QSE Intra-Day Movement Commentary

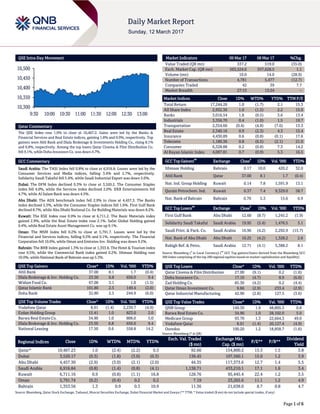

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 1.0% to close at 10,467.2. Gains were led by the Banks & Financial Services and Real Estate indices, gaining 1.8% and 0.9%, respectively. Top gainers were Ahli Bank and Dlala Brokerage & Investments Holding Co., rising 8.1% and 6.8%, respectively. Among the top losers Qatar Cinema & Film Distribution Co. fell 9.1%, while Doha Insurance Co. was down 4.7%. GCC Commentary Saudi Arabia: The TASI Index fell 0.8% to close at 6,916.8. Losses were led by the Consumer Services and Media indices, falling 3.4% and 2.7%, respectively. Solidarity Saudi Takaful fell 5.4%, while Saudi Industrial Export was down 5.0%. Dubai: The DFM Index declined 0.3% to close at 3,520.2. The Consumer Staples index fell 4.0%, while the Services index declined 2.0%. DXB Entertainments fell 4.7%, while Al Salam Bank was down 4.5%. Abu Dhabi: The ADX benchmark index fell 2.9% to close at 4,457.3. The Banks index declined 5.3%, while the Consumer Staples indices fell 1.6%. First Gulf Bank declined 8.7%, while Abu Dhabi National Co. for Building Materials was down 8.2%. Kuwait: The KSE Index rose 0.9% to close at 6,711.2. The Basic Materials index gained 2.9%, while the Real Estate index rose 2.1%. Safat Global Holding gained 9.4%, while Real Estate Asset Management Co. was up 9.1%. Oman: The MSM Index fell 0.2% to close at 5,791.7. Losses were led by the Financial and Services indices, falling 0.5% and 0.1%, respectively. The Financial Corporation fell 10.0%, while Oman and Emirates Inv. Holding was down 9.2%. Bahrain: The BHB Index gained 1.3% to close at 1,353.6. The Hotel & Tourism index rose 0.5%, while the Commercial Bank index gained 0.2%. Ithmaar Holding rose 10.0%, while National Bank of Bahrain was up 5.3%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Ahli Bank 37.00 8.1 1.7 (0.4) Dlala Brokerage & Inv. Holding Co. 23.50 6.8 656.0 9.4 Widam Food Co. 67.00 3.1 1.0 (1.5) Qatar Islamic Bank 101.80 2.5 149.4 (2.0) Doha Bank 32.80 2.5 244.9 (6.0) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 8.91 (1.4) 2,239.7 (4.9) Ezdan Holding Group 15.41 1.0 823.0 2.0 Barwa Real Estate Co. 34.90 1.0 806.0 5.0 Dlala Brokerage & Inv. Holding Co. 23.50 6.8 656.0 9.4 National Leasing 17.50 0.6 558.8 14.2 Market Indicators 09 Mar 17 08 Mar 17 %Chg. Value Traded (QR mn) 337.2 519.0 (35.0) Exch. Market Cap. (QR mn) 563,524.6 557,628.5 1.1 Volume (mn) 10.0 14.0 (28.9) Number of Transactions 4,781 5,477 (12.7) Companies Traded 42 39 7.7 Market Breadth 27:13 13:24 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,244.26 1.0 (1.7) 2.1 15.3 All Share Index 2,932.36 1.0 (1.5) 2.2 15.0 Banks 3,016.54 1.8 (0.5) 3.6 13.4 Industrials 3,356.70 0.4 (1.0) 1.5 19.7 Transportation 2,354.66 (0.4) (4.8) (7.6) 13.3 Real Estate 2,340.16 0.9 (2.3) 4.3 15.4 Insurance 4,430.89 0.6 (0.8) (0.1) 17.6 Telecoms 1,180.36 0.8 (6.5) (2.1) 21.0 Consumer 6,328.88 0.2 (0.8) 7.3 14.2 Al Rayan Islamic Index 4,087.81 0.7 (0.9) 5.3 16.5 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Ithmaar Holding Bahrain 0.17 10.0 420.2 32.0 Ahli Bank Qatar 37.00 8.1 1.7 (0.4) Nat. Ind. Group Holding Kuwait 0.14 7.8 1,591.9 13.1 Qurain Petrochem. Ind. Kuwait 0.37 7.4 9,329.0 58.7 Nat. Bank of Bahrain Bahrain 0.70 5.3 15.6 6.9 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% First Gulf Bank Abu Dhabi 12.60 (8.7) 1,245.2 (1.9) Solidarity Saudi Takaful Saudi Arabia 19.95 (5.4) 1,476.5 5.1 Saudi Print. & Pack. Co. Saudi Arabia 16.96 (4.2) 2,292.9 (15.7) Nat. Bank of Abu Dhabi Abu Dhabi 10.25 (4.2) 1,328.2 2.6 Rabigh Ref. & Petro. Saudi Arabia 12.71 (4.1) 5,388.2 8.1 Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Cinema & Film Distribution 27.00 (9.1) 0.2 (1.6) Doha Insurance Co. 17.10 (4.7) 8.9 (6.0) Zad Holding Co. 85.30 (4.2) 0.2 (4.4) Qatar Oman Investment Co. 9.66 (2.9) 233.4 (2.9) Qatar Industrial Manufacturing 42.90 (2.8) 127.5 (3.6) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 149.30 1.9 48,805.3 0.8 Barwa Real Estate Co. 34.90 1.0 28,102.0 5.0 Medicare Group 93.70 1.3 22,664.3 49.0 Vodafone Qatar 8.91 (1.4) 20,127.4 (4.9) Ooredoo 100.20 1.2 18,858.7 (1.6) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,467.23 1.0 (2.4) (2.2) 0.3 