Adnoc awards Italy's Eni and Austria's OMV refining stakes

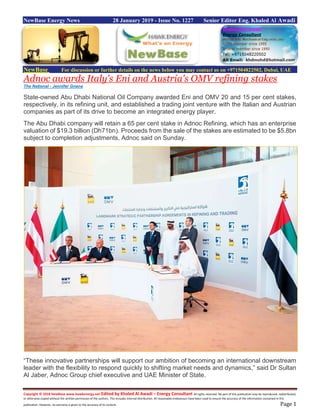

- 1. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 28 January 2019 - Issue No. 1227 Senior Editor Eng. Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Adnoc awards Italy's Eni and Austria's OMV refining stakes The National - Jennifer Gnana State-owned Abu Dhabi National Oil Company awarded Eni and OMV 20 and 15 per cent stakes, respectively, in its refining unit, and established a trading joint venture with the Italian and Austrian companies as part of its drive to become an integrated energy player. The Abu Dhabi company will retain a 65 per cent stake in Adnoc Refining, which has an enterprise valuation of $19.3 billion (Dh71bn). Proceeds from the sale of the stakes are estimated to be $5.8bn subject to completion adjustments, Adnoc said on Sunday. “These innovative partnerships will support our ambition of becoming an international downstream leader with the flexibility to respond quickly to shifting market needs and dynamics,” said Dr Sultan Al Jaber, Adnoc Group chief executive and UAE Minister of State.

- 2. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 The UAE, which accounts for about 4.2 per cent of global crude production, much of it from fields owned and operated by Adnoc is looking to double refining and triple chemical capacities by 2025. The Abu Dhabi major unveiled plans to invest Dh165bn with partners across the downstream value chain, amid ambitions to build the world’s largest integrated refining and chemicals complex by 2025 in the emirate’s western region of Ruwais. Adnoc Refining has a total refining capacity of 922,000 barrels per day and is the world’s fourth- biggest single site refinery. After the development of a new 600,000 bpd refinery, the unit’s capacity is expected to rise to process crude and condensate amounting to 1.5 million bpd, rivalling India’s 1.24 million bpd at the Jamnagar refinery, the world’s biggest. The sale of stakes in Adnoc’s refining unit would open up opportunities “to supply markets in Africa, Asia and Europe,” the company said. The three partners will support short and mid-term growth plans for Adnoc Refining, supported by the entity’s high cash-flowing generation capacity. The partners also agreed to “a comprehensive capital allocation framework to achieve self-funded growth, paired with an attractive dividend policy,” Adnoc added. Eni and OMV will also own 20 and 15 per cent stakes, respectively, in the newly established trading JV, that will export up to 70 per cent of volumes generated by Adnoc Refining. The remaining 30 per cent locked in for the domestic market will be managed by the Abu Dhabi producer. In April last year Adnoc announced its intention to set up a non-speculative trading unit as the company looks to expand revenue streams and beef up sale of crude and products. Other state- owned firms in the region have adopted a similar strategy. The three-way trading JV between Adnoc and its European partners will be incorporated at the Abu Dhabi Global Markets, with “physical and derivative trading” likely to commence as early as 2020, following completion of necessary processes and procedures. The transaction is expected to close

- 3. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 in the third quarter of this year, pending customary closing conditions and regulatory approvals, Adnoc said. Adnoc Refining, which has a product range that includes liquefied petroleum gas, naphtha, gasoline, jet fuel, gas oil and base oils, fuel oil as well as petrochemical feedstocks such as propylene, will see better optimisation of systems and management of international product flows following the establishment of the trading unit. "The stated objective of the trading joint venture is to expand its global presence over time,” the company said. The transaction is the second for Eni this year with the Abu Dhabi major following the award of two offshore exploration blocks in Adnoc’s first ever competitive bid round. The Italian major in consortium with Thailand’s PTT Exploration and Production Public Company paid Dh844 million for exploration and appraisal of the concessions. The latest transaction represented a 35 per cent increase in Eni’s global refining capacity and was in line with the strategy to make the company’s portfolio more diversified, Eni chief executive Claudio Descalzi said. Eni has had successful head start in ongoing upstream competitive bids in the UAE, picking up three concessions in Sharjah’s first licensing round in January.

