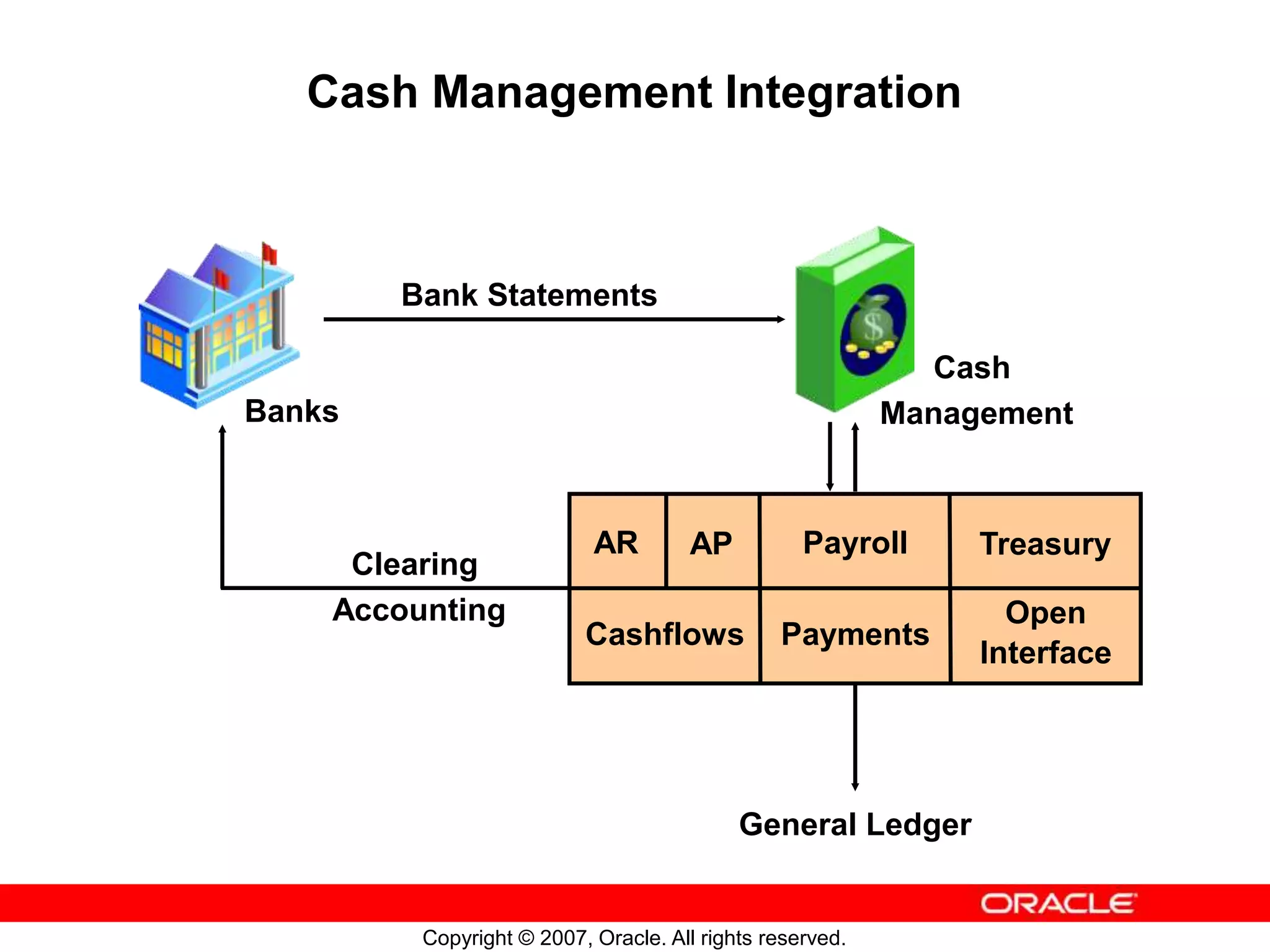

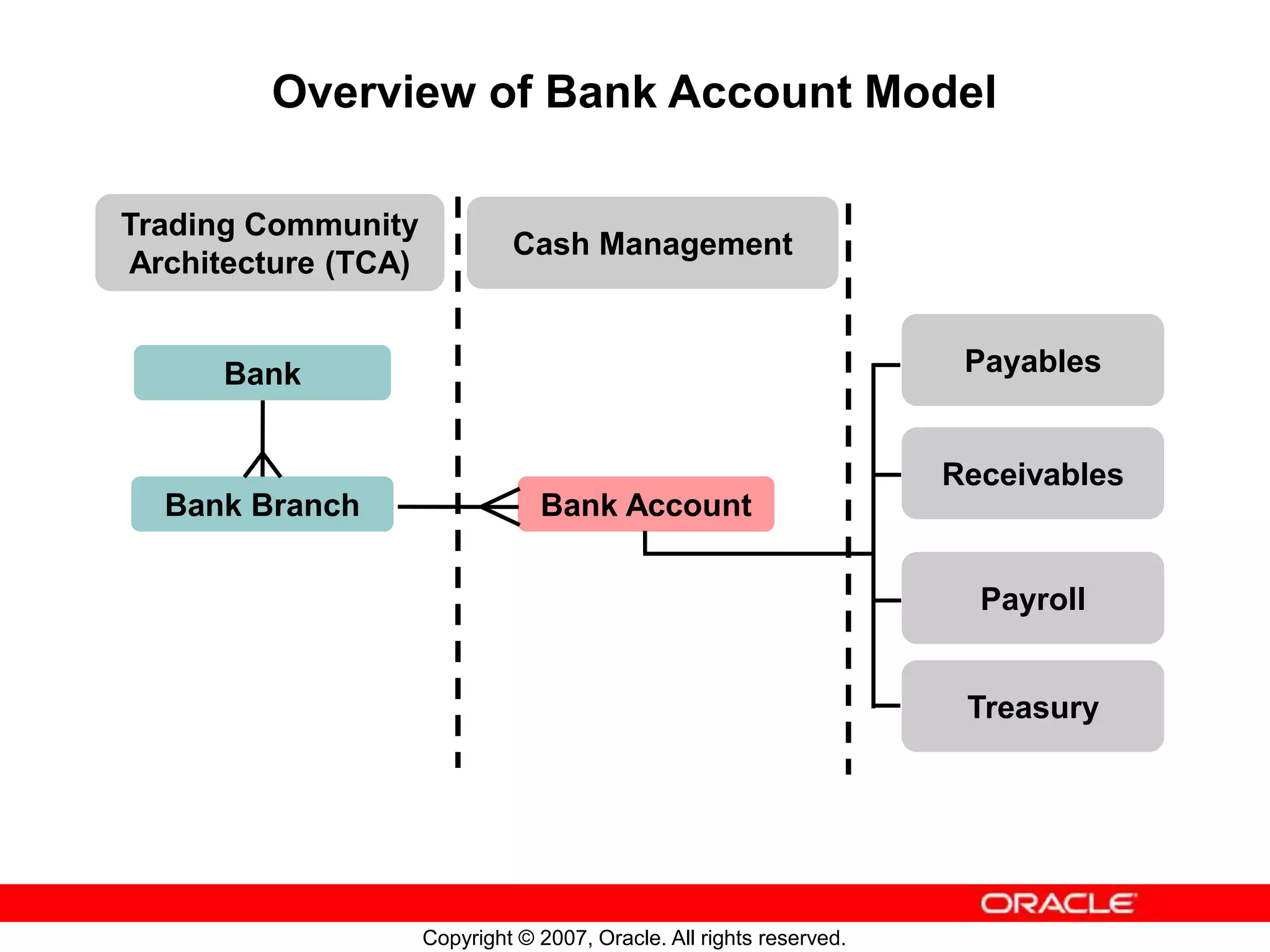

