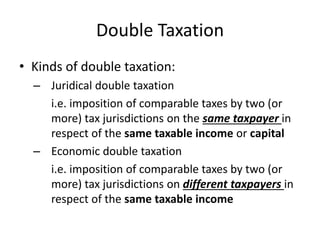

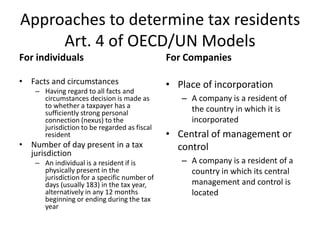

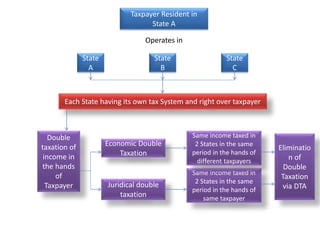

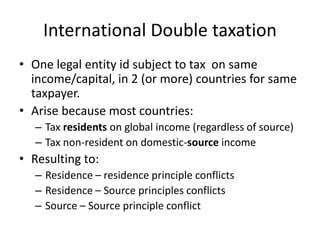

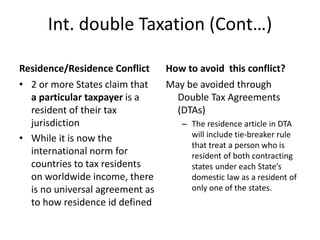

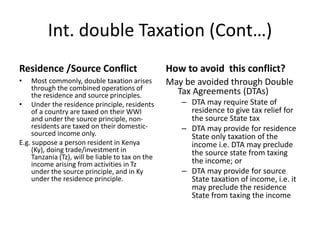

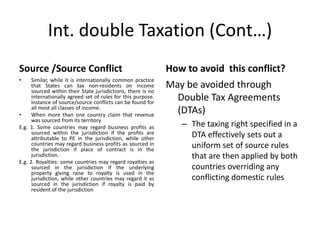

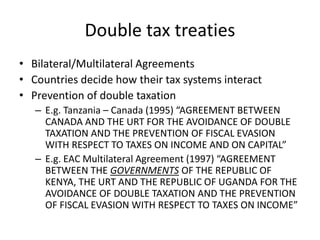

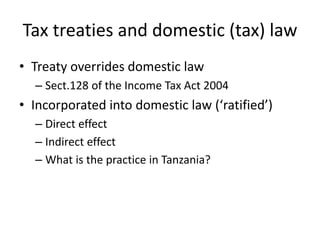

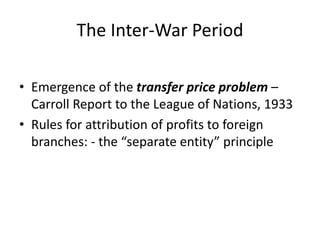

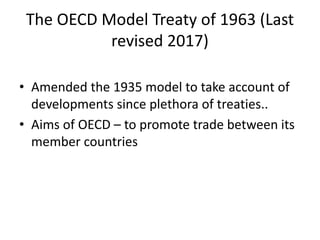

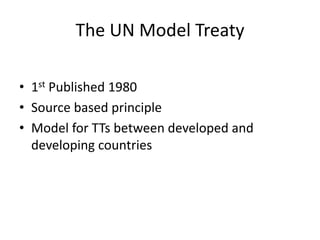

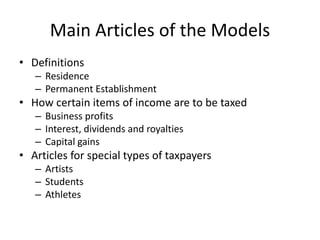

This document discusses double taxation and tax treaties. It defines double taxation as the imposition of income tax or corporate tax on the same income for the same taxpayer in two different jurisdictions. This can occur internationally when different countries tax the same income. Tax treaties are bilateral agreements between countries that determine how their tax systems interact to avoid double taxation. The key principles developed in early tax treaties include permitting the source country to tax profits of a permanent establishment and determining tax residence based on where central management is located.