92.60 154,800.2 15.3 1.5 3.8 Dubai 3,520.17 (0.3) (1.8) (3.0) (0.3) 138.45 107,560.1 15.0 1.2 3.9 Abu Dhabi 4,457.30 (2.9) (3.0) (2.1) (2.0) 44.35 117,373.6 12.7 1.4 5.5 Saudi Arabia 6,916.84 (0.8) (1.4) (0.8) (4.1) 1,138.71 433,210.1 17.1 1.6 3.4 Kuwait 6,711.16 0.9 (0.8) (1.1) 16.8 128.76 95,445.4 22.4 1.2 3.5 Oman 5,791.74 (0.2) (0.4) 0.2 0.2 7.19 23,265.6 11.1 1.2 4.9 Bahrain 1,353.56 1.3 0.9 0.3 10.9 11.36 21,638.0 8.7 0.8 4.7 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 10,300 10,350 10,400 10,450 10,500 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index rose 1.0% to close at 10,467.2. The Banks & Financial Services and Real Estate indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari and GCC shareholders. Ahli Bank and Dlala Brokerage & Investments Holding Co. were the top gainers, rising 8.1% and 6.8%, respectively. Among the top losers Qatar Cinema & Film Distribution Co. fell 9.1%, while Doha Insurance Co. was down 4.7%. Volume of shares traded on Thursday fell by 28.9% to 10.0mn from 14.0mn on Wednesday. However, as compared to the 30-day moving average of 10.0mn, volume for the day was 0.1% higher. Vodafone Qatar and Ezdan Holding Group were the most active stocks, contributing 22.5% and 8.3% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 2016 % Change YoY Operating Profit (mn) 2016 % Change YoY Net Profit (mn) 2016 % Change YoY Mobile Telecom. Co. Saudi Arabia * Saudi Arabia SR – – -55.0 N/A -980.0 N/A Saudi Chemical Co.* Saudi Arabia SR – – 197.0 -30.4% 138.0 -45.2% Tourism Enterprise Co.* Saudi Arabia SR – – 1.5 -25.6% 0.6 -72.1% Dubai Investments* Dubai AED 3,050.9 14.2% – – 1,218.3 9.8% Source: Company data, DFM, ADX, MSM, TADAWUL (*FY2016) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 03/09 US Department of Labor Initial Jobless Claims 4-March 243k 238k 223k 03/09 US Department of Labor Continuing Claims 25-February 2,058k 2,062k 2,064k 03/10 UK UK Office for National Statistics Industrial Production MoM January -0.4% -0.5% 0.9% 03/10 UK UK Office for National Statistics Industrial Production YoY January 3.2% 3.2% 4.3% 03/10 UK UK Office for National Statistics Manufacturing Production MoM January -0.9% -0.7% 2.2% 03/10 UK UK Office for National Statistics Manufacturing Production YoY January 2.7% 2.9% 4.2% 03/10 France INSEE Industrial Production MoM January -0.3% 0.5% -1.1% 03/10 France INSEE Industrial Production YoY January -0.4% 0.4% 0.9% 03/10 France INSEE Manufacturing Production MoM January -1.0% 0.5% -1.0% 03/10 France INSEE Manufacturing Production YoY January -1.3% 0.3% 0.1% 03/09 China National Bureau of Statistics CPI YoY February 0.8% 1.7% 2.5% 03/09 China National Bureau of Statistics PPI YoY February 7.8% 7.7% 6.9% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of board meeting No. of days remaining Status MRDS Mazaya Qatar 14-Mar-17 2 Due QFBQ Qatar First Bank 14-Mar-17 2 Due AKHI Al Khaleej Takaful Insurance 14-Mar-17 2 Due AHCS Aamal Company 15-Mar-17 3 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 38.67% 44.19% (18,598,596.57) Qatari Institutions 18.38% 18.79% (1,386,717.55) Qatari 57.05% 62.98% (19,985,314.12) GCC Individuals 0.88% 3.13% (7,604,519.64) GCC Institutions 3.03% 5.78% (9,251,053.03) GCC 3.91% 8.91% (16,855,572.67) Non-Qatari Individuals 13.51% 10.50% 10,162,369.53 Non-Qatari Institutions 25.53% 17.61% 26,678,517.26 Non-Qatari 39.04% 28.11% 36,840,886.79

- 3. Page 3 of 6 News Qatar Qatar's onshore oil price edges up to $55.11 – Qatar’s onshore oil price in February marginally increased above its price in January to reach $55.11 a barrel. That means the oil price remained $10.11 above the price of $45 a barrel approved in the state budget, the Group Securities noted in its government data review for the month of February. The data reading shows the value of margin traded in February has decreased to QR5.71bn. In contrast, the market value of all stock shares by the end of February rose by QR9.5bn to QR577.7bn, while P/E Ratio is at 15.63 by the end of the month and 15 as average for the month. (Peninsula Qatar) QCB issues instructions on fighting money laundering – Qatar Central Bank (QCB) Governor HE Sheikh Abdulla bin Saoud al- Thani issued instructions on combating money laundering and terrorism financing