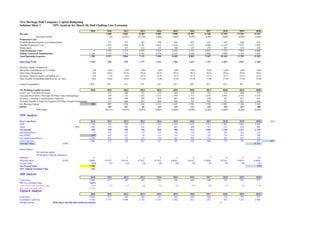

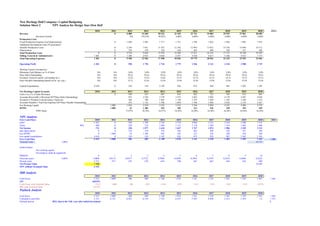

The document summarizes capital budgeting analyses for two potential new product lines for New Heritage Doll Company:

1) Match My Doll clothing line extension, which has a positive NPV of $7,150 and IRR above the company's hurdle rate, indicating it should be accepted.

2) Design Your Own Doll, which has a negative NPV without considering terminal value but a positive NPV of $7,298 and IRR of 18.33% when factoring in terminal value, suggesting it may also be worthwhile but is more marginal.