New base 1185 special 11 july 2018 energy news rev22

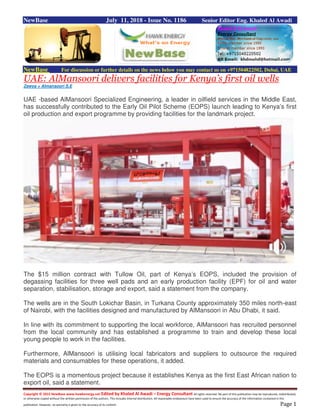

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase July 11, 2018 - Issue No. 1186 Senior Editor Eng. Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE UAE: AlMansoori delivers facilities for Kenya’s first oil wells Zawya + Almansoori S.E UAE -based AlMansoori Specialized Engineering, a leader in oilfield services in the Middle East, has successfully contributed to the Early Oil Pilot Scheme (EOPS) launch leading to Kenya’s first oil production and export programme by providing facilities for the landmark project. The $15 million contract with Tullow Oil, part of Kenya’s EOPS, included the provision of degassing facilities for three well pads and an early production facility (EPF) for oil and water separation, stabilisation, storage and export, said a statement from the company. The wells are in the South Lokichar Basin, in Turkana County approximately 350 miles north-east of Nairobi, with the facilities designed and manufactured by AlMansoori in Abu Dhabi, it said. In line with its commitment to supporting the local workforce, AlMansoori has recruited personnel from the local community and has established a programme to train and develop these local young people to work in the facilities. Furthermore, AlMansoori is utilising local fabricators and suppliers to outsource the required materials and consumables for these operations, it added. The EOPS is a momentous project because it establishes Kenya as the first East African nation to export oil, said a statement.

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 Under the scheme, oil from the wells will be transported by road to refineries in Mombassa in advance of an 821-km pipeline being constructed to allow full production by 2021/2022, it said. The recent launch of the scheme was attended by the President of Kenya Uhuru Kenyatta, who described it as: “A great day for Kenya.” The launch event was also attended by AlMansoori Production Services (MPS) general manager, Ahmed Aboulfotouh; and operations manager Tamer ElZayat. Nabil Alalawi, chief executive officer, AlMansoori, said: “We were honoured to be chosen to support what is a landmark project for Kenya’s emerging oil industry, and for the country as a whole.” “This important scheme has enabled us to demonstrate our capabilities in executing a full project scope, including engineering, procurement, construction and pre-commissioning as well as the operation and maintenance of the facilities. These have all been undertaken successfully despite challenges due to the conditions, location and human resources available,” he said. “Although we have worked in East Africa before, this is our first project in Kenya. Our success in supporting the EOPS represents a springboard for us to market our strong EPF capabilities elsewhere in other countries on the continent,” he added. About Al Mansoori AlMansoori Specialized Engineering is the leading provider of oilfield services in the Middle East. Founded in Abu Dhabi, United Arab Emirates, in 1977, the company has grown to employ a workforce of 2, 075 across 24 countries throughout the world. In 2008, AlMansoori made the strategic decision to create holding companies AlMansoori Petroleum Services (AMPS) and AlMansoori Petroleum Industries (AMPI), which segregated the company’s business units and manufacturing and fabrication unit respectively. Additionally, AlMansoori has developed an integrated project services division to ensure that clients who may use more than one of AlMansoori’s skills experience seamless project management.

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 UAE: ENEC says testing to start on UAE's third nuclear reactor Emirates Nuclear Energy Corporation says it has achieved a series of significant milestones in the construction of Unit 3 of the Barakah Nuclear Energy Plant Emirates Nuclear Energy Corporation (ENEC) said on Tuesday it has achieved a series of significant milestones in the construction of Unit 3 of the Barakah Nuclear Energy Plant in the Al Dhafra region of Abu Dhabi. ENEC said it has successfully completed the concrete pouring, installation of the turbine generator, and the internal components of the reactor vessel, paving the way for the commencement of testing and commissioning. It said construction crews will begin transitioning from Unit 3 to Unit 4, taking with them the lessons learned during their construction of Units 1, 2 and 3. The completion of major construction work on Unit 3 comes about one year after the completion of the similar work on Unit 2, and two years after the completion of the same work on Unit 1, ENEC added. “I am proud of the continued adherence to the highest standards of quality and safety displayed by our teams here in Barakah, which is setting the benchmark for efficiency in nuclear energy plant construction projects around the world,” said Mohamed Al Hammadi, CEO of ENEC. He added that in addition to completing major construction and concrete work, Unit 3 is now fully connected to the Abu Dhabi Transmission & Despatch Company’s (TRANSCO’s) transmission grid. ENEC said the project at Barakah is progressing steadily, with the construction completion of Unit 2 standing at 93 percent, Unit 3 at 83 percent, and Unit 4 at 72 percent, while the overall construction completion is more than 89 percent. The construction of Unit 1 has been completed in accordance with the highest global standards of quality and safety, and it is currently undergoing commissioning and testing, prior to the final regulatory reviews and receipt of the operating licence. All four units will will save up to 21 million tons of carbon emissions each year, equivalent to removing 3.2 million cars from the roads, ENEC added. Last week it was announced that its first nuclear reactor would come online in late 2019 or early 2020. The first of four reactors at the $20 billion Barakah plant had been due to come online last year, but the launch was initially delayed until 2018 to make time for regulatory approvals and complete safety checks.