in the insurance sector. The instructions are the first of their kind in Qatar and have been under preparation since QCB took charge of supervising and overseeing the insurance sector in line with the law on QCB and regulation of financial institutions, which was issued as Law No. 13 of 2012 and came into the force of law in the beginning of 2013, the central bank said. The statement added that the instructions were laid out in 25 articles covering everything related to money laundering and terrorism financing in the insurance sector and provided definitions for relevant terms as well as general and governing rules for combating the menace. (Gulf- Times.com) ValuStrat: Qatar has become buyers’ market for home purchase – Qatar, has become a buyers’ market for home purchase as rents remain stable this year, a situation that is seen ideal for tenants to consider ownership, according to ValuStrat. Qatar has most likely to have transformed into a buyers’ market due to steady increase in supply, it said, highlighting that new construction contracts worth QR46.1bn are expected this year. “This is reflected by the increasing gap between listed and transaction prices of residential properties in the favor of buyers,” it said in a report. Doha has the highest number of total sales transactions and prices for residential properties compared to other municipalities, as per the Ministry of Justice data. Currently, three out of four freehold zone properties, Pearl-Qatar, Lusail and West Bay Lagoon are in Doha. It also has a majority of leasehold properties where foreigners can lease property for 99 years. (Gulf-Times.com) Ready-built factories to boost SME sector – HE the Prime Minister and Interior Minister Sheikh Abdullah bin Nasser bin Khalifa al-Thani inaugurated a project at the New Industrial Area that aims to promote small and medium enterprises in the country. Jahiz1 is a Qatar Development Bank (QDB) initiative to rent ready-built industrial facilities for manufacturing. In his opening remarks, HE the Minister of Energy and Industry Dr Mohamed bin Saleh al-Sada praised Qatar’s small and medium enterprises, which “have succeeded” in meeting the requirements of industrial sectors set by the ministry. These units are operating in the fields of chemicals, plastics, wood, and electronics and are “innovative and eco-friendly”. Jahiz1 project comes in line with the vision of the Ministry of Energy and Industry to build a strong industrial production base in the country and supports local products, in order to achieve balanced economic growth, and not depend on revenues from oil as the main source of income. It also increases the industrial sector’s contribution to the gross domestic product (GDP). (Gulf-Times.com) Al-Baker: Qatar Airways continues to set new standards in global luxury travel – Qatar Airways continues to set new standards in global luxury travel, said Group Chief Executive Akbar al-Baker and noted the airline will continue to develop new and exciting propositions for its passengers. In the context of the national airline’s highly successful participation at ITB Berlin, the world’s largest tourism trade fair, al-Baker said, “Qatar Airways continues to set new standards in global luxury travel and our announcements at this year’s ITB Berlin are no exception. With the introduction of private suites in business class and interchangeable social spaces for business and leisure, Qatar Airways is truly bringing first class travel to its business class passengers.” (Gulf-Times.com) Qatar keen to enhance ties with South Africa – HE the Foreign Minister Sheikh Mohammed bin Abdulrahman al-Thani met with South African Minister of International Relations and cooperation, Maite Nkoana-Mashabane, during his visit to South Africa. The meeting reviewed bilateral relations and means of boosting mutual cooperation in investment and trade as well as promoting economic cooperation between the two countries and benefiting from South Africa’s experience in organizing the football World Cup. The meeting discussed the efforts of Qatar and South Africa in preventive diplomacy, mediation and conflict resolution in the region, in addition to issues of common concern. The Minister said, “We are keen on enhancing our bilateral