This document is the user guide for Oracle Cash Management Release 12.1. It describes the key features and functions of Oracle Cash Management including bank reconciliation, bank statements, cash forecasting, and integration with other Oracle applications. It provides instructions for setting up Oracle Cash Management and related products as well as system parameters, security, bank transaction codes, and open interfaces for bank statements, reconciliation, and external cash flows.

![the complexity of the file format, you might choose to use one of a variety of

other programming languages.

2. Use your loader program to populate the Bank Statement Open Interface tables.

Bank Statement Open Interface Tables

The Bank Statement Open Interface consists of two tables:

• Bank Statement Headers Interface Table[Symbol_arrowhorizex]contains the bank

statement header information. The table is named

CE_STATEMENT_HEADERS_INT.

• Bank Statement Lines Interface Table[Symbol_arrowhorizex]contains the bank

statement transaction lines. The table is named

CE_STATEMENT_LINES_INTERFACE.

Related Topics

Bank Statement Headers Interface Table, page 2-35

Bank Statement Lines Interface Table, page 2-39

Loading Bank Statement Open Interface, page 4-1

Bank Statement Validation, page 4-17

Importing Bank Statements, page 4-13

Correcting Bank Statement Interface Errors, page 4-23

Reconciling Bank Statements Automatically, page 5-1

System Parameters, page 2-14

Archiving and Purging Imported Bank Statements, page 5-62

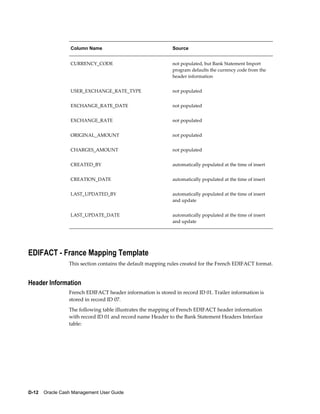

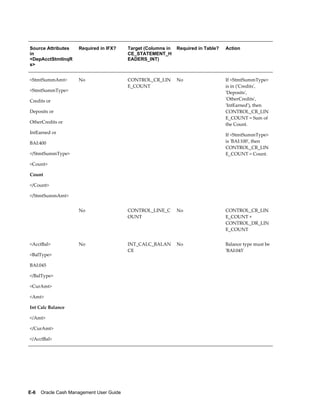

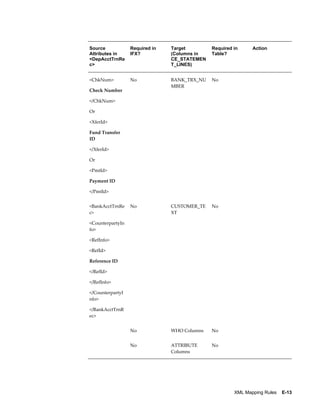

Bank Statement Headers Interface Table

The CE_STATEMENT_HEADERS_INT table must contain exactly one record for each

bank account within a bank statement. If a bank statement contains more than one

account, define a header record for each of the accounts on the statement.

The following table shows the columns contained in the

CE_STATEMENT_HEADERS_INT table:

Column Name Null? Type

STATEMENT_NUMBER N CHAR

System Setup 2-35](https://image.slidesharecdn.com/121cashmgmt-110819000450-phpapp01/85/121cash-mgmt-87-320.jpg)

![Status: The status of the signing authority. The status can be Approved, Pending, or

Rejected.

Additional Details Tabbed Region

Name: Name of the bank signatory.

Person Type: The classification of the bank signatory in Oracle HRMS.

HR Organization: The group or department the bank signatory belongs to.

Job: The job function of the bank signatory.

Location: The physical location of the bank signatory in the organization.

Email: The email address of the bank signatory.

Discoverer View

The Discoverer view for Bank Account Signing Authority provides details and a

historical audit trail of the changes made to the signing authority record. The

Discoverer view of the Bank Signing Authority can be used to report on the bank

account signing authority information.

