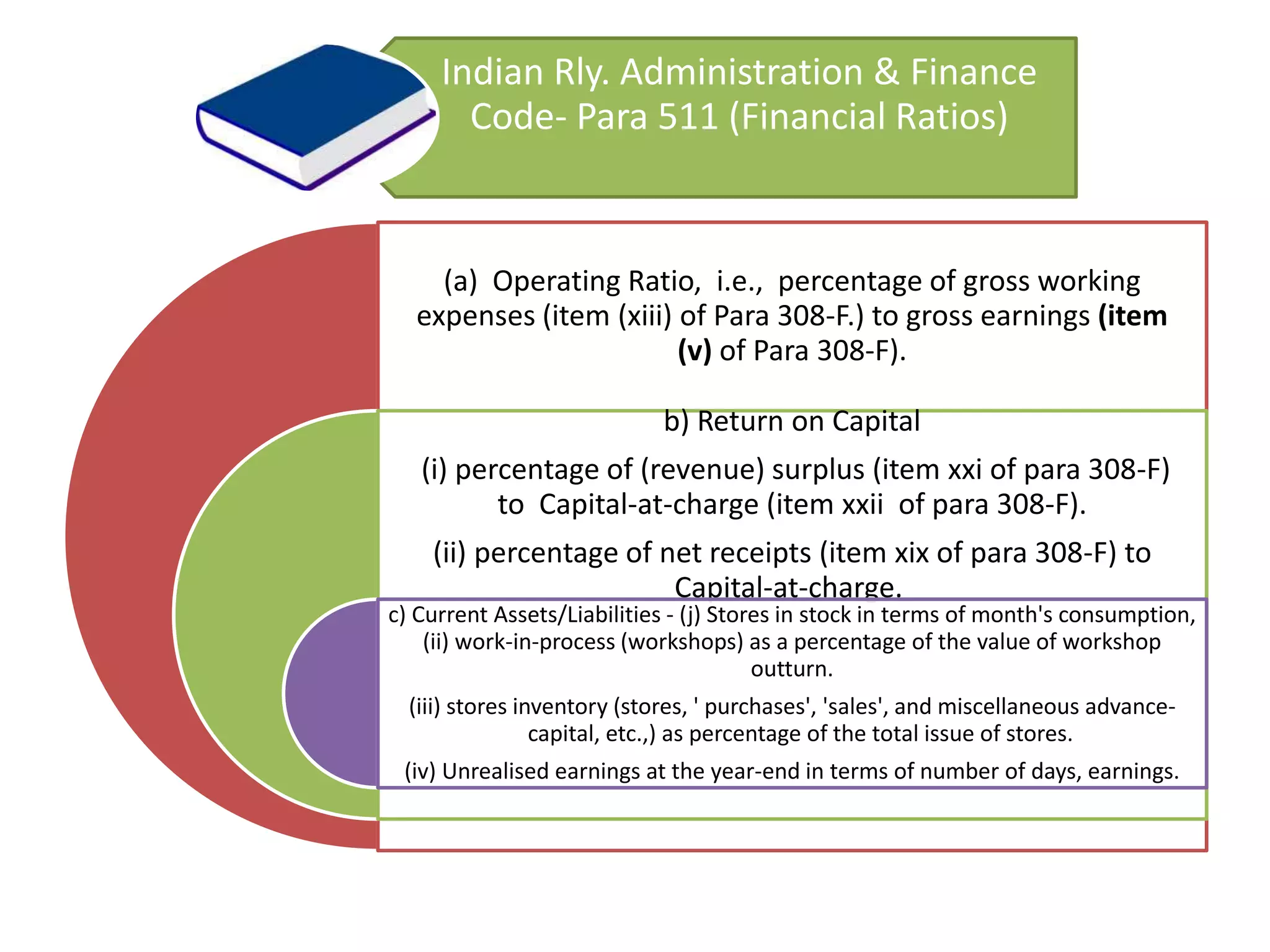

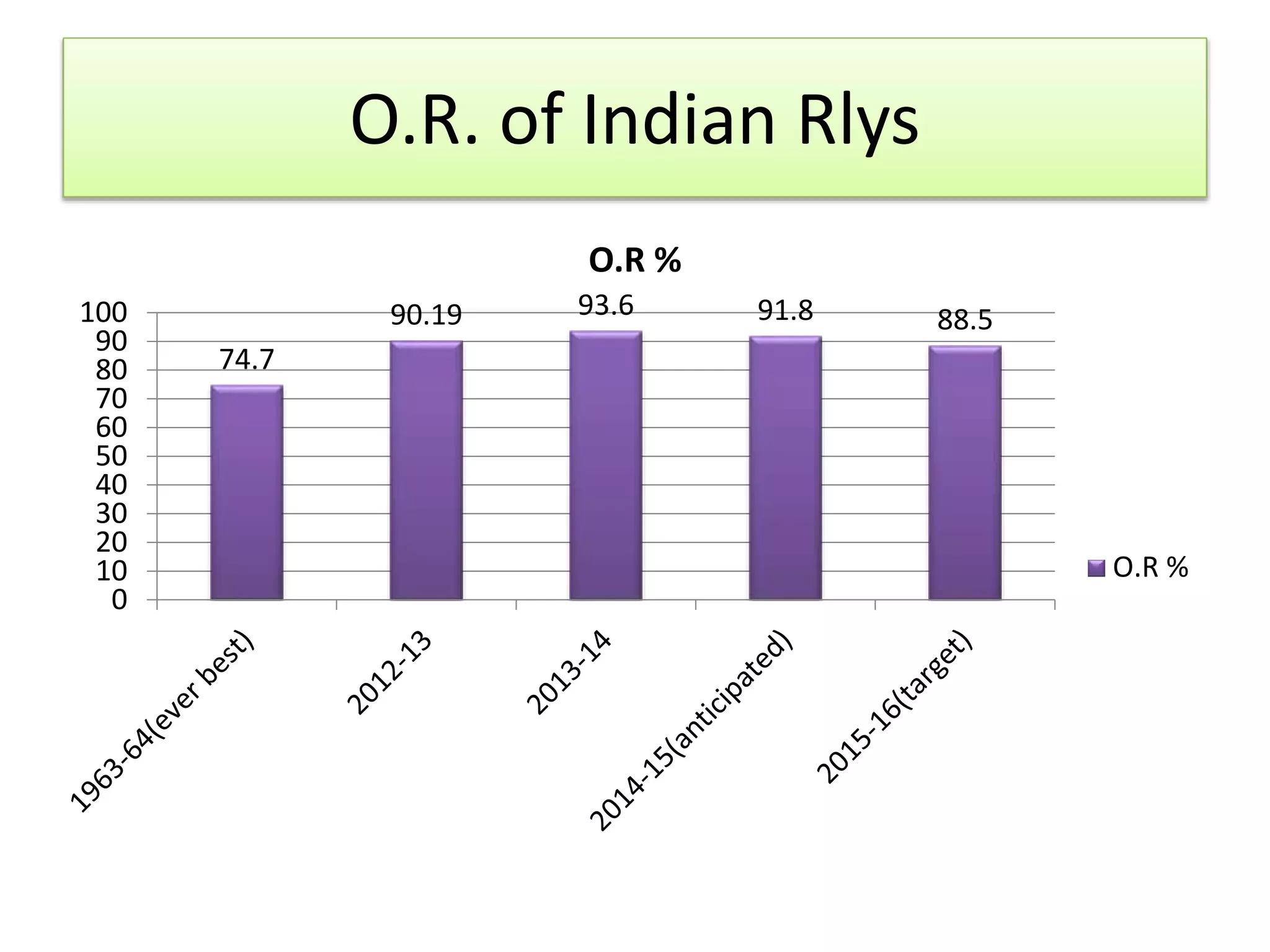

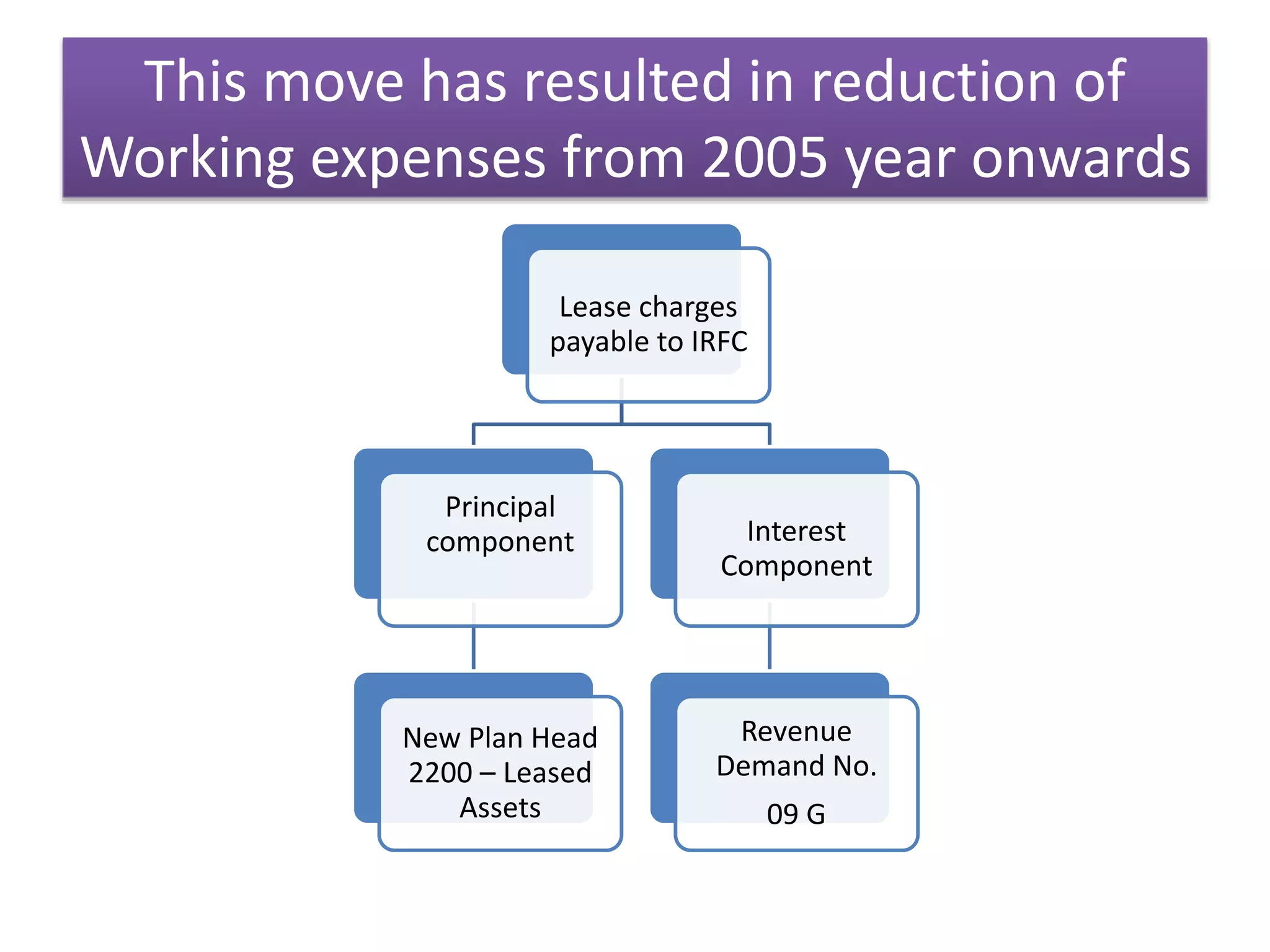

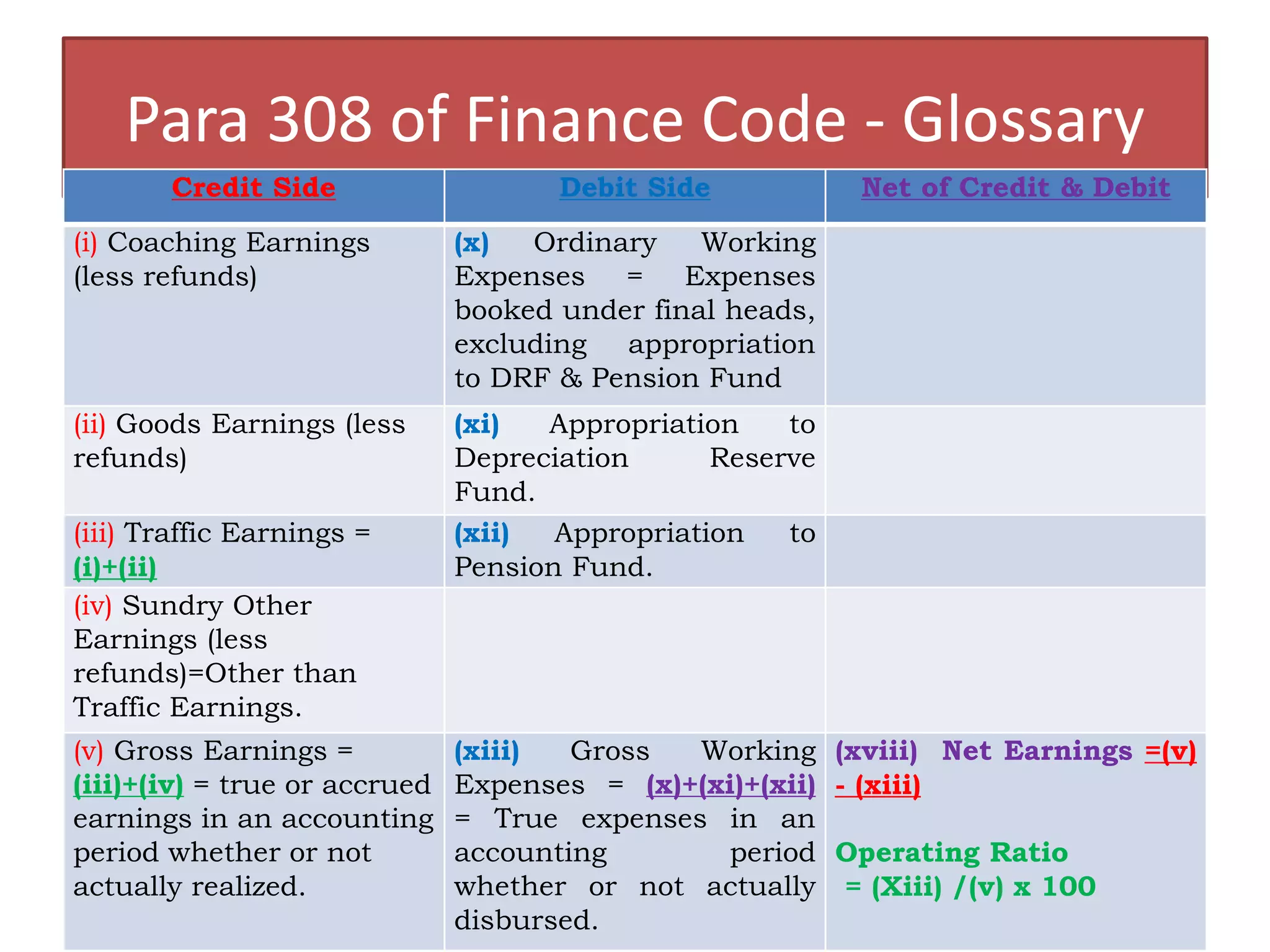

