Insurance claims

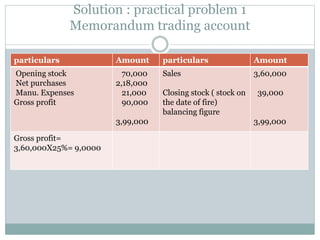

- 1. Solution : practical problem 1 Memorandum trading account particulars Amount particulars Amount Opening stock Net purchases Manu. Expenses Gross profit 70,000 2,18,000 21,000 90,000 3,99,000 Sales Closing stock ( stock on the date of fire) balancing figure 3,60,000 39,000 3,99,000 Gross profit= 3,60,000X25%= 9,0000

- 2. Calculation of net loss of stock = stock on the date of fire 39,000 Less: salvaged value of stock 8,000 Loss of stock 31,000

- 3. Solution to p.2 Calculation of gross profit Memorandum Trading a/c as on 31.3.2016 Particulars Amount particulars Amount Stock on 1.4.15 Net purchases Wages & manu. Gross Profit (b/f) 40,000 4,20,000 40,000 1,50,000 6,50,000 Sales Closing stock 6,00,000 50,000 6,50,000 Gross profit = gross profit/net sales x 100 1,50,000/6 00000 x100 25%

- 4. Solution to p.2 Gross profit rate= 25% Memorandum Trading a/c as on 15.8.2016 Particulars Amount particulars Amount Opening Stock Net purchases Wages & manu. Gross Profit (% of sales) 50,000 2,90,000 25,000 1,00,000 4,65,000 Sales Closing stock (b/f) 4,00,000 65,000 4,65,000 Gross profit = Salesx25% = 4,00,000X25% 1,00,000

- 5. Calculation of net loss of stock = stock on the date of fire 65,000 Less: salvaged value of stock 18,000 Loss of stock 47,000

- 7. Ascertainment of stock on the date of fire Ascertainment of net loss of stock Value of stock on the date of fire 66,000 Less; salvaged value 2,000 Claim to be lodged 64,000 Particulars Based on last year rate actuals particulars Based on last year rate actuals To, 0,stock ‘purchases ‘gross profit 30,000 80,000 50,000 30,000 88,000 53,000 By sales ‘closing stock 1,00,000 66,000 1,05,000 60,000 1,60,000 1,71,000 1,60,000

- 8. Poor selling goods Sometimes stock of a business may include some goods which are shope-soiled*, outdated, etc. which are called as poor selling goods. These goods are generally valued at below cost and in effect, gross profit is reduced. On determining the normal rate of gross profit, the stock and sales proceeds of these goods are to be eliminated from the stock and total sales. Trading Account in such cases, is prepared in columnar form to show separately the normal and abnormal items. *Slightly dirty, damaged

- 10. Wn.1 Memorandum Trading a/c as on 31.12.2015 Particulars Amount particulars Amount To, Opening Stock Net purchase Gross Profit c/d (balancing figure) 27,570 2,71,350 1,05,300 Sales Closing stock Normal item (51,120- 1,500 ) Abnormal item 3,51,000 49,620 3,600 4,04,220 4,04,220 Gross profit rate= GP/Net salesx100 = 1,05,300/3,51,000X10 0 =30%

- 11. Memorandum Trading a/c 1.1.16 to 31.3.16 Particulars normal abnorm al particulars normal abnorm al To, Opening Stock Net purchase Gross Profit c/d ( % of sales) 49,620 90,000 26,640 3,600 xxx Sales loss Closing stock (balancing fig) 88,800 77,460 2,700 9,00 1,66,260 3,600 1,66,260 3,600 Wn 2,purchases 75,000+ goods received but not recorded 75,000+ 15,000 = 90,000 Gp=88,800 x30/100 26640

- 12. Wn 3. Actual sales 91,500- abnormal sales (2,700)= normal sales =88,800 Statement of claim to be lodged Book value of stock on the date of fire =77,460 Less: salvaged stock 6,300 Loss of stock 71,160

- 13. Loss of profit insurance policy / consequential loss policy “A loss of profit policy is a policy attached to the fire insurance policy, where the insured will be compensated also for loss in profit due to interruption in business activities due to fire in addition to loss of stock. ’’ This policy is taken to cover the loss of profit occurred due to the interruption of fire in a business. Ex: dislocation, inconvenience

- 14. A fire insurance policy differs from a loss of profit policy on the following grounds: (1) While a fire insurance policy covers loss of or damage to insured property such as Building, stock etc., a loss of profit policy covers loss of gross profit sustained inconsequent of a business interruption. (ii) The subject matter of fire insurance is tangible and covers material property. In the case of loss of profits insurance, it is intangible and covers the earning capacity of the business.