- 4. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 Oman: Tethys Oil's acquistion of an interest in Oman Block 53 Source: Tethys Oil / energy-pedia Tethys Oil has announced that its previously announced agreement to acquire a two percent participating interest in Block 53 onshore Oman from Total E&P Oman, a wholly-owned subsidiary of Total, has been pre-empted by the existing partners and Tethys Oil will as a result not be able to complete the transaction. Block 53 holds the Mukhaizna oil field, the single largest producing oil field in Oman. The Mukhaizna field is a giant heavy-oil development operated by Occidental Petroleum. The field's average gross daily production is in excess of 100,000 bopd. Block 53 is located in central Oman covering an area of 694 km2, south of Tethys Oil's operations in Blocks 3 & 4 and east of Block 49. The block is covered by a 30-year production-sharing agreement signed in 2005. Tethys Oil had agreed to acquire a two percent direct interest in Block 53 from Total for a cash consideration of MUSD 32 with an effective date of 1 January 2018 with customary cash adjustment to be made at closing. Tethys was to have financed the acquisition with cash on hand, which at the end of the third quarter 2018, amounted to MUSD 63.7. 'We are disappointed that we cannot complete this acquisition as Block 53 would have been a valuable complement to our existing asset base. Our long-term commitment to the Sultanate of Oman remains and we will continue to seek new projects and other growth opportunities,' commented Tethys Oil's Managing Director Magnus Nordin. Tethys Oil has entered into an agreement to acquire a two percent participating interest in Block 53 onshore Oman from Total E&P Oman, a wholly-owned subsidiary of Total S.A. ("Total"). Block 53 holds the Mukhaizna oil field, the single largest producing oil field in Oman with a gross production in excess of 100,000 bopd. The acquisition is subject to government approval and the waiver of partner pre-emption rights. "We welcome this opportunity which, if completed, will be a valuable complement to our existing asset base and underscores our long-term commitment to the Sultanate of Oman," comments Tethys Oil's managing director Magnus Nordin. The Mukhaizna field is a giant heavy-oil development in Block 53 onshore Oman operated by Occidental Petroleum. The field's average gross daily production is in excess of 100,000 bopd. Block 53 is located in central Oman covering an area of 694 km2, south of Tethys Oil's operations in Blocks 3&4 and east of Block 49. The block is covered by a 30-year production-sharing agreement signed in 2005.

- 5. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 Saudi Aramco doubles down on South Korea with $1.6 billion bet on Hyundai Oilbank Reuters + NewBase State-owned Saudi Aramco plans to invest up to $1.6 billion for a nearly 20 percent stake in South Korean refiner Hyundai Oilbank, expanding its foothold in one of its biggest Asian buyers of crude oil. Saudi Aramco is already the biggest shareholder in South Korea’s No.3 refiner, S-Oil Corp, with a 63.41 percent stake, and the latest deal should help Aramco boost crude oil sales to Hyundai Oilbank, the South’s smallest refiner by capacity. Saudi Arabia is the top crude oil supplier to South Korea, the world’s fifth-biggest importer. In 2018, South Korea imported 323.17 million barrels of crude from the kingdom, or 885,408 barrels per day (bpd), according to data from Korea National Oil Corp. Saudi Aramco’s chief executive told Reuters in November that it planned to expand its market share in Asia — including China, India, Malaysia and Indonesia — and Africa. Saudi Aramco said it plans to buy a stake of up to 19.9 percent of Hyundai Oilbank from Hyundai Heavy Industries Holdings, which now owns 91.13 percent of Hyundai Oilbank. “Saudi Aramco seems to be boosting investments in downstream projects ahead of an initial public offering,” said Lee Dong-wook, an analyst at Kiwoom Securities. Saudi Energy Minister Khalid al- Falih said in early January that the state oil giant will be listed by 2021. Aramco, the world’s largest crude producer, plans to increase investment in refining and petrochemicals in a bid to cut its reliance on crude as demand for oil slows. Hyundai Oilbank has a total of 650,000 barrels per day of refining capacity in the southwestern city of Daesan and also aims to expand its petrochemical business. In May last year, it announced plans to build a 2.7 trillion won petrochemical plant with South Korea’s Lotte Chemical.

