New base special 09 november 2014 475

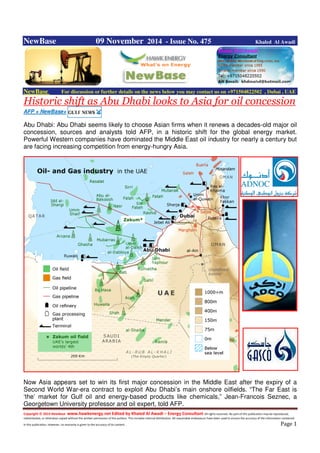

- 1. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 1 NewBase 09 November 2014 - Issue No. 475 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Historic shift as Abu Dhabi looks to Asia for oil concession AFP + NewBase+ Abu Dhabi: Abu Dhabi seems likely to choose Asian firms when it renews a decades-old major oil concession, sources and analysts told AFP, in a historic shift for the global energy market. Powerful Western companies have dominated the Middle East oil industry for nearly a century but are facing increasing competition from energy-hungry Asia. Now Asia appears set to win its first major concession in the Middle East after the expiry of a Second World War-era contract to exploit Abu Dhabi’s main onshore oilfields. “The Far East is ‘the’ market for Gulf oil and energy-based products like chemicals,” Jean-Francois Seznec, a Georgetown University professor and oil expert, told AFP.

- 2. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 2 Experts believe it is inevitable that, after seeing huge boosts in oil exports to Asia, Middle East producers like the United Arab Emirates will seek to attract Asian companies as production partners as well. This will “help the UAE secure a market share in the Far East at this time of ample supplies and relatively weak demand,” Seznec said. Industry sources tell AFP that global giant China National Petroleum Corporation (CNPC) is the top contender for the Abu Dhabi bid, along with firms from South Korea and Japan. The 75- year-old concession ran out in January and state-owned Abu Dhabi National Oil Company (ADNOC) is reviewing bids from nine international majors to award new long-term production-sharing agreements. The ultimate decision will be taken by the Abu Dhabi Supreme Petroleum Council, the emirate’s highest decision-making body on energy issues. China, Korea, Japan firms bidding An industry source said a decision is expected by the end of the year or early 2015, barring any last-minute hurdles. The previous concession, granted in January 1939, was operated by Western companies ExxonMobil, Royal Dutch Shell, BP and Total, with 9.5 per cent each, in addition to Partex Oil and Gas with two per cent. The Abu Dhabi Company for Onshore Oil Operations (ADCO), which currently operates production, had the remaining 60 per cent. The new concession will be for 40 years, local media reported and the goal is to raise output from the current 1.5 million barrels per day to 1.8 million by 2017. As well as China’s CNPC, the Korean National Oil Corporation (KNOC) and Japan’s Inpex Corporation are among the nine companies bidding for the concession. The former partners — US giant ExxonMobil, Anglo-Dutch Shell, Britain’s BP and Total of France — are also bidding, along with newcomers Statoil of Norway and Russia’s Rosneft. “There is certainly a natural fit for Asian oil companies interested in these concessions,” Victor Shum, vice-president at IHS Energy Insight, told AFP. The Middle East is the primary supplier of crude oil to Asian nations and Asia’s importance in the energy market has risen in recent years amid fundamental changes in production, exports and prices, he said. Last year China replaced the United States as the world’s top crude oil importer, after US producers increased domestic output of oil and natural gas from conventional and shale sources. China imports more than six million barrels per day, mostly from the Gulf, as opposed to about five million by the United States.

- 3. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 3 Asia emerging as ‘key investor’ Chinese and Korean companies have already struck smaller concession deals in undeveloped areas of Abu Dhabi. China also signed a strategic deal to import 200,000 barrels per day from the UAE until 2020. “With the growing supply from the United States, we expect that Middle Eastern countries would likely have to focus more on the Asian region,” said Daniel Ang, an investment analyst at Phillip Futures in Singapore. “We already saw Saudi Arabia, Iraq and Iran cut prices and believe that this is already a step towards maintaining their market share in the Asian market,” Ang told AFP. While demand from the United States and Europe is declining or stagnant at best, thirst for oil is increasing rapidly in Asia and emerging markets. IHS forecasts that the Asia-Pacific share of world consumption will rise from 26.4 per cent in 2014 to 34.4 per cent by 2024. The UAE, OPEC’s fourth-largest supplier, is one of the last nations still giving major concession rights to international oil majors. Industry sources said ExxonMobil bid reluctantly to stay in the concession, after securing rights alone at the 550,000 barrel per day Upper Zakum offshore field under improved conditions. Given their track record on the concession, some of the Western firms are likely to win parts of the rights. Total, which has operated in the UAE for the past 40 years, is confident of retaining at least its current share, an industry source said. “There is room for everybody,” Shum said. “But Asian oil companies certainly are emerging as key investors.”