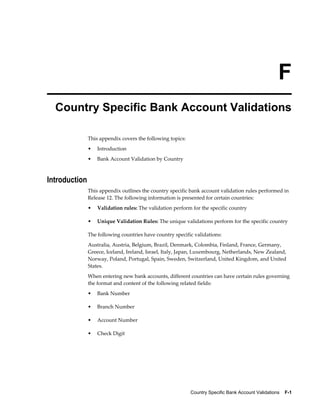

Bank Account Signing Authority Messages

The following table contains bank account signing authority messages and explanation

of those messages.

Error Message Explanation

In order to maintain bank account signing FND user ID is not mapped to HR Person ID.

authority, your FND user ID must be mapped

to a valid person-id in HR. Please contact your

system administrator. [OK]

Do you want to save the changes you have Standard save changes message

made? [YES] [NO] [CANCEL]

Delete Message [text] Standard confirm deletion message

The limit amount can not be negative. Please Negative limit amount

enter a new limit. [OK]

Please enter a limit amount. [OK] Enter a signing limit amount.

Bank Account Setup 3-33](https://image.slidesharecdn.com/121cashmgmt-110819000450-phpapp01/85/121cash-mgmt-147-320.jpg)

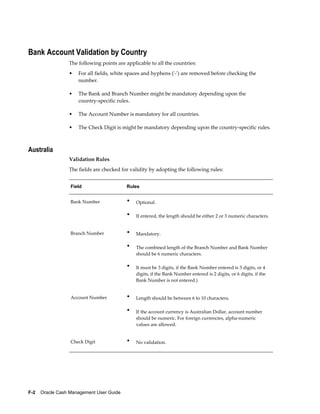

![Error Message Explanation

The joint signing limit must be zero or greater Joint signing limit amount

than or equal to the single signing limit. Please

enter a new amount. [OK]

The effective start date must equal or precede Effective dates

the effective end date. Please enter a new date.

[OK]

The effective date ranges, of the records for a Overlapping effective date ranges

signer's limits, may not overlap. Please correct

the effective dates. [OK]

Cash Pools

Cash pooling is a cash management technique aimed at optimizing the balances of the

internal bank accounts held at one or several banks. It is usually performed on a daily

basis.

To perform cash pooling, you need to define a cash pool and assign internal bank

accounts to the cash pool.

Creating Cash Pools

A cash pool is a group of bank accounts with one or more concentration accounts and

multiple sub accounts. You can create the following two types of cash pools:

• Notional Cash Pool: A cash pool consisting of one concentration account and

multiple sub accounts. This type of cash pool is used for cash leveling similar to

zero balancing without the actual funds movement. The cash pool's closing balance

for a day is calculated as a notional sum of the individual balances of the bank

accounts included in the pool. The interest is calculated on the notional net balance

of all accounts included in the pool and then paid out or charged to the

concentration or lead account.

• Physical Cash Pool: A cash pool consisting of one or two concentration accounts

and multiple sub-accounts with funds transfer rules specified for each combination

of concentration accounts and sub accounts. This type of cash pool is used for cash

leveling wherein the user can initiate fund transfers or mirror cash transfers

performed by the bank.

Before creating Physical Cash Pools, you have to decide how the physical fund

transfers will be recorded in the system. If you are using Oracle Treasury, you can

choose to create fund transfers in Oracle Treasury or Oracle Cash Management by

3-34 Oracle Cash Management User Guide](https://image.slidesharecdn.com/121cashmgmt-110819000450-phpapp01/85/121cash-mgmt-148-320.jpg)

