New base 520 special 18 january 2014

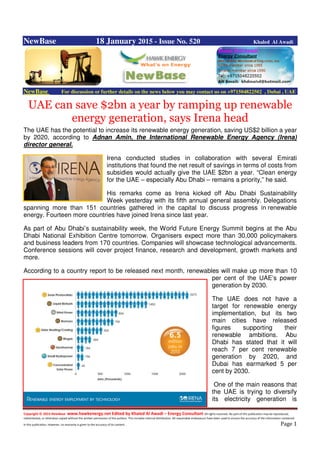

- 1. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 1 NewBase 18 January 2015 - Issue No. 520 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE UAE can save $2bn a year by ramping up renewable energy generation, says Irena head The UAE has the potential to increase its renewable energy generation, saving US$2 billion a year by 2020, according to Adnan Amin, the International Renewable Energy Agency (Irena) director general. Irena conducted studies in collaboration with several Emirati institutions that found the net result of savings in terms of costs from subsidies would actually give the UAE $2bn a year. “Clean energy for the UAE – especially Abu Dhabi – remains a priority,” he said. His remarks come as Irena kicked off Abu Dhabi Sustainability Week yesterday with its fifth annual general assembly. Delegations spanning more than 151 countries gathered in the capital to discuss progress in renewable energy. Fourteen more countries have joined Irena since last year. As part of Abu Dhabi’s sustainability week, the World Future Energy Summit begins at the Abu Dhabi National Exhibition Centre tomorrow. Organisers expect more than 30,000 policymakers and business leaders from 170 countries. Companies will showcase technological advancements. Conference sessions will cover project finance, research and development, growth markets and more. According to a country report to be released next month, renewables will make up more than 10 per cent of the UAE’s power generation by 2030. The UAE does not have a target for renewable energy implementation, but its two main cities have released figures supporting their renewable ambitions. Abu Dhabi has stated that it will reach 7 per cent renewable generation by 2020, and Dubai has earmarked 5 per cent by 2030. One of the main reasons that the UAE is trying to diversify its electricity generation is

- 2. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 2 because the main power feedstock is heavily subsidised, meaning the government pays for part of the total cost so the customer is able to get the product – such as natural gas – at cheaper rates. Mr Amin said that the subsidising of energy consumption in the UAE equals a revenue loss. Suhail Al Mazrouei, the Minister of Energy, said that the government was taking steps to become less dependent on fuel subsidies, but the first part was to increase efficiency rates. “We are working very hard on the management demand side, improving efficiency of plants and distribution,” the minister said at a Gulf Intelligence forum in Abu Dhabi last week. Mr Al Mazrouei added that further measures had been taken such as implementing green building standards and even going into a few residential areas to install energy-efficient products. By diversifying the energy mix, the fuel used to generate power in the UAE could be exported to other countries to make a profit. Oil could be sold, depending on the day, for far more money. If the UAE is taking one barrel of oil for its own purposes at $7, at the current oil prices, the UAE loses out on $43 for each barrel it could have exported to places such as South Korea. Mr Amin said that by using indigenous resources in a cost-effective way for power generation, the country can use its hydrocarbons for higher value products like petrochemicals. “It’s optimising economic use of resources, and it makes sense that the UAE would ramp up investment in clean energy,” he said. The plus side about renewable energy today is that with financial mechanisms evolving for the field, renewable energy prices have become more cost competitive with conventional forms of power generation like natural gas, coal and diesel. And Mr Amin noted that the UAE was one of the most interesting places, particularly after bids for Dubai Electricity and Water Authority’s Mohammed bin Rashid Al Maktoum 100- megawatt solar park. The winning bid came in below 6 US cents, which is below the current price for gas at 9 cents. Mr Amin said that with new gas exploration coming online, the prices could rise up to 13 cents. Although more gas would be generated with these new developments, it will not be cheaper since the UAE has a high amount of sour gas. Sour gas means that a high amount of hydrogen sulfide can be found, which makes the hydrocarbon very expensive to process so that it can be used in various applications. The director general said the costs of renewable energy developments like solar have become equal to gas in many cases. The improvements that the UAE has made, particularly as an oil producer, provide an example for others. “We are very impressed at what Abu Dhabi and Dubai are doing,” said the Irena head. Source: The National + NewBase

