Embed presentation

Download to read offline

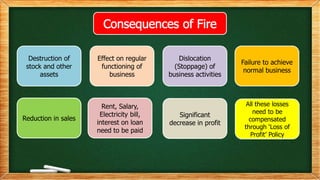

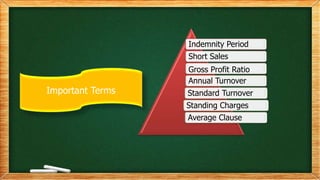

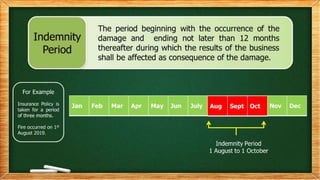

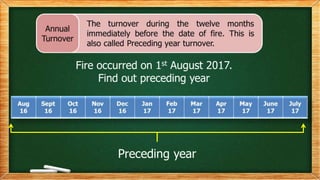

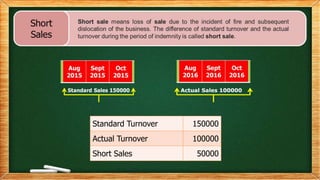

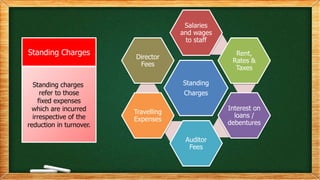

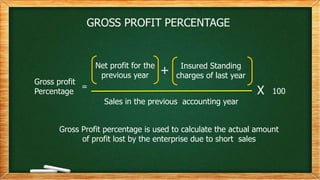

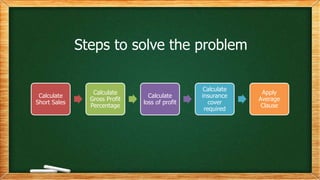

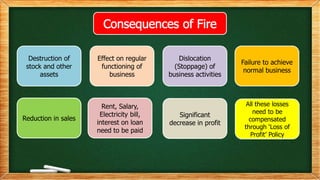

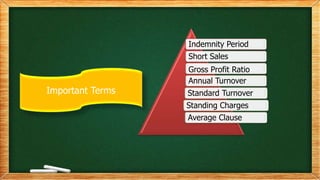

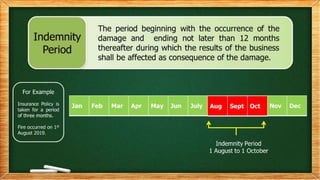

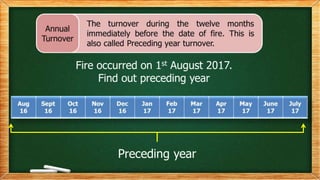

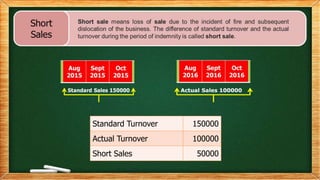

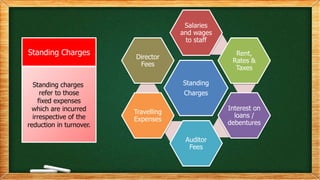

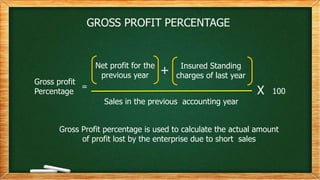

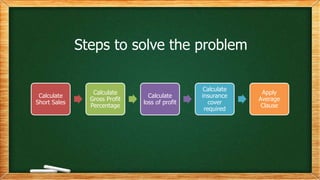

This document discusses key concepts related to insurance claims for loss of profit, including indemnity period, short sales, gross profit ratio, annual turnover, standard turnover, standing charges, and average clause. It provides examples to calculate short sales, gross profit percentage, loss of profit, and insurance coverage required using the average clause. The document outlines the steps to solve loss of profit insurance claim problems as: calculate short sales, gross profit percentage, loss of profit, insurance cover required, and apply the average clause.