- 6. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 “RECONSIDER” HYUNDAI OILBANK IPO Saudi Aramco plans to value Hyundai Oilbank at 10 trillion won, or 36,000 won per share, Hyundai Heavy Industries Holdings said in a statement. A person familiar with the matter said the company plans to offer a discount of 10 percent to Saudi Aramco in a block deal that will require board approval from both firms. News of the stake sale drove up shares of the parent company by as much 6.6 percent. Hyundai Heavy Industries Holdings also said it planned to “reconsider” the stock market listing of the refinery arm after completing the stake sale, possibly this year. Hyundai Oilbank, which had aimed to list on South Korea’s stock exchange in 2018, delayed the plan until this year due to regulatory scrutiny of its balance sheet. The holding company, which also includes shipbuilder Hyundai Heavy Industries, said it would use the funds from the Oilbank deal to invest in new businesses and improve its financial health. The shipbuilding firm is part of a joint venture with Saudi Aramco and others to build a shipyard on Saudi Arabia’s eastern coast.

- 7. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 Senegal: Doris Engineering awarded advisor contract for developments offshore Senegal … Source: Doris Engineering DORIS Engineering, one of the leaders in providing engineering services to the oil and gas and renewables industries, has been awarded an advisor contract by the Senegalese Ministry of Petroleum and Energies for the development of Oil & Gas projects offshore Senegal. This two-year mission consists in reviewing the optimization and the robustness of the field development performed on these projects to be in line with the Ministry expectations. It focuses on two projects: Grand Tortue Ahmeyim, operated by BP, and the SNE project, operated by Woodside. Grand Tortue Ahmeyim is located at the border between Senegal and Mauritania and lies in ultradeep-water. The facilities under review include the subsea network, the FPSO and the FLNG. The SNE Deepwater Oil Field is located in the Rufisque, Sangomar and Sangomar Deep Blocks, within the Senegalese portion of the Mauritania-Senegal-Guinea Bissau Basin. The subsea network and the FPSO are also part of the review. This project is a great opportunity for DORIS to train Senegalese engineers to the Oil & Gas deep- water developments and to DORIS methods and tools. Nicolas Parsloe, CEO of DORIS Group, said: 'This award is the recognition by the Senegalese Government of DORIS expertise in LNG and Oil & Gas deep water projects. It is also the result of a good communication with GES-Petrogaz and understanding of their requirements. This is in line with the consultancy missions that we have performed alongside NOC’s in West Africa during the last twenty years, and in line with our strategy to work hand-in-hand with NOC’s and regulatory authorities. We are proud to support Senegal in its development in the oil & gas sector.'

- 8. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 NewBase 27 January 2019 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oil falls on increased U.S. rig count, China industrial slowdown Reuters + NewBase Oil prices fell by 1 percent on Monday after U.S. companies added rigs for the first time this year, a signal that crude output may rise further, and China, the world’s second-largest oil user, reported additional signs of an economic slowdown. U.S. crude oil futures were at $53.13 per barrel at 0543 GMT, down 56 cents, or 1 percent, from their last settlement. International Brent crude oil futures were at $61.03 a barrel, down 61 cents, or 1 percent. High U.S. crude oil production, which rose to a record 11.9 million barrels per day (bpd) late last year, has been weighing on oil markets, traders said. In a sign that output could rise further, U.S. energy firms last week raised the number of rigs looking for new oil for the first time in 2019 to 862, an additional 10 rigs, Baker Hughes energy services firm said in its weekly report on Friday. Oil price special coverage