ties on all fronts and we have complete confidence in the South African economy that has the capacity to benefit both countries.” (Gulf-Times.com) QSE announces trading suspension in the shares of MCGS on March 12 – Qatar Stock Exchange (QSE) announced trading suspension of the shares of Medicare Group (MCGS) on March 12, 2017 due to its AGM being held on the day. (QSE) QSE announces trading suspension in the shares of QGTS on March 12 – Qatar Stock Exchange announced trading suspension of the shares of Qatar Gas Transport Company (QGTS) on March 12, 2017 due to its AGM and EGM being held on the day. (QSE) International Strong US job growth, rising wages set stage for Fed rate hike – US employers hired workers at a robust pace in February, beating expectations, and wages grinded higher, which could give the Federal Reserve the green light to raise interest rates next week despite slowing economic growth. Nonfarm payrolls increased by 235,000 jobs last month as the construction sector recorded its largest gain in nearly 10 years due to unseasonably warm weather, the Labor Department said. January's employment gains were revised up to 238,000 from the previously reported 227,000. Fed Chair Janet Yellen signaled last week that the US central bank would likely hike rates at its March 14-15 policy meeting. Job gains averaged 209,000 per month over the past three months, well above the 75,000 to

- 4. Page 4 of 6 100,000 needed to keep up with growth in the working-age population. (Reuters) US government posts $192bn deficit in February – The US government had a $192bn budget deficit in February as outlays far outstripped receipts, the Treasury Department said. The budget deficit was $193bn in February 2016, according to Treasury's monthly budget statement. The fiscal 2017 year-to- date deficit was $349bn compared with $353bn in the same period of fiscal 2016. When accounting for calendar adjustments, the deficit last month was $181bn. Receipts last month came to $172bn, a 2% increase from February 2016, while outlays stood at $364bn, up 1% from the same month a year earlier. (Reuters) UK factories see Brexit boost from weaker sterling – British factories enjoyed their strongest growth in nearly seven years in late 2016 and early 2017 and exports rose quickly, data showed, suggesting a boost for manufacturers from sterling's fall after the Brexit vote. Over the November-January period, factory output had its strongest performance since the three months to May 2010, rising 2.1% from the previous three months, the Office for National Statistics said. While factory output slipped 0.9% in January, more than predicted in a Reuters poll of economists, which only unwound some of the strong growth in the previous two months. In another sign of an improvement in Britain's trade position, volumes of goods exports over the three months to January grew by 8.7%, the biggest increase in more a decade, while imports rose by 1.6%. The data suggest Britain's economy might be starting to reduce its reliance on consumers to drive growth, economists said, something that has eluded policymakers for years. (Reuters) German imports soar in January, current account surplus shrinks – German imports soared more than expected in January, outperforming a surprisingly strong rise in exports in a further sign that Europe's biggest economy fired on all cylinders at the start of 2017. Data released by the Federal Statistics Office, also showed the current account surplus fell sharply on the month suggesting vibrant domestic demand is helping to slowly re-balance Germany's traditionally export-driven economy. Seasonally adjusted imports rose by 3.0% on the month, while exports increased by 2.7%, the data showed. Both figures came in much stronger than expected. A breakdown of unadjusted trade figures showed that exports to countries outside the European Union rose the sharpest while imports were particularly strong from EU countries outside the Eurozone. (Reuters) India's industrial output up 2.7% in January – India's industrial output rose 2.7% in January from a year earlier, government data showed. Economists surveyed by Reuters had forecast a 0.5% growth in output compared with a revised 0.1% YoY fall in December. (Reuters) Regional Islamic