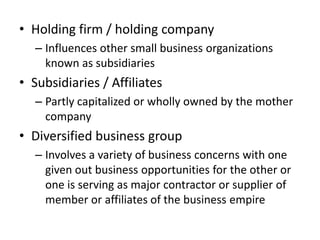

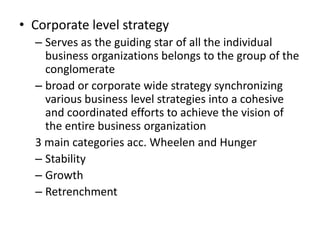

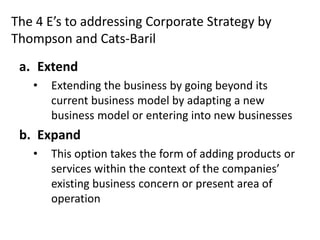

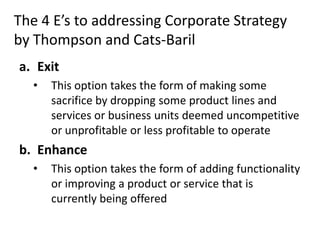

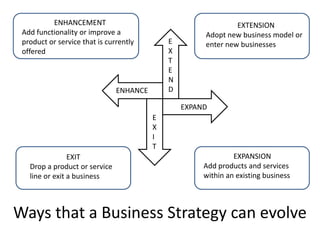

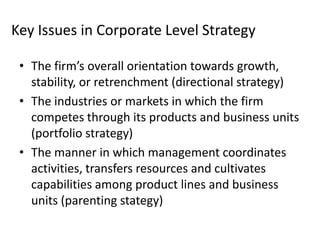

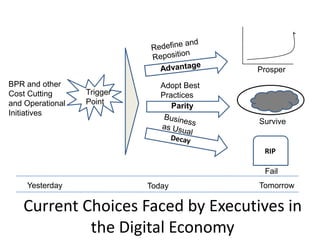

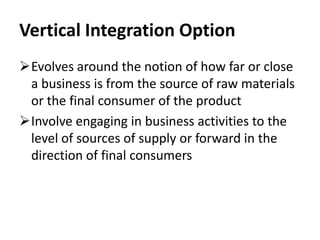

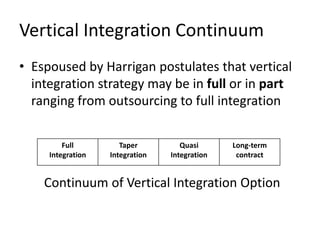

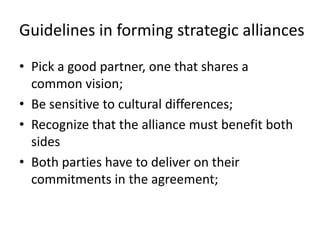

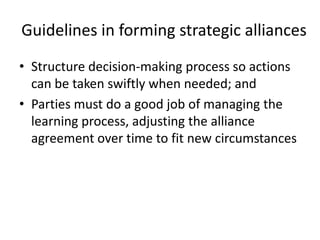

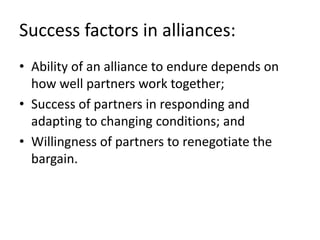

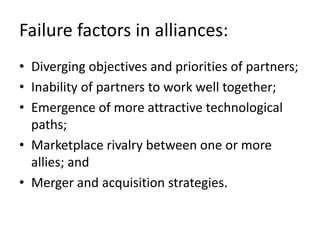

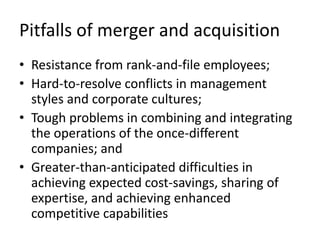

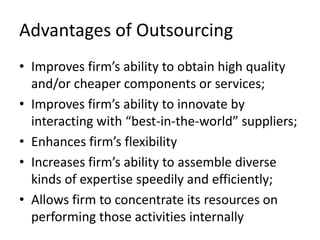

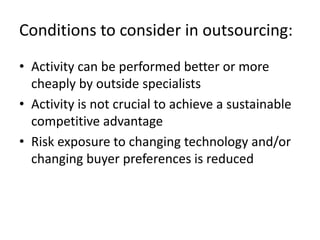

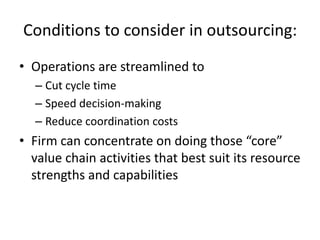

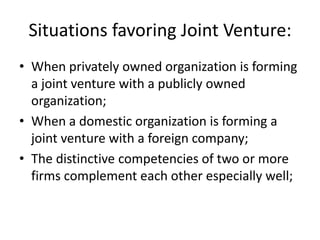

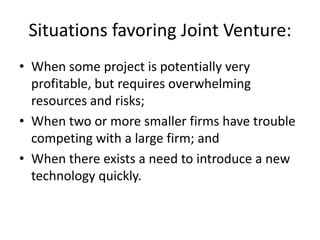

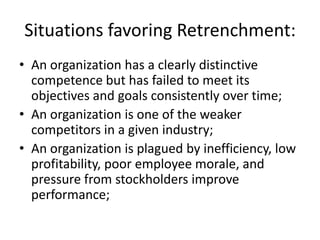

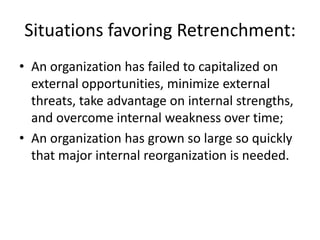

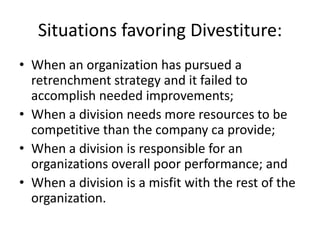

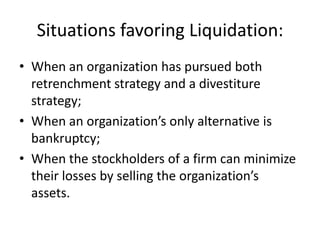

This document discusses various corporate level strategies. It describes categories of business organizations including corporations, sole proprietorships, partnerships, and cooperatives. It then discusses corporate level strategies such as stability strategies, growth strategies, and retrenchment strategies. It outlines various strategic options corporations can take including expansion, acquisition, alliance, outsourcing, and divestment. It provides examples of situations that may favor each of these strategic options.