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 Egypt: Eni announces 2nd light oil discovery in the South West Source: Eni Eni has announced a second light oil discovery on the B1-X exploration prospect located in South West Meleiha licence, in the Egyptian Western Desert, some 130 Km North of the oasis of Siwa. The well is the second one drilled by Eni to explore the deep geological sequences of the Faghur Basin. SWM B1-X has been drilled 7 km away from the first discovery (SWM A2-X), to a total depth of 4,523 meters and encountered 35 meters net of light oil in the Paleozoic sandstones of Dessouky Formation of Carboniferous age and in the Alam El Bueib sandstones of Cretaceous Age. The well has been opened to production in the Dessouky sandstones and delivered 5,130 barrels of oil per day (BOPD) of light oil (37° API) with low associated gas. The discovery on B-1X confirms the high exploration and production potential of deep geological sequences of the Faghur Basin. Eni plans, in the near term, the drilling of other exploratory prospects located nearby the A2-X and B-1X discoveries to consolidate what can result as a new productive area for Eni in Egypt. The production is expected to be routed to already existing infrastructures and then shipped to El Hamra Terminal through existing pipelines, after Development Plan approval by Ministry of Petroleum and Mineral Resources. Eni, through its subsidiary International Egyptian Oil Company (IEOC), holds a 100% stake in South West Meleiha licence. IEOC through its Operating Company Agiba, which is equally held by IEOC and the Egyptian General Petroleum Corporation (EGPC), currently produces 55,000 barrels of oil equivalent per day from the Egyptian Western Desert.

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 Libya Oil Chief Warns Output to Drop Every Day as Ports Halted Bloomberg - Salma El Wardany Libya’s oil output will keep dropping day by day if major ports remain closed after clashes last month led to a political deadlock, the head of the country’s state energy producer said. “Today, production is 527,000 barrels a day, tomorrow it will be lower, and after tomorrow it will be even lower and everyday it will keep falling,” Mustafa Sanalla, chairman of the Tripoli-based National Oil Corp., said in a video statement posted on the company’s Facebook page. The nation was producing more than twice that amount before fighting in February forced an oil field in western Libya to shut down, he said. Sanalla urged Khalifa Haftar, an army commander in the politically divided nation’s east, to transfer control of the closed oil ports to the NOC in Tripoli. Haftar’s forces gave control of the ports to a separate oil authority in the eastern city of Benghazi, after recapturing them from a rival militia. The U.S., U.K., France and Italy expressed concern about this transfer to an entity other than the NOC. The surprise handover led to a halt in shipments from the ports of some 850,000 barrels a day. Libya’s instability in complicating

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 OPEC’s effort to pump more crude as well as United Nations-backed efforts to hold elections this year. ‘Frustrated’ Libyans Haftar’s forces said their army was not receiving payments for protecting oil facilities. Sanalla said in the video statement that crude revenue is sent to the central bank and that the NOC isn’t responsible for how it gets distributed. “I understand Haftar’s feeling,” Sanalla said. “He must be frustrated like most Libyans, but do we express this disappointment by halting exports? I don’t think this is right. We all agree that the situation is not right, that national wealth is not utilized to its best.” While Libya holds Africa’s largest oil reserves, years of conflict among armed groups competing for influence over its energy riches have hobbled production and exports since a 2011 revolt led to the ouster and death of former strongman Moammar Al Qaddafi. The economy’s decay economy has stoked anger in eastern Libya over a perceived misuse of funds and a view that that too much wealth is concentrated in the west. “We hope that the army leadership will hand over the ports to keep oil production going, and any other discussion can be held with the government, the central bank, the house of representatives,” Sanalla said. “If you hand over the ports to us, this will be an act of courage and nobility because no one wins in this battle, we all lose.” Libya was pumping about 1.3 million barrels of crude a day in February before militias closed the western 80,000-barrels-a-day Elephant, or El-Feel, field in February, Sanalla said. Output will continue to decline if the five ports recaptured by Haftar stay closed, he said. Oil facilities in the Gulf of Sirte along the central coast are old and in poor condition, and only four of 13 storage tanks at the port of Ras Lanuf are currently operational, he said. “Let’s keep oil out of politics, especially at these difficult times,” Sanalla said. “We are appealing to everyone’s national spirit, keep oil facilities out of the conflict.”