finance instruments to be taxed at par with conventional bank – According to Ernst & Young (EY), Islamic finance instruments will be subject to tax under the amended Income Tax Law promulgated by Royal Decree and published in the official gazette last month. The amended statute issues much awaited provisions on taxability of Islamic Finance Instruments. According to EY, the revised Income Tax Law provides some clarity on how Islamic finance instruments will be subject to tax. Whilst the law provides a framework on which instruments will fall within the purview of Islamic finance, it appears that these instruments would be treated at par with conventional banks, it was pointed out. Income on Islamic finance instruments would be taxed on similar lines as products offered under the conventional banking system. Similarly, provisions on what is deductible have been issued as well as treatment of loan loss provision has been clarified. (GulfBase.com) SABB, Ministry of Housing to further raise cooperation – Majid Al-Hugail, Saudi Minister of Housing, met with SABB Managing Director David Dew at the bank’s head office in Riyadh in the presence of Senior Executives from the bank, the Ministry of Housing and Real Estate Development Fund. The discussion focused on ways to enhance cooperation and partnership in the field of financing housing and real estates in general, and offering of finance products that suits the programs and products launched by the Real Estate Development Fund in collaboration with the Saudi Arabian local banks. (GulfBase.com) ADM and Almarai among companies eyeing Saudi grains agency asset sale – A partnership of US agribusiness giant Archer Daniels Midland Co. (ADM) and Saudi foods group Almarai is among potential bidders for Saudi Grains Organization’s milling operations, the Kingdom’s sole supplier. Italian wheat supplier Casillo Group and a partnership of Turkey’s TAV Group, a construction and airports conglomerate, and Saudi Arabia’s Al Rajhi Holding Group, a real estate concern, are also considering bids. The state-owned Saudi Grains Organization (SAGO), which handles the Kingdom’s grains purchases, is preparing to sell off its milling operations by placing them in four specially formed corporate entities while retaining other functions. (GulfBase.com) Saudi Aramco, McDermott sign MoU for construction of offshore platform – Saudi Aramco signed a memorandum of understanding (MoU) with McDermott International for the integrated engineering procurement construction and installation (EPCI) of offshore platforms for McDermott’s growing Middle East and other regional oil and gas development markets. This project is part of Saudi Aramco’s plan to expand its local supply chain, which will improve the company’s agility while driving additional economic and human capital development, as well new employment opportunities to help the Kingdom achieve the goals of Saudi Vision 2030. (GulfBase.com) Fitch: UAE banks set to take Basel capital rules in their stride – Fitch Ratings said that the UAE banks are mostly well placed to meet new local capital requirements related to the global Basel III regulatory framework, given their strong levels of Tier 1 capital in particular. The minimum total capital ratio, including a capital conservation buffer, has risen to 13% of risk-weighted assets (RWAs) from 12% under the previous regime, and most major banks are comfortably above this. The Central Bank of the UAE issued new regulations this week, effective from 1 February, to ensure that banks' capital adequacy is at least in line with Basel III requirements. In addition, they must hold further common equity Tier 1 (CET1) of 2.5% of RWAs (fully

