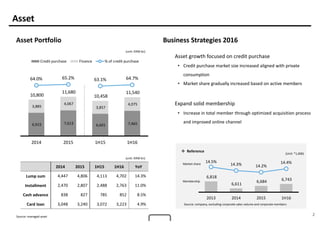

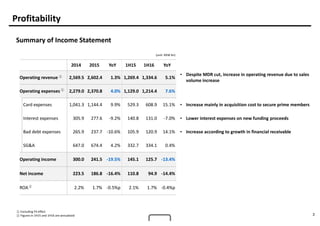

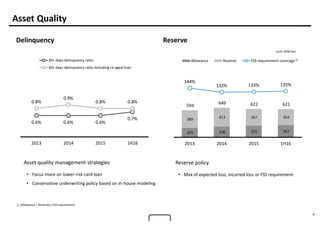

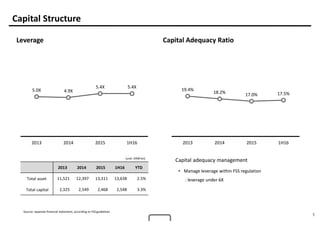

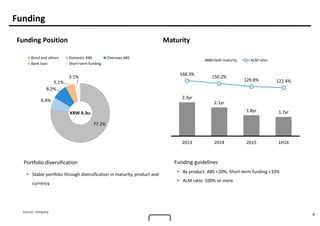

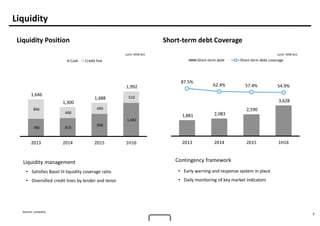

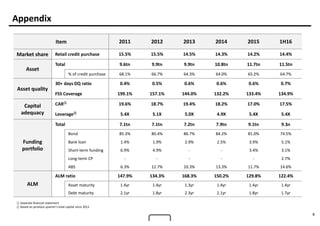

Hyundai Card Corporation reported its 1H16 earnings. During this period, the company saw its total assets grow 2.5% to KRW 13.6 trillion driven by an 11% increase in installment loans. Operating revenue increased 5.1% despite interest rate cuts, while operating expenses rose 7.6% mainly due to higher acquisition costs. Net income declined 14.4% annually to KRW 94.9 billion as profitability was impacted by rising delinquencies and provisions. The company maintained sound capital and liquidity positions with a capital adequacy ratio of 17.5% and short-term debt coverage of 54.9%.