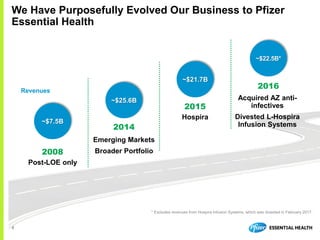

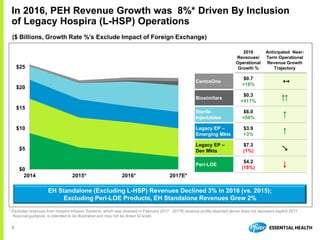

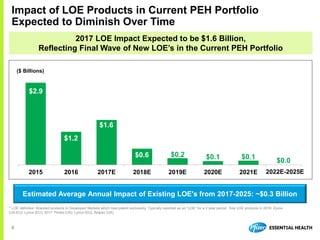

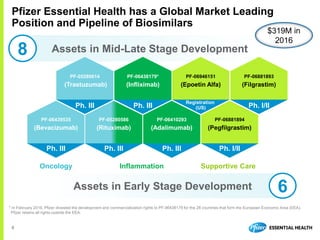

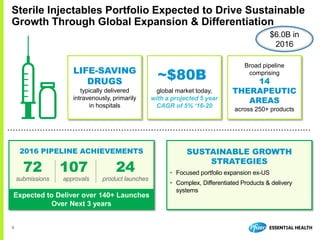

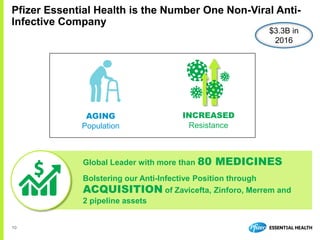

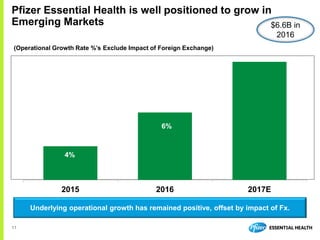

John Young, president of Pfizer Essential Health, presented at the Cowen and Company 37th Annual Health Care Conference. Pfizer Essential Health has evolved its business through acquisitions and portfolio management to become a leader in biosimilars, sterile injectables, anti-infectives, and emerging markets. It aims to deliver sustainable growth through focused R&D, global expansion, and differentiation. Losses of exclusivity will have a diminishing impact over time as the portfolio is managed. Pfizer Essential Health contributes to Pfizer's overall business through its lower-risk profile and steady cash flows.