- 15. Loss of profits insurance covers the following risks consequent upon fire. 1.Loss of net profits due to stoppage of business. 2.Payment of standing charges such as salaries, rent, rates and taxes, director's fees, lighting and heating. repairs and maintenance, depreciation, postage and stationery. etc. which the insured is obliged to incur in spite of stoppage of business. The insured has to specify the standing charges which he would like to insure. 3. Increased working expenses incurred by the insured during the indemnity period in order to maintain normal business activity.

- 16. Explanation of certain terms Gross profit: It is the sum obtained on adding the amount of the insured standing charges to the net profit. Gross profit = Net profit + Insured standing charges If there is net loss, gross profit is the amount of insured standing charges less such a proportion of any net trading loss as the amount of the insured standard charges bear to all the standing charges (insured + uninsured) of the business.

- 17. Explanation of certain terms Net Profit: It is the net trading profit resulting from the business of the insured at the premises after due provision has been made for all standing and other charges including depreciation but before the deduction of any taxation chargeable on profits

- 18. Explanation of certain terms Insured Standing Charges: The insured standing charges are those charges specified in the policy which the insured desires to recover in the case of an accident. It may include the following: i. Rent, rates and taxes (not related with the profit of the business): ii. Interest on debentures and loans; iii. Salaries of permanent staff: iv. Wages of skilled workers; v. Directors' fees vi. Auditor's fees; vii. Advertising: viii. Travelling and ix. Unspecified standing charges (not exceeding 5% of the amount of specified standing charges)

- 19. Explanation of certain terms Turnover: The money paid or payable to the insured for goods sold and delivered and for services rendered. In other words it is the total sales effected in a trading concern during the period. Annual Turnover: It is the turnover during the twelve months immediately preceding the date of the damage or fire. Indemnity Period: It is the period beginning with the occurrence of the damage and ending not later than 12 months thereafter during which the results of the business shall be affected as a consequence of damage by fire.

- 20. Date of fire 1st sept 2020 Turn over .. 1.4.2019 to 31.3.2020 Annual turnover 1.9.2019 to 31.8.2020 Indemnity period 1.9.2020 to 30.11.2020 , 3 months Stand turn over= turn over /sales during 1.9.2019 to 30.11.2019 , (1,00,000) Actual turn over = turn over during current indemnity period (1.9.2020 to 30.11 .2020)(20,000) Short sales= standard turnover – actual turn over =1,00,000-20,000=80,000

- 21. Explanation of certain terms Standard Turnover: It is the turnover during that period in the twelve months immediately before the date of damage which corresponds with the indemnity period. It means that if the indemnity period is 4 months (Ist August to 30th November of 2020). the standard turn over will also be for 4 months (I st August to 30th November 2019). Rate of Gross Profit: It is the rate of gross profit earned on the turnover during the financial year immediately before the date of the damage

- 22. Procedure or Steps in calculating the amount of loss in profit 1. Calculation of rate of gross profit: Rate of Gross Profit = Net Profit + Insured standing charges x100 Sales of the FY preceding the year of fire 2. Calculation of short sales: Short sales is the shortage in sales during the indemnity period because of dislocation in business due to fire. It is the difference between standard sales and actual sales of dislocated (indemnity) period. Standard sales is one after adjustment for necessary trend or business and for variation in the business either before or after the damage or which would have affected the business had the damage not occurred.