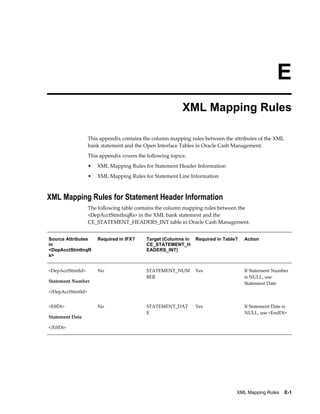

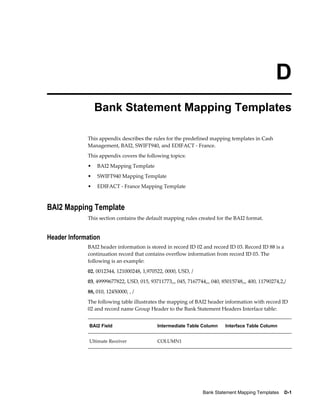

![:62F:C990227BEF37812,12

The following table contains the legend for SWIFT940 tables:

Legend for SWIFT940 Tables Legend for SWIFT940 Tables

a character

n numeric

number numeric

x character or numeric

[] optional

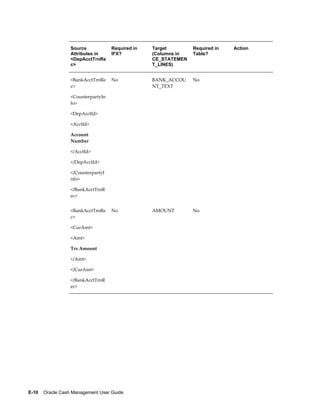

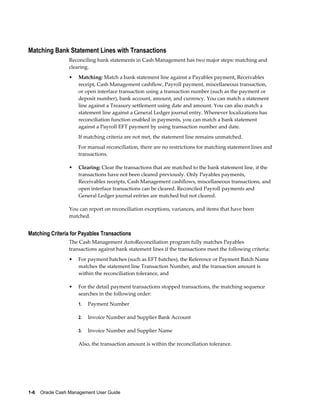

The following table illustrates the mapping of SWIFT940 header information with

record ID 25/25 and record name Account Identification to the Bank Statement Headers

Interface table:

Format in SWIFT940 SWIFT940 Field Intermediate Table Interface Table

Column Column

35x: Account 35x COLUMN1 BANK_ACCOUNT_

Identification NUM

The following table illustrates the mapping of SWIFT940 header information with

record ID 28C/28 and record name Statement Number/Sequence Number to the Bank

Statement Headers Interface table:

Format in SWIFT940 SWIFT940 Field Intermediate Table Interface Table

Column Column

5n: Statement 5n[/3n] COLUMN1 STATEMENT_NUMB

Number [/3n]: ER

Sequence Number

The following table illustrates the mapping of SWIFT940 header information with

record ID 60a/60 and record name Opening Balance to the Bank Statement Headers

Interface table:

Bank Statement Mapping Templates D-7](https://image.slidesharecdn.com/121cashmgmt-110819000450-phpapp01/85/121cash-mgmt-449-320.jpg)

![following is an example:

:61:9903020301D3,92N422NONREF

/OCMT/EURI,78

:86: 43.59.16.629 GTS OPERATIONS ADM

00011000000090 000000520012 9123456 19999

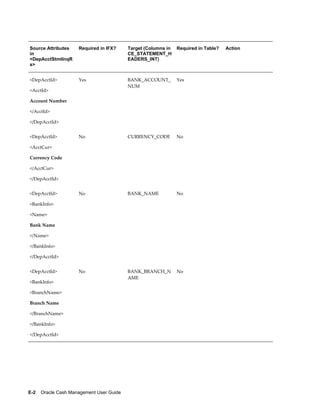

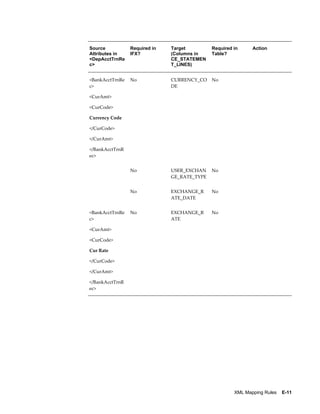

The following table illustrates the mapping of SWIFT940 line information with record