- 3. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 3 Oman: OOCEP opens $1.3b AbuButabul gas field processing plant TIMES OF OMAN + NEWBASE Oman Oil Company Exploration and Production (OOCEP) has announced the commercial export of 27 million standard cubic feet per day (MMscfd) of natural gas and 2,500 barrels per day (bpd) of condensates from its newly developed block 60 tight gas field in Abu Butabul, located around 500 kilometres (kms) away from Muscat in the western region of Central Oman. The company has so far invested $1.3 billion for developing the field, a processing plant, and other related pipeline facilities and the total investment in the present phase will reach $2.5 billion once the remaining work is completed OOCEP has announced the official opening of the gas field and a state-of-the-art processing plant on Thursday at a ceremony held at the field under the auspices of His Highness Sayyid Shihab bin Tariq Al Said, advisor to His Majesty Addressing the inaugural function, Salem bin Zahir Al Sibani, chief executive officer of OOCEP, said that natural gas and condensate production would gradually reach 70 MMscfd and 6,000bpd, respectively, by the middle of this year "The investment in the project amounted to $1.3 billion until the end of 2014. Development will continue as per the first plan for the project to reach about $2.5 billion," he added. In fact, the Abu Butabul gas processing plant was commissioned on September 23, 2014, while production and export of gas started in November 2014 "The project was completed in a record time of three years and is considered a global record at this stage," said Al Sibani, adding, "The Sultanate is one of the first countries in the region to extract non-conventional gas from deep reservoirs. Abu Butabul, also known as Block 60, is a 1,500sqkm concession encompassing the wilayats of Ibri and Haima, and is 100 per cent owned and operated by OOCEP – a wholly-owned subsidiary of Oman Oil Company, which is the Oman government's investment arm in the energy sector.

- 4. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 4 The field is situated 50kms west to Mabrouk Field and 85kms from Barik Field. Abu Butabul Field (Block 60) was discovered in 1998 by ABB-01 drilled by Petroleum Development Oman. The concession was acquired by OOCEP in December 2010, after the previous operator relinquished the block The newly built gas processing plant, with a capacity to treat 90 MMscfd of gas, 6,000 bpd of condensates and 2,000 bpd of water, was commissioned on September 23, enabling processing and export of unconventional tight gas into the Government Gas System – for the first time in the country's modern history The successful production of gas from the deep and tight reservoir substantially enhanced gas availability to meet the growing local demand – which is vital for the economic development of the country. Elaborating on the scope of development work in the first phase, Al Sibani said the overall development of the Barik gas reservoir included preparation of geological studies and drilling of hydraulically fractured 80 wells at a depth of 4.5kms, so that the gas can go out of its tight reservoir. Other major facilities include a major plant for treating natural gas and condensates, construction of gathering network for well products with a total length of 122kms, building an integrated storage and export system with the construction of dual pipelines of 90kms to transport natural gas and condensates to Barik "While the condensate is transported to PDO facilities, the gas is exported to the government gas system run by Oman Gas Company. While the concentration is to deliver the Barik project on stream, other opportunities have also been matured utilising the drilled wells into Barik. Miqrat, Haushi (Gharif and Alkhlata) and Khuff at ABB field have been realised as potential projects that can be delivered altogether with Barik to enhance ABB project profitability. OOCEP has also found a number of exploration prospects of which is currently drilling the first exploration well, Bisat structure. The real value of this achievement is the success of establishing local expertise that can compete in this industry and the establishment of lots of procedures, standards and policies that provide foundations for the execution of future projects, added Suleiman Al Zakwani, project director of OOCEP. Block 60 development has been challenging in different aspects. The block is located in a remote area away from any existing infrastructure, majority of the block is covered with sand dunes and the block is located away from the known subsurface salt basins. The reservoirs under development are at 4500 metre depth and they are treated as unconventional tight sandstones. The inaugural function was attended by top-level officials including ministers, undersecretaries and other officials from both government and private sector.