- 4. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 4 Qapco sees 500% LDPE capacity jump Qatar Gulf Times Qatar Petrochemical Company (Qapco) has seen its low-density polyethylene production capacity increase five-fold since 1974 as the petrochemical major currently celebrates its 40th anniversary. From humble beginnings as the first petrochemical plant established in the Middle East in 1974, Qapco has transformed itself into a global and leading petrochemical powerhouse. Qapco was established on November 9, 1974 through Emiri Decree Number 109. From a staff strength of 20 in 1978, the number of employees at Qapco grew to 700 in the early 1980s and reached 1,324 in 2014. Today, with Qatarisation standing at 30.2%, national leadership is one of the driving forces of Qapco and gives the company its cultural identity. A joint venture between Industries Qatar (80%) and Total Petrochemicals France (20%), Qapco is currently one of the largest producers of low density polyethylene (LDPE) in the region besides producing ethylene, sulphur and other petrochemical products. Qapco is involved in a number of joint ventures that include Qatofin, QVC, and QPPC. LDPE is considered the most widely used type of plastic, with applications such as food packaging, agricultural films, cables and wires, coating, lamination and many other products broadly used all over the planet. Low-density polyethylene produced by Qapco is a “high quality food-contact safe” grade polymer and complies with local, European Union and US’ FDA (Food and Drug Administration) standards. Qapco started commercial production in 1981, with an annual output of 132,679 tonnes of ethylene. The plant also had the capacity to produce 140,000 tonnes of low density polyethylene and minor amounts of sulphur, generated as a by-product. Qapco chairman Hamad Rashid al-Mohannadi said, “I am incredibly proud of our 40 years of growth and excellence, inspired by our pioneers. Our successful and extraordinary journey rests on the minds and brilliance of many. An aerial view of Qapco facilities in Mesaieed. Right: HH the Father Emir, Sheikh Hamad bin Khalifa al- Thani, HE the Minister of Energy and Industry, Dr Mohamed bin Saleh al-Sada with Total chairman and CEO Patrick Pouyanne and al-Mulla during Qapco LDPE3 inauguration in 2012.

- 5. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 5 “It first started with a dream in 1974. By transforming a visionary idea into a reality, making the most of what we have been given, by further optimising our hydrocarbon resources, Qapco broke new grounds and paved the way to an entirely new and promising industry in the GCC, petrochemicals. “Our success story has been made possible through the visionary leadership of HH the Emir, Sheikh Tamim bin Hamad al-Thani and with the wise guidance of HE the Minister of Energy and Industry, Dr Mohamed bin Saleh al-Sada. Our shareholders are also drivers of progress and their contribution has been essential to our four decades of growth. I would like to thank Qatar Petroleum and our shareholders, Industries Qatar and Total Petrochemicals France, as they are the foundation of our success. They have left their mark, influenced our corporate culture and propelled Qapco into new eras of development thanks to their focus on assertive growth and sustainability,” al-Mohannadi said. “From our humble beginnings as the first petrochemical plant established in the Middle East in 1974, we got transformed into a global and leading petrochemical powerhouse. Our employees’ expertise, loyalty and hard work along with their unwavering commitment to the highest standards of performance and excellence made us who we are. The Qapco family is at the heart of everything we do and a vital force that has always propelled us forward.” As part of its 40th anniversary celebrations, Qapco is paying tribute to all its employees and holding celebrations in their honour at its Mesaieed facility today. Developing Resources in Volatile Environment Biggest Challenge for Gas Industry, Says Qatar The biggest challenge facing the natural gas industry is how to develop the resources in a volatile environment amid variation in consumer-producer perceptions about how to ensure the stability of the markets in the long term, according to Qatar’s Minister of Energy and Industry Mohammed bin Saleh Al Sada. The minster, who spoke at the 3rd LNG Producer-Consumer Conference held in Tokyo on Thursday said contracts must mainly consider balanced contractual terms to ensure stable supply for consumers and security of demand for producers, Qatar News Agency reported. Al Sada also emphasised the importance of the Qatari-Japanese cooperation in the field of LNG, especially as Qatar is Japan's second largest LNG supplier. During the 8th Ministerial meeting of the Qatari-Japanese Economic committee, the two sides discussed the latest developments in the efforts to upgrade their cooperation to "Comprehensive Partnership", Qatar News Agency added. Qatar affirmed commitment to continuing and expanding supply of LNG and petroleum derivatives to Japan, according to stabled and agreed-upon terms.

