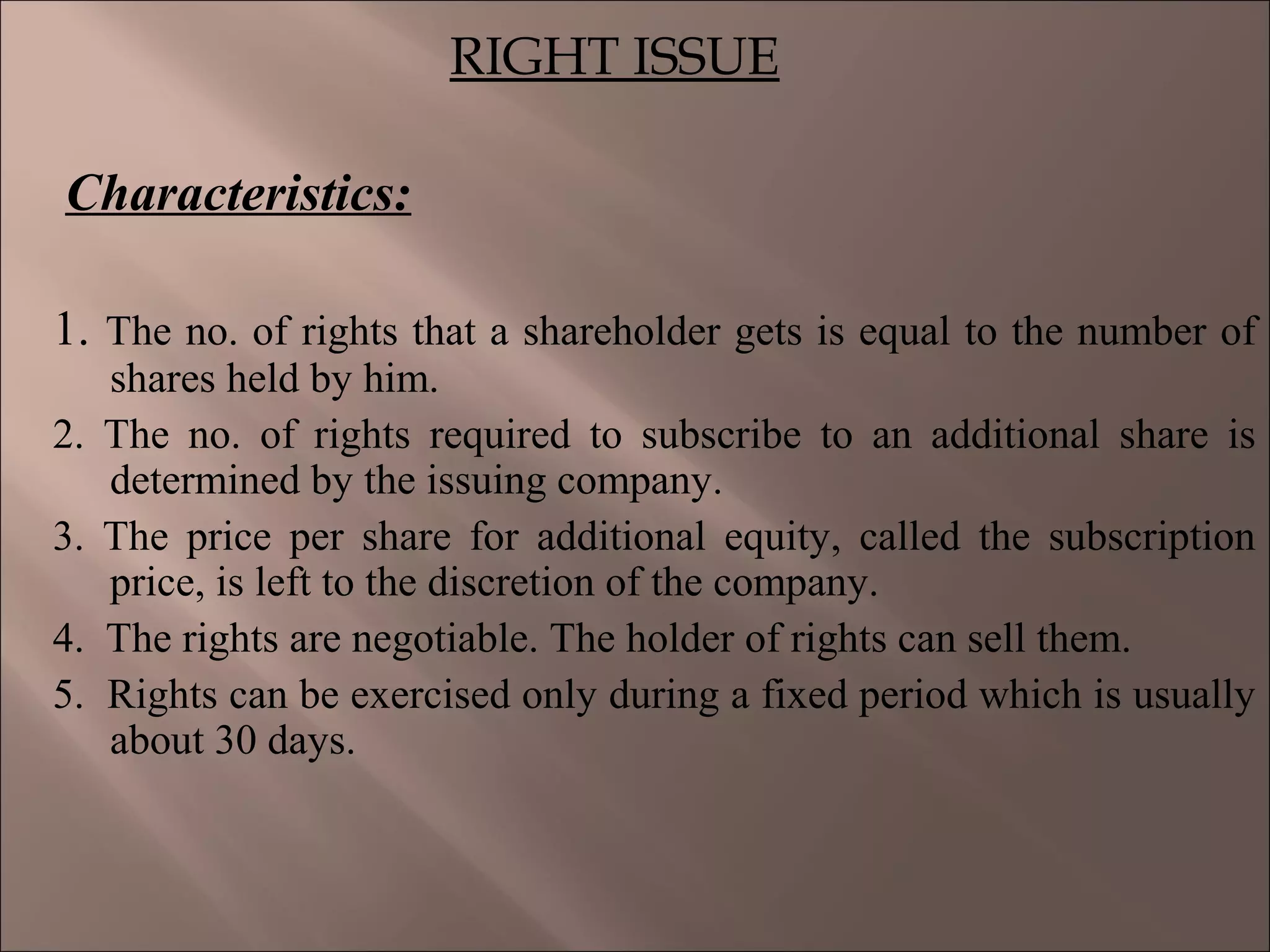

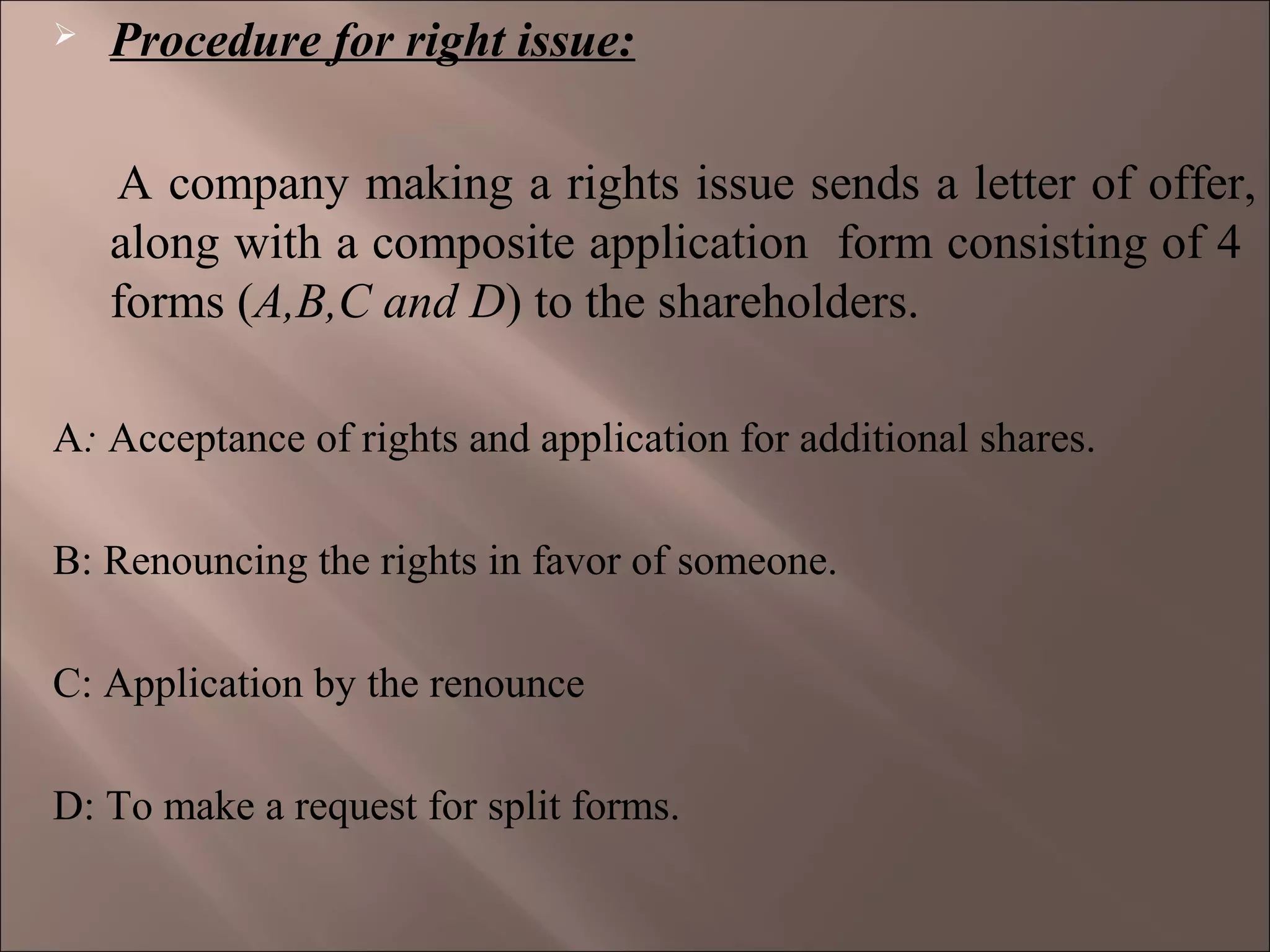

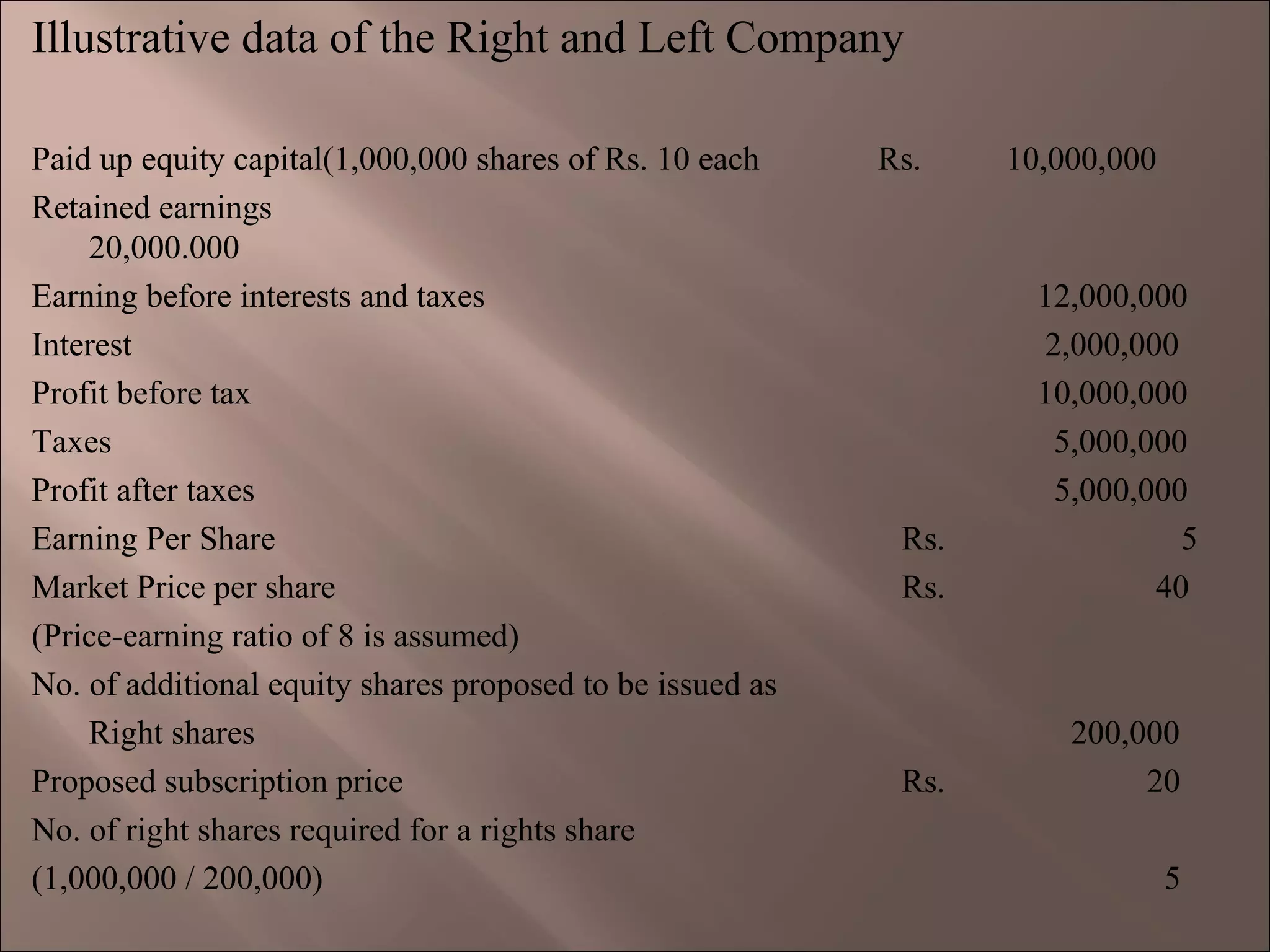