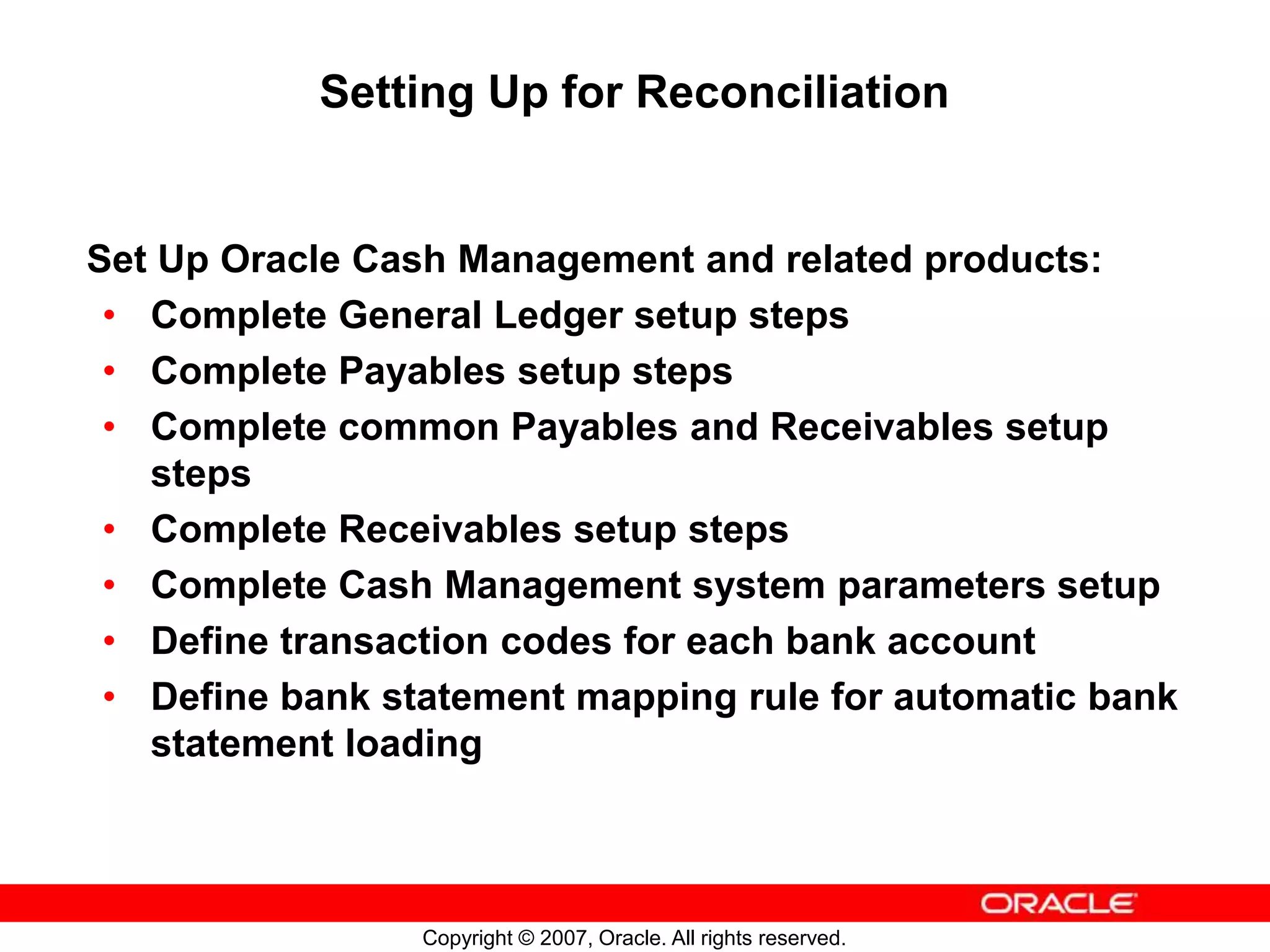

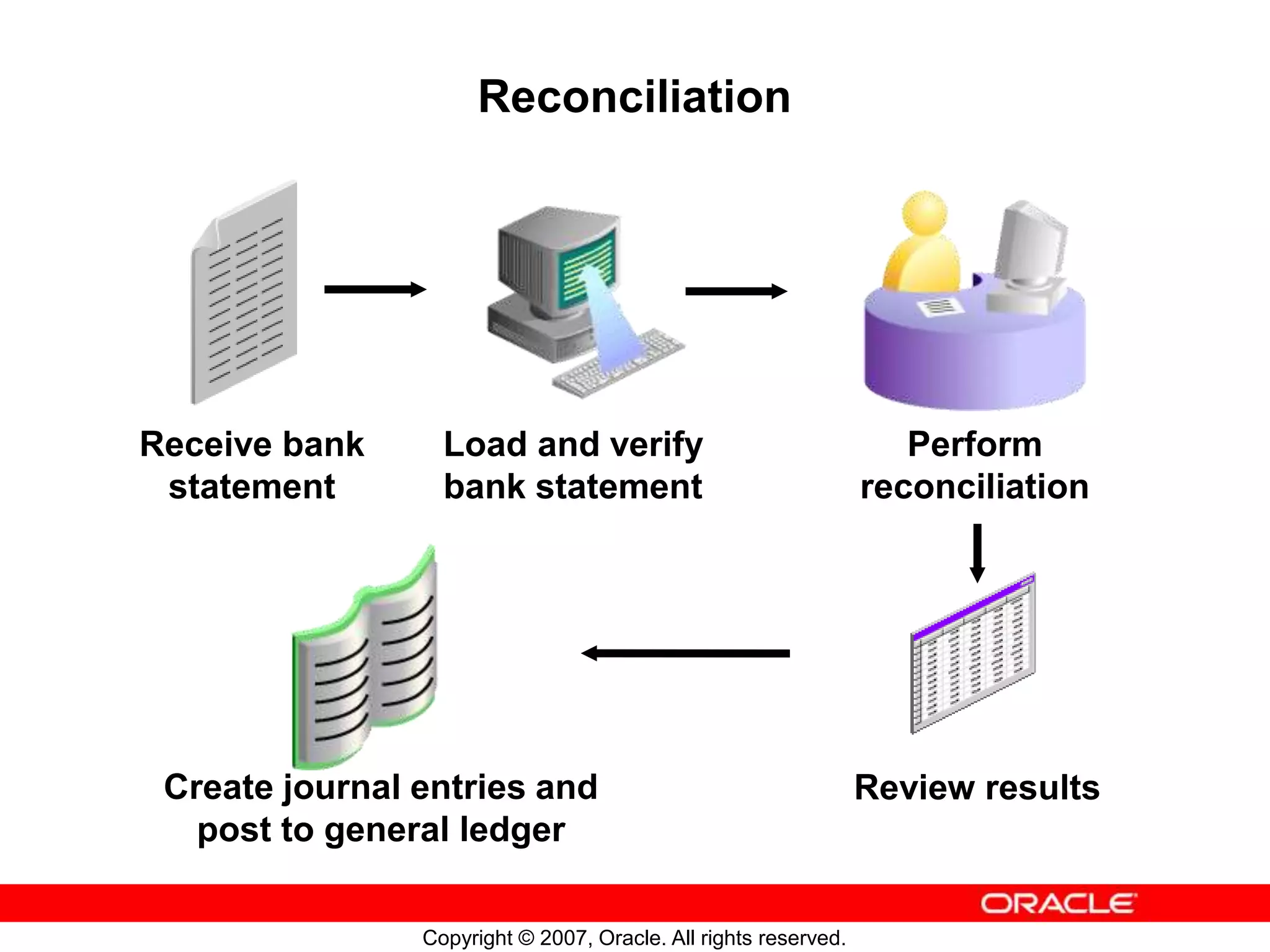

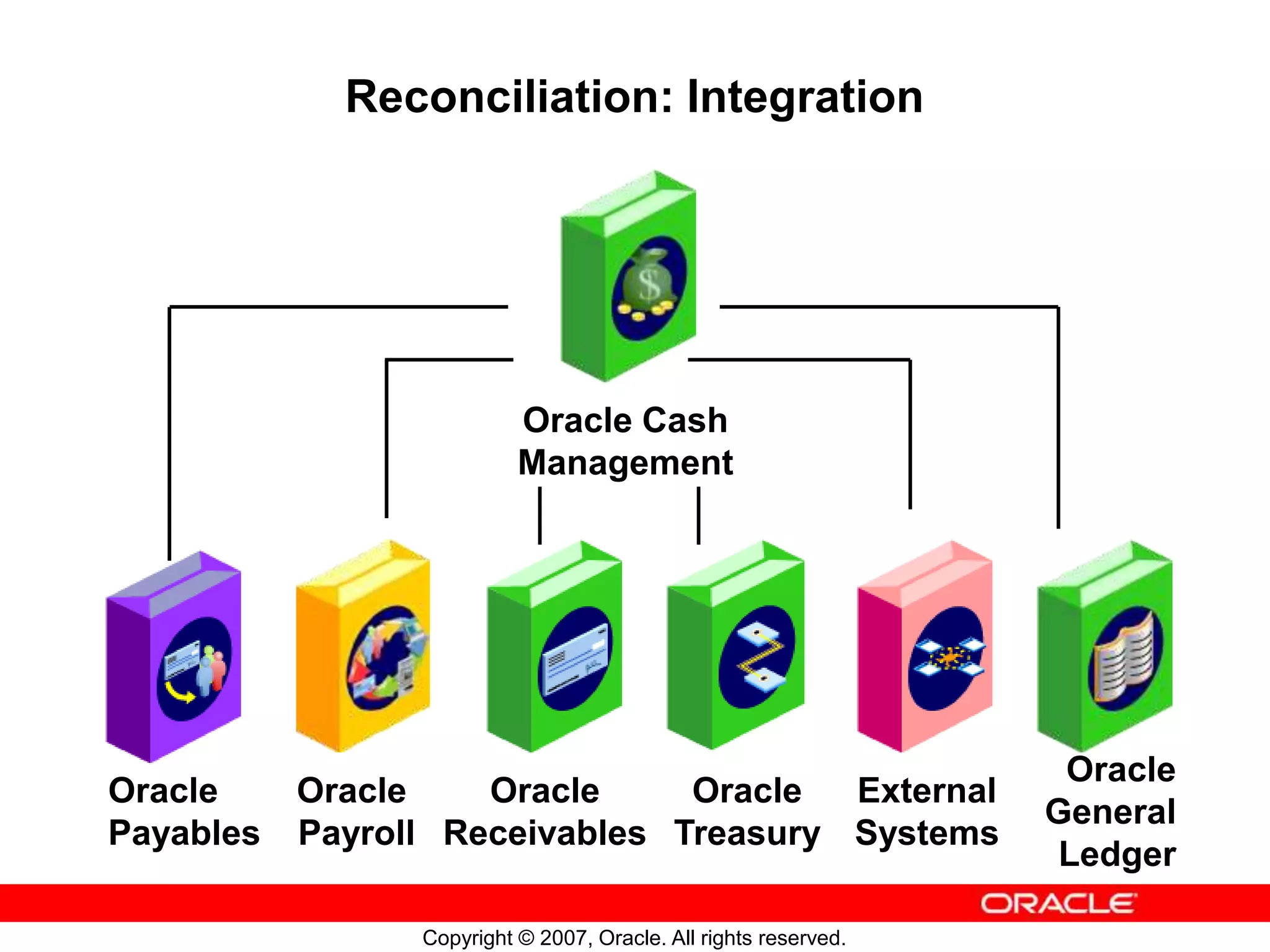

