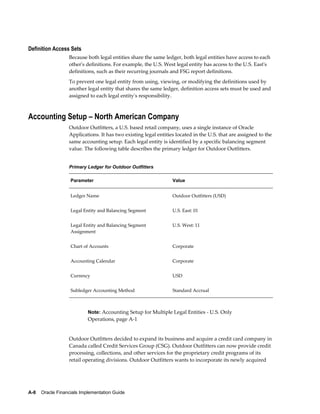

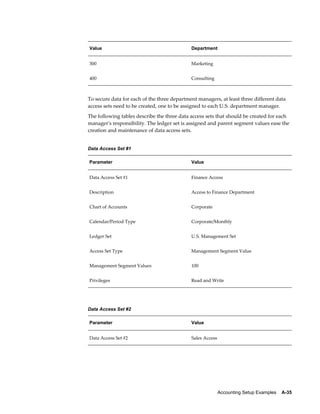

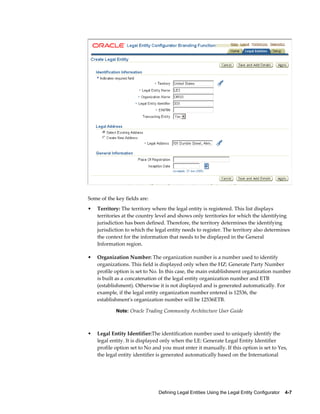

This document provides an implementation guide for Oracle Financials Release 12. It outlines considerations for designing accounting setups, including whether to use one or multiple legal entities. It describes how to create accounting setups using the Accounting Setup Manager, including defining legal entities, ledgers, reporting currencies, and journal conversion rules. It also provides examples of different accounting setup structures and comparisons of feature support across different setup options.

![7-6 Oracle Financials Implementation Guide

• Sequence Events – GL Period Close and Posting

• Validate Sequence By – Journal Effective Date and Reference Date for the

Accounting sequence event. Posting Date and Journal Effective Date for GL Period

Close sequence event

• Assign Sequence By – Posting Date, Journal Effective Date and Reference Date.

• Balancing Segment Values – Specify the balancing segment values that are fiscal in

nature. This is used only by GL Period Close sequence event. When the GL period

is closed, only fiscal journal entries are sequenced.

Note: To use this option, balancing segment values must be

assigned to the legal entity in your accounting setup.

Assigning a Sequence

After you define the Sequencing Context, use the Assign Sequences page to assign the

sequences to journal entries. A sequence assignment uses a combination of the

sequencing context, sequence entity, and sequence event to sequentially number the

journal entries.

Before assigning the sequences, you must determine the following sequence control

attributes:

• Effective date range

• Balance Type

• Journal Source

• Journal Category

• Accounting Event Type (only for subledger journal entries)

• Accounting Entry Type (only for subledger journal entries)

• Document Category (only for subledger journal entries)

Sequence Assignments Page

Use the Create Assignments [Sequence Context] page to create and update assignments

and exceptions for a sequence context.

The following table explains selected fields in the Create Assignments page.](https://image.slidesharecdn.com/120finig-150805230033-lva1-app6892/85/120finig-176-320.jpg)