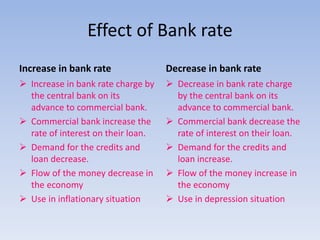

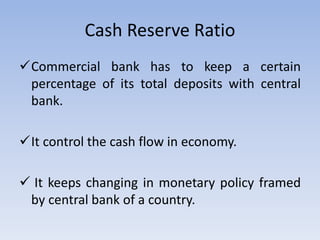

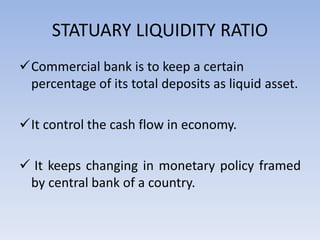

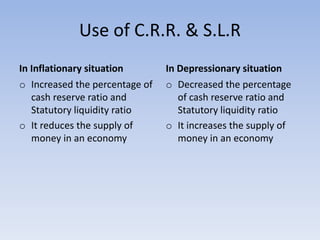

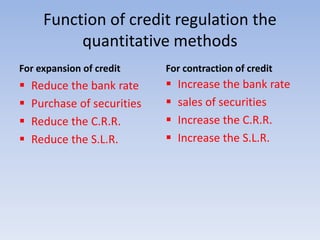

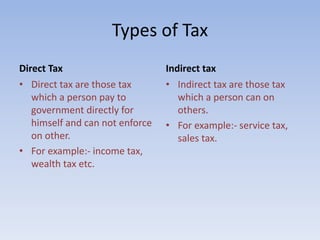

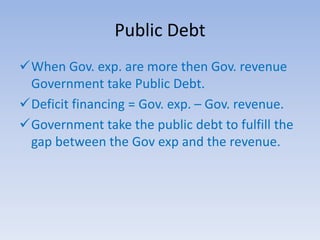

The document discusses monetary policy and fiscal policy as the main instruments that governments use to influence economic activity and stability. It describes the objectives, instruments, and effects of various monetary policy tools like bank rate, open market operations, cash reserve ratio, and statutory liquidity ratio. The document also outlines the objectives, components, and impacts of fiscal policy measures involving public expenditure, taxation, and public debt.