- 5. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 5 Algeria-EU: Studies on sustainable energy launched in 3 provinces APS + Newbase Studies for the development of sustainable energy action plans in three provinces of the country have been launched as part of the European Union programme "Cleaner Energy Saving Mediterranean Cities" (CES-MED), said the European Neighbourhood Info Centre on its website. The three concerned provinces are Batna, Boumerdes and Sidi Bel Abbes, said the source adding that working groups in charge of collecting data have been set up. The scope of intervention and a proposal for methods of data collection as well as the objectives of the annual programme for 2015 in each of the three provinces had been already presented during workshops held recently in Algeria. The CES-MED project is an EU- funded initiative aiming at "providing training and technical assistance to local and national authorities in the southern Mediterranean region, in order to help them respond more actively to sustainable policy challenges," the source said. This initiative "ensures that the actions proposed match with the objectives of the Covenant of Mayors: to reach and even go beyond the European objective to reduce CO2 emissions by 20% thanks to the improvement of energy efficiency and the increase of the use of sustainable energy," the source added. The three workshops on the launch of the Sustainable Energy Action Plan were held last December with the participation of the National Agency for the Promotion and Rationalization of Energy Use (APRUE). Four working groups have been set up to collect data for Batna, two for Boumerdes and three for Sidi Bel Abbes. One of the world's first hybrid solar power plant is located at Hassi R'Mel.

- 6. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 6 US: Judge Puts BP's Top Fine at $13.7 Billion for Gulf Oil Disaster; U.S. Sought $18 Billion Bloomberg . BP Plc (BP/) faces a maximum fine of $13.7 billion after a U.S. judge ruled that the company dumped 3.2 million barrels of oil into the Gulf of Mexico in 2010 -- about 75 percent of what the U.S. calculated. The government’s 4.2 million-barrel estimate of the spill size was rejected yesterday by U.S. District Judge Carl Barbier, decreasing the potential maximum fine from $18 billion. BP estimated the flow at 2.45 million barrels. The maximum possible fine would still be the largest U.S. pollution penalty. Barbier previously found BP’s exploration unit acted with gross negligence in causing the largest offshore oil spill in U.S. history. That decision triggered BP’s exposure to the maximum fines under the Clean Water Act. The ruling on the spill’s size sets the stage for a trial next week in New Orleans at which Barbier will determine the amount of the fines, based on the law’s provision for as much as $4,300 per barrel released and factors such as what BP did to minimize or mitigate the effects of the disaster. BP still faces multiple claims by private parties and state governments. The company reached an estimated $9.7 billion settlement of claims from most private parties who alleged they were harmed by the spill. The company didn’t settle with banks, casinos, local governments and businesses claiming harm from the deep-water drilling moratorium imposed by the government after the spill. Louisiana, Alabama and other Gulf states are also seeking unspecified damages for harm to natural resources.

- 7. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 7 Shares Rise BP rose 4.7 percent to 411.2 pence at 3:29 p.m. in London, valuing the company at 74.9 billion pounds ($113.9 billion). BP’s American depositary receipts rose 5.3 percent to $37.63 at 11:23 a.m. in New York. “Today’s ruling is a major victory for BP and reduces by billions their potential liability,” said David Uhlmann, a law professor at the University of Michigan and former head of the Justice Department’s environmental crimes division. “A fine in excess of $10 billion remains possible but is now less likely,” Uhlmann said yesterday in an e-mail. The London-based oil company has set aside $3.5 billion to cover the pollution fines. It has already spent more than $28 billion in spill response, cleanup and claims. It reached a $4.5 billion settlement of criminal allegations in 2012. The company had taken a $43 billion charge to cover all the costs, according to an Oct. 28 earnings statement. The ultimate cost is “subject to significant uncertainty,” BP said. BP’s Stance The company doesn’t believe it deserves the maximum Clean Water Act fine, Geoff Morrell, a BP spokesman, said in an e-mailed statement. “BP believes that considering all the statutory penalty factors together weighs in favor of a penalty at the lower end of the statutory range,” he said. Barbier isn’t likely to fine BP more than $9.2 billion, Fadel Gheit, an analyst at Oppenheimer & Co., said today in an interview. Gheit bases this estimate on the 67 percent proportion of fault for the incident Barbier assigned to BP. The fine may be as low as $3.5 billion, Gheit said. BP deserves credit for its response to the spill, which should bring down the ultimate fine, Gheit said. “They went beyond what any other company would do,” he said. “I would hope the judge takes this into consideration.” Wyn Hornbuckle, a Justice Department spokesman, said the agency was reviewing the ruling.