- 9. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 Oil consumption has been increasing steadily, likely averaging above 100 million bpd for the first time ever in 2019, driven largely by a boom in China. However, an economic slowdown amid a trade dispute between Washington and Beijing is weighing on fuel demand-growth expectations. Earnings at China’s industrial firms shrank for a second straight month in December on sluggish factory activity, piling more pressure on the world’s second-largest economy, which reported the slowest pace of growth last year since 1990. “Persistent weakness seen in Chinese economic data has raised downside risks ... of lower crude oil imports by Beijing in 2019,” said Benjamin Lu of Singapore-based brokerage Phillip Futures. China is trying to stem the slowdown with aggressive fiscal stimulus measures. But there are concerns that these measures may not have the desired effect as China’s economy is already laden with massive debt and some of the bigger government spending measures may be of little real use. The increased U.S. supply, the country is now the world’s largest oil producer, and the economic slowdown are weighing on the oil price outlook. “We expect U.S. crude oil prices to range between $50-$60 per barrel in 2019 and about $10 more per barrel for Brent,” Tortoise Capital Advisors said in its 2019 oil market outlook. However, Tortoise added that oil prices would be supported above $50 per barrel as it was “very clear that Saudi Arabia will no longer be willing to accept these lower oil prices”. The Organization of the Petroleum Exporting Countries (OPEC), de-facto led by Saudi Arabia, started supply cuts late last year to tighten markets and buoy prices.

- 10. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 NewBase Special Coverage News Agencies News Release 28 January 2019 There’s No Path to a Fast Recovery in Venezuelan Oil By - Julian Lee The longest a human has held their breath is 24 minutes and 3.45 seconds, according to Guinness World Records. Even if every minute were three months, Venezuela’s oil industry won’t be back on its feet by the time you have to come up for air, no matter how the current political chaos plays out. I’m not going to try to pretend I know how the situation in Venezuela will evolve over the coming days, weeks or months. Almost anything could happen: the quick ouster of President Nicolas Maduro; a protracted period of civil unrest; or the current regime digging in with the support of the military. One thing I am fairly sure of, though, is that the damage inflicted on the country’s oil sector by years of under-investment and mismanagement, compounded by the exodus of large parts of the skilled workforce, will not be quickly, or easily, reversed. And it won’t matter who is in power, or how any transition comes about. If you want a quick comparison of how things might evolve in the Venezuelan oil sector in the coming years, look no further than Libya’s recent past, or Iran’s experience after the Islamic Revolution of 1979. After The Fall More than seven years after their revolutions, oil production in Iran and Libya had still not recovered fully Source: Bloomberg Note: Oil production relative to the average level over the two years prior to revolution

- 11. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 In both cases there was an immediate slump in production to near zero, followed by a brief recovery, then years of a slow grind, with output levels around half what they had been before the revolutions. Seven years after the toppling of the previous regimes, output had still not recovered fully. While there are differences between the situations in each of the three countries, there are similarities too. Iran’s oil industry was heavily politicized by the post-revolution government, with technocrats purged and replaced by political appointees with little, or no, industry experience. In Venezuela that has already happened. President Hugo Chavez purged technocrats who were critical of his socialist revolution. His successor, Maduro, installed Major General Manuel Quevedo, a military man with no industry expertise, to run the state oil company and simultaneously head the country’s oil ministry in 2017. In Libya, competing local militias and a breakdown of government control over large parts of the country have hampered the recovery. Theft, hostage-taking and closure of pipelines and production facilities continue to delay rehabilitation of oil field and transportation infrastructure. Storage tanks have been destroyed and inward investment remains a trickle. While that kind of lawlessness hasn’t yet affected Venezuela, the country’s oil infrastructure is crumbling. Today, its production is roughly a third of what it was when Chavez took power. PDVSA’s overseas refineries have mostly gone and its domestic plants are running at as little as 20 percent of capacity. The joint ventures developing the heavy oil projects in the Orinoco Belt have, for the most part, failed to build the expensive upgraders required to meet ambitious output targets. They instead rely on blending smaller volumes of the tar-like crude they produce with lighter oil — itself occasionally imported from as far away as Algeria — to allow it to flow through pipelines to export terminals on the coast. That investment may pick up under more benign conditions, but even so it will take several years to bear fruit. What Goes Down May Not Come Up Venezuela's oil production has dropped 50 percent in 3 years and capacity is a third of what it was when Hugo Chavez became president Source: Bloomberg