- 6. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 6 Saudia : Sabic’s carbon reduction project wins CDM registration Sabic + NewBase Saudi Basic Industries Corporation’s innovative carbon reduction project at its manufacturing affiliate, Al Jubail Fertiliser Company (Al-Bayroni) has been registered by the executive board of the Clean Development Mechanism (CDM). The CDM initiative encourages reduction of greenhouse gas emissions responsible for climate change, said a statement. Sabic’s Boiler Optimisation Project at Al-Bayroni will run for 10 years and reduce the firm’s CO2 emissions by more than 400,000 tonnes per annum by utilising new technologies that cut greenhouse emissions and energy consumption, it said. Mohamed Al-Mady, Sabic vice chairman and CEO, said: “Our Boiler Optimisation Project has once again demonstrated our strong commitment to a low-carbon economy for sustainable development, clean environment and a better tomorrow.” Prior to registration by the board, the project was reviewed and approved by the National Committee for CDM, presided over by Prince Abdulaziz bin Salman, Assistant Minister of Petroleum and Mineral Resources for Petroleum Affairs. The CDM project cycle is highly complex in its nature and requires technical and sustainability expertise, adherence to transparency, advanced corporate governance and high EHSS standards. It puts the project proponents under local and international scrutiny, said the statement. Khaled Al-Mana, Sabic executive vice president, Fertilisers, and Al-Bayroni chairman, said: “Tackling climate change has recently become a key element of sustainability, and we are reducing our own carbon footprint. One of the ways for this is CDM. I am proud to see Al-Bayroni become the first member of the Sabic family to have a project achieve CDM registration. “When we initiated the CDM program at SABIC, we knew that it would be a difficult undertaking. CDM is a complex program with many challenges but we spared no effort in pursuing it. SABIC is proud of the CDM registration for this project and will continue with the program in all earnestness.”

- 7. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 7 $250bn ‘needed to tackle energy crunch’ in India Reuters + NewBase India needs to invest $250 billion over the next five years to tackle chronic energy shortages and provide power for all its 1.2 billion people, its power minister said on Thursday. Piyush Goyal said the bulk of the investment would need to come from the private sector but the government would also invest more. "I visualise an investment of nearly $250 billion in this sector in the next four or five years," Goyal told a World Economic Forum conference in New Delhi. The government is targeting $100 billion of investment in renewables and $50 billion in transmission and distribution to "create a national grid where power can seamlessly flow", Goyal said, as it seeks to avoid a repeat of 2012 when one of the world's biggest blackouts hit swathes of northern India. He also said that nuclear power offered the "potential" to help resolve India's energy shortages. Rapidly growing demand that outstrips supply and an antiquated transmission system mean much of India still suffers regular outages, which hamper investment and force many businesses to rely on costly generators for back up. As many as 400 million Indians are still not connected to the grid, while the average Indian household uses about a third of the power consumed by a family in China. Total energy consumed in India will double by 2019, Goyal said. Prime Minister Narendra Modi, elected in May, has made a commitment to bring uninterrupted power to all India's people a key plank of his government's programme. To achieve that, Goyal said India needed to rapidly raise the amount of coal it mined for power generation, cut back on electricity lost on transmission lines and through theft, and promote the use of renewable resources such as solar and wind. Coal, which generates about three-fifths of the country's energy, would retain an "essential role" in India's energy mix, as in the United States, despite more environmentally friendly alternatives, Goyal said. Past governments have struggled to attract foreign cash into the power industry, partly because companies remain unconvinced they will be able to earn a return on their investment while tariffs are kept low to please consumers. "The most important thing for infrastructure related investments (in India) is how to make the project bankable," Masakazu Sakakida, Managing Director of the Indian arm of Japan's Mitsubishi Corp, said earlier this week. "In a coal based power plant, the price of electricity is almost fixed, it's not related to the price of the coal." Dong-Kwan Kim, Managing Director at Hanwha Group, a Korean conglomerate with interests in solar, said India's high cost of capital was also deterring investors from renewable projects because they could earn far better returns elsewhere.

- 8. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 8 Petronet LNG to expand Dahej’s receiving capacity to 17.5 mtpa Ource Petron LNG + NewBase Petronet LNG of India plans to expand capacity of its Dahej terminal to 17.5 million tonne per annum. “Encouraged by the increasing demand at Dahej, the Board of Directors have given their approval to undertake further studies to make an assessment for further expansion of the Dahej terminal to 17.50 mtpa,“ the company said in a statement on Friday. Petronet LNG is already working on expanding Dahej’s capacity from 10 mtpa to 15 mtpa. “The work is going on as per schedule and it is expected that this capacity expansion will be completed by end of the year 2016,” Petronet said. According to the statement, during the quarter ended 30th September, Petronet’s Dahej terminal has operated at highest level ever of around 117 % of its nameplate capacity. The volume regasified at the Dahej terminal during the second quarter of FY 2014-15 was 149.16 TBTUs. The company’s second LNG terminal – Kochi, which was commissioned last year, processed 1.31 TBTUs of LNG serving the Kochi Refinery in the vicinity of the terminal. The total volume processed i.e. 150.47 TBTUs compares with a volume of 138.67 TBTUs in the previous quarter and 122.93 TBTUs in the corresponding quarter of the last year, Petronet said. Truck loading facilities at Kochi have also been commissioned and supplies started to M/s HLL at Trivandrum. Petronet also said that the Government of Andhra Pradesh has granted approval for setting up its 5 mtpa LNG project at Gangavaram.