- 8. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 8 Anadarko’s Role Anadarko Petroleum Corp., which owned a 25 percent share of the doomed well, will also be a defendant in the penalty phase of the trial. Barbier previously ruled Anadarko wasn’t responsible for the spill and is on the hook for pollution fines as a part owner of the well. The U.S. said last month it was seeking no more than $1 billion from Anadarko, which is based in the Woodlands, Texas. “Today’s ruling regarding the volume does not change the court’s previous findings that we had no direct operational involvement in this event,” John Christiansen, an Anadarko spokesman, said in an e-mail yesterday. BP didn’t extend the spill by lying about its size or misrepresenting the efforts to contain it, Barbier found. “BP was not grossly negligent, reckless, willful or wanton in its source control planning and preparation,” Barbier said. The blowout of the Macondo well off the coast of Louisiana in April 2010 killed 11 people aboard the Deepwater Horizon drilling rig and spewed oil for almost three months into waters that touch the shores of five states. Three Companies The accident sparked thousands of lawsuits against BP, as well as Vernier, Switzerland-based Trans ocean Ltd. (RIG), the owner of the rig that burned and sank, and Houston- based Halliburton Co. (HAL), which provided cementing services for the project. Transocean’s $1 billion settlement with the U.S. in 2013 is the largest civil penalty for Clean Water Act violations, according to the Environmental Protection Agency. Barbier conducted two trial phases in 2013, one on fault and gross negligence, the other on the size of the spill and the efforts to contain it. Lawyers for the U.S. and oil-spill victims contended in the first phase that BP was over budget and behind schedule, prompting it to cut corners and ignore safety tests showing the well was unstable. They alleged that Halliburton’s cement job was defective and that Transocean employees made a series of missteps on the rig, including disabling safety systems and failing to adequately train its crew and maintain the installation. Finger-Pointing During the trial, BP also accused Transocean of failing to maintain the drilling rig and Halliburton of providing defective cementing services. Transocean and Halliburton pointed fingers back at BP. Barbier on Sept. 4 found that BP’s exploration unit was “reckless,” while Transocean and Halliburton were merely negligent. He apportioned fault at 67 percent for BP, 30 percent for Transocean and 3 percent for Halliburton.

- 9. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 9 BP Exploration & Production is “subject to enhanced penalties under the Clean Water Act” because the discharge of oil was the result of its gross negligence and willful misconduct, Barbier held Sept. 4. BP has appealed that decision. In the second phase of the trial, which ended in October 2013, the U.S. government contended BP’s well put 4.2 million barrels of oil into the Gulf before it was capped almost three months later. BP estimated the flow at 2.45 million barrels. Captured Oil Both agreed that their numbers would have been higher if 810,000 barrels hadn’t been captured by a siphoning device at the wellhead. Barbier concluded that 4 million barrels of oil spewed from the well, and he subtracted the amount captured at the wellhead. That left 3.19 million barrels that will be considered in determining the civil penalty, he said. In the penalty phase, Barbier will consider eight criteria in setting the fine, including the seriousness of the violation, the degree of culpability, any history of prior violations, any other penalties for the same incident, and what BP has done to minimize or mitigate the effects of the spill. Barbier also must consider the possible economic impact of any penalty on the company. The U.S. said in court papers last month that it was seeking $16 billion to $18 billion in fines, based on its estimate of the size of the spill. The case is In re Oil Spill by the Oil Rig Deepwater Horizon in the Gulf of Mexico on April 20, 2010, MDL-2179, U.S. District Court, Eastern District of Louisiana (New Orleans).

