This document provides an overview and summary of a study on the impact of organized retailing on the unorganized sector in India.

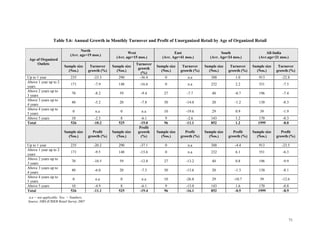

The study estimates that total retail business in India will grow at 13% annually from $322 billion in 2006-07 to $590 billion in 2011-12. It finds that both unorganized and organized retail are expected to grow substantially and coexist, with unorganized retail growing at 10% annually and organized retail growing much faster at 45-50% annually.

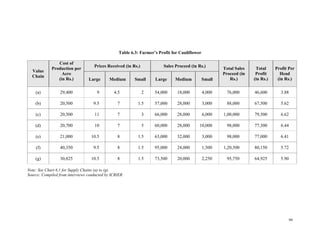

One surprising finding is that low-income consumers save more through shopping at organized retail outlets due to targeted discount shopping. Farmers also benefit from direct sales to organized retailers, realizing higher prices and profits than selling to intermediaries

![began recovering in the 2000s. Matahari doubled its sales between 2002 and 2006,

becoming a billion-dollar chain by 2006. The share of foreign chains (one European

and one Hong Kong) in the top-seven chains is now 40 per cent. However, because

the sector is still fragmented, foreign chains do not have more than a 20 per cent

share, similar to the situation in China.

FDI combined with financing from either the competitive or leading local investors

led to the rapid consolidation and multinationalization of the supermarket sectors in

developing countries over the past decade, with the trend again correlated with the

waves. The rapid consolidation of the sector in those regions mirrors what is

occurring in the United States and Europe. For example, in Latin America the top-five

chains per country have 65 per cent of the supermarket sector compared with 50 per

cent in the United States (although Kinsey [2004] reports that is rapidly increasing)

and 72 per cent in France.

3.3.3 Domestic Policies Concerning Retail

Domestic regulations of the commerce sector can either promote supermarket

diffusion or hinder it. The overall body of regulations can push and pull both ways,

with promotion or hindrance winning out in different phases of supermarket diffusion.

The authors’ perception is that the regulatory balance appears to favour supermarket

diffusion in most developing countries today.

Modern Retail Diffusion Encouraged by Domestic Policies

Several sets of policies are promoting supermarkets and hindering traditional retail in

developing countries today.

Developing countries have a tradition of establishing policies promoting the

development of supermarkets. In the 1960s and 1970s in Latin America, Malaysia,

and Hong Kong, among other countries, governments were keen to promote the tiny

supermarket sectors in the name of food sector modernization. Promotion

programmes were based on the previously described perception of the traditional

retail sector as weak and inefficient, a drag on increasing overall competitiveness and

efficiency. Most of these promotion programmes were artificial and not yet consonant

with overall economic transformation nor fed by private sector investment; thus, few

succeeded.

In the 1990s and 2000s, many governments directly supported supermarket

development as part of modernization policies, although at the same time those

governments had policies limiting or regulating supermarkets and supporting

traditional retailers (Goldman et al. 1999). An example is tax exoneration to

supermarkets setting up in municipalities in Russia (Dries and Reardon 2005) or

South Korea (Lee and Reardon 2005). Some governments have even directly invested

in modern retail explicitly to modernize the food distribution sector as well as

generate revenue for government. For example, in China the semi-public chains

operate as profit-oriented enterprises and compete with private firms. State-sponsored

companies get easy access to credit, cheap real estate, and other benefits (Hu et al.

2004).

22](https://image.slidesharecdn.com/unorganizedretailinindia-120106025607-phpapp01/85/Unorganized-retail-in-india-37-320.jpg)

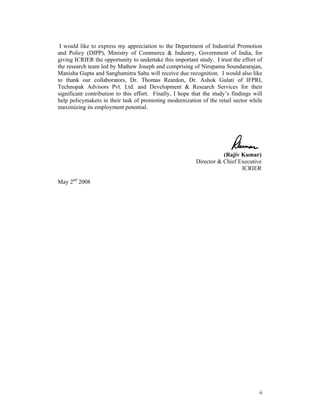

![Section 5: Sales Composition

Do you deal Sales Trend

in this

PRODUCT In the last ___months, has the

product sale of this product category

CATEGORY If decreased,

category? increased/ decreased/

reasons for the

remained same?

same.

