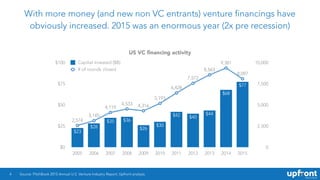

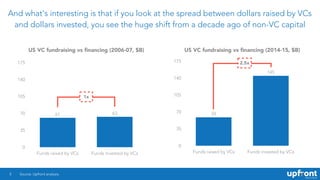

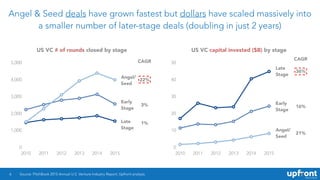

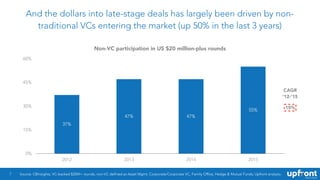

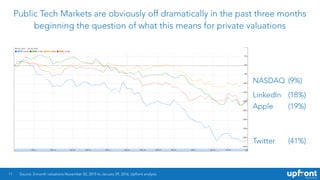

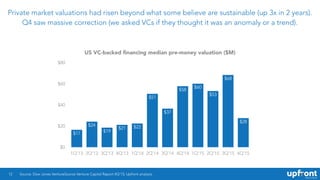

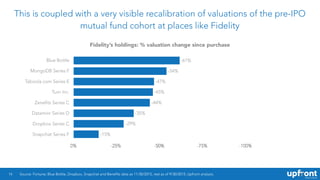

- Venture capital fundraising and investments reached record levels in 2015, with more money coming from non-traditional investors. However, public tech valuations have dropped and private valuations are correcting from unsustainable highs.

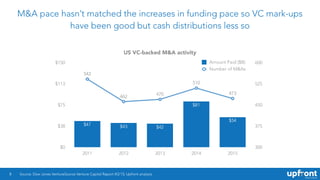

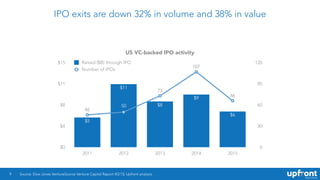

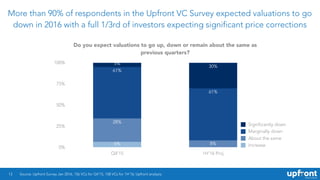

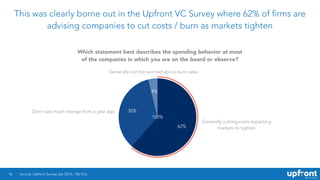

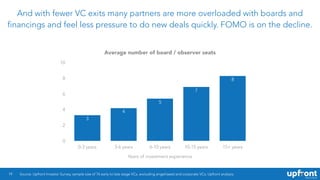

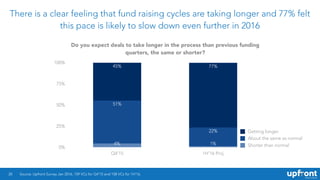

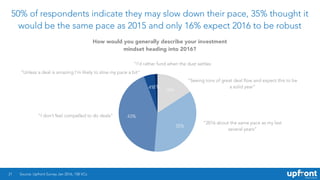

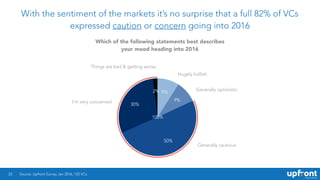

- Most venture capitalists expect valuations to decline further in 2016 and are advising portfolio companies to cut costs. Fewer IPO and acquisition exits also have VCs taking a more cautious approach to new investments.

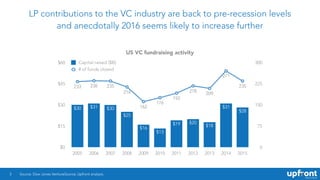

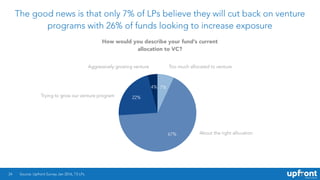

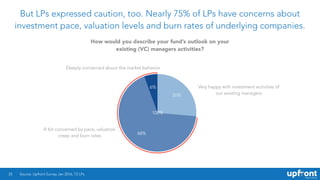

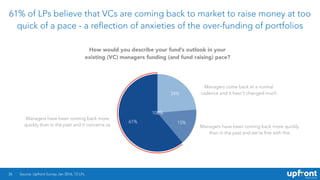

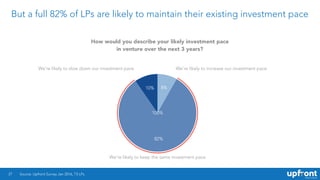

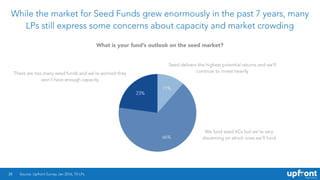

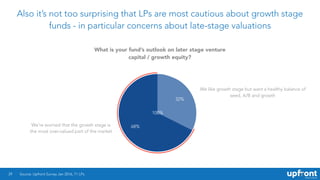

- Limited partner investors in venture funds remain concerned about high investment pacing, valuations, and company burn rates. However, most will maintain rather than decrease their commitments to venture capital over the next three years.