- 9. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 9 Dry well southwest of the 7228/7-1 oil and gas discovery in the Barents Sea Press Release Statoil Petroleum AS, operator of production licence 230, has completed drilling of wildcat well 7227/10-1. The well was drilled about 30 kilometres southwest of the 7228/7-1 oil and gas discovery and about 210 kilometres northeast of Hammerfest. The primary exploration target for the well was proving petroleum in Late Triassic reservoir rocks (Snadd formation). The secondary exploration target was proving petroleum in Middle Triassic reservoir rocks (Kobbe formation), as well as investigating the presence and quality of Early to Middle Triassic source rock. The well encountered about 40-metre thick reservoir rocks in the Snadd formation and about 15- metre thick reservoir rocks in the Kobbe formation, both with poor reservoir quality. The well is dry. Data acquisition and sampling were carried out. This is the first exploration well in production licence 230, which was awarded in the Barents Sea project in 1997. The well was drilled to a vertical depth of 3095 metres below the sea surface, and was terminated in the Kobbe formation. Water depth is 232 metres. The well will now be permanently plugged and abandoned. Well 7227/10-1 was drilled by the Transocean Spitsbergen drilling facility, which will now proceed to wildcat well 7324/9-1 in the Barents Sea to cut and pull the wellhead. The well is located in production licence 614, where Statoil Petroleum AS is the operator.

- 10. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 10 US:Natural gas storage levels now within 7% of 5-year average Source: U.S. Energy Information Administration, Weekly Natural Gas Storage Report Working natural gas in storage ended October at 3,571 billion cubic feet (Bcf), a record increase of 2,734 Bcf during the April 1 to October 31 injection season, and within 7% of the average of the last five end-of-season storage levels. While end-October natural gas stocks are at a five-year low, increased natural gas production, which has reached an all-time high, and new pipeline projects will help meet winter natural gas demand. Higher production means that even if this winter were as cold as last year, EIA expects that natural gas storage at the end of March 2015 will be above its March 2014 level. Heading into the refill season last spring, inventories were at an 11-year low after a prolonged and severe winter, about 1,000 Bcf lower than the five-year (2009-13) average. Although the refill season began slowly in April, injections quickly ramped up and exceeded five-year average levels for 28 weeks in a row. The gap between the five-year average and current inventories has now narrowed to 261 Bcf. Analysts often refer to the injection season as ending on October 31, but the peak in storage inventories may come later, as it is common for injections to continue into November. High levels of injections over the summer were possible because of relatively low natural gas demand from the electric power sector as well as substantial increases in domestic natural gas production. Relatively mild summer temperatures led to lower than expected demand for air conditioning, allowing natural gas to go to underground storage facilities rather than to electric power generators. Bentek data from April through October indicate consumption of natural gas in the electric power sector averaged about 2% less than last year's level and roughly 16% below its level during the summer of 2012.

- 11. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 11 The October Short-Term Energy Outlook projects inventories will drop to 1,532 Bcf by the end of the heating season on March 31, 2015. This projection is based on National Oceanic and Atmospheric Administration (NOAA) projections for relatively normal winter weather with temperatures much milder than the winter of 2013-14. Even if the weather this winter matches last year's cold temperatures, it is unlikely that stocks would drop to March 2014 levels (when inventories were at an 11-year low). This is largely because of the gains in domestic natural gas production. As of August 2014, dry natural gas production was 3.5 Bcf/d greater than the same month last year. Continued high levels of production expected through next spring will also help reduce the need to withdraw natural gas from storage over the upcoming winter. Falling natural gas prices have reflected this increase in supply. Following sustained cold weather this past winter, daily spot prices at the Henry Hub benchmark rose to six-year highs in February, spiking above $7 per million British thermal units on three separate occasions. Prices have declined over the past several months, as weekly inventory additions have been consistently high and production continues to rise.