Increased -1, Decreased---2

Food Items Yes No Remained the same—3

(Use codes)

Staples (rice/ atta/

A 1 2

wheat)

Other foodgrains /

flours / food items

[maida/ rava/ suji/

B 1 2

pulses/ dals/ spices/

masalas/ sugar/ salt/

eggs / bread/ milk]

Cooking oil/ ghee/

C 1 2

vanaspati

D Other packaged foods 1 2

Toiletries

[soap/ shampoo/ talcum

powder/ hair oil/

E 1 2

toothpaste/ shaving

products/ sanitary

napkins]

Cosmetics

F [creams/ lotions/ skin 1 2

care products]

Household cleaning

products

[washing

G 1 2

soap/detergents/ toilet

cleaners/ utensil

cleaners]

Fruit & Vegetables

H Fruit 1 2

I Vegetables 1 2

Textile &

Readymade

Garments

J Readymade 1 2

K Fabric 1 2

Hosiery

L 1 2

(undergarments)

* 1. Competition from organized (large) retailers 2. Competition from small (unorganized) retailers

3. Seasonality factors

4. Reduced household incomes 5 .High prices 6. Any other

(Specify)______________________________________

193](https://image.slidesharecdn.com/unorganizedretailinindia-120106025607-phpapp01/85/Unorganized-retail-in-india-208-320.jpg)

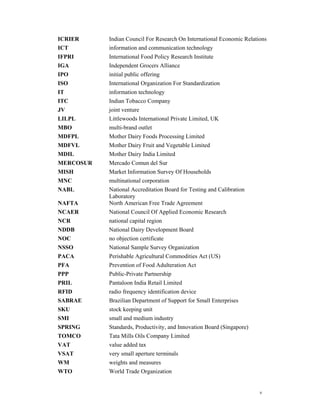

![Please tell me what all did you buy in this visit?

Q1.17 Q1.19

Q1.16 How much If yes, of the

What is on an Q1.18 total amount

Q1.15 the value average do Do you also spent on this

Which of of you spend buy this category in a

the purchase on this product month, how

following of this product category much do you

categories product category in a from spend at

PRODUCT

did you category month? unorganized unorganized

CATEGORY

buy in in this Three outlets / outlets?

this visit? visit? months in hawkers? (in rupees)

(in case of (3 months in

rupees) garments case of

(in rupees) clothing)

Food & Grocery Yes No Yes No

A Staples wheat).

(rice/ atta/

1 2 1 2

Other foodgrains/

flours / items

B [maida/ rava/ suji/ pulses/ 1 2 1 2

dals/ spices/ masalas/

sugar/ salt/ eggs / bread/

milk].

Cooking oil/ ghee/

C 1 2 1 2

vanaspati.

Other packaged

D 1 2 1 2

foods.

Toiletries

[soap/ shampoo/ talcum

E powder/ hair oil/ tooth 1 2

paste/ shaving products/ 1 2

sanitary napkins].

Cosmetics

F [creams/ lotions/ skin 1 2

care products].

Household cleaning

products

G [washing 1 2 1 2

soap/detergents/ toilet

cleaners/ utensil

cleaners].

Fruit and

Yes No Yes No

Vegetables

H Fruit 1 2 1 2

I Vegetables 1 2 1 2

Clothing, Textile &

Fashion Yes No Yes No

Accessories

J Readymade 1 2

K Fabric 1 2

1 2

Hosiery

L 1 2

(undergarments)

202](https://image.slidesharecdn.com/unorganizedretailinindia-120106025607-phpapp01/85/Unorganized-retail-in-india-217-320.jpg)

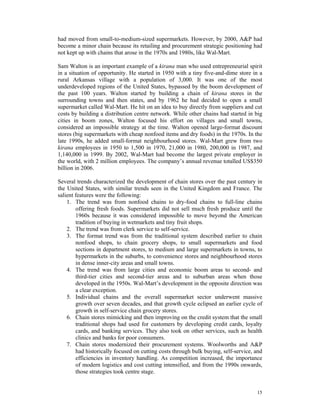

![Please tell me what all did you buy in this visit?

Q1.12

Q1.9

Q1.10 If yes, of

What

How much the total

is the

on an Q1.11 amount

value

average, Do you spend on

Q1.8 of

do you also buy this

Which of purcha

spend on this category in

the se of

this product a month,

following this

product category how much

categories produc

PRODUCT category in from do you

did you t

CATEGORY a month? organized spend at

buy in this categor

Three outlets / organized

visit? y in

months in hawkers? outlets?

this

case of (in rupees)

visit?

garments (3 Months in

(in

(in rupees) case of

rupees)

clothing)

Food & Grocery Yes No Yes No

A Staples 1 2 1 2

(Rice/ Atta/ Wheat)

Other food grains /

flours / items

B [maida/ rava/ suji/ pulses/ 1 2 1 2

dals/ spices/ masalas/ sugar/

salt/ eggs / bread/ milk]

Cooking oil/ ghee/

C 1 2 1 2

vanaspati

D Other packaged foods 1 2 1 2

Toiletries

[soap/ shampoo/ talcum

E powder/ hair oil/ tooth paste/ 1 2

shaving products/ sanitary 1 2

napkins]

Cosmetics

F [creams/ lotions/ skin care 1 2

products]

Household cleaning

products

G [washing soap/detergents/ 1 2 1 2

toilet cleaners/ utensil

cleaners]

Fruit and Vegetables Yes No Yes No

H Fruit 1 2 1 2

I Vegetables 1 2 1 2

Clothing, Textile &

Yes No Yes No

Fashion Accessories

J Readymade 1 2

K Fabric 1 2 1 2

Hosiery

L 1 2

(undergarments)

206](https://image.slidesharecdn.com/unorganizedretailinindia-120106025607-phpapp01/85/Unorganized-retail-in-india-221-320.jpg)