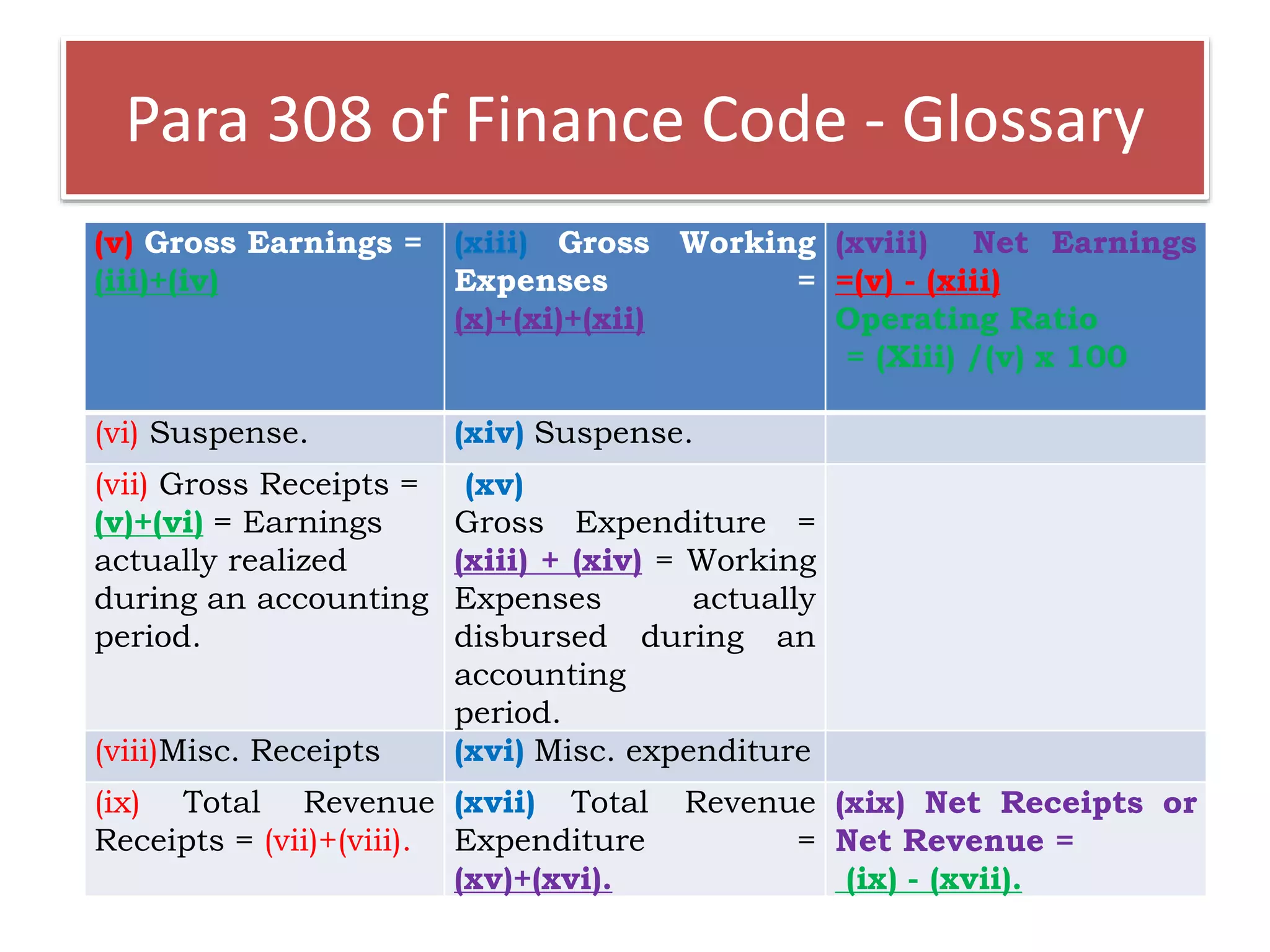

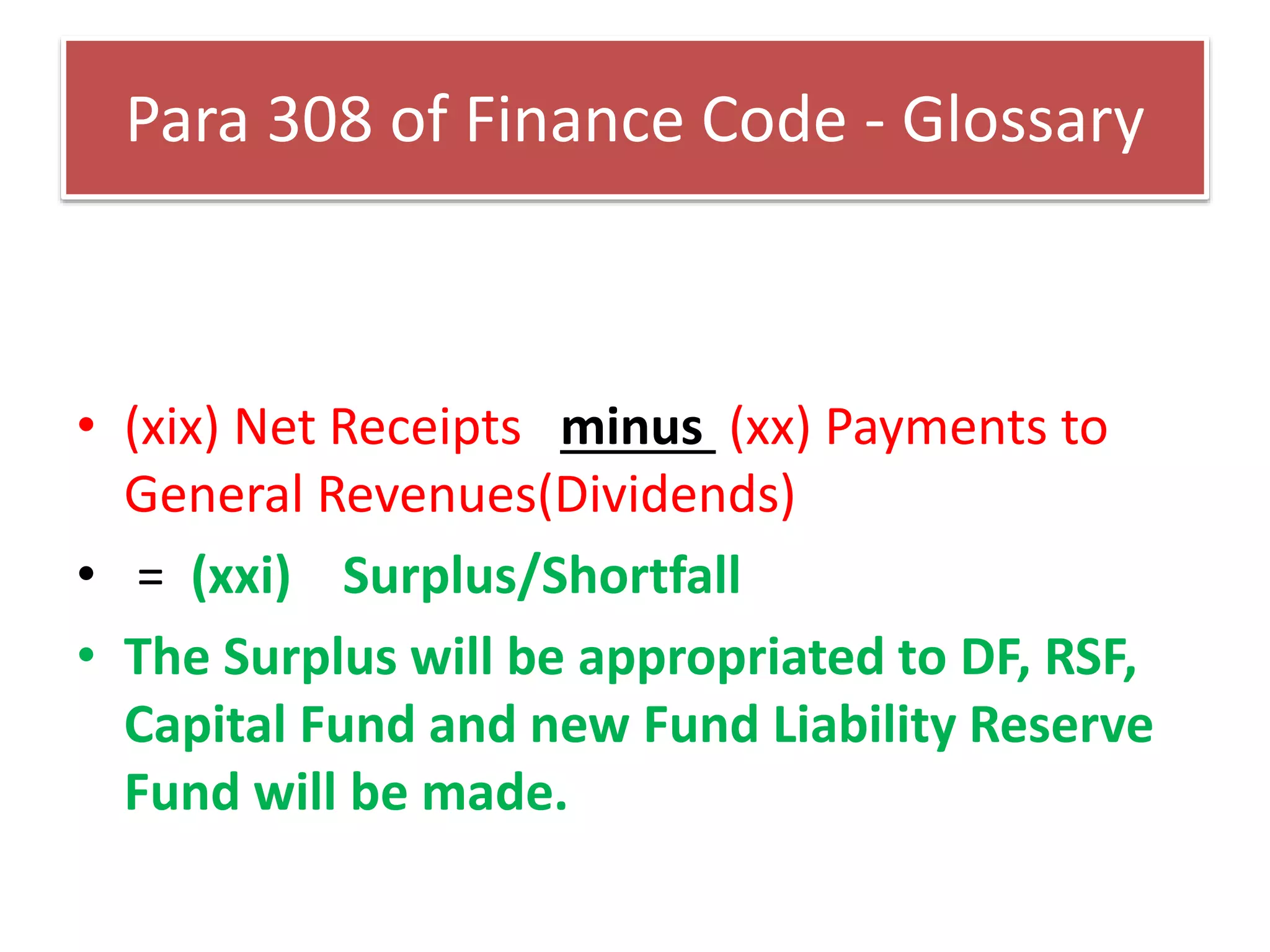

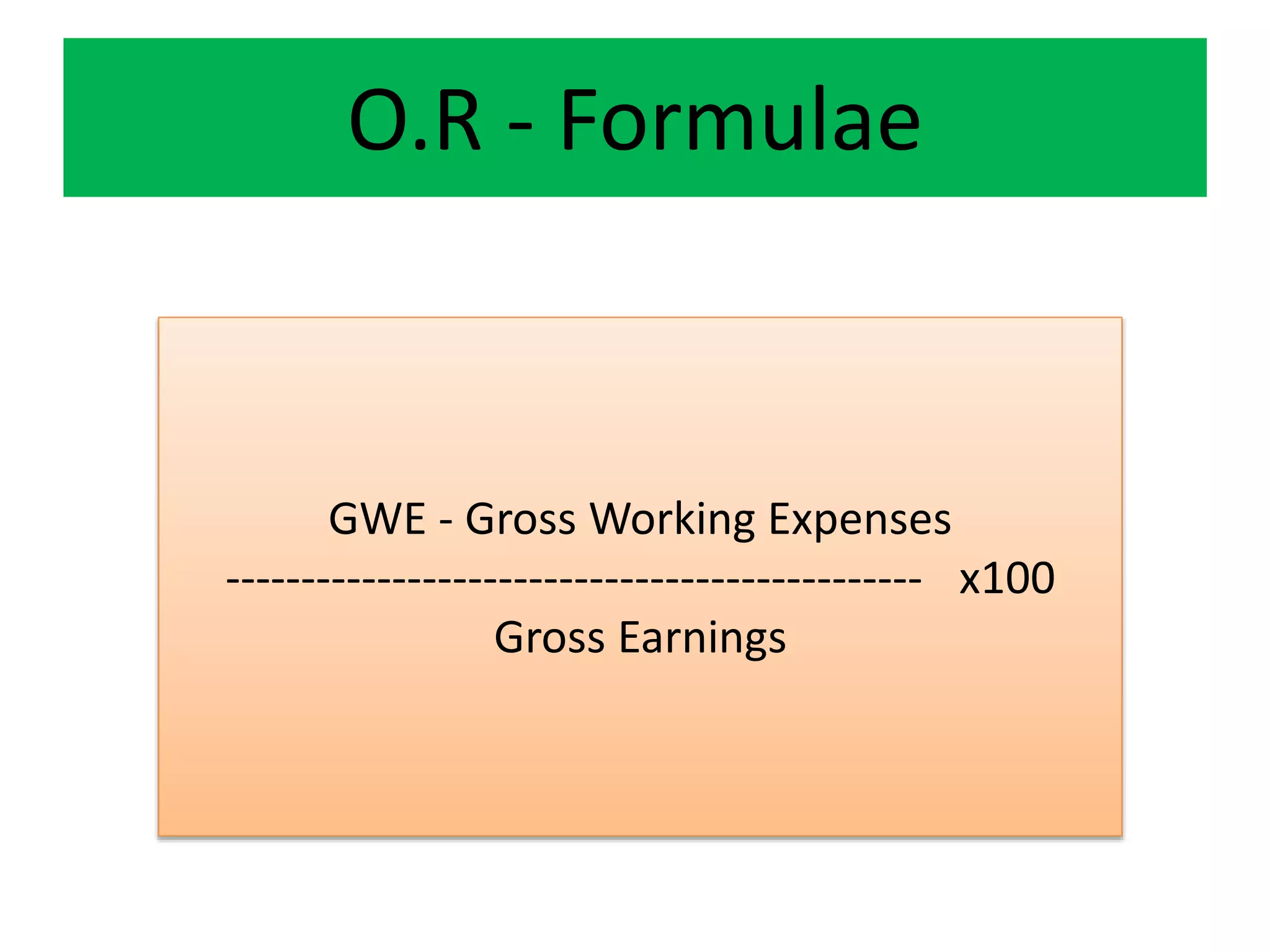