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 Mozambique: Eni and ExxonMobil but Rovuma LNG Phase 1 D.P Source: Eni Mozambique Rovuma Venture has submitted the development plan to the government for the first phase of the Rovuma LNG project, which will produce, liquefy and market natural gas from the Mamba fields located in the Area 4 block offshore Mozambique. The plan details the proposed design and construction of two liquefied natural gas trains which will each produce 7.6 million tons of LNG per year. • Two liquefied natural gas trains will each produce 7.6 million tons per year • LNG production expected to commence in 2024 • Marketing and financing negotiations underway in parallel with government approval process ExxonMobil will lead construction and operation of natural gas liquefaction and related facilities on behalf of the joint venture, and Eni will lead construction and operation of upstream facilities. As the Rovuma LNG project progresses, every effort will be made to actively build the local workforce and supplier capabilities in Mozambique. 'We are excited to be progressing the Rovuma LNG project, working with the government and leveraging the expertise and capabilities of all of the partners,' said Liam Mallon, president of ExxonMobil Development Company. 'The Rovuma LNG Project is moving forward swiftly,' said Stefano Maione, Eni’s executive vice- president for the Mozambique Program. 'The size of the project makes it not only an important investment in the country, but also supports economic growth and opens new opportunities for Mozambicans.' A final investment decision by the Area 4 joint venture parties is scheduled in 2019, with LNG production expected to commence in 2024. Marketing activities are progressing, with negotiations on sales and purchase agreements underway, targeting completion in parallel with the development plan approval process. Rovuma LNG is operated by Mozambique Rovuma Venture, an incorporated joint venture owned by ExxonMobil, Eni and CNPC, which holds a 70 percent interest in the Area 4 concession alongside its partners Galp, KOGAS and Empresa Nacional de Hidrocarbonetos (ENH), each of which hold a 10 percent interest.

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 U.S. Is Set to Become World's Top Oil Producer, Government Says Bloomberg - Jessica Summers The U.S. government sees oil production further climbing next year even amid transportation logjams in the country’s most prolific shale play. The Energy Information Administration sees U.S. crude output averaging 11.8 million barrels a day in 2019, up from its 11.76 million barrel a day estimate in the June outlook. “In 2019, EIA forecasts that the United States will average nearly 12 million barrels of crude oil production per day,” said Linda Capuano, Administrator of the EIA. “If the forecast holds, that would make the U.S. the world’s leading producer of crude.” U.S. crude output has remained above the 10-million-barrel a day mark since February. That’s while Saudi Arabia told OPEC it pumped about 10.5 million barrels of crude a day last month as the kingdom sought to cap rallying prices by ramping up output, according to people familiar with the matter. Concerns linger over the worsening bottleneck in the biggest U.S. shale region, the Permian Basin, and how that might affect domestic output in the second half of the year. Due to limited pipeline transportation in the region, production may start to slow in the area, according to Scott Sheffield, the chairman of Pioneer Natural Resources Co. “We will reach capacity in the next 3 to 4 months,” he saidin June. The EIA left its average domestic output forecast for this year unchanged at 10.79 million barrels a day, above the 1970 record of 9.6 million a day, according to the agency’s Short-Term Energy Outlook released on Tuesday. Its global crude production forecast for next year was raised to 102.54 million barrels a day from a previous forecast of 102.21 million a day. The agency’s world demand growth estimate for 2019 was lowered.

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 China is a key destination for increasing U.S. energy exports Source: U.S. Energy Information Administration, Petroleum Supply Monthly, Natural Gas Monthly In recent years, as its domestic energy consumption has grown, China has become a more significant destination for U.S. energy exports. In particular, China has been among the largest importers of U.S. exports of crude oil, propane, and liquefied natural gas. In 2017, more U.S. crude oil was sent to China than any other destination except Canada. China received more U.S. crude oil in 2017 than the third- and fourth-largest importers, the United Kingdom and Netherlands, combined. China has been the world’s largest net importer of total petroleum and other liquid fuels since 2013 and surpassed the United States as the world’s largest gross crude oil importer in 2017. Based on data through April, China’s imports of U.S. crude oil have continued to increase, averaging 330 thousand barrels per day (b/d) in 2018. In February 2018, China received more U.S. crude oil than any other destination. Nearly all of these crude oil exports were sent from the U.S. Gulf Coast region. Source: U.S. Energy Information Administration, Petroleum Supply Monthly

