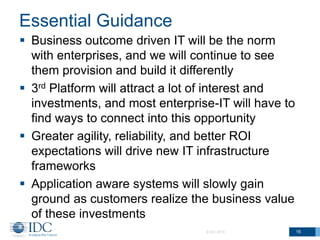

The document discusses the rise of application-aware systems and the need for IT transformation. It makes three key points:

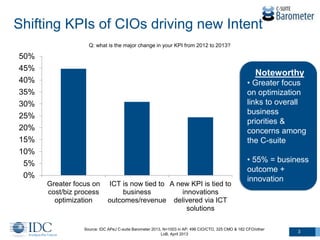

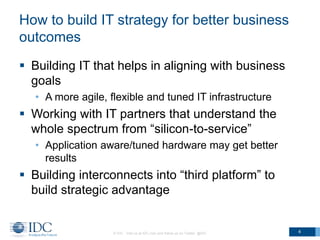

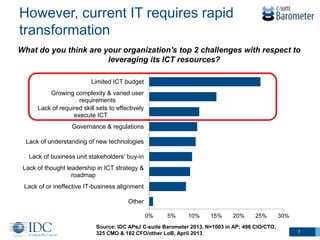

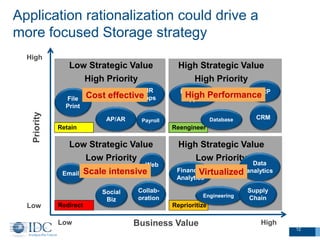

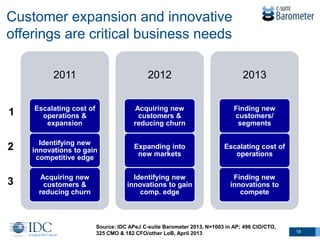

1) Business outcomes and innovation are becoming top priorities and KPIs for CIOs, requiring new IT strategies that are aligned with business goals.

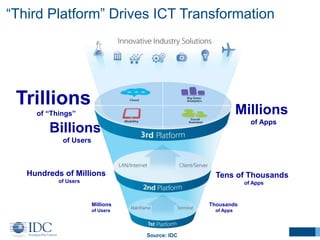

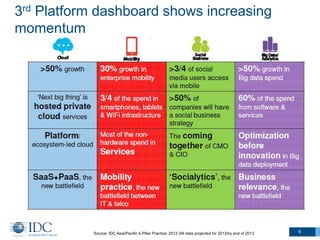

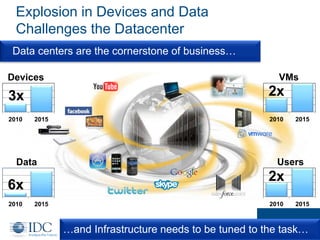

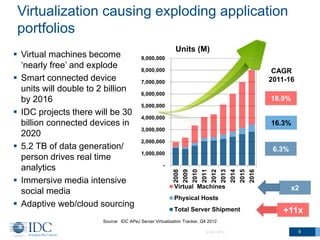

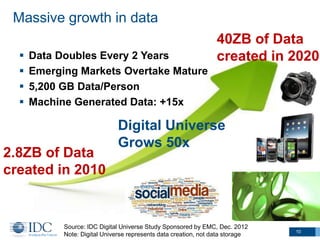

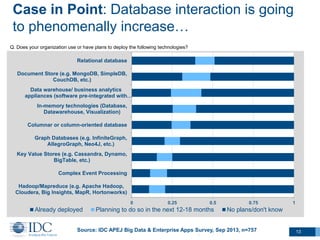

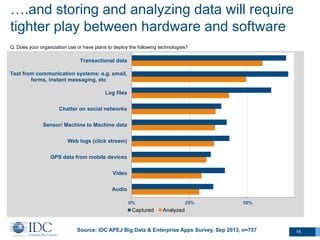

2) The "Third Platform" of billions of connected devices, apps, and users is driving immense data growth and creating opportunities for competitive advantage through new technologies.

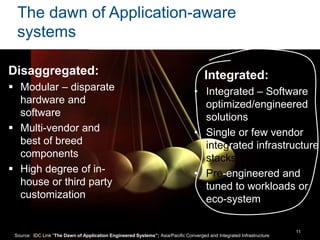

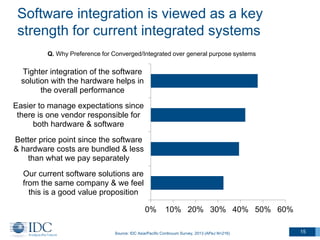

3) To address the challenges of rapid data growth and application explosion, there is a shift towards more integrated, application-aware infrastructure that is optimized for specific workloads through tighter software-hardware integration.