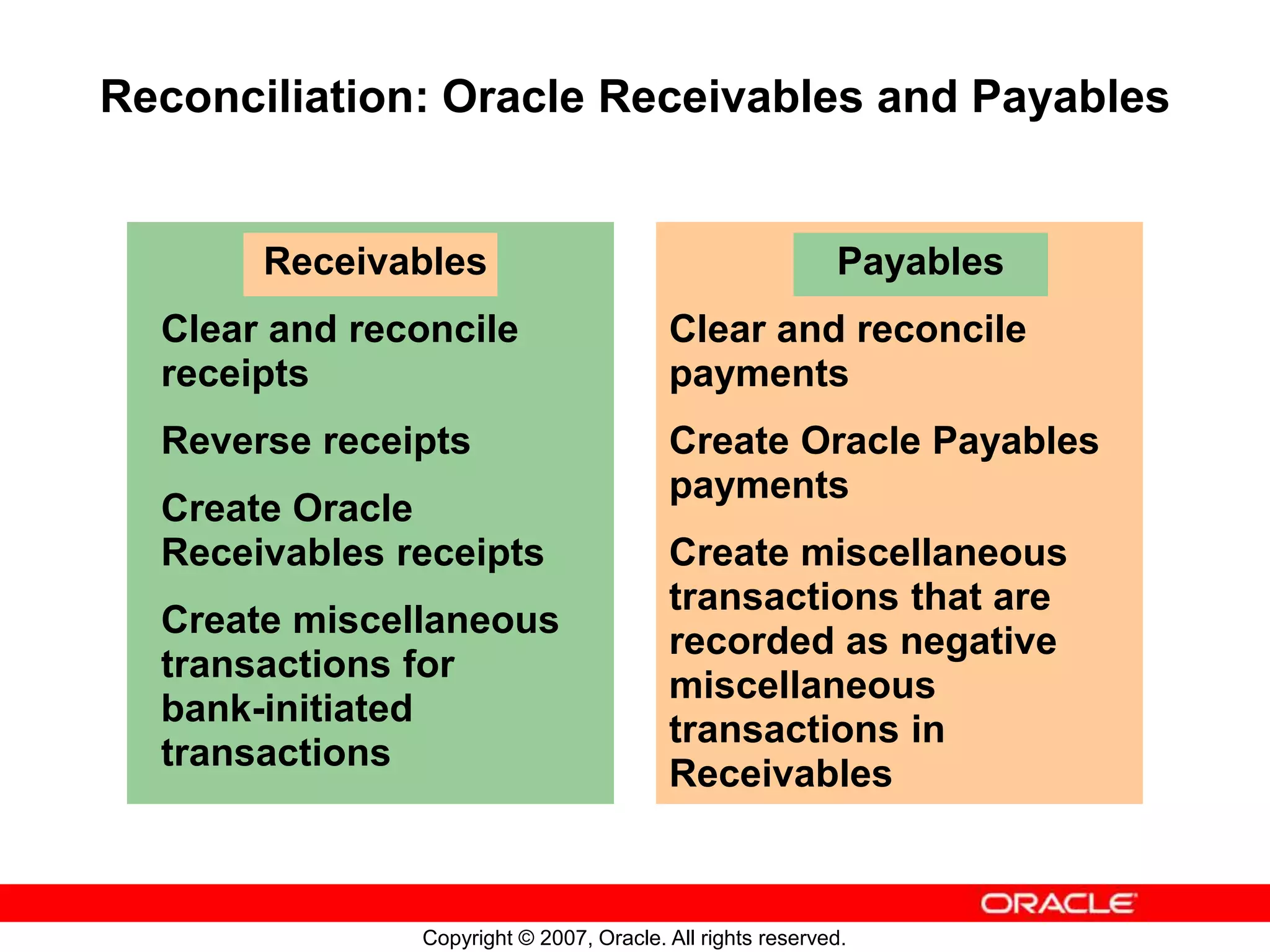

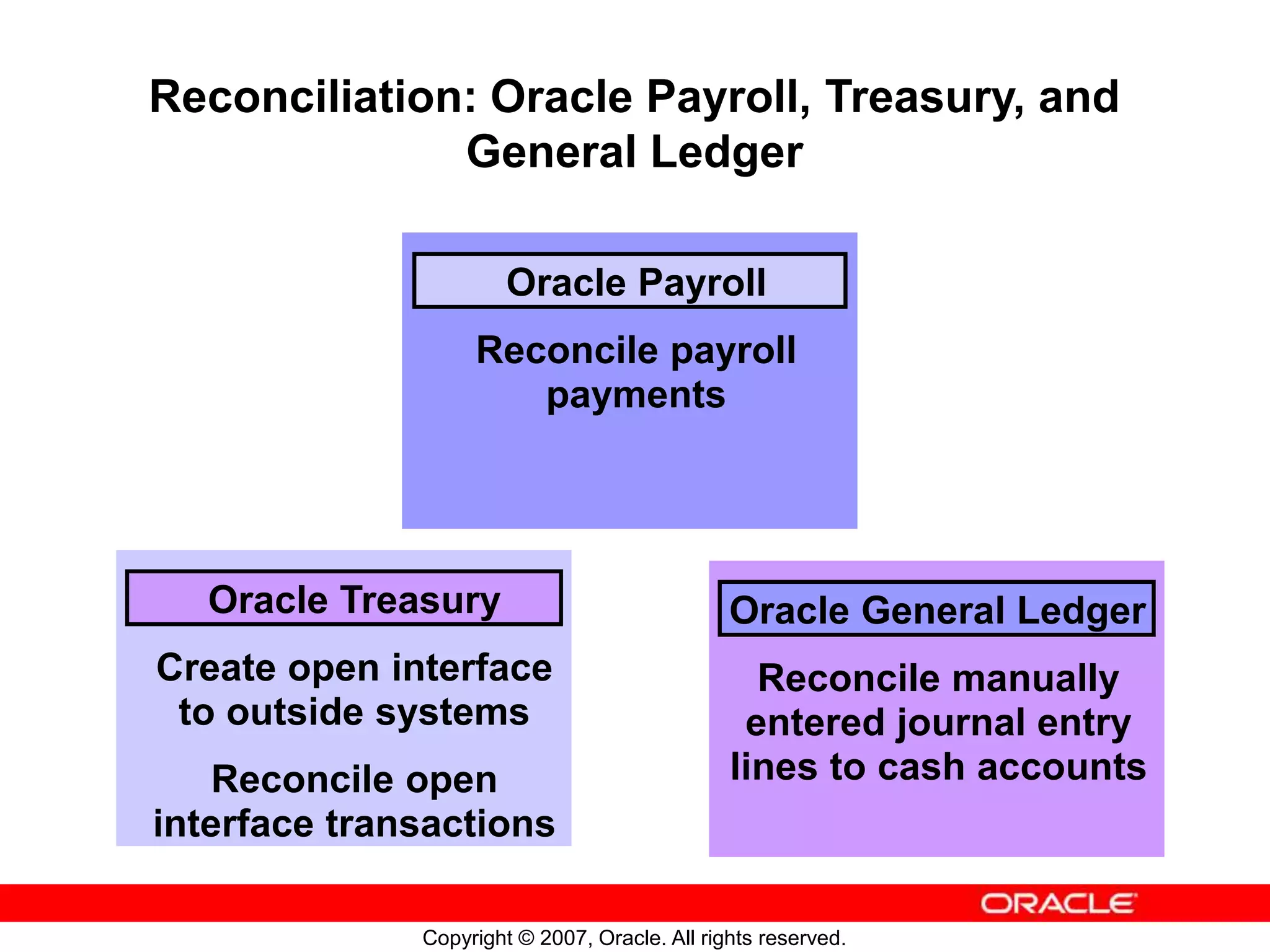

