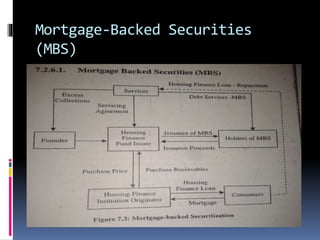

This document provides an overview of securitization of debt. It defines securitization as the conversion of future cash flows from financial assets like loans into tradable securities that can be sold in the market. This process allows lenders to raise funds. A special purpose vehicle (SPV) is used as an intermediary between the originator of assets and investors. The SPV issues different types of securities backed by assets like mortgages (MBS), consumer debt (ABS), and corporate debt (CDO). The document discusses the key features and types of securitizable assets in securitization.