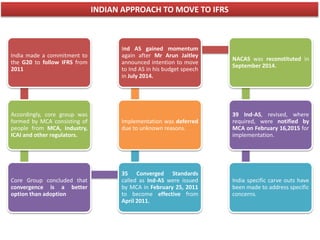

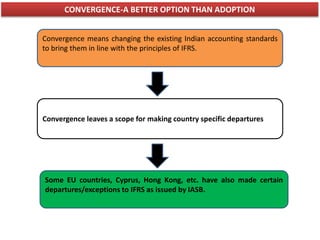

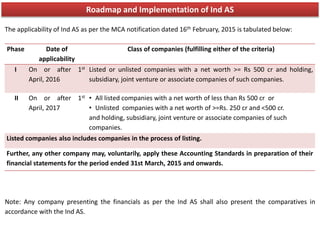

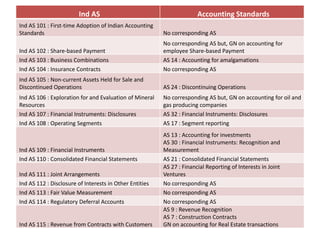

India committed to G20 to adopt IFRS from 2011, opting for convergence of accounting standards rather than full adoption, leading to the introduction of 39 Ind AS by the MCA in 2015. Ind AS are designed to align Indian financial reporting with international standards while allowing for specific deviations known as carve outs. The implementation dates for various classes of companies were specified, beginning April 1, 2016, with ongoing enhancements to the reporting framework.