- 12. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 12 Opec sees global energy demand up 60 per cent by 2040 BYAGENCIES + NewBase Global energy demand will increase by 60 per cent by 2040 compared to 2010 levels, Opec said on Thursday, with greenhouse-gas-emitting fossil fuels remaining by far humanity's main source of power. World oil output is projected to soar from 81.8 million barrels of oil equivalent per day (mboed) to 99.6 mboed over the same period, the Organisation for the Petroleum Exporting Countries (Opec) said in its new annual report The share of oil in global energy use is however projected to fall from 31.9 per cent to 24.3 per cent, while that of all fossil fuels — oil, coal and gas — will dip from 81.6 per cent to 78.4 per cent. Hydro, biomass and other renewables will account for 15.8 per cent, up from 12.7 in 2010 and nuclear power will represent 5.7 per cent, little changed from 5.6 per cent, the 12-member Opec said Renewables like solar and wind "are expected to continue to grow at a fast pace, partly as a result of government support. However, given their low initial base, their share of the global energy mix is expected to remain modest by 2040," Opec said. "It is fossil fuels that will continue to play the leading role in satisfying world energy needs in the future. Regarding the price of oil, which has fallen almost 30 per cent since June to around $80 per barrel, Opec said that it expects a nominal price of around $110 per barrel for the rest of this decade. By 2025, the nominal price will have hit $123.90, rising steadily to $177.40 by 2040. In real or inflation-adjusted terms the price will fall to $95.40 by 2020 and hit $101.60 by 2040, Opec predicts. Opec, which pumps a third of the world's crude, also predicted 2.2 billion cars on the planet by 2040, up from 938 million in 2011, with the number in developing countries soaring fivefold. The predictions are based on global economic output rising 160 per cent by 2040 compared to 2013 by purchasing power parity "Under all scenarios, the health of the global economy remains central. Although there have been both ups and downs this year, the global economy is generally seen continuing its gradual recovery," Opec said

- 13. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 13 Oil prices have slumped into a bear market amid signs that global supply is outpacing consumption. Leading Opec members have resisted calls to cut output as they compete with the US, which is pumping at the fastest pace in more than 30 years "It will take a threat to a significant chunk of production to really alter things," Ric Spooner, a chief strategist at CMC Markets in Sydney, said by phone on Friday. "A geopolitical event would be a catalyst for a rally. Brent for December settlement declined as much as 56 cents to $82.30 a barrel on the London- based ICE Futures Europe exchange and was at $82.39 at 2:45pm Singapore time. The contract lost nine cents to $82.86 on Thursday. The volume of all futures traded was about two per cent below the 100-day average Prices have decreased 26 per cent in 2014. WTI for December delivery dropped as much as 44 cents, or 0.6 per cent, to $77.47 a barrel in electronic trading on the New York Mercantile Exchange. Prices are down 3.6 per cent this week. The US benchmark crude was at a discount of $4.70 to Brent, compared with $5.32 on October 31 Crude demand Oil will rebound by the second half of next year as supply and demand don't justify the market's collapse and prices are low enough to threaten investment in production, according to Opec Secretary-General Abdalla El-Badri The 12-member group, scheduled to meet November 27 in Vienna, is "concerned but not panicking," he said on Thursday . Opec will probably reduce its output quota if oil slides to $70 a barrel, the Wall Street Journal reported, citing officials it didn't identify. The group produced 30.974 million barrels a day last month, the most since August 2013, data compiled by Bloomberg show. That exceeded its collective target of 30 million, which was set in January 2012. In Libya, where output gains have contributed to rising supply from Opec, the Sharara field will "soon" resume, said Mansur Abdallah, the director of oil movement at the Zawiya refinery and port.

- 14. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 14 Oil Price Drop Special Coverage All eyes on oil price amid concerns of a dip below $80 a barrel The National + Bloomberg News + NewBase Regional equity investors will be watching oil prices this week as Brent crude hovers just above US$80 a barrel, a barometer for the Arabian Gulf economies. “We have reached new lows with oil prices,” said Sebastien Henin, the head of asset management at The National Investor, an Abu Dhabi-based investment bank. “If we break the current level, it might trigger a kind of violent reaction from investors and sell-off across regional markets.” The Abu Dhabi Securities Exchange General Index lost 1.4 per cent over last week, while the Dubai Financial Market General Index declined 3 per cent in the same period. “We had a bad session at the beginning of the week and then the market recovered a little,” said Mr Henin. Brent crude declined for a seventh week as Opec reduced its forecast for demand through 2035 amid the US shale boom. Global demand for crude from Opec, which is responsible for about 40 per cent of the world’s oil supply, may fall to a 14-year low of 28.2 million barrels a day in 2017, its outlook showed. That is 600,000 a day less than last year’s projection and 800,000 below the amount required this year. “The sharp slide in oil prices since the summer won’t cause a major headache for the Gulf states, but it does reinforce the point that these economies are set to lose some steam over the coming years,” Capital Economics said in a note. “Falling oil revenues mean that government spending won’t be as supportive of growth as it has been in recent years. At the same time, another boom in oil production seems unlikely in light of rising supplies from elsewhere, notably the US,” said the London-based research house.

