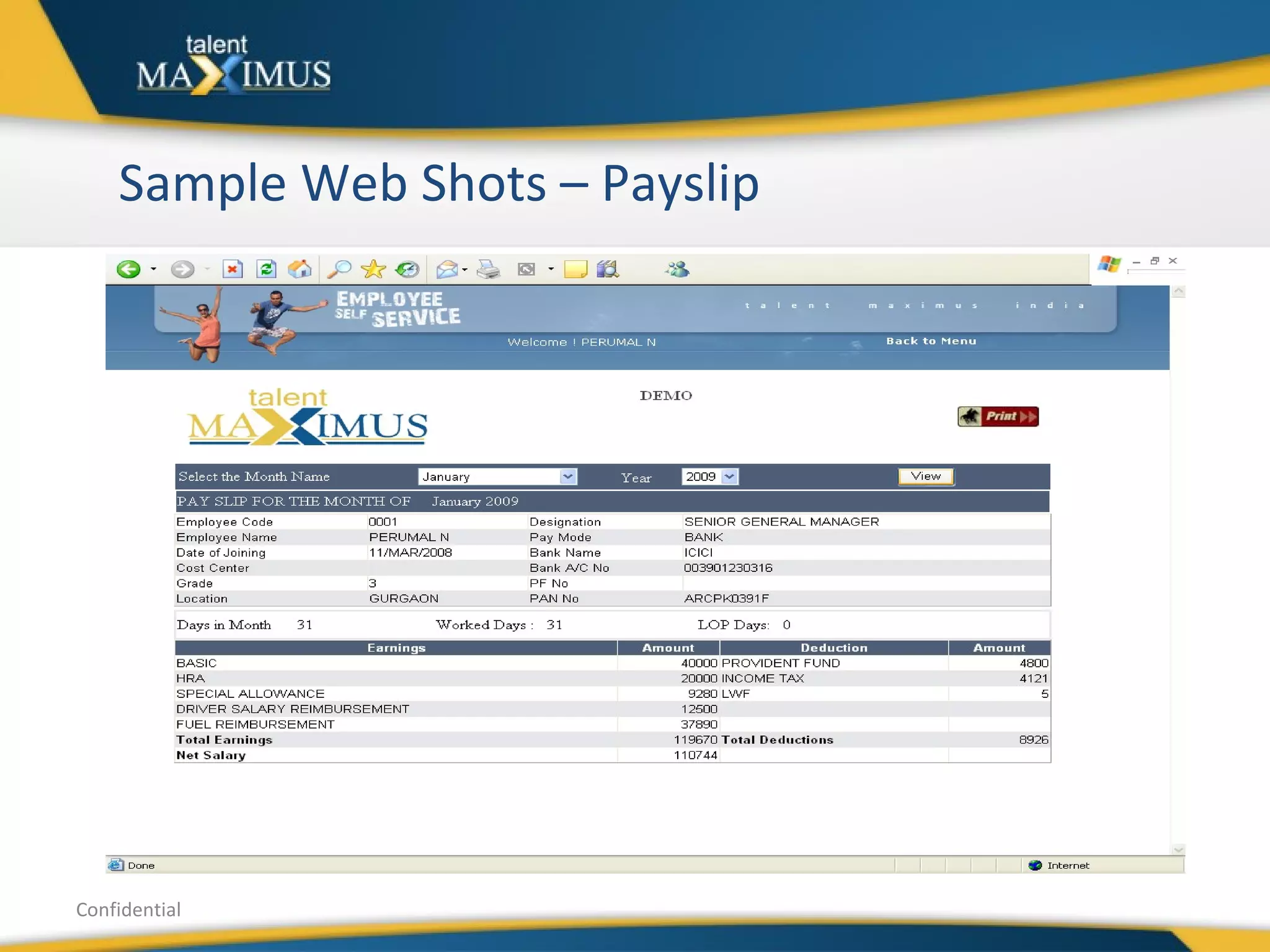

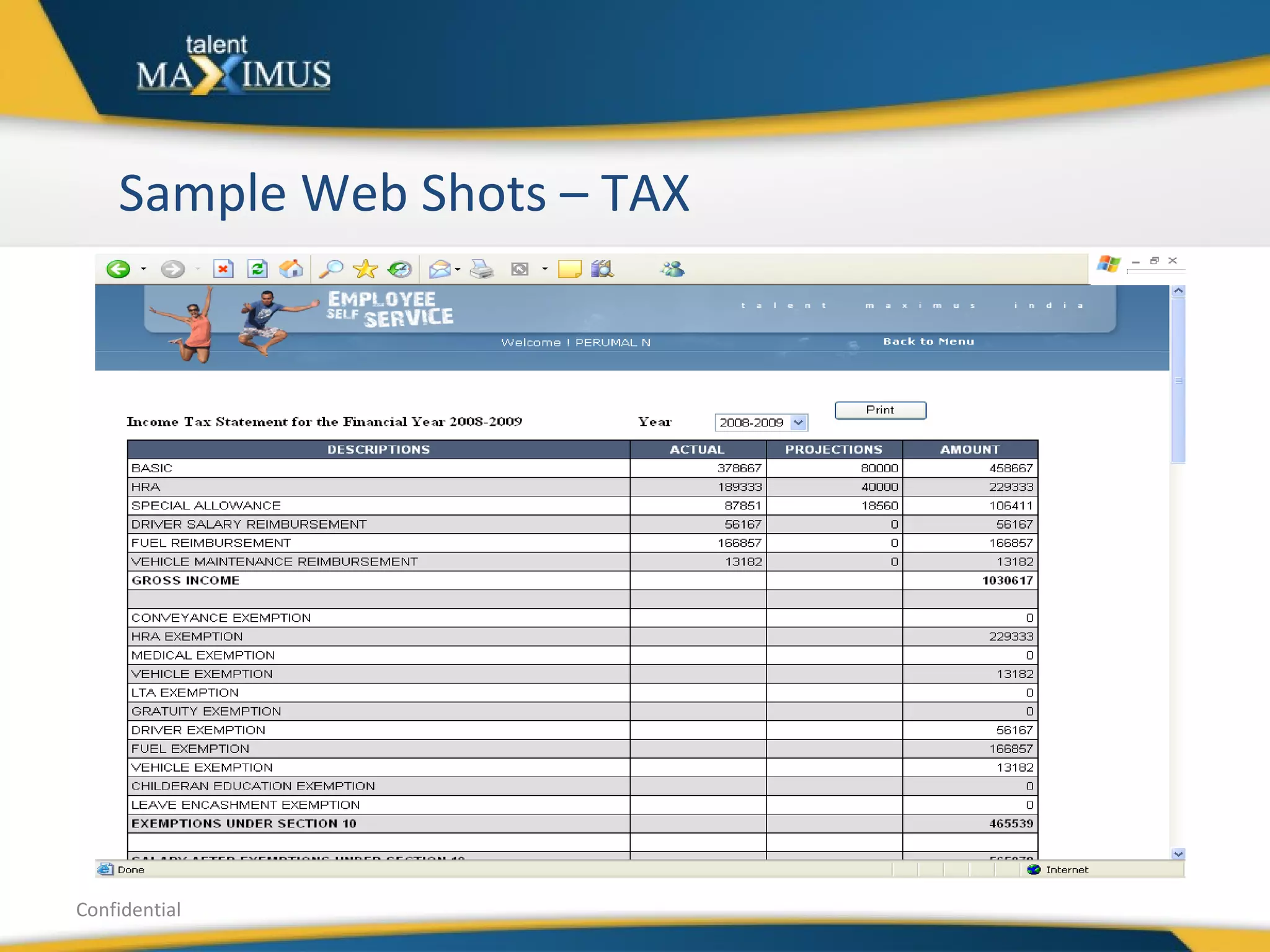