- 10. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 10 Oil Price Drop Special Coverage The same move yet under two starkly different scenarios Syed Rashid Husain + NewBase Very much into the footsteps of his predecessor, the firebrand, left protagonist late Hugo Chavez, the current Venezuelan President Nicolas Maduro too has been traveling all around, pleading immediate action to support falling oil prices. He has been endeavoring to bring producers to a common ground so as to push the oil prices up and to garner support and financial aid for the faltering Venezuelan economy in the wake of crashing oil markets. The price of Venezuelan oil, which accounts for about 95 percent of its export revenue, fell last week to $42.44 a barrel from a peak of $100.64 on June 27. The largest decline in oil prices since 2008 has brought Venezuela on brink of default, default as foreign currency reserves are ebbing and the economy is contracting. Maduro was hence on a mission - to change all this - to prop the oil prices somehow. And thus in a bid to change the tide, very much in the style of his predecessor, Maduro too undertook a whirlwind tour - far and wide - taking him to China, Iran, Saudi Arabia, Qatar, Algeria and finally Russia. Maduro’s first stop was China, the country’s biggest financial backer. China has already granted Venezuela more than $50 billion in loans since 2007, with about $20 billion of that still being outstanding. And during the visit,China reportedly agreed to invest another $20 billion over the next decade in a variety of energy, social and industrial projects in the country. However, Maduro’s diplomatic push for an OPEC oil output cut seems to have failed to soften the stance of fellow OPEC members - at least for the time being. “There’s a push from Venezuela for a cut, this is what they argued in Vienna and this is what they are lobbying for now. But from what I see there is no sign of cutting production from the Gulf states,” a Gulf OPEC delegate told Reuters. “The only solution is to have the market absorb this surplus and the extent of that will be assessed by OPEC ministers during their meeting in June.” Another delegate added: “You need to give it some time to see the effect on prices. I think the Saudi oil minister was very clear on that.” He had though receptive ears in Tehran, where Iran’s supreme leader Ayatollah Ali Khamenei told

- 11. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 11 the Venezuelan president he backed coordinated action between Tehran and Caracas to reverse a rapid fall in global oil prices. “(Khamenei) endorsed an agreement between the presidents of Iran and Venezuela for a coordinated campaign against the slide in oil prices,” the official IRNA news agency said. Earlier on the day, Iranian President Hassan Rouhani too said that Iran and Venezuela “can undoubtedly cooperate to thwart world powers’ strategies ... and to stabilize prices at a reasonable level in 2015.” During Maduro’s visit to Saudi Arabia, it was agreed that a high-level commission between the two countries would meet every four months to review the (oil) market, a diplomatic source was While in Doha, though concern was expressed by Qatar about (the lowering oil) prices yet, reportedly no promises or commitments as to what action should be taken, were made. However, Maduro was able to garner some support for his struggling economy. Speaking during the trip, Maduro announced securing “several billion dollars” from Qatari banks to help Venezuela muddle through its cash shortfall in the wake of falling oil prices. “We are finalizing a financial alliance with banks from Qatar that will give us sufficient oxygen to help cover the fall in oil prices and give us the resources we need for the national foreign currency budget,” Maduro said following a meeting with Qatari Emir Sheikh Tamim bin Hamad Al Thani. The president added he was working to secure financing “not just for 2015, but also for 2016.” Good news will keep coming,” Maduro later added in a televised interview from Doha. And then via Algeria, where the president emphasized once again on coordinated output cuts, Moscow was the next stopover of President Nicolas Maduro. Slumping oil price was reportedly the main topic of conversation when Venezuelan President Nicolas Maduro met his Russian counterpart Vladimir Putin last Thursday. “Of course, today’s situation with prices and crude oil markets is being discussed one way or another at all levels,” Russian Energy Minister Alexander Novak told Russia’s Tass news agency. This whirlwind tour of President Nicolas Maduro reminds one of a bygone era. Faced with the daunting task of stabilizing volatile crude markets, the late President Chavez also undertook a visit of the region in 2000, heralding a new era in bilateral relations. But it was an altogether different scenario then, one needs to underline. The challenges faced by he markets then were totally different. This correspondent vividly remembers the red carpet rolled out to President Chavez and his entourage when he landed in Riyadh then. An ailing King Fahd on a wheelchair, was himself at the tarmac to receive Chavez. Virtually the entire Saudi leadership including the then Crown Prince and now King Abdullah, were also present to welcome the important visitor. The issue under the radar then too was to seek ways to stabilize the oil markets. “We discussed

