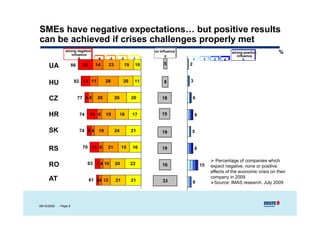

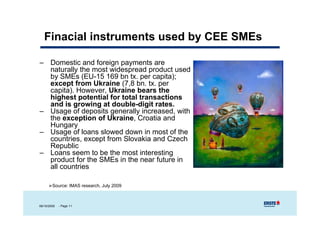

This document summarizes a forum on Ukrainian SMEs held in Lviv, Ukraine in October 2009. It notes that SMEs make up 10-15% of Ukraine's GDP, compared to 30-40% in other CEE countries. The downturn has negatively impacted Ukrainian and CEE SMEs, forcing some into the shadow economy, while others are restructuring. Banks in Ukraine have tightened lending due to losses, adopting a more risk-averse approach. To receive financing, Ukrainian SMEs must improve transparency, management, and financial structures. The document advocates adopting European standards and attracting foreign investment to allow businesses to grow beyond small pockets. Erste Bank was highlighted as continuing to support SMEs