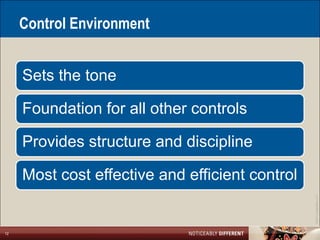

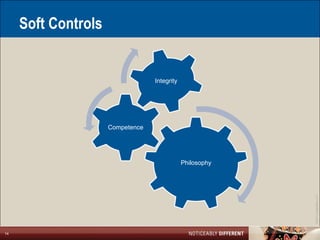

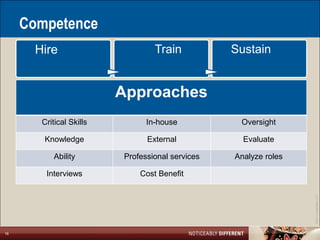

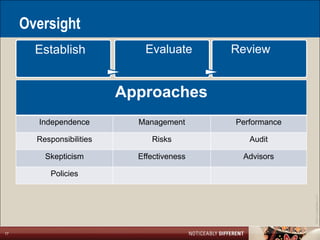

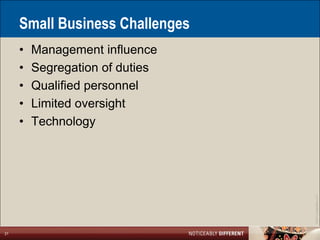

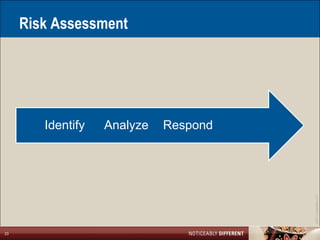

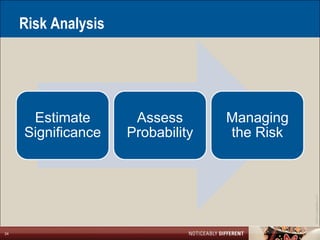

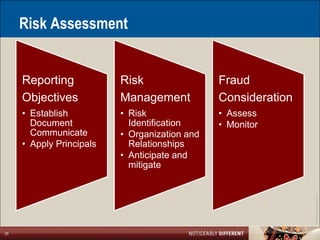

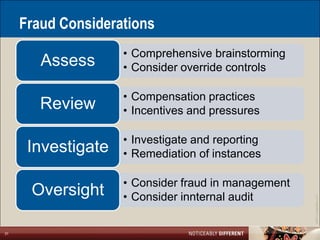

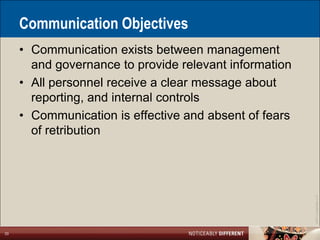

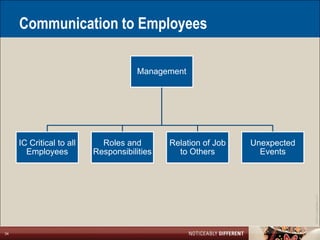

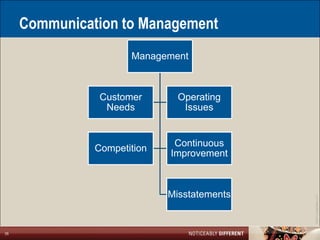

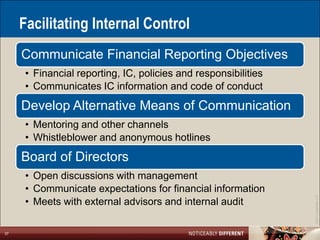

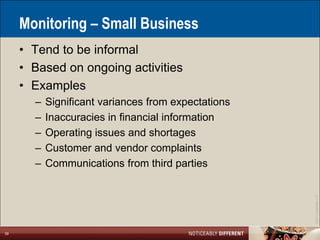

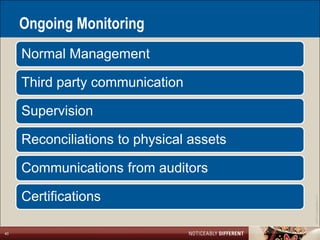

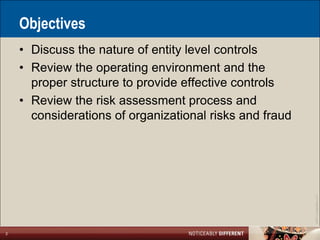

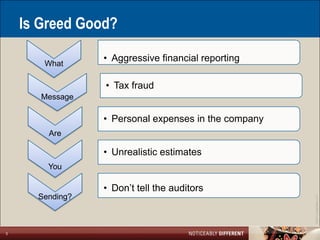

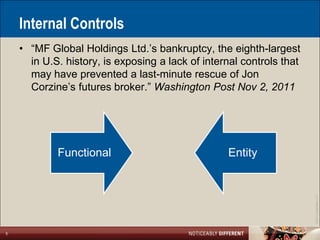

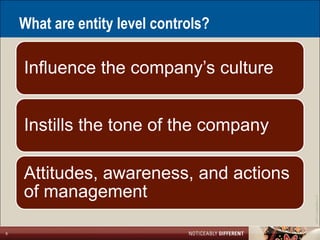

The document discusses the importance of entity-level controls in preventing fraud and improving organizational effectiveness, emphasizing risk assessment and the need for a strong control environment. It highlights various aspects such as integrity, oversight, and accountability, as well as the challenges faced by small businesses. Effective communication between management and employees is crucial for maintaining internal controls and ensuring transparency.

![Or do you have to live it?

• ―It is not simply a case of having a set of

procedures and processes, nor is it just about

having controls in place. Reliance on a poor

control is often worse than having no control at

all. [The trustees must have] … a clear

understanding of the business and what can go

wrong.‖ - Tony Rawlins - (2001)

©2011 LarsonAllen LLP

10](https://image.slidesharecdn.com/entitylevelcontrolsand-13208649473666-phpapp02-111109131310-phpapp02/85/Entity-Level-Controls-And-10-320.jpg)