- 5. Page 5 of 6 loaded) as a capital conservation buffer, and manage their capital and dividends to maintain this buffer. Fitch expect UAE banks to continue to calculate RWAs using the standardized approach, at least in 2017, as the central bank seems unlikely to allow the use of internal models to reduce capital requirements. Most banks in the UAE and across the Gulf Cooperation Council (GCC) region are capitalized well above the new minimum regulatory requirements and will also comfortably meet the 3% leverage ratio required under Basel III, given their high Tier 1 capital levels. Although a few banks are near the new minimum capital requirements, reflecting strong loan growth or pressure from their institutional shareholders for higher returns on equity, we believe they have the ability to raise capital if needed, through internal capital generation or rights issues. (Reuters) UAE’s ADNOC cuts the crude oil supply– Abu Dhabi National Oil Company (ADNOC) said it has informed its customers of cuts in crude allocations for March and April. ADNOC said, “In line with OPEC’s decision to cut production, we regret to advise you that crude oil allocation for the month of March and April 2017 will be reduced.” In March, only Upper Zakum crude grade will be cut by 5%, while in April both the Murban and Das grades will be reduced by 5%, and Upper Zakum by 3%. (Peninsula Qatar) UNB arranges aircraft purchase loan – Union National Bank (UNB) has announced the successful completion of a 12-year aircraft financing term loan facility for the acquisition of an Airbus A380 aircraft by Baz Aircraft Leasing One, in which it acted as mandated lead arranger. The aircraft is leased to the UAE’s national carrier Abu Dhabi-based Etihad Airways. The term loan facility forms part of a financing package extended to Etihad in connection with the sale and leaseback of two Airbus A380 arranged by Natixis S.A. The financing package also included a seven-year standby letter of credit facility granted by UNB in relation to the two aircraft. (GulfBase.com) Kuwait turns Silk Road into massive causeway – Kuwait is building one of the world’s longest causeways to its remote north where it will pump billions into Silk City, aiming to revive the ancient Silk Road trade route. The oil-rich country is eager to inject life into the uninhabited Subbiya region on its northern tip that has been chosen as the location for Silk City. The plan is to reinvigorate the ancient Silk Road trade route by establishing a major free-trade zone linking the Gulf to Central Asia and Europe. Investment in the Silk City project is expected to top $100bn, and a 5,000-megawatt power plant has already been built in Subbiya. (GulfBase.com) Zain, Rapid Telecom sign strategic partnership deal – Zain Bahrain officially signed a strategic partnership agreement with Rapid Telecom, a licensed Bahraini telecommunications and information services company. The agreement will enable the operators to provide innovative international connectivity solutions particularly to the under-tapped enterprise segment and enhance the international connectivity of the Kingdom of Bahrain. Zain Bahrain’s Regulatory, Wholesales & Roaming Director, Ali Mustafa said, “This partnership will further enhance our capability in providing B2B full innovative turnkey solutions on resilient international connectivity to the enterprise customers.” (GulfBase.com)

- 6. Contacts Saugata Sarkar Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mohamed Abo Daff QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mohd.abodaff@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Feb-13 Feb-14 Feb-15 Feb-16 Feb-17 QSE Index S&P Pan Arab S&P GCC (0.8%) 1.0% 0.9% 1.3% (0.2%) (2.9%) (0.3%) (3.2%) (1.6%) 0.0% 1.6% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,204.73 0.3 (2.4) 4.6 MSCI World Index 1,845.88 0.5 (0.2) 5.4 Silver/Ounce 17.04 0.5 (5.2) 7.1 DJ Industrial 20,902.98 0.2 (0.5) 5.8 Crude Oil (Brent)/Barrel (FM Future) 51.37 (1.6) (8.1) (9.6) S&P 500 2,372.60 0.3 (0.4) 6.0 Crude Oil (WTI)/Barrel (FM Future) 48.49 (1.6) (9.1) (9.7) NASDAQ 100 5,861.73 0.4 (0.2) 8.9 Natural Gas (Henry Hub)/MMBtu 2.98 5.4 19.1 (19.0) STOXX 600 373.23 0.9 0.5 4.5 LPG Propane (Arab Gulf)/Ton 66.12 0.9 8.0 (8.3) DAX 11,963.18 0.7 0.5 5.4 LPG Butane (Arab Gulf)/Ton 68.12 (2.2) 0.5 (41.7) FTSE 100 7,343.08 0.4 (1.1) 1.3 Euro 1.07 0.9 0.5 1.5 CAC 40 4,993.32 1.1 1.0 3.9 Yen 114.79 (0.1) 0.7 (1.9) Nikkei 19,604.61 1.4 0.3 4.2 GBP 1.22 0.0 (1.0) (1.4) MSCI EM 926.14 0.3 (0.5) 7.4 CHF 0.99 0.1 (0.3) 0.8 SHANGHAI SE Composite 3,212.76 (0.0) (0.2) 4.1 AUD 0.75 0.5 (0.7) 4.6 HANG SENG 23,568.67 0.3 0.1 7.0 USD Index 101.25 (0.6) (0.3) (0.9) BSE SENSEX 28,946.23 0.2 0.7 11.0 RUB 58.98 (0.5) 1.3 (4.2) Bovespa 64,675.46 1.0 (3.6) 10.8 BRL 0.32 1.7 (0.7) 3.6 RTS 1,055.93 0.9 (4.7) (8.4) 120.0 101.0 99.4