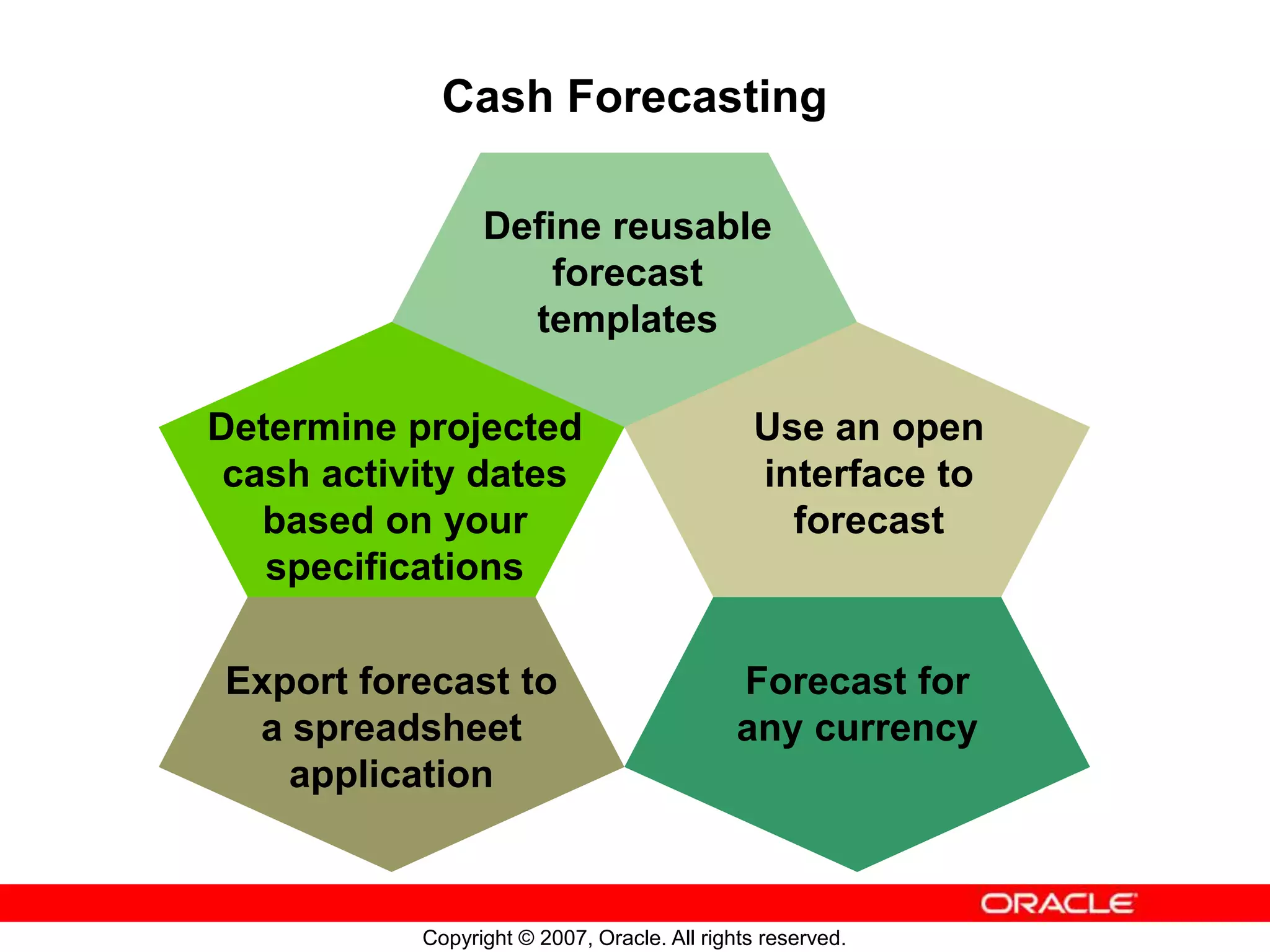

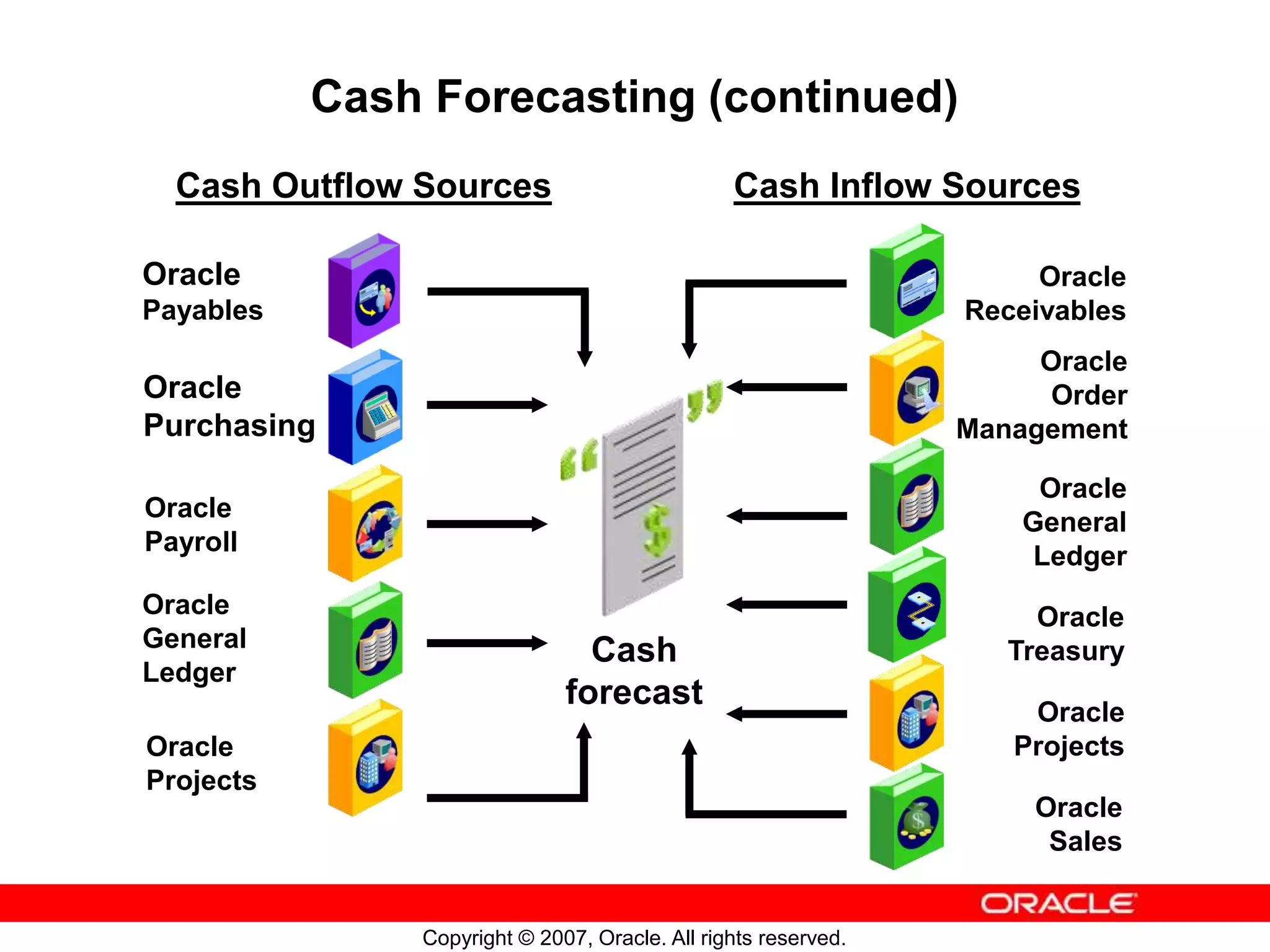

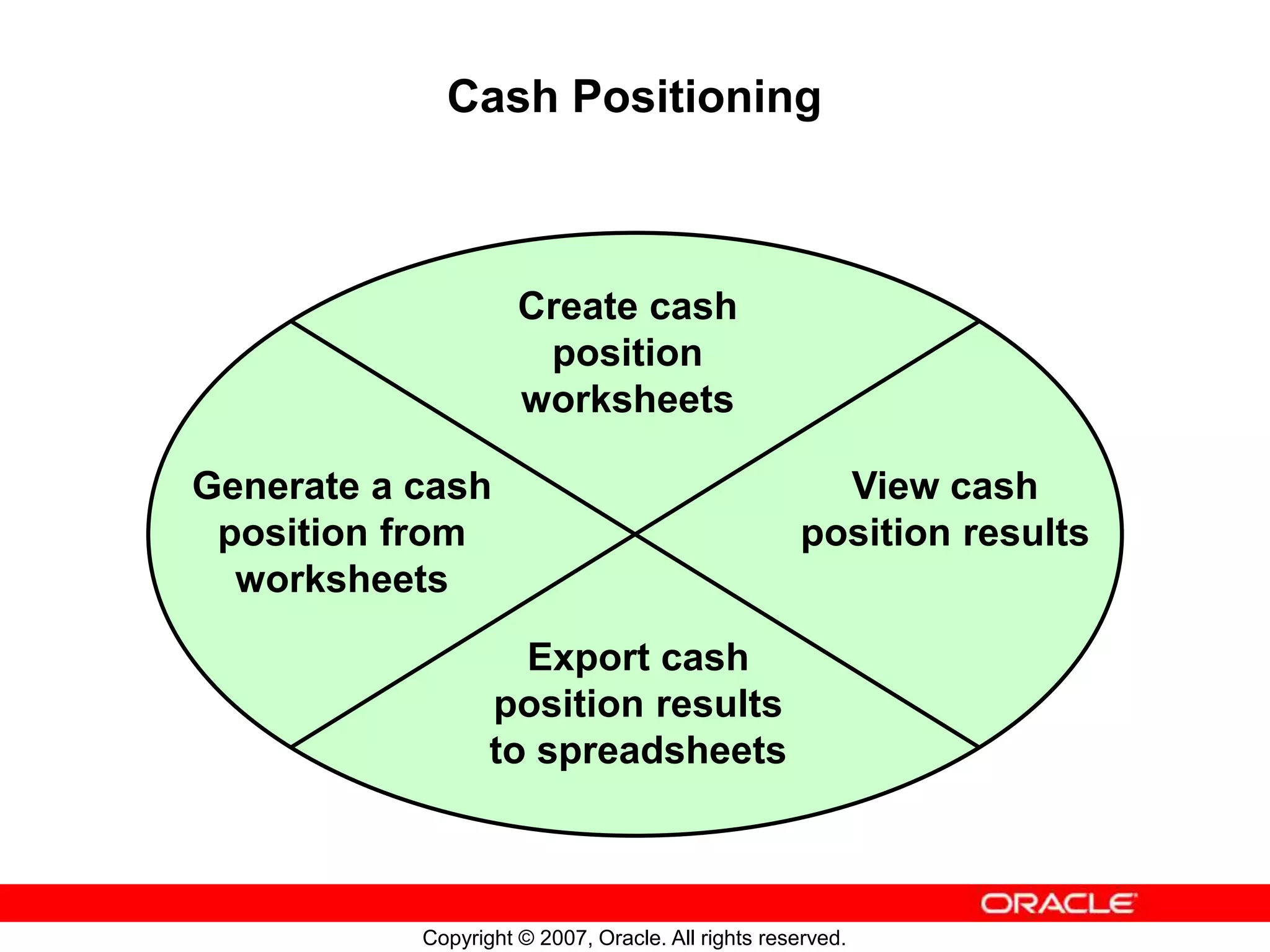

This document provides an overview of Oracle Cash Management, including describing its key features and concepts such as the bank account model, reconciling bank statements, cash forecasting, cash positioning, and cash pools. It outlines the objectives and agenda and provides details about setup, reconciliation processes, integration with other Oracle products, and reporting.