- 12. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 It will take more than just opening some taps to let the oil flow again. Cracked pipes, busted valves and worn gaskets have left a legacy of toxic spills. Much of that infrastructure may need to be replaced before production can increase. Venezuela's Cuts Venezuela contributed more than any other country to OPEC's output cuts introduced in 2017 Source: Bloomberg, OPEC Note: Average 2018 production versus the October 2016 baseline for cuts. Libya and Nigeria were exempt from the agreement. The country’s older oil fields in and around Lake Maracaibo in the west of the country need constant supervision, but the engineers who understand the reservoirs have largely left, taking up jobs in neighboring countries, the U.S. or Canada. A change of government is only the start of what will be needed to bring them flooding back. Giusti, who trained as a petroleum engineer, told me several months ago that he worries that there may also have been irreversible damage to the oil reservoirs in Maracaibo, and that production in western Venezuela may never recover. The collapse in Venezuela’s production over the past two years was a major part of the OPEC+ group’s success in cutting supply. It shouldn’t worry too much about a rapid repound.

- 13. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 Venezuela’s in Crisis. The Oil Market Doesn’t Care The country is still an important source of heavy crude for U.S. refiners. By - David Fickling Once upon a time, the shock waves from a political crisis in Venezuela could reverberate around the world. In 1954, the country accounted for more than half of profits at Standard Oil Co. of New Jersey, the company that would eventually become Exxon Mobil Corp. When former President Hugo Chavez briefly disappeared amid an abortive 2002 coup, West Texas Intermediate oil fell 10 percent in two days on the prospect that a different government might end up pumping more crude. That makes the latest turn in the country’s decline a double blow. Economic collapse is spiraling into political turmoil, with President Donald Trump recognizing opposition leader Juan Guaido as head of state amid street protests Wednesday and President Nicolas Maduro in turn breaking off relations with the U.S., Venezuela’s biggest trading partner. Yet the oil market doesn’t care. WTI and Brent contracts slipped just 62 cents at the close Wednesday, affected far more by pending data on U.S. crude inventories and worries about the slowing global economy. Setting in the West Venezuela once trailed only the U.S. in western hemisphere oil production. How the mighty have fallen Source: BP Statistical Review, Bloomberg Opinion calculations

- 14. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 In one way, that’s hardly surprising. A country that was the world’s biggest oil exporter until Saudi Arabia started to overtake it in the mid-20th century has declined to the point where it’s almost a footnote. Decline and Fall Venezuela's oil output slump in 2018 has left what was once one of the biggest crude exporters barely ahead of North African and European producers Source: Bloomberg, Energy Intelligence Group The collapse of production last year as state-owned Petroleos de Venezuela SA crumbled has left Venezuela behind the likes of Nigeria and Angola, and barely ahead of Libya, Algeria and the U.K. The Permian basin in west Texas, the heart of the U.S. shale oil boom, now produces more than three times as much crude as the South American country, which still on paper has the world’s biggest crude reserves. Patched Up The boom in Texas's oil patch has more than offset the decline of Venezuelan production Source: Bloomberg, Rystad Energy

- 15. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 At the same time, those tempted to ignore Venezuela should take care. The country still accounts for about 7 percent of U.S. crude imports, and its importance to U.S. refiners is, if anything, still greater. All that sweet, light oil coming out of the Permian is great for making gasoline, but the world already has a glut of that. Processors along America’s Gulf Coast instead need more heavy crudes to produce diesel and other middle distillates, which are particularly in demand thanks to changing regulations on shipping emissions. The decline of Venezuelan production and the difficulty of getting product out of Canada’s prairies means they’re running out of options. Maya crude, a Mexican variety that’s the best heavy crude option for American refiners to mix with light domestic product, rose to its biggest premium over WTI in five years in November. He Ain't Heavy The premium for heavy Mexican Maya crude over light WTI has risen to five-year highs as Venezuela's output has fallen Source: Bloomberg, Bloomberg Opinion calculations The days when events in Venezuela could sway the world’s oil market seem far in the past. Still, a crippled giant can still lash out. It’d be best not to be too relaxed about events in Caracas.

- 16. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE The Editor :”Khaled Al Awadi” Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 28 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase January 2019 K. Al Awadi

- 17. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17

- 18. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18