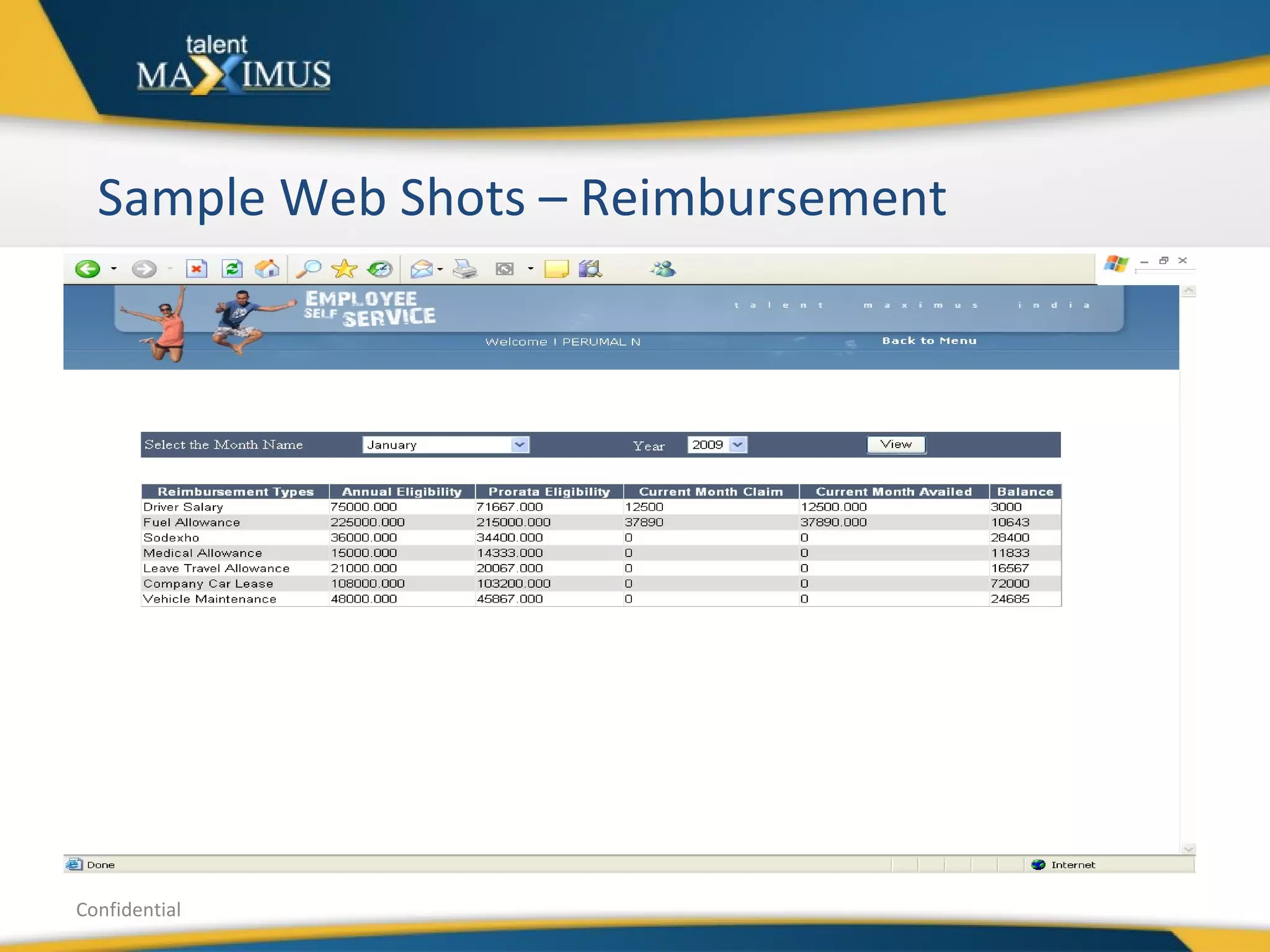

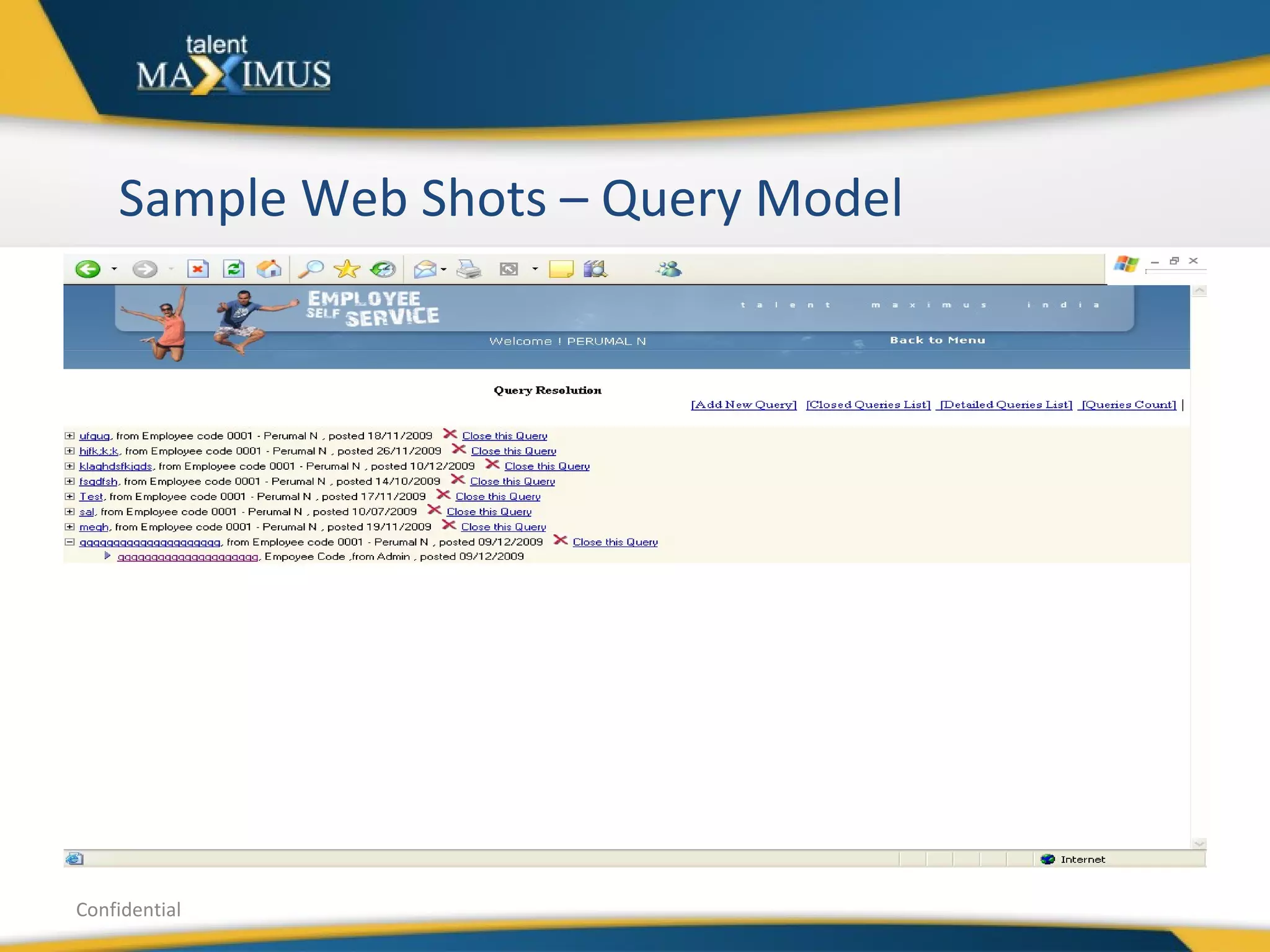

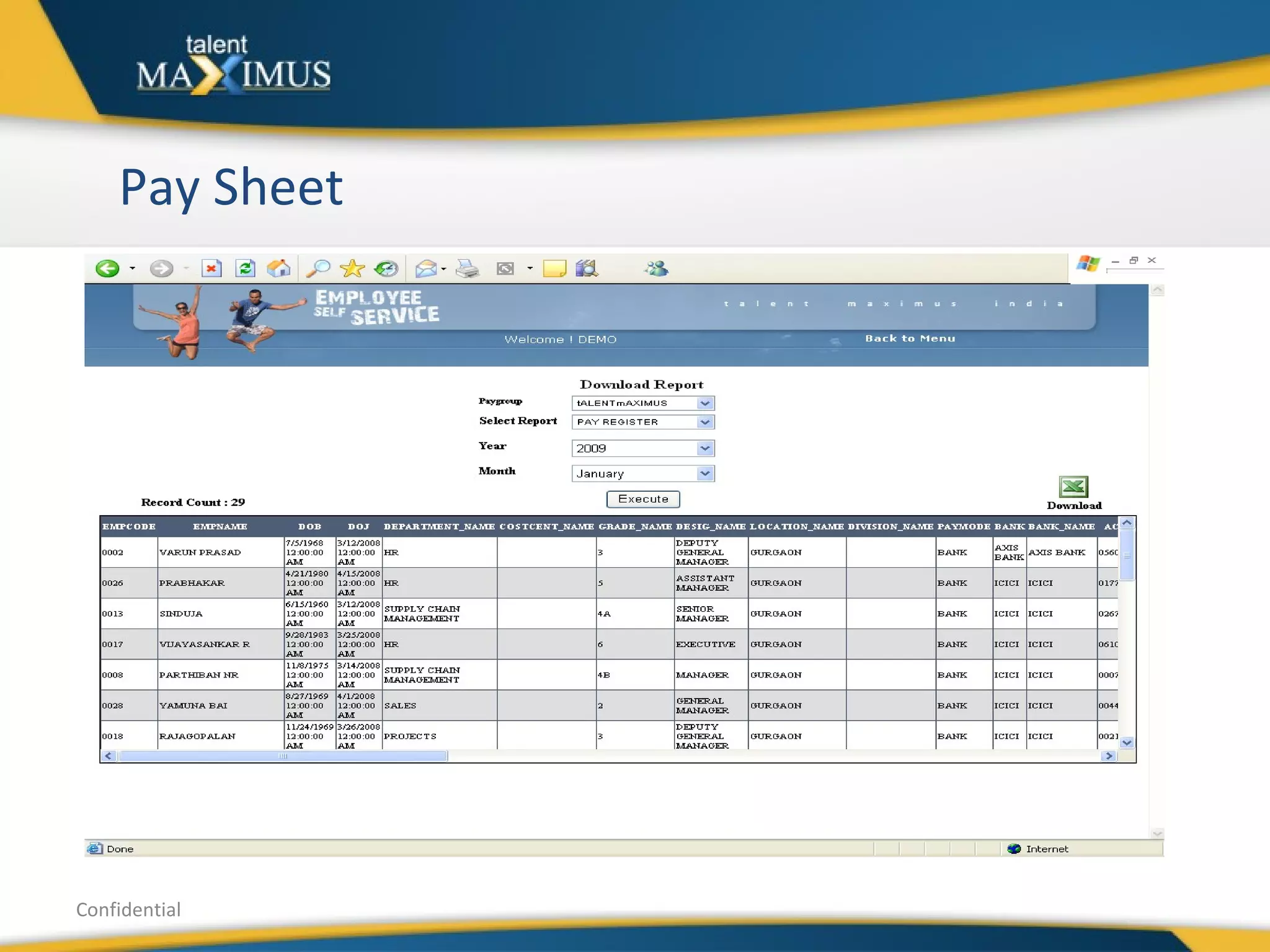