- 15. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 15 But declining crude prices should bode well for the oil importing economies of Egypt, Morocco and Tunisia, Capital Economics said, by “reducing twin budget and current account deficits”. Global markets stabilised on Friday, as regional equity markets were closed for the weekend. In the US, the Dow Jones Industrial Average rose 0.1 per cent to 17,573.93 points, while the S&P500 added 0.03 per cent to 2,031.92 points. The London-based FTSE 100 gained 0.25 per cent to 6,567.24 points. In Asia, the Nikkei 225 Index rose 0.5 per cent to 16,880 and the Hang Seng slipped 0.4 per cent to 23,550.24. Brent crude inched 0.6 per cent higher to $83.39 and gold jumped 2.3 per cent to 1169.80 points. “If you look at international equity markets, whether its monetary policy from the European Central Bank or other data, a lot of things have been clarified and the volatility has decreased,” Mr Henin said. UAE and Qatari stocks have become more sensitive to global equity trends after the international index compiler MSCI incorporated the shares into its Emerging Markets Index. OMV warns lower oil price will hit investment Anthony McAuley OMV, the troubled Austrian energy group which is partly owned by Abu Dhabi’s Ipic, warned on Thursday that it might miss its production goals over the next two to three years as a declining oil price cuts into its investment programme. The integrated energy company, which has oil and gas exploration and production interests primarily in Europe and North Africa, as well as European power generating and refining operations, issued the warning as it was reporting mixed financial results for the third quarter, with improved profit in refining offset by lower earnings from oil production. OMV said it suffered a 21 per cent decline in “clean” earnings in its exploration and production business compared to last year’s third quarter, with profit in its largest division falling to US$455 million. Earnings in refining and marketing more than doubled, however, to $206m, and its power and gas unit also turned a small profit of $14m. Overall, the third quarter’s clean profit (which strips out inventory and one-off gains or losses), was up 6 per cent at $656m. OMV shares were hardly changed at midday in Vienna on Thursday and stood at about €25, but they have been declining for months and stood 32 per cent lower than this time last year. The company is in the middle of a management shake-up that was set in motion by its board of directors last month, and which will result in a number of its most senior executives departing earlier than planned. That includes the chief executive Gerhard Roiss, who has agreed to step down by the end of June next year. This week, Mr Roiss told CNBC in an interview: “Our target is to grow upstream production by about 4 per cent a year, including acquisitions.” But in a statement accompanying Thursday’s’s

- 16. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 16 earnings, he struck a note of caution on investment, saying: “In order to reflect a more challenging operating environment, especially the softness in the oil price together with the unpredictability of our Libyan production, which is adversely impacting the group’s cash flow, we have decided to review the pace of our investment programme for the next two to three years.” Before the shake-up was announced, Mr Roiss had been taking OMV in a new direction, with more focus on exploration and development and less on downstream. It sold its Bayernoil refinery and last year made its largest-ever acquisition, paying €2.65 billion (Dh12.18bn) for assets in the UK and Norway, including the Gudrun field. It has also had good results from exploration in the Black Sea. Mr Roiss has also been a strong proponent of the South Stream gas pipeline project led by Russia’s Gazprom, which has been rumoured to be in talks to buy Ipic’s near 25 per cent OMV stake, although none of the interested parties have confirmed that. OMV signed a deal last June to bring South Stream to Austria. As part of the shake-up agreed last month, the refining and marketing and power and gas divisions will be merged into one downstream division under Manfred Leitner, the current head of refining. Meantime, the head of the gas and exploration divisions have both also agreed to depart. OMV’s largest shareholder is the Austrian government, through a 31.5 per cent stake owned by its industrial investment agency. A number of ministers have been highly critical of the company’s management recently, with the prime minister calling its revamp plan “chaotic” last month, precipitating the changes at the top. Conspiracy theorists seem in abundance amid oil downswing Syed Rashid Husain Oil war is on and on several fronts, global media is screaming. Last week when Saudi Aramco announced cutting Official Selling Price (OSP) to American refiners, the move was seen by many not only as an attempt to shore up its customer base in a market that accounts for more than 20 percent of global crude demand, but also to rein in the galloping shale oil production in the US. Some observers viewed the Saudi price cut to US customers as an effort to undermine the boom in American production of oil from shale. “The market reacted to it very negatively, thinking, “Here we go, we’re going to have a price war in the United States,” Anthony Lerner, a senior vice president of industrial commodities at brokerage R.J. O’Brien & Associates LLC, told The Wall Street Journal. An otherwise very technical and commercially driven adjustment mechanism was thus misinterpreted by a number of pundits. “We see a clear lack of understanding of an OSP’s purpose,” says Morgan Stanley analyst Adam Longson. Ironically the same had happened when Aramco announced a reduction in Saudi OSPs to Asia last month. It too sparked the chatter - market share war is on. Facts however, state otherwise!