- 12. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 12 ways of strengthening bilateral ties, oil market stability and support to OPEC,” President Chavez then said after the meetings with the Saudi leadership. But the two scenarios were starkly different. When Chavez came to office in late 1998, the price of oil was less than $10 a barrel. Production quotas set by OPEC were not being stuck to. Venezuela was regarded as the top quota buster within OPEC. Saudi Arabia and its allies within the OPEC wanted the group members to bring some order into their outputs so as to stabilize the markets. And Chavez was key to it. Once President Chavez was won over, thanks to the tireless efforts of Minister Naimi then, the road to market stability was clear. Today the scenario is strikingly different - and so is the response. The issue of market share is dominating radars at major OPEC oil producers today, Saudi Arabia including. Most believe that in case OPEC decides to cut output, it may not help stabilize the markets. Rather other players would grab the market share relinquished by OPEC. Hence the call of Maduro to restrain OPEC output is not getting the ears, as Chavez once got, in this part of the energy-rich world. Amid US oil crash, cost cutting ripples through industry Reuters + NewBase Any lingering doubt about the depth of the crisis facing the US energy industry is quickly evaporating as even the biggest firms slash spending amid the steepest oil price crash since the recession, sending ripples across the vast sector. In a stark sign of how a sudden, 60% drop in oil prices is biting, oil services giant Schlumberger Ltd on Thursday said it will reduce spending this year by 25% and fire 9,000 workers worldwide, surprising investors with the size of the cuts. As activity slows and drillers idle rigs at the fastest pace in more than 20 years, the magnitude and speed of the changes are surprising firms that provide some of the raw materials and equipment essential to drilling that even two months ago hoped to dodge the ill effects of the slowdown. “There is total chaos and uncertainty and it is impacting the whole ecosystem,” said Aamer Sarfraz, chief executive of United Guar, which provides guar gum used in fracking to major oil service firms, but not Schlumberger. Schlumberger’s announcement lays bare the strain that a supply glut and subsequent dive in

- 13. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 13 prices is putting on the engine room of the US fracking boom: the oil service firms like Schlumberger and rivals Baker Hughes and Halliburton that provide drilling services for thousands of wells across the country. Service firms, desperate to cut costs, asked Sarfraz to lower the price of his company’s guar by 30% as soon as possible in meetings held in recent days. Other suppliers are being met with similar demands, he said, and even existing contracts are being withdrawn. The cost reductions come as little surprise. After five boom years for the oil industry, a pullback is only natural when prices slide. Producers are cutting spending budgets and calling on Schlumberger and others to cut prices. Service firms are simply passing that on to their suppliers of raw materials, including sand and guar. But the speed at which it is happening and the depth of the cuts being asked for is an indication of the desperation in the industry. “There is no negotiation, it is a demand,” said Sarfraz. “It has erased our margins.” Service firms are also asking sand providers to cut prices as oil prices dip. Sand firms say that long term contracts will shield them from oil price swings. Even so, some are reducing prices. Hi-Crush Partners, which produces sand for drilling in various shale plays across the US, has reduced prices by up to 25%, in part by shaving transportation and storage costs, Chief Financial Officer Laura Fulton said. Fulton said that sand demand remains strong. In a presentation earlier this month the company said that it has 6.6mn tonnes of sand contracted in 2015, up from 3.8mn in 2014. Still, for firms reliant on orders from the energy industry alone, it has been a rough ride and may get worse. Oil prices have dropped from nearly $110 a barrel in June to below $50 this month as rocketing production, particularly in the US, outpaces tepid demand. While projects have been postponed or canceled across the globe, the price drop is likely to have a “significantly more dramatic” impact on North America than on the rest of the world, Schlumberger said on Friday, following the release of its earnings a day earlier. The company plans to cut spending this year by a billion to $3bn. Texas-based Galtway Industries, which has 300 employees, normally receives orders six months out from the major service firms like Schlumberger for the forged metal parts used in fracking pressure pumps. But it says business has fallen 30% over the past year. Now, orders are being postponed at the last minute, pushed back while clients decide if they can afford the new materials. “We’ve experienced everything from push-outs in delivery dates to order cancellations,” said Galtway President Trey Smith. “We’re definitely in the fall out phase. It’s going to get ugly.”

