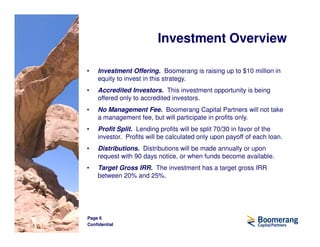

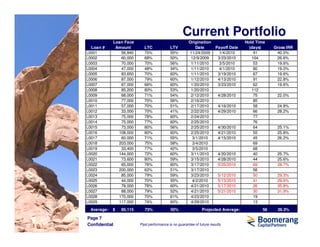

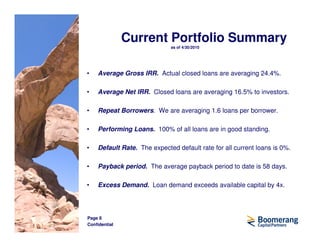

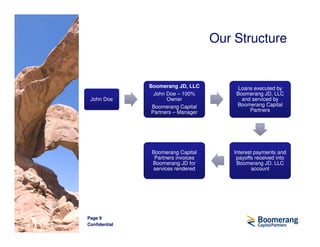

This document summarizes an opportunity for investors to provide short-term, high-interest loans to real estate investors purchasing foreclosed homes at auction in Phoenix, Arizona. The loans would have conservative terms, requiring 20-30% borrower equity and paying 17-19% annual interest over 6 months. Based on an existing portfolio of loans, the opportunity offers an expected gross return of 20-25% and has mitigated risks such as borrower guarantees, cross-collateralization, and first lien positions. The document seeks to raise $10 million from accredited investors for this lending program.