- 23. Procedure or Steps in calculating the amount of loss in profit 3.Calculation of gross profit on short sales = Short sales X Gross profit rate 4. Calculation of the amount of admissible additional expenses as follows: The least of the following shall be taken as admissible additional expenses. (i) Actual expenses incurred (ii) Gross profit on additional sales (iii)additional exp X GP on annual turnover GP on annual turnover + uninsured standing charges

- 24. Procedure or Steps in calculating the amount of loss in profit Additional expenses X NP+Insured standing charges Net profit+ All standing charges 5. Calculation of amount of gross claim: Amount of claim = Gross profit on short sales + Admissible additional expenses - any savings in insured standing charges during the period of indemnity. 6. Application of average clause: Net claim = Gross claim X Policy value GP on annual Turnover

- 27. 1) rate of gross profit= net profit + standing charges/sales = 3,50,000+3,63,000x 100=15% 47,50,000 2) Short sales= standard –actual sales =15,00,000-2,00,000=13,00,000 3) Loss of profit=GP on short sales =13,00,000x15%=1,95,000 4) Admissible additional expenses =16,000 5) Gross claim= loss of profit + admissible expenses- savings in insured standing charges =1,95,000+16,000-8,000=2,03,000 6) Net claim = gross claim x policy value GP on Annual TO =2,03,000X 6,00,000/15% of 50,00,000 = 1,62,400

- 29. Solution to practical problem 13 1) rate of gross profit = net profit +insured standing charges net sales = 16,00,000+4,00,000 x100= 25% 80,00,000 2) Calculation of short sales = standard- actual sales 36,00,000-6,00,000=30,00,000 3) Loss of profit/ GP on short sales = short sales x GP Rate =30,00,000x 25% =7,50,000

- 30. Solution to practical problem 13 4) admissible additional expenses = 14,000 5) calculation of gross claim= loss of profit/GP on Short sales + admissible expenses – salvaged value in insured standing charges = 750,000+14,000 – 4,000 =7,60,000 6) Net claim= gross claim x policy value GP on annual turn over = 7,60,000 x 16,00,000/(25% 0f 88,00,000) =5,52,727

- 32. Solution to illustration 12 WN:1 CALCULATION OF AMOUNT RECEIVED FROM DEBTORS BANK ACCOUNT Particulars Amount Particulars Amount To, balance b/d ; debtors (balancing fig.) 60,000 2,58,000 By, creditors ‘Wages (12,000X2) ‘Sundry expenses (6000X2) ‘Balance c/d 2,40,000 24,000 12,000 42,000 3,18,000 3,18,000

- 33. Solution to illustration 12 TOTAL DEBTORS ACCOUNT Particulars Amount Particulars Amount To, balance b/d Sales (bal. fig.) 2,00,000 3,08,000 By, Bank ‘’’ balance c/d 2,58,000 2,50,000 5,08,000 5,08,000 Particulars Amount Particulars Amount To, bank To, balance c/d (1,80,000) 2,40,000 1,80,000 By, balance B/d ‘” Purchases (balancing fig,) 1,80,000 2,40,000 4,20,000 4,20,000 TOTAL CREDITORS ACCOUNT

- 34. Solution to illustration 12 Ascertainment of stock on the date of fire memorandum trading account for the period from 1.4.2017 to 15.5.2017 Particulars Amount Particular s Amount To, opening stock “ purchases 2,40,000 + invoice not received 20,000 ’’ Wages (12,000x2) “gross profit (25% of sales) (3,08,000x25%) 50,000 2,60,000 24,000 77,000 By, Sales ‘closing stock (Balancing fig.) 3,08,000 1,03,000 4,11,000 4,11,000 Statement of claim for loss of stock as on 15th MAY 2017 Book value of stock on the date of fire (closing stock) - 1,03,000 Less : salvaged stock - xxxxx Loss of stock - 1,03,000

- 36. Solution to practical problem 8 WN:1 CALCULATION OF AMOUNT OF CREDIT PURCHASES TOTAL CREDITORS ACCOUNT Particulars Amount Particulars Amount To, Cash (98,016-562) To, Bills receivable To, goods returned To, balancing c/d 97,454 562 6,390 22,112 By, Balance b/d “ credit purchases (Balancing figure) 24,608 1,01,910 1,26,518 1,26,518

- 37. Solution to practical problem 8 Ascertainment of stock on the date of fire memorandum trading account Particulars Amount Particulars Amount To, opening stock “ purchases 1,01,910 - Drawings 2,000 - Free samples 8,000 - goods returned 6,390 “ Gross profit (15% of sales ie,1,09,200) 58,820 8,55,20 16,380 By, Sales “Closing stock (Balancing fig.) 1,09,200 51,520 1,60,720 1,60,720 Statement of claim for loss of stock as on 31st December 2017 Book value of stock on the date of fire (closing stock) - 51,520 Less : salvaged stock - 1,520 Loss of stock 50,000