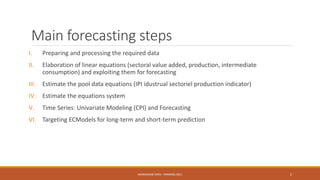

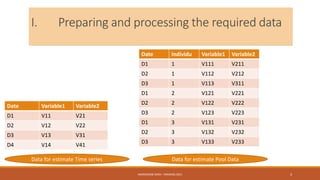

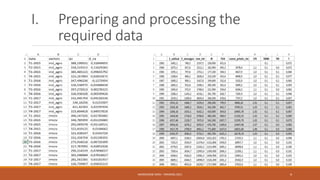

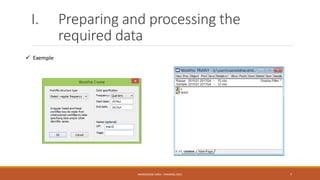

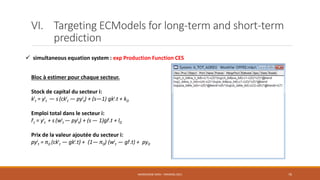

The document provides an overview of modeling and forecasting techniques using EViews software. It discusses the main forecasting steps, which include preparing and processing data, estimating linear equations and pool data equations, univariate time series modeling and forecasting, and using error correction models for long-term and short-term prediction. The document uses examples of consumer price index data to demonstrate preparing data, identifying appropriate time series models like ARMA, and generating forecasts using Box-Jenkins and Holt-Winters exponential smoothing methods.