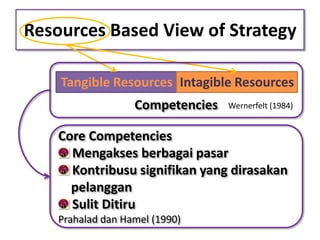

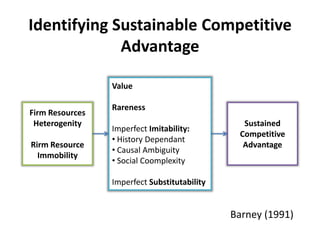

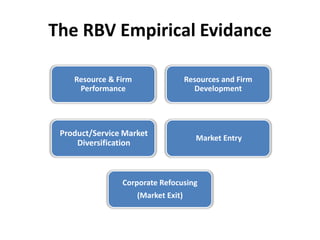

The document discusses the development of the resource-based view of the firm and provides a critical appraisal of the theory, outlining both its methodological difficulties and practical insights. It examines the empirical evidence supporting the resource-based view and addresses areas that require further focus, such as resource functionality and combining the theory with other strategic perspectives.