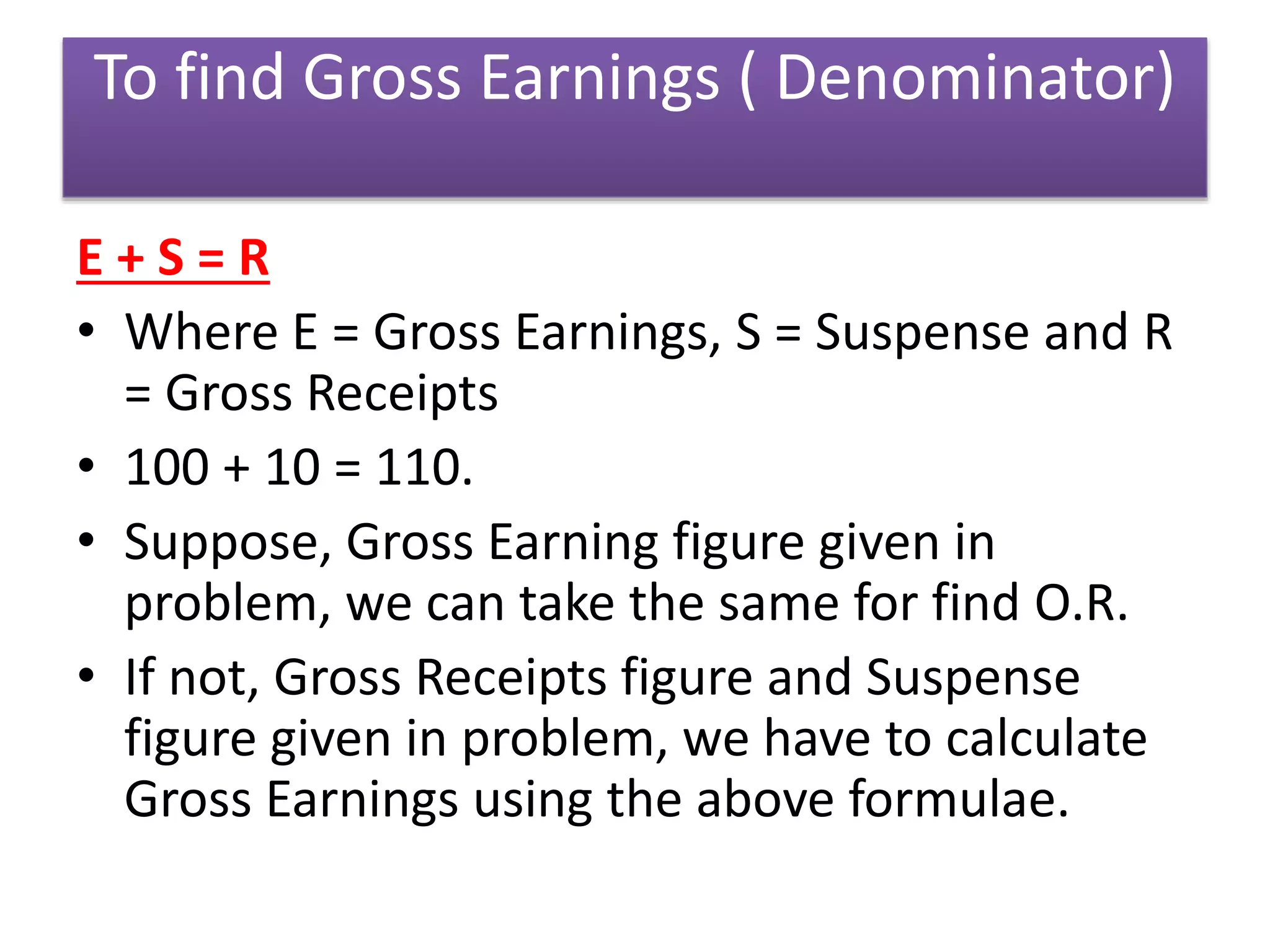

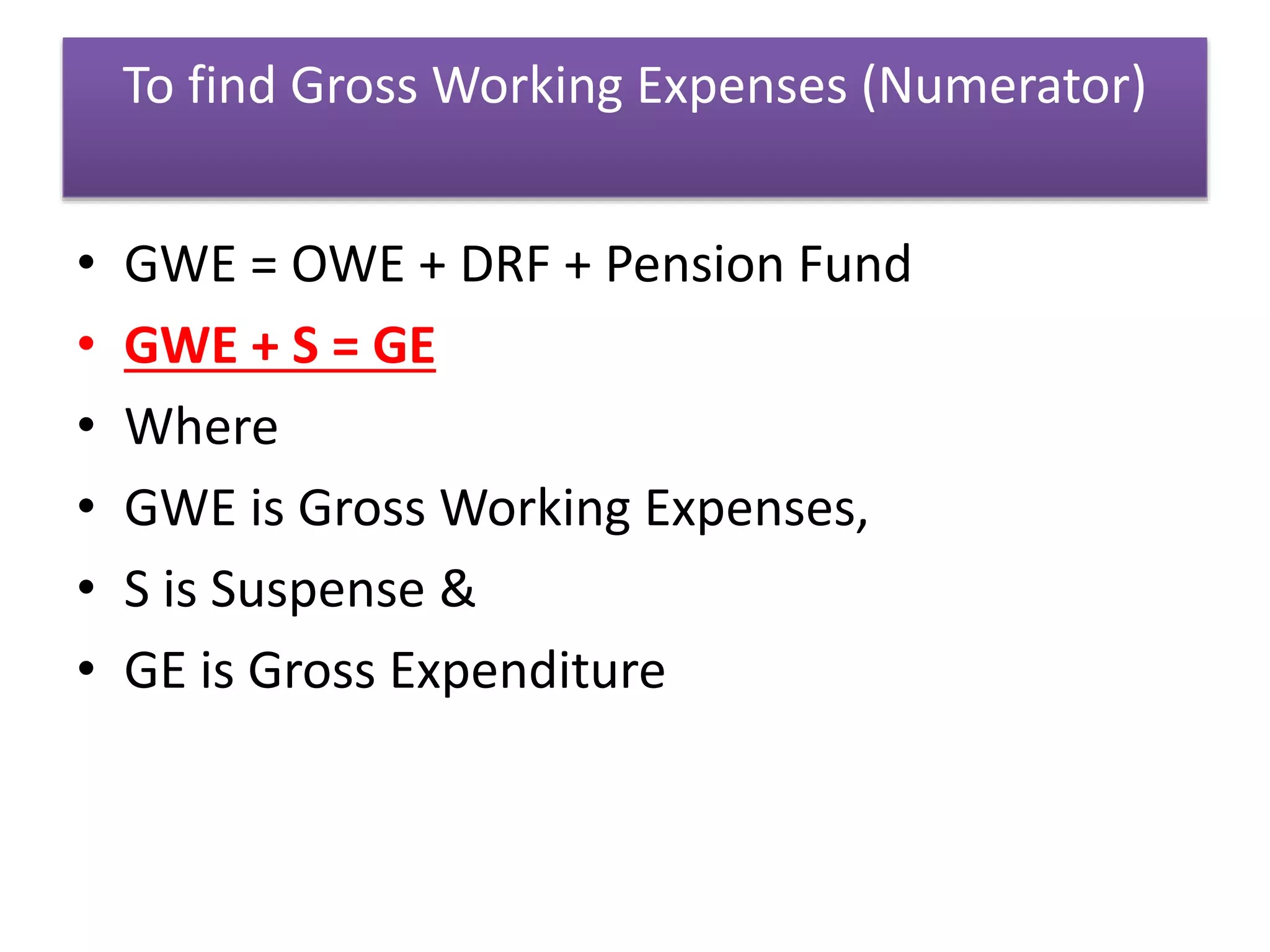

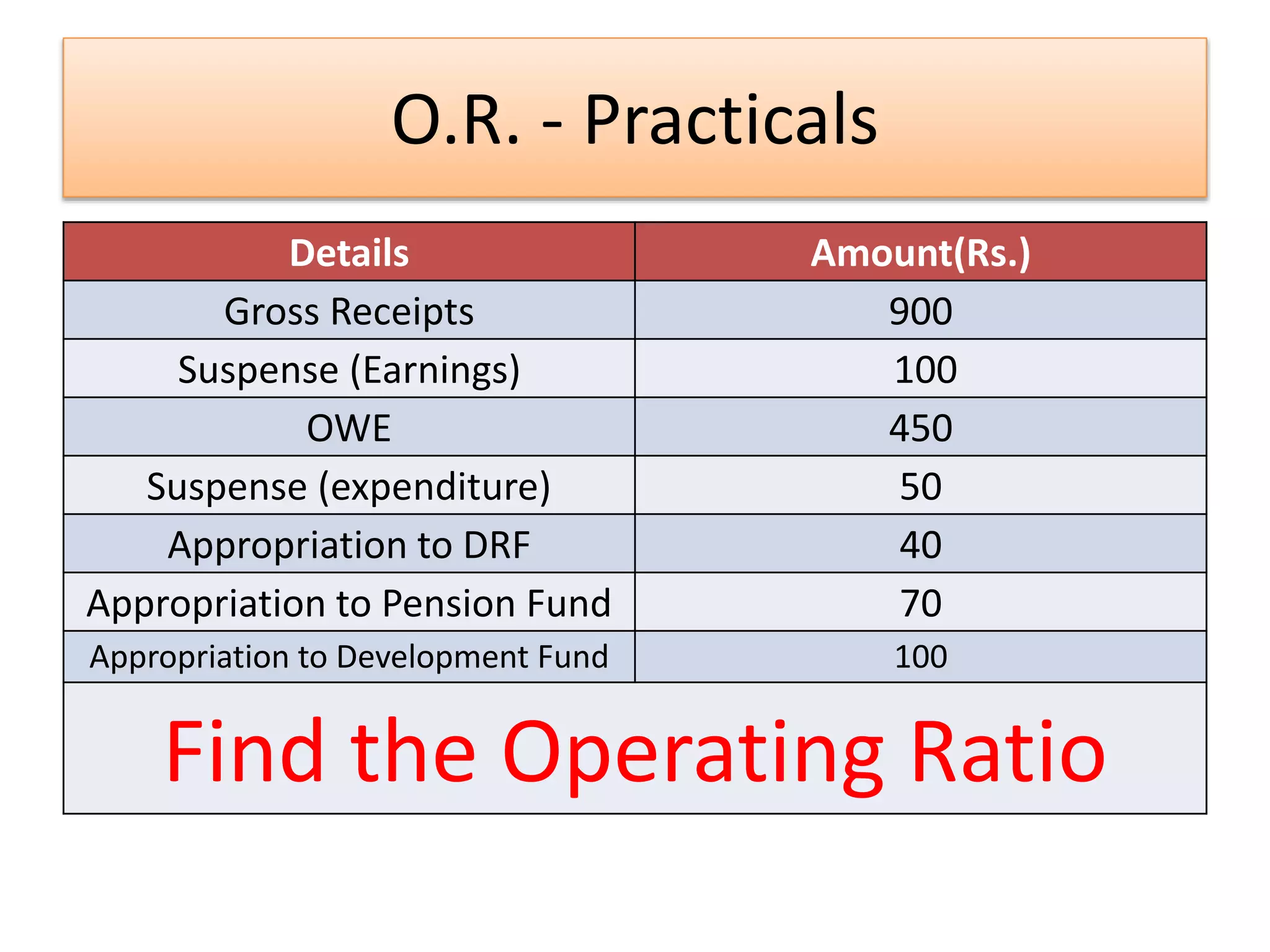

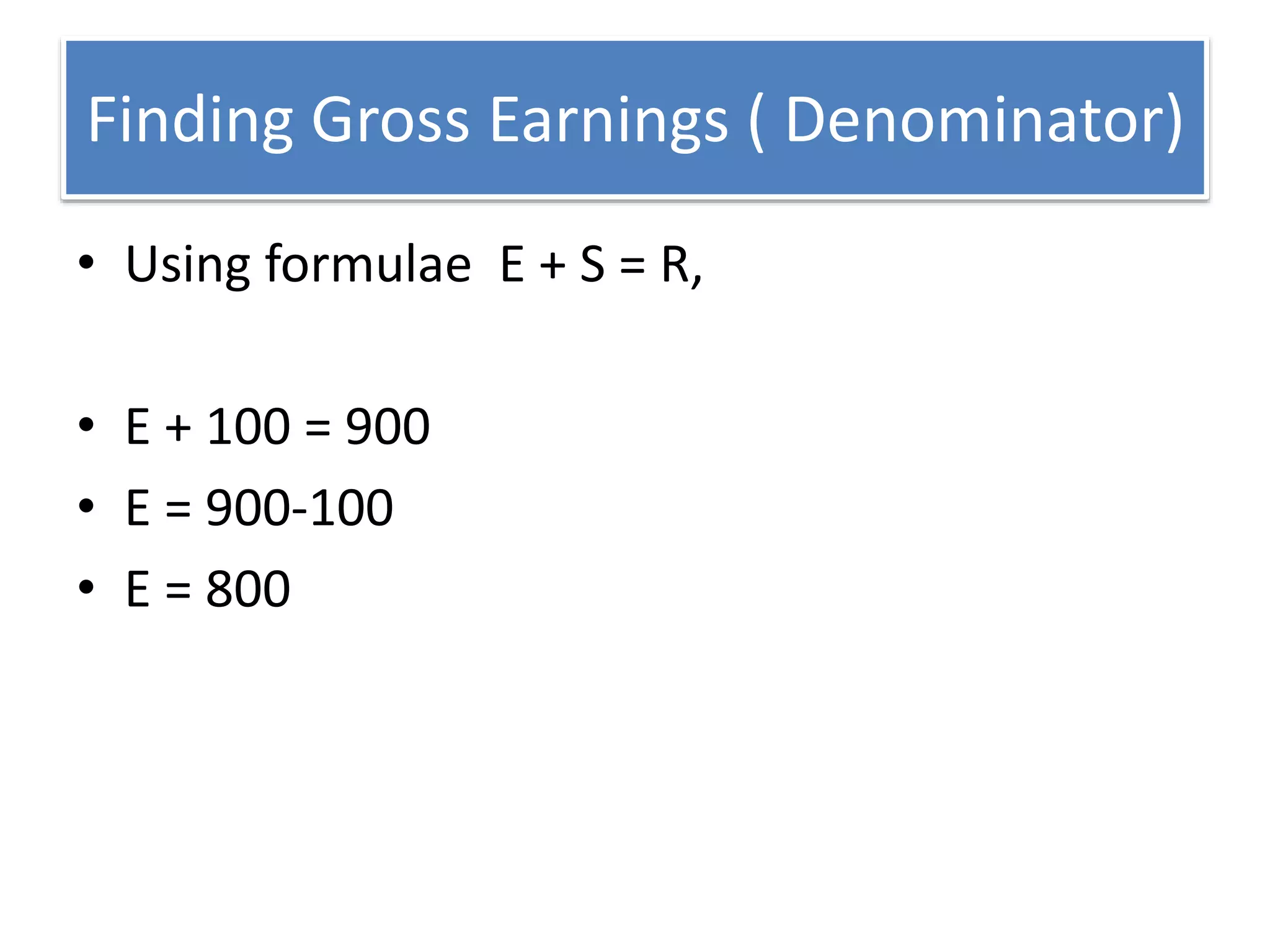