- 14. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 14 OPEC To See Market Share Drop Even As Shale Boom Slows Reuters+ NewBase The collapse in oil prices is starting to slow growth in U.S. output, OPEC said on Thursday, although the slowdown will not prevent demand for the exporter group’s oil falling in 2015 to its lowest in a decade. In a monthly report, the Organization of the Petroleum Exporting Countries (OPEC) forecast demand for the group’s oil would drop to 28.78 million barrels per day (bpd) in 2015, down 140,000 bpd from its prior estimate and the lowest since 2004. Oil prices have fallen almost 60 per cent since June, partly because OPEC in November decided against cutting output to retain market share against rival suppliers. The rout has put forecasts for a boom in U.S. output in the spotlight. “The steep drop in global oil prices could endanger the marginal barrel’s output from unconventional sources,” OPEC said in the report, written by its economists at the group’s Vienna headquarters. “As drilling subsides due to high costs and a potentially sustained low oil price, production could be expected to follow, possibly late in 2015.” At OPEC’s meeting, top exporter Saudi Arabia urged fellow members to combat the growth in supply from competing sources including U.S. shale, which needs relatively high prices to be economic and has been eroding OPEC’s market share. In the report, OPEC lowered its forecast of total U.S. oil supply in 2015 by 100,000 bpd to 13.81 million bpd. It still forecasts hefty U.S. supply growth of 950,000 bpd year-on-year. OPEC is not the only oil forecaster to see a slowdown in U.S. supplies. The U.S. government said on Tuesday it expects domestic oil output in 2016 to grow by only 2.2 per cent, the slowest pace in years. Even so, this year’s average demand for OPEC crude is expected to be the lowest since 28.15 million bpd in 2004, using the December reports published on OPEC’s website each year as a comparison. Steepest Oil-Rig Drop Shows Shale Losing Fight to OPEC By Lynn Doan + NewBase U.S. drillers have taken a record number of oil rigs out of service in the past six weeks as OPEC sustains its production, sending prices below $50 a barrel. The oil rig count has fallen by 209 since Dec. 5, the steepest six-week decline since Baker Hughes Inc. (BHI) began tracking the data in July 1987. The count was down 55 this week to 1,366. Horizontal rigsused in U.S. shale formations that account for virtually all of the nation’s oil production growth fell by 48, the biggest single-week drop.

- 15. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 15 Analysts including HSBC Holdings Plc say the decline shows that the Organization of Petroleum Exporting Countries is winning its fight for market share and slowing the growth that’s propelled U.S. production to the highest in at least three decades. OPEC’s decision not to curb its output amid increasing supplies from the U.S. and other countries has driven global oil prices down 58 percent since June. “OPEC’s strategy is working, and it will be obvious in U.S. production by midyear when growth from shale plays will come to a halt,” James Williams, president of energy consulting company WTRG Economics in London, Arkansas, said by telephone Friday. “You can imagine the impact on any industry from a 50 percent impact on sales.” West Texas Intermediate for February delivery rose $2.44 on Friday to settle at $48.69 a barrel on the New YorkMercantile Exchange, up 33 cents for the week, the first gain since November. Brent, the international benchmark, rose $1.90 to end the day at $50.17 on the London-based ICE Futures Europe Exchange, a weekly gain of 6 cents for the front- month contract. Shut-Ins “Prices are being forced toward levels that would force outright shut-ins in high-cost areas, mainly in Canada and the U.S.,” Societe Generale SA (GLE) analysts including Mark Keenan, its head of commodities research for Asia in Singapore, said in a research note Jan. 14. The slump in oil rigs has yet to stop the unprecedented growth in U.S. oil production, which added 60,000 barrels a day in the week ended Jan. 9 to 9.19 million, Energy Information Administration data show. That’s the most in weekly data since at least 1983. Meanwhile, projects are being canceled and budgets cut around the globe. Royal Dutch Shell Plc (RDSA) called off a $6.5 billion project in Qatar. Contract drillers Helmerich & Payne Inc. (HP)and Pioneer Energy Services Corp. (PES) lost U.S. rig contracts. Mexican oil service companies cut more than 10,000 people. Suncor Energy Inc. (SU) fired workers in Canada. Permian Basin The Permian Basin of Texas and New Mexico, the largest U.S. oil field, lost the most rigs this week, declining by 15 to 487, Baker Hughes data show. Rigs in Texas’s Eagle Ford formation dropped 12 to 185, and the Williston Basin, home of North Dakota’s prolific Bakken formation, declined by six to 165. “We are seeing leading indicators of weak prices starting to drive the rebalancing that OPEC is seeking to achieve,” HSBC analysts including Gordon Gray said in a research note Jan. 15. Rigs drilling for natural gas in the U.S. dropped by 19 to 310. Inventories of the heating fuel in the lower 48 states totaled 2.853 trillion cubic feet last week, 11 percent above year-earlier levels.Natural gas for February delivery dropped 3.1 cents to settle at $3.127 per million British thermal units on the Nymex Friday, down 29 percent in the past year.

- 16. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 16 NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Your Guide to Energy events in your area

- 17. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 17 NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile : +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years , he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation , operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally , via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 18 January 2015 K. Al Awadi

- 18. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 18