ID 61/61 and record name Statement Line to the Bank Statement Lines Interface table:

Format in SWIFT940 SWIFT940 Field Intermediate Table Interface Table

Column Column

6n: Transaction Date 6n COLUMN1 TRX_DATE

[4n] : Entry Date [4n] COLUMN2

2a: Debit/Credit Mark 2a COLUMN3

[1a] : Funds Code [1a] COLUMN4

15number : Amount 15number COLUMN5 AMOUNT

axxx : Transaction axxx COLUMN6 TRX_CODE

Code

16x : Reference for 16x COLUMN7 CUSTOMER_TEXT

Account Owner

[//16x] : Account [//16x] COLUMN8 BANK_ACCOUNT_T

Servicing Institution's EXT

Reference

[34x] : Supplementary

Detail

The following table illustrates the mapping of SWIFT940 line information with record

ID 86/61A and record name Information to Account Owner to the Bank Statement Lines

Interface table:

D-10 Oracle Cash Management User Guide](https://image.slidesharecdn.com/121cashmgmt-110819000450-phpapp01/85/121cash-mgmt-452-320.jpg)

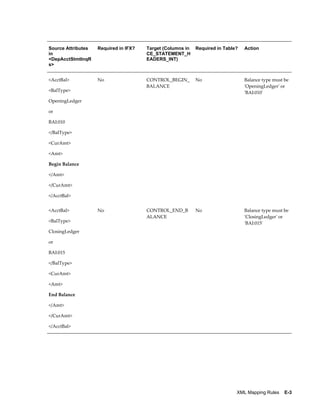

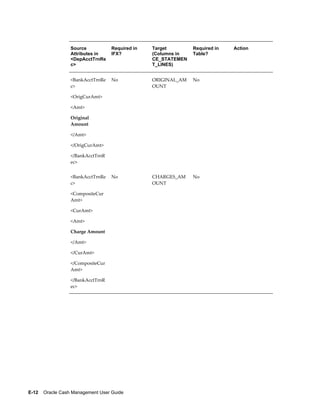

![Format in SWIFT940 SWIFT940 Field Intermediate Table Interface Table

Column Column

65x: Information to 65x COLUMN1 BANK_TRX_NUMBE

Account Owner R, TRX_TEXT

Note: [34x] is stored as a separate record ID 61A and is mapped to the

TRX_TEXT column. Overflow information from record ID 61 is stored

in the same column as the supplementary details in record ID 61. The

BANK_TRX_NUMBER column is populated with data from the

Information to Account Owner field that matches the default format of

Example (xxx). You must change the format to the actual format used

by your bank. The Transaction Code field identifies the type of

transaction. For example, transfers are identified as TRF. However, the

Transaction Code field does not contain information about the debit or

credit nature of the transaction. A separate field, the Debit/Credit Mark

field, is used to differentiate debit and credit entries, where D means

debit and C means credit. When the Bank Statement Loader program

populates the TRX_CODE column in the Bank Statement Lines

Interface table, it appends the Debit/Credit Mark to the Transaction

Code to form a new code. For example, debit transfers are identified as

TRFD and credit transfers as TRFC. You must set up these new bank

transaction codes in Cash Management before you can import the bank

statement information.

The remaining columns in the Bank Statement Lines Interface table are populated as the

following table illustrates:

Column Name Source

BANK_ACCOUNT_NUM copied from the header information

STATEMENT_NUMBER copied from the header information

LINE_NUMBER sequentially generated, starting with 1

EFFECTIVE_DATE not populated

INVOICE_TEXT not populated

Bank Statement Mapping Templates D-11](https://image.slidesharecdn.com/121cashmgmt-110819000450-phpapp01/85/121cash-mgmt-453-320.jpg)