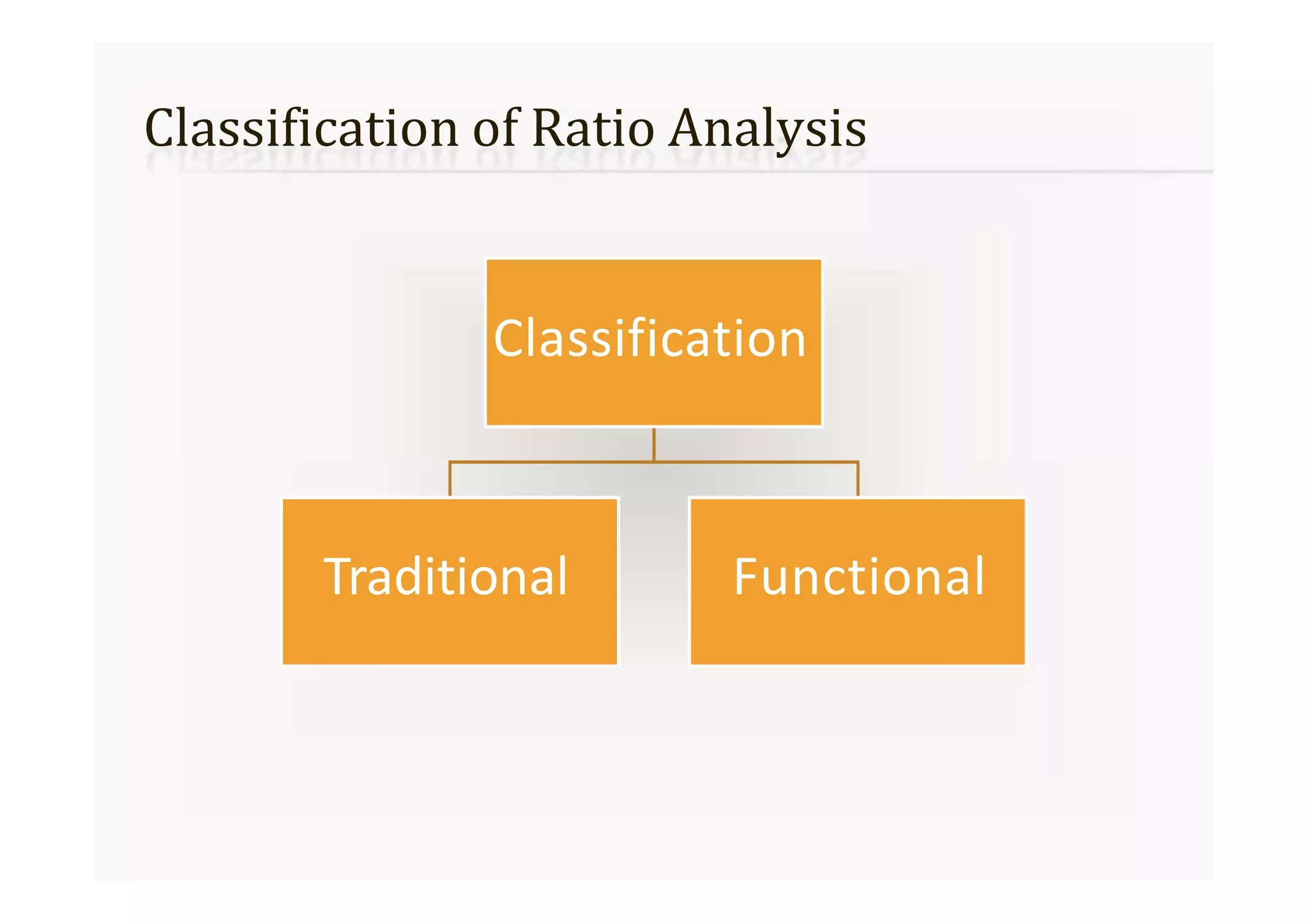

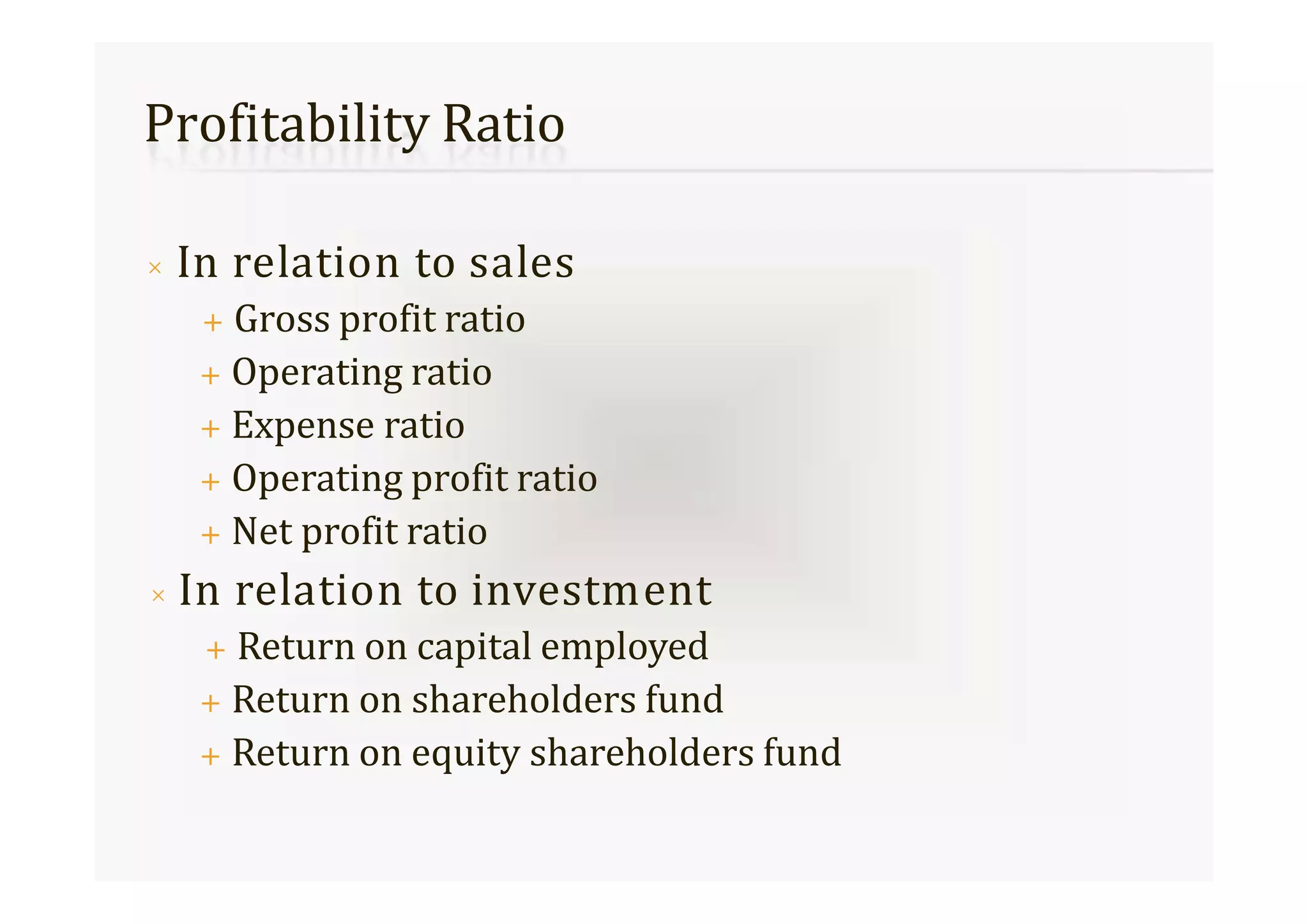

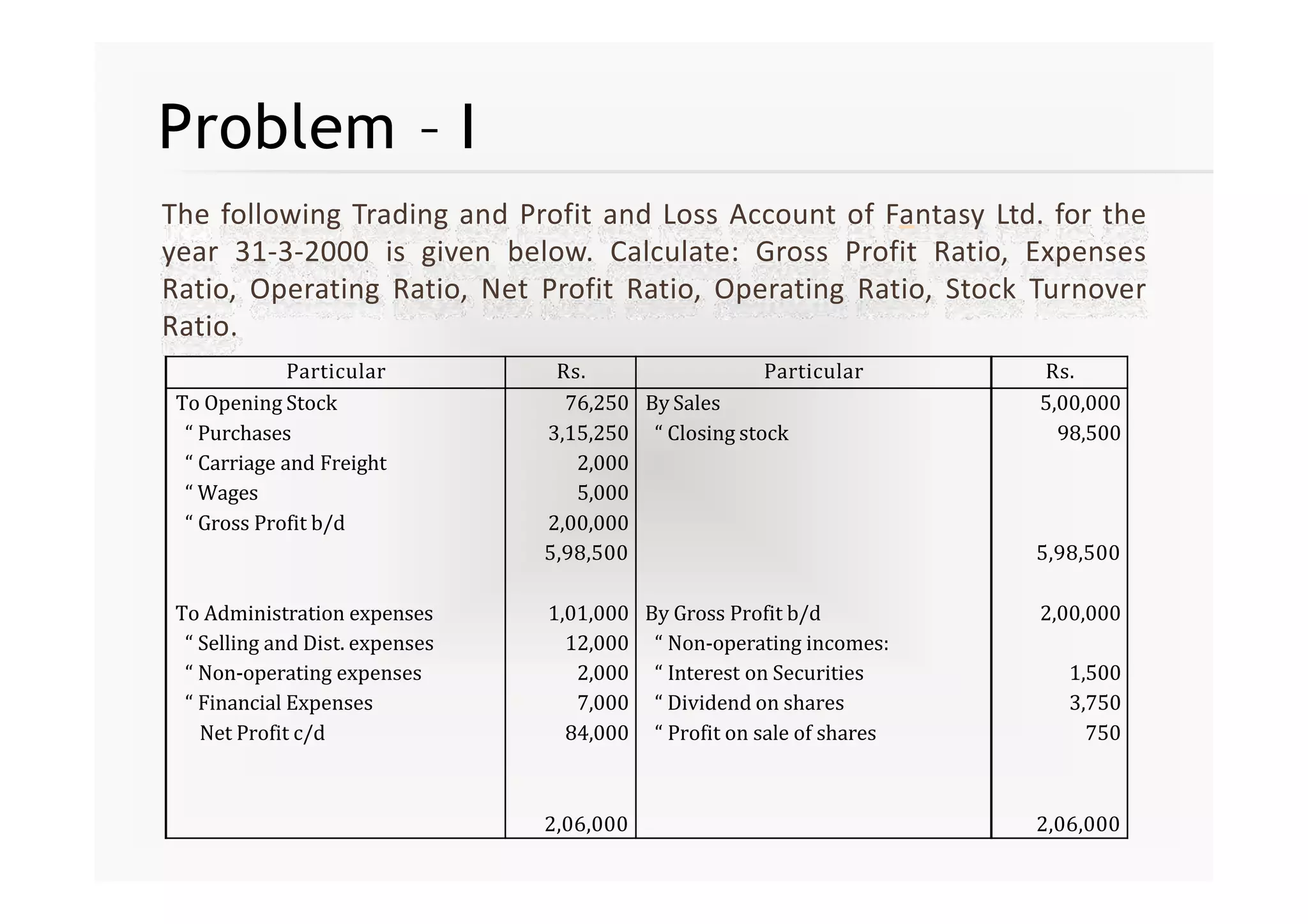