- 17. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 17 In recent months, as US crude production jumped to the highest in three decades, shale oil has been capturing more of the domestic refining market at Saudi Arabia’s expense. The Saudi decision to increase discounts on deliveries to US refiners could also be seen in this perspective. It was basically to protect its competitiveness amid an erosion of its US market share by rival exporters such as Canada and Iraq. In August, US crude imports from Saudi Arabia slipped below 900,000 barrels per day. With the exception of a brief period in 2009 and early 2010, Saudi exports to the United States has never been that low since 1988. US imports from Saudi Arabia in August were just 70 percent of the average level for the past ten years which has been around 1.3 million bpd. Saudi oil, which is priced at a differential to a US sour crude marker, had in the meantime, become too expensive, compared to alternatives available to US refiners. Market dictates hence forced Saudi Aramco to react, cutting the differentials for US refiners by between 45 and 50 cents (depending on grade), while it raised differentials for refiners in Europe and Asia. Most commentators however, interpreted the US price cuts as a signal that the Kingdom was initiating a deliberate price-war targeting US shale producers. A day after the Saudi decision, White House spokesman Josh Earnest said that the US was monitoring the global oil supply and demand situation. However, he did not comment on the possibility of Washington opting to replenish the Strategic Petroleum Reserve (SPR), as was being rumored. Phil Flynn of FOXBusiness reported that hinting at the possibility of the US increasing the SPR, was obviously a thinly veiled message to Saudi Arabia. It was an attempt by the White House to underline they were not happy with the price discounts and to remind that there were steps that the US could contemplate. And Flynn then underlines, that not only the US government could go on a buying spree to fill up the SPR, basically to shore market prices, it could also levy a tax on Saudi oil. Later in the day, the Wall Street Journal reported that BP was going to export ultra-light crude without the permission of the US government. This move not only indicated, the bypassing of the US export ban, many also termed it as a direct challenge to OPEC and other producers. The Wall Street Journal reported that BHP Billiton cut a deal to sell about $50 million of ultralight oil from Texas to foreign buyers without formal government approval. The Journal says that this may “be only the first of many such moves as energy companies seek new markets and higher prices for the surge of crude now pumped in the US.” If the US government remains silent and uses as a loophole the high quality of oil as not fitting the definition of crude oil it will open up the floodgates and unleash US shale oil into the world. Would lowering crude market prices stifle US sale output growth? Not everyone seemed to agree. A recent report, “The Rapid Rise of the United States as a Global Energy Superpower,” from Citi suggests the price of oil would have to dip to the vicinity of $50 a barrel to flatten US production growth completely. And it is still considerably away from that level. “Saudi Arabia could look to allow prices to fall enough until US shale production is reined in. However, should such a circumstance arise, it looks like US shale/tight oil production growth could remain robust even in an environment of sustained lower oil prices, lower capex, and lower rig counts,” the report underlined. And indeed pundits also fail tend to take into account that with a growing public budget, the Kingdom could not take the bait and drive oil prices - its bread and butter - down. This would be painful, none argues here too.

- 18. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 18 And when Mr. Ali Naimi, in Venezuela last week to attend a climate conference, had a meeting with Rafael Ramírez, Venezuela’s foreign minister and its OPEC representative, global media went on an overdrive, indicating a return of the 90s era. Then too, in the backdrop of a similar drop in oil market prices, Minister Naimi had brokered a deal with the late Venezuelan president Hugo Chavez and Mexico to curb output and stabilize the markets. Venezuela then was regarded as one of the biggest OPEC quota buster. And the deal eventually helped in stabilizing markets. But the similarities are superficial. While Venezuela has already begun pressing for output curbs, some of OPEC’s members appear hesitant. In recent weeks, Venezuela has been pushing for an emergency OPEC meeting due to the steep fall in oil prices. Riyadh however, has not been warm to the idea. Saudi officials told oil market participants in New York last month to brace for an extended period of prices as low as $80, Reuters reported. Today Venezuela and Saudi Arabia are not on the same page on the issue and they know their limits too. They cannot alter the current scenario. It is different from the 90s. “The Venezuelans are not the reason for oversupply - and, truthfully, won’t be the solution to it either,” Mark Routt, Senior Staff Consultant with KBC Advanced Technologies told Reuters. Qatar’s investment programme sustainable at much lower oil prices: QNB Gulf Times + NewBase Qatar has the capacity to finance its infrastructure investment programme although the oil price has fallen 30% since June, QNB has said in a report. Based on the 2013 data, QNB estimates that the fiscal breakeven price—the oil price at which government expenditure would equal government revenue—was $67 a barrel. The bank’s estimates are based on the impact of a change in oil priceswhile everything else remains constant (such as hydrocarbon production) with the exception of gas prices, which it assumes fall in line with oil prices. Even if oil prices did fall below $67 a barrel, they would have to remain depressed for some time to have an impact on the investment programme. Qatar has the resources to draw on before being forced to make any significant cut backs to domestic investment. However, should oil prices remain low for a considerable time; a prioritisation process is likely to be implemented to ensure the completion of key projects. According to QNB Qatar’s large infrastructure investment programme would be sustainable, even if oil prices fell considerably further. Brent crude oil prices have dropped from a peak of $115 a barrel in June 2014 to about $82 currently. This, it said, has raised speculation about the impact of falling oil prices on hydrocarbon exporting countries.