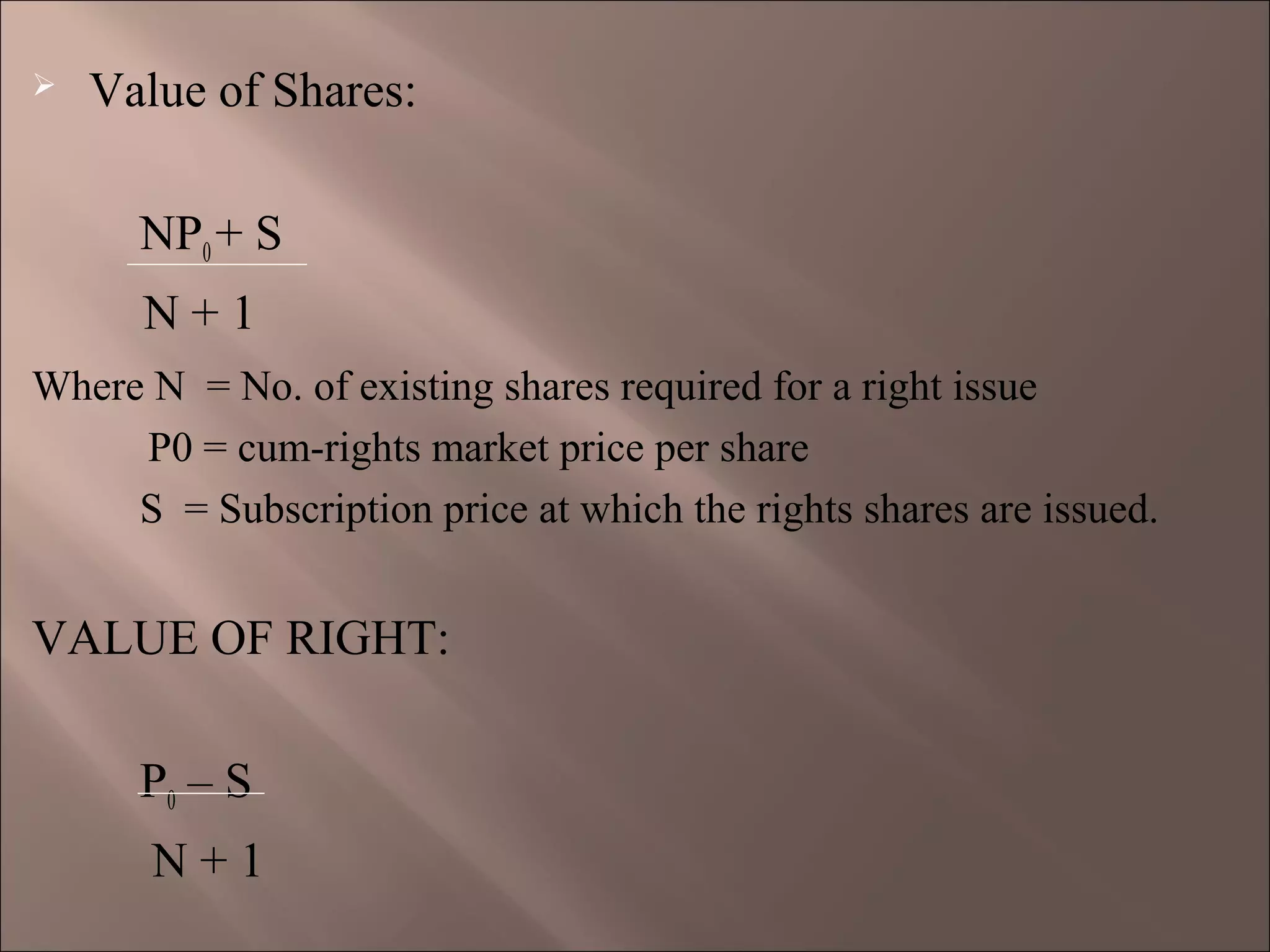

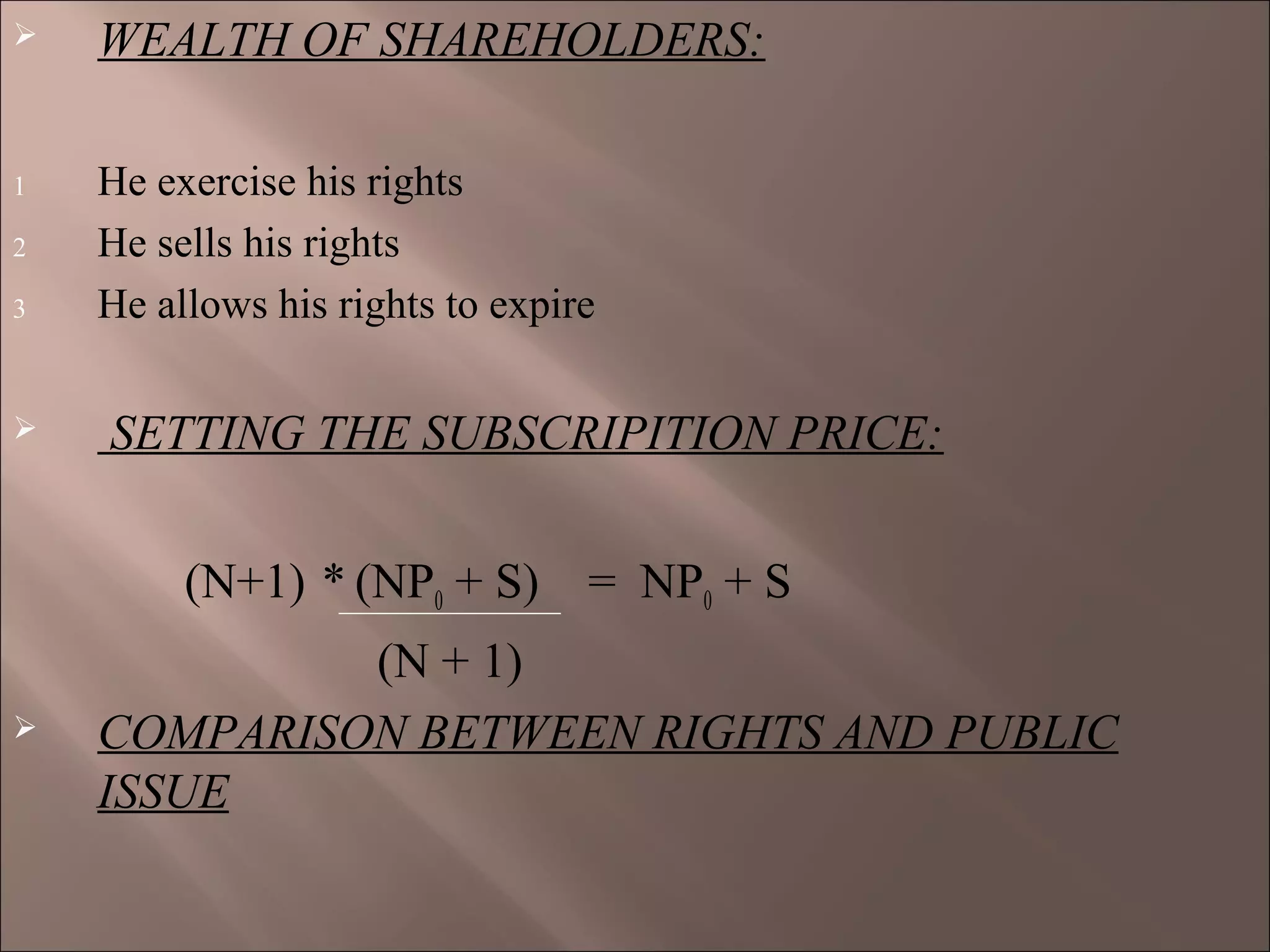

The document discusses various long term financing options for companies including venture capital, initial public offerings, rights issues, private placements, preferential allotments, and term loans. It provides details on the process and requirements for each type of financing. Some key points covered include the roles of merchant bankers and underwriters in IPOs, the pricing and allotment process for rights issues, and the steps involved in applying for and disbursing a term loan.