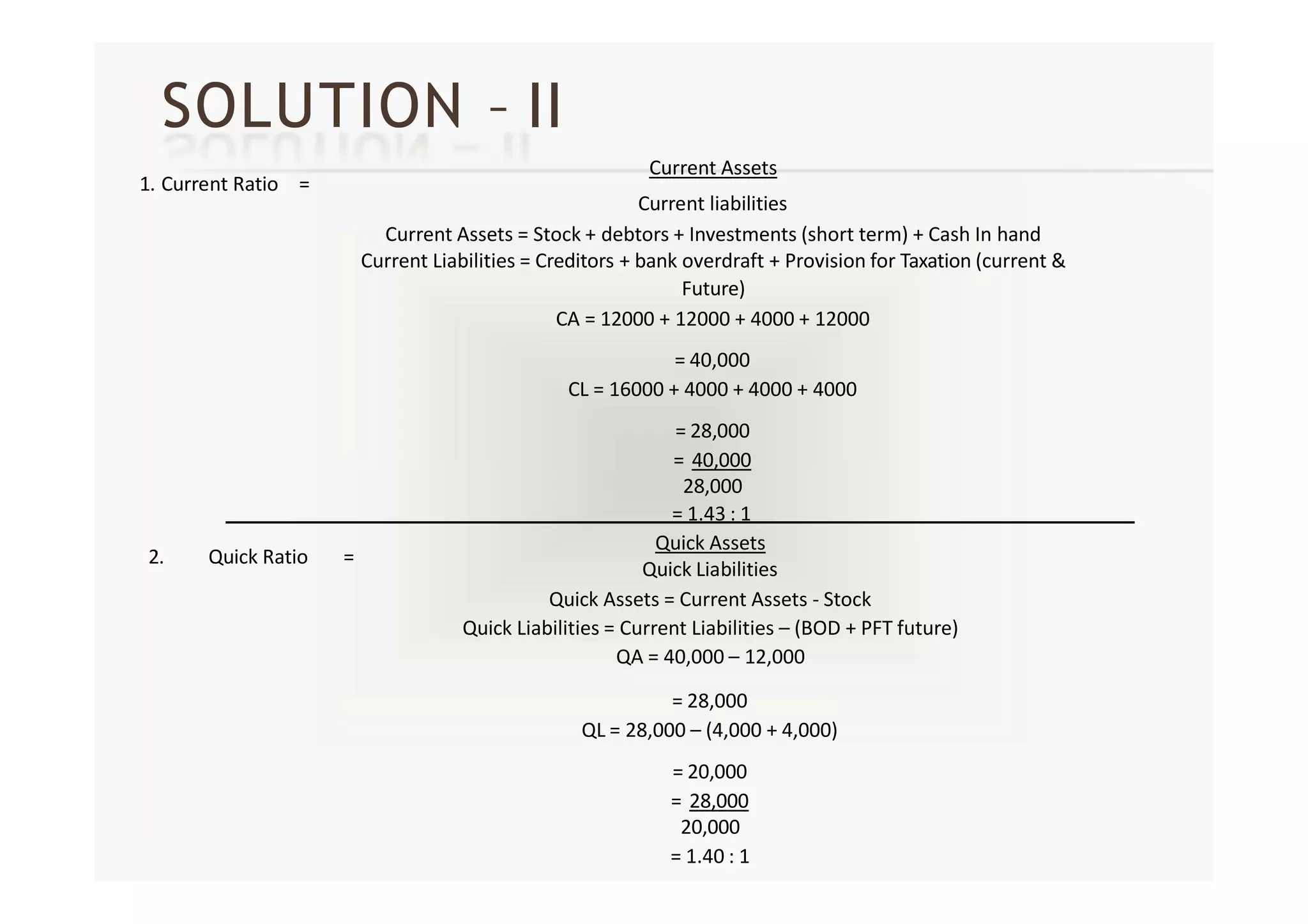

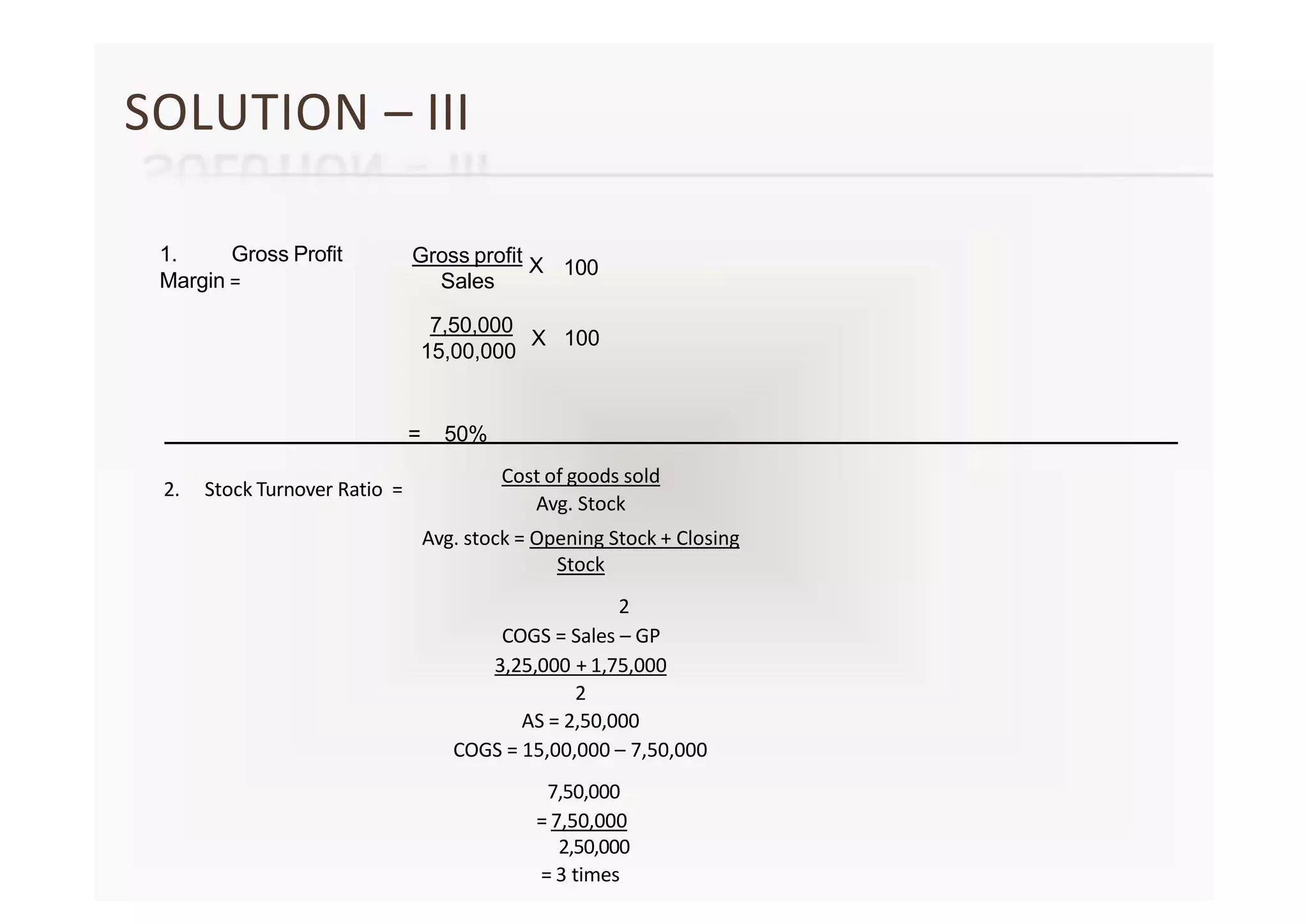

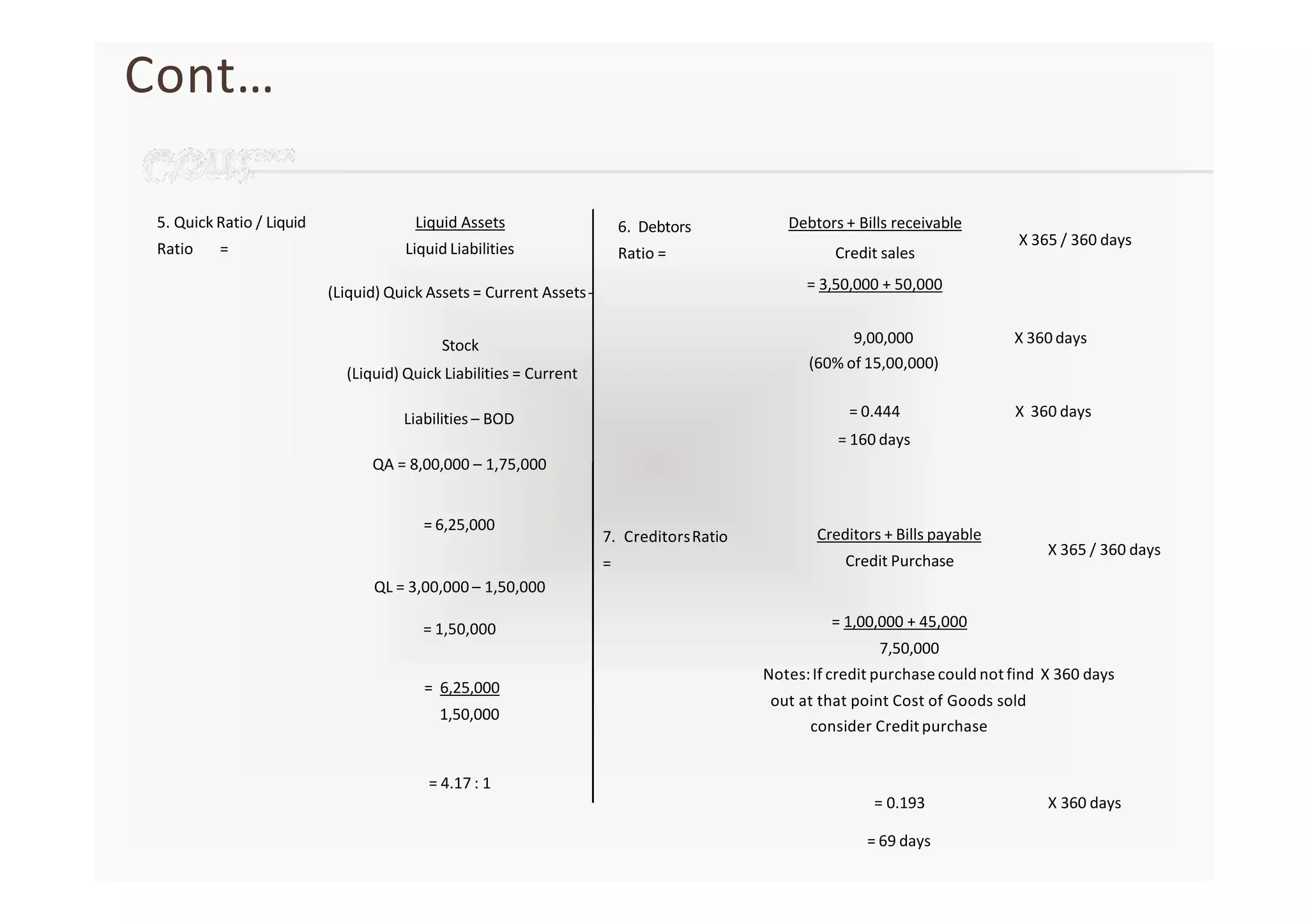

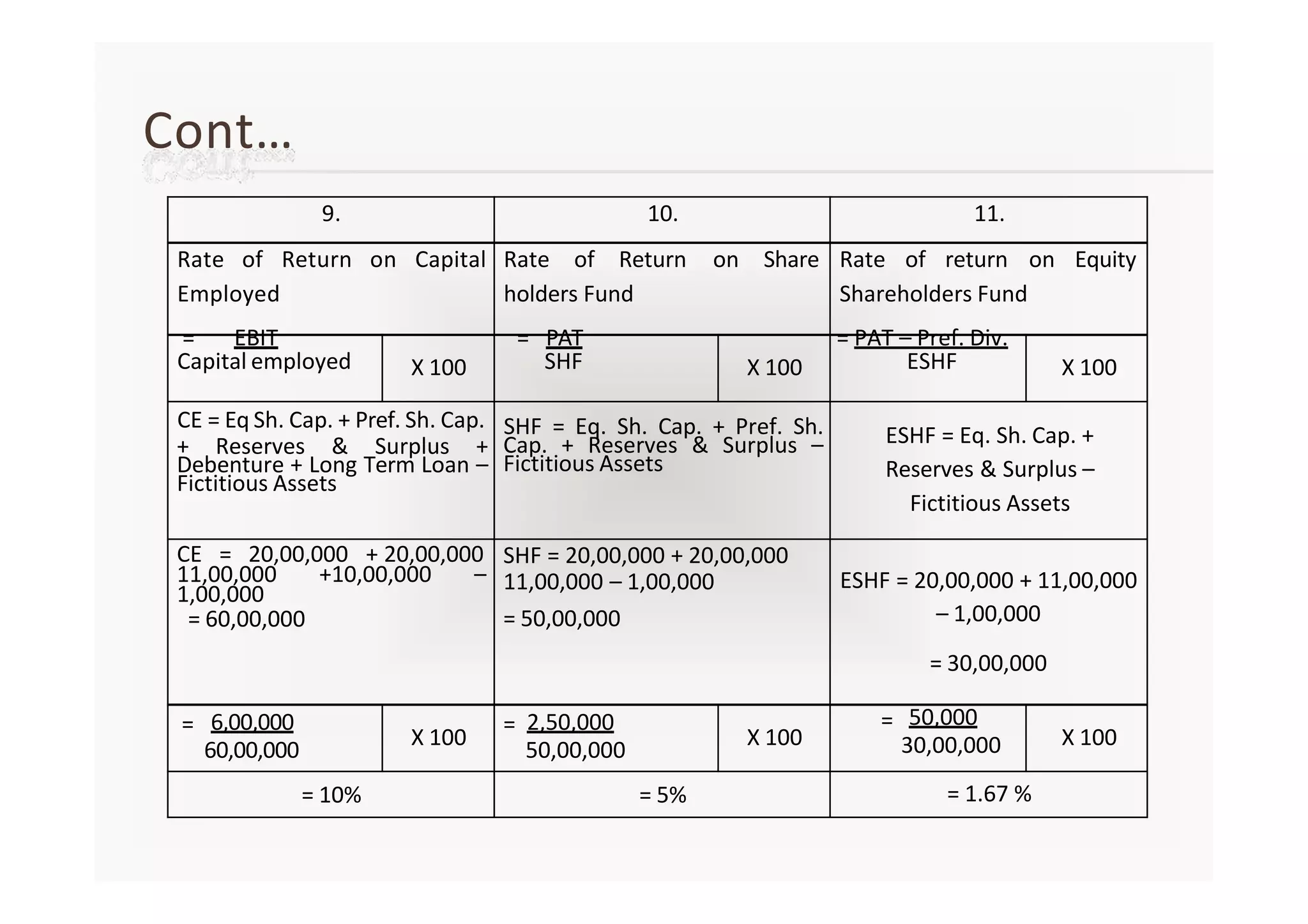

Ratio analysis is a technique used to analyze and interpret financial statements. It involves calculating and comparing various financial ratios to evaluate the overall performance and financial position of a company. The document discusses various types of financial ratios including profitability ratios like gross profit ratio and net profit ratio, liquidity ratios like current ratio and quick ratio, turnover ratios like inventory turnover ratio and debtors turnover ratio, and ownership/solvency ratios like debt-equity ratio. It also provides examples of calculating ratios from financial statements and discusses the usefulness and limitations of ratio analysis.