- 19. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 19 In Qatar, oil prices would have to fall considerably further to have any impact on the infrastructure investment programme that is expected to drive economic growth over the next few years. Our assessment is based on fiscal breakeven prices (the oil prices at which the government budget would be in balance), which is estimated to be well below current oil prices. Qatar is currently implementing a large infrastructure investment programme in the run-up to the 2022 World Cup and in line with its 2030 Vision to diversify the economy away from dependence on hydrocarbons. The government has recently announced $182bn for project implementation outside the oil and gas sector over the next five years. The largest projects include several major real estate developments (Lusail, The Pearl Qatar and Musheireb for example), a new metro and rail network as well as new roads and highways. These major projects are creating large numbers of jobs leading to high population growth (annual average of 9.2% in the first ten months of 2014). This is expected to drive GDP growth throughout the non-hydrocarbon sector, thereby supporting diversification. The government expects to finance infrastructure investments predominantly through revenue from hydrocarbon exports. With fiscal and current account surpluses of 15.6% and 30.9% of GDP respectively in 2013, ample resources should be available. The question is how far would oil prices have to fall to push the fiscal balance into deficit and force the government to cut back on its investment plans? Even though oil prices have fallen almost 30% since their June highs, Qatar retains the capacity to finance its infrastructure investment programme. Therefore, it is expected that strong economic growth will continue, driven by the infrastructure investment programme, QNB added.

- 20. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 20 NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Your partner in Energy Services Khaled Malallah Al Awadi, Energy Consultant MSc. & BSc. Mechanical Engineering (HON), USA ASME member since 1995 Emarat member since 1990 Mobile : +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with aKhaled Al Awadi is a UAE National with aKhaled Al Awadi is a UAE National with aKhaled Al Awadi is a UAE National with a total of 24 yearstotal of 24 yearstotal of 24 yearstotal of 24 years of experience in theof experience in theof experience in theof experience in the Oil &Oil &Oil &Oil & Gas sector. CurrentlyGas sector. CurrentlyGas sector. CurrentlyGas sector. Currently working as Technical Affairs Specialistworking as Technical Affairs Specialistworking as Technical Affairs Specialistworking as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ withfor Emirates General Petroleum Corp. “Emarat“ withfor Emirates General Petroleum Corp. “Emarat“ withfor Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area viaexternal voluntary Energy consultation for the GCC area viaexternal voluntary Energy consultation for the GCC area viaexternal voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most ofHawk Energy Service as a UAE operations base , Most ofHawk Energy Service as a UAE operations base , Most ofHawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operatithe experience were spent as the Gas Operatithe experience were spent as the Gas Operatithe experience were spent as the Gas Operations Managerons Managerons Managerons Manager in Emarat , responsible for Emarat Gas Pipeline Networkin Emarat , responsible for Emarat Gas Pipeline Networkin Emarat , responsible for Emarat Gas Pipeline Networkin Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years , heFacility & gas compressor stations . Through the years , heFacility & gas compressor stations . Through the years , heFacility & gas compressor stations . Through the years , he has developed great experiences in the designing &has developed great experiences in the designing &has developed great experiences in the designing &has developed great experiences in the designing & constructingconstructingconstructingconstructing of gas pipelines, gas metering & regulatingof gas pipelines, gas metering & regulatingof gas pipelines, gas metering & regulatingof gas pipelines, gas metering & regulating stations and in tstations and in tstations and in tstations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation , operation &he engineering of supply routes. Many years were spent drafting, & compiling gas transportation , operation &he engineering of supply routes. Many years were spent drafting, & compiling gas transportation , operation &he engineering of supply routes. Many years were spent drafting, & compiling gas transportation , operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil &maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil &maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil &maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in thGas Conferences held in thGas Conferences held in thGas Conferences held in the UAE ande UAE ande UAE ande UAE and Energy program broadcasted internationally , via GCC leading satellite Channels .Energy program broadcasted internationally , via GCC leading satellite Channels .Energy program broadcasted internationally , via GCC leading satellite Channels .Energy program broadcasted internationally , via GCC leading satellite Channels . NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 09 November 2014 K. Al Awadi