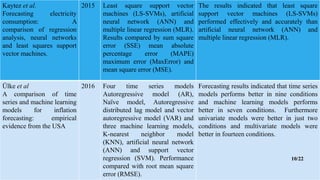

1) The document describes a study comparing time series and machine learning models for forecasting economic growth in Pakistan.

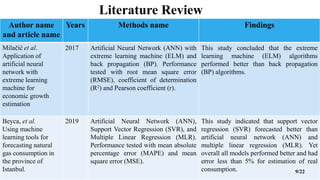

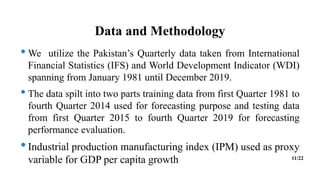

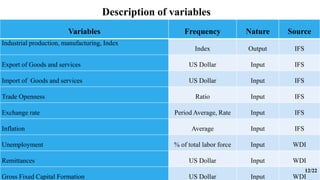

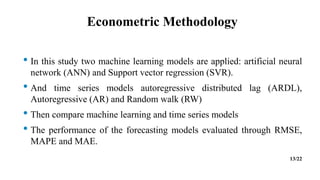

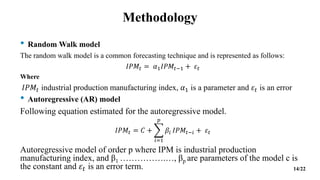

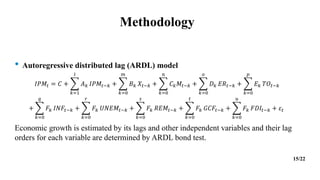

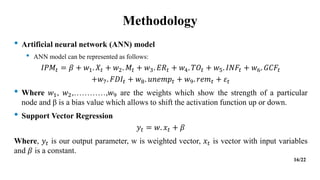

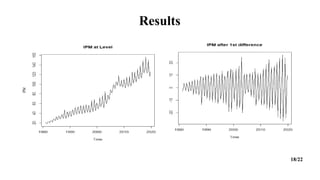

2) It uses quarterly data from 1981 to 2019 on indicators like industrial production and GDP to test autoregressive (AR), random walk (RW), autoregressive distributed lag (ARDL), artificial neural network (ANN), and support vector regression (SVR) models.

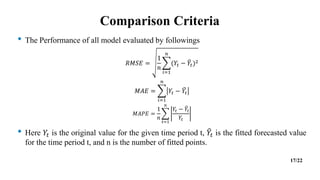

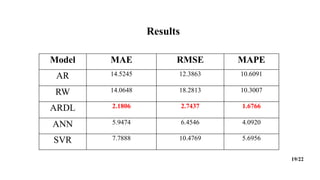

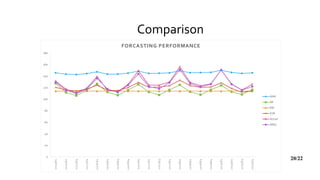

3) The results show that the ARDL model performed best overall according to error metrics like RMSE, MAE, and MAPE, and thus is recommended for efficiently forecasting economic growth.