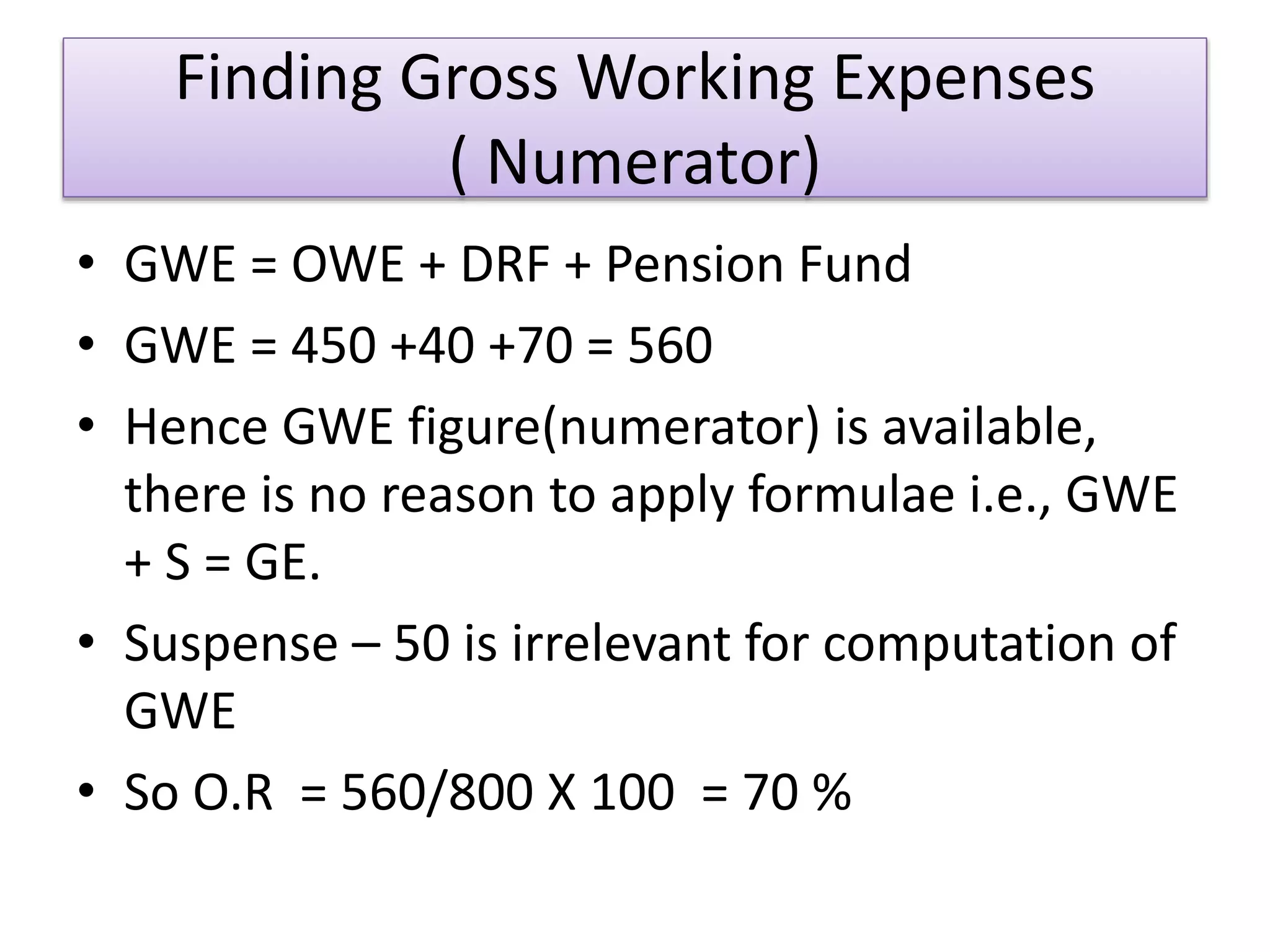

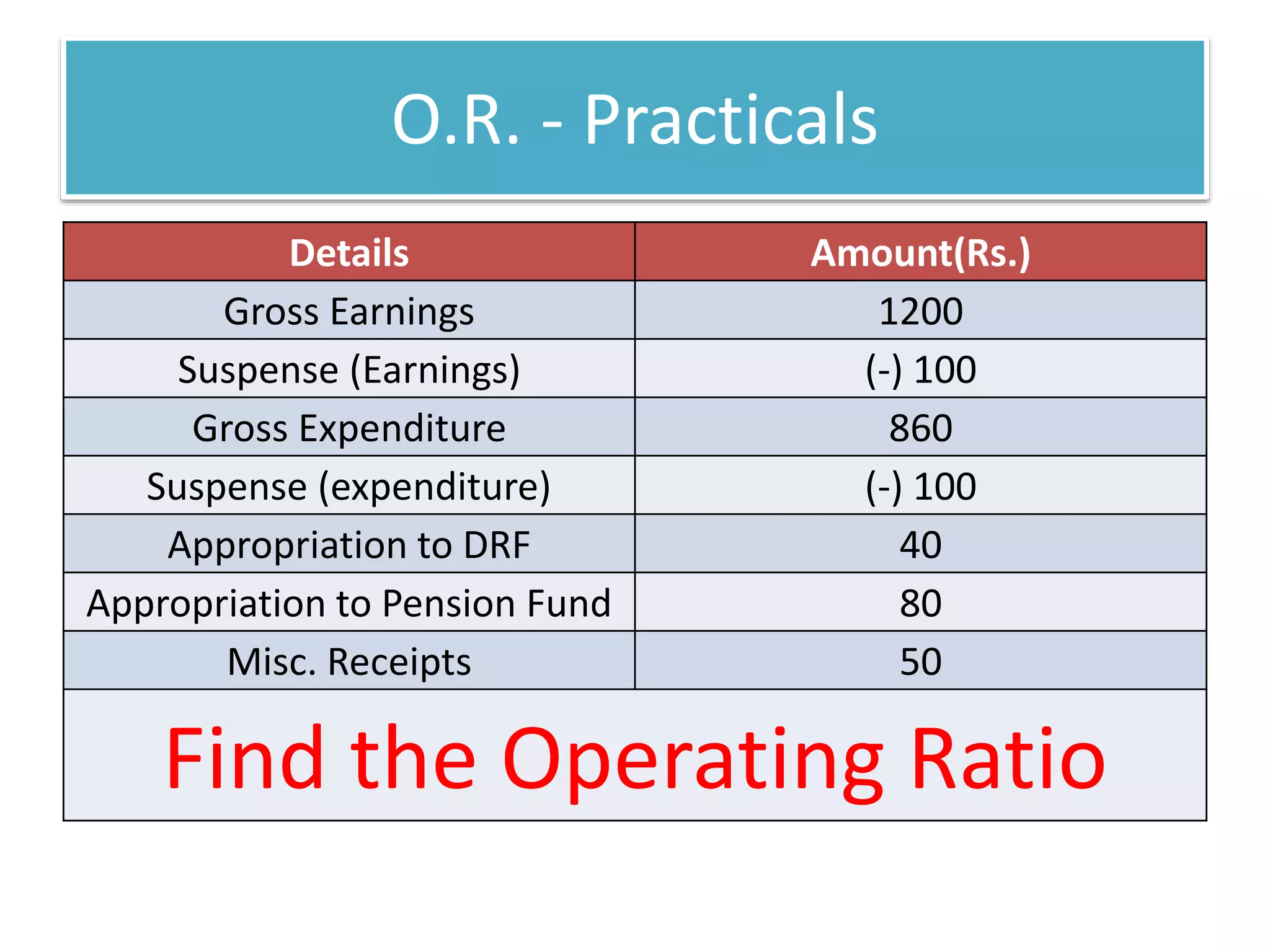

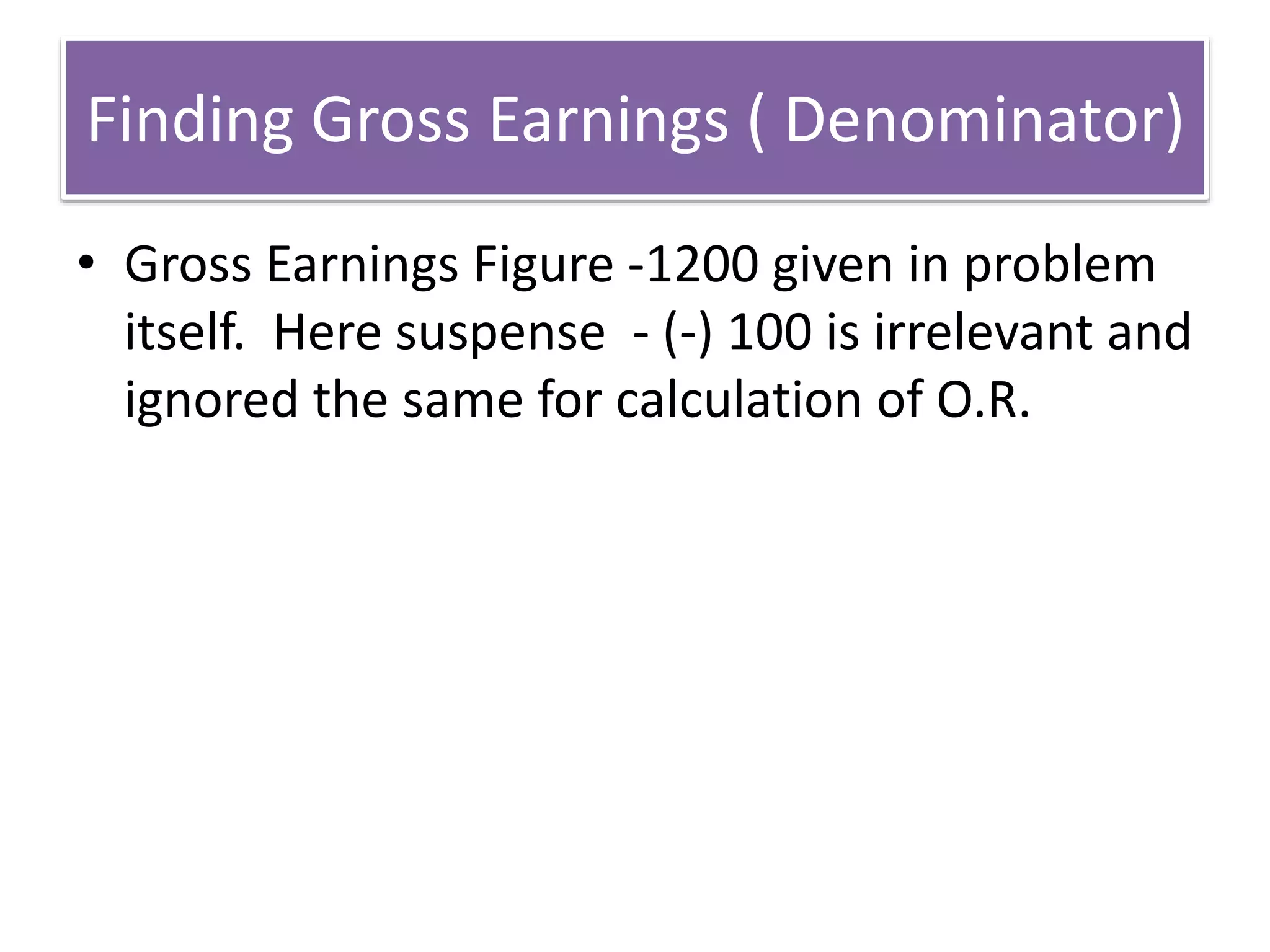

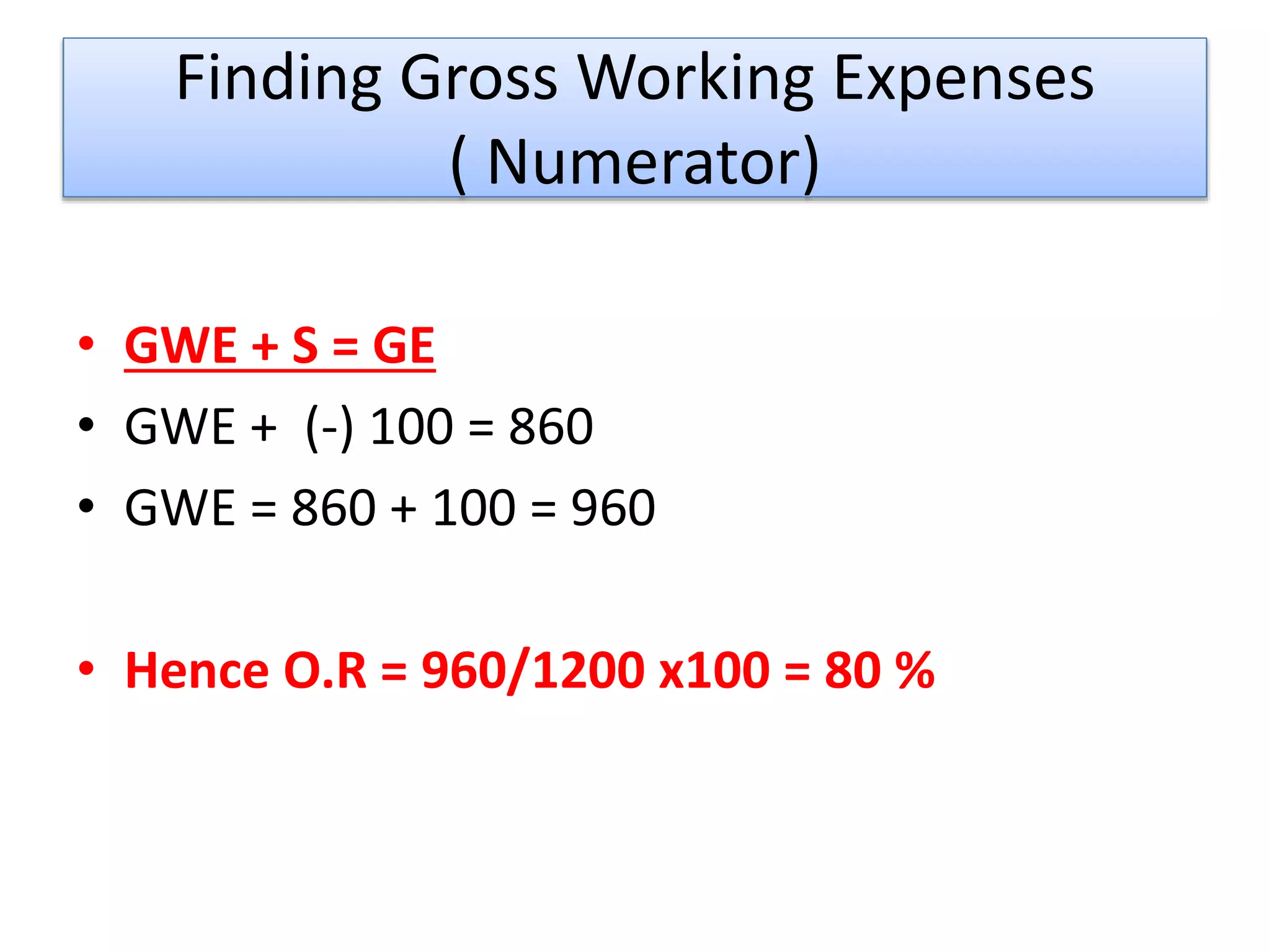

The document discusses operating ratio and financial ratios used to measure the financial efficiency of railways. It defines operating ratio as the percentage of gross working expenses to gross earnings, with a lower ratio considered more desirable. It provides examples of operating ratio calculations using figures for gross earnings, working expenses, suspense accounts, and appropriations. A ratio below 80% is generally considered good for railways. The document also discusses how changing accounting policies around lease charges affected working expenses and operating ratio calculations for Indian Railways.