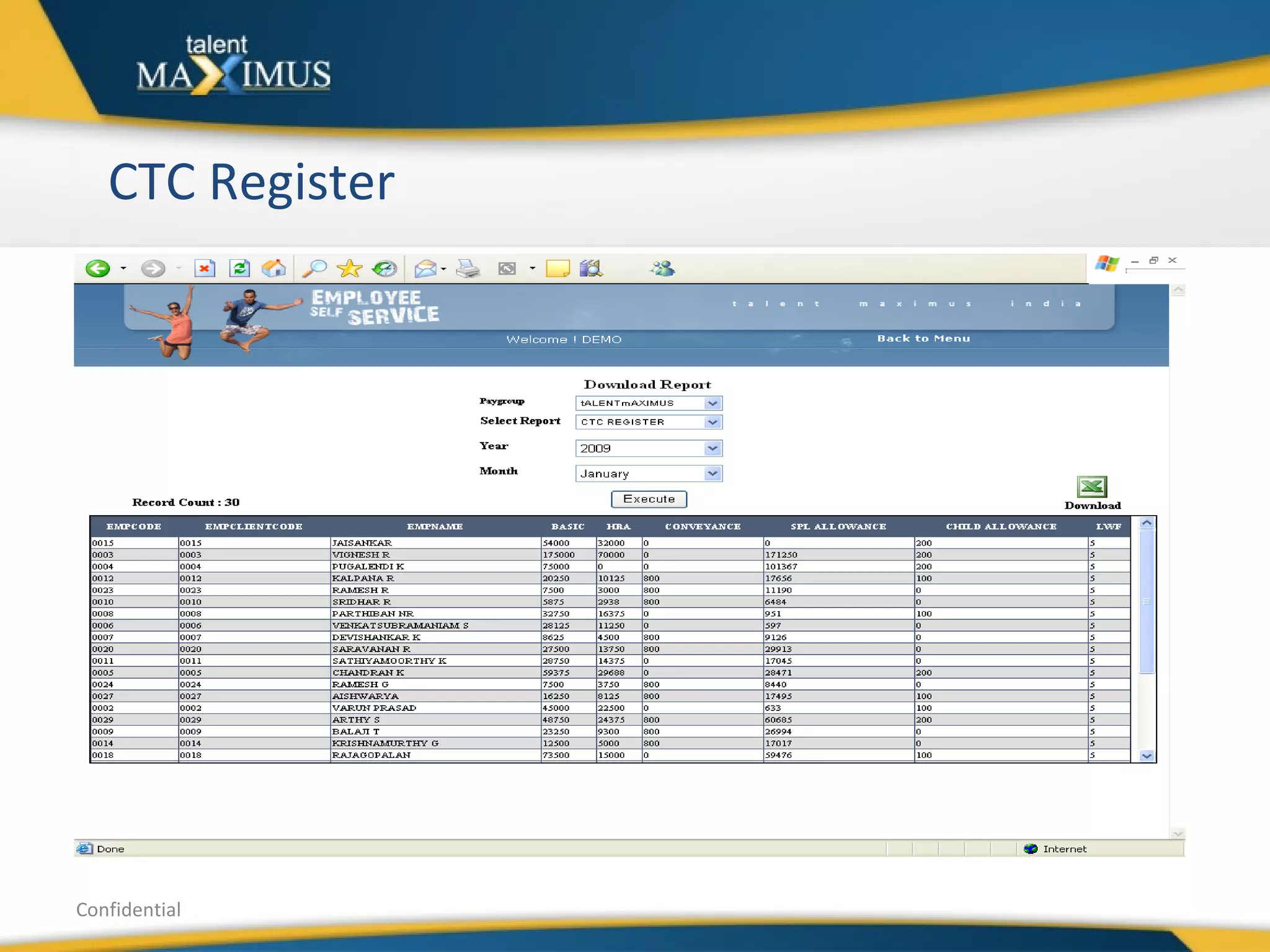

Talent Maximus provides payroll outsourcing services including payroll processing, tax compliance, and reimbursement management. They have over 100 clients across India in various industries. Their services are supported by a proprietary payroll application, robust IT infrastructure, and dedicated teams for compliance, software development, and customer support.