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 China was the third-largest destination for U.S. propane exports in 2017, behind only Japan and Mexico. Overall, about half of U.S. propane exports went to Asian countries in 2017, displacing supplies from Middle Eastern countries and some regional production of propane. Propane is used in many Asian countries as a feedstock for producing ethylene and propylene, building blocks for chemical and plastic manufacturing. So far in 2018, China has remained the third-largest destination for U.S. propane exports, receiving 92 thousand barrels per day through April, or 31% less than U.S. propane exports to China in the first four months of 2017. Source: U.S. Energy Information Administration, Natural Gas Monthly As U.S. liquefaction export facilities have come online, the United States has exported greater volumes of liquefied natural gas (LNG), averaging 1.9 billion cubic feet per day in 2017. Of that amount, 15% went to China, making it the third-largest importer of U.S. LNG exports behind Mexico and South Korea. The next-largest importer, Japan, received about half as much U.S. LNG in 2017 as China. In 2017, China surpassed South Korea to become the second-largest importer of LNG in the world. Based on data through April 2018, China’s imports of U.S. LNG have averaged 0.4 billion cubic feet per day, behind only South Korea and Mexico. The next-largest importer of U.S. LNG, India, has received less than half as much U.S. LNG as China so far in 2018. China also receives other petroleum product exports from the United States, such as petroleum coke and normal butane. Although China has large domestic supplies of coal, China also imports some coal from the United States. In 2017, China received 3.2 million short tons of U.S. coal, or 3% of total U.S. coal exports, making it the tenth-largest destination for U.S. coal exports. About 90% of China’s 2017 imports of U.S. coal was metallurgical coal used in the production of steel.

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 NewBase 11 July 2018 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oil falls on trade fears after Trump tariff threat Reuters + Bloomberg + NewBase Oil prices fell on Wednesday after U.S. President Donald Trump threatened to levy new tariffs on China, deepening a trade dispute that could depress global economic growth and reduce energy demand. The specter of tariffs on a further $200 billion of Chinese goods sent commodities lower along with stock markets, as tension between the world’s biggest economies intensified. Benchmark Brent crude LCOc1 was down $1.15 at $77.71 a barrel by 0735 GMT, having fallen as low as $77.60. U.S. light crude CLc1 was down 40 cents at $73.71. “Trade concerns have bitten today,” said Michael McCarthy, chief markets strategist at CMC Markets. “If these tariffs are introduced there will be an impact on global growth and demand.” Oil price special coverage

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 The bearish mood was also fueled by news the United States would consider requests for waivers from sanctions due to snap back into place on Iranian crude exports. Washington will consider requests from some countries to be exempted from sanctions it will put into effect in November to prevent Iran from exporting oil, U.S. Secretary of State Mike Pompeo said. Washington had previously said countries must halt all imports of Iranian oil from Nov. 4 or face U.S. financial measures, with no exemptions. The United States pulled out of a multinational deal in May to lift sanctions against Iran in return for curbs to Tehran’s nuclear program. The prospect of sanctions on oil exports from Iran, the world’s fifth-biggest oil producer, has helped push up oil prices in recent weeks with both crude contracts trading near 3-1/2-year highs. Supply to the U.S. market has also been squeezed by the loss of some Canadian oil production. U.S. crude inventories fell last week by 6.8 million barrels, according to the American Petroleum Institute, an industry group. Analysts polled by Reuters forecast on average that crude stocks fell by 4.5 million barrels, ahead of government data at 10:30 a.m. EDT (1430 GMT) on Wednesday. U.S. crude oil production is expected to average more than 12 million barrels per day late next year for the first time, the U.S. Energy Information Administration said on Tuesday.

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 U.S. Allies Starved of Iran Oil Even Before Trump's Deadline Iranian oil shipments to some U.S. allies are being threatened even before America’s Nov. 4 deadline for buyers to curb imports and comply with renewed sanctions on the OPEC member. September-loading cargoes are set to be the last to head for Japan if the Asian nation doesn’t receive an exemption from the U.S., people with knowledge of the matter said. South Korea, meanwhile, is said to be facing problems with July shipments because of tanker-insurance and chartering issues, with buyers already shunning a form of oil known as condensate from the Arabian Gulf state. A Taiwanese refiner is mulling ending purchases. Source: FGE NOTE: Iranian crude oil imports by country; 'Others' include Syria, Russia; 2018 figures are average of Jan.-June volumes Japan, Iran’s third-biggest customer, imported 140,000 barrels a day of oil from the Middle Eastern nation in the first six months of this year, 32 percent more than for 2015, according to data from industry consultant FGE. South Korea, meanwhile, has cut shipments from Iran by 30 percent in the period to 81,000 barrels a day, while Taiwan has boosted purchases to 11,000 barrels daily this year from zero three years ago. A decision on what to do about imports from Iran by China and India, who together bought about 1.4 million barrels a day of Iranian crude over the past three months, will probably have a larger impact on the broader oil market. China, which is currently embroiled in a trade dispute with the U.S., hasn’t yet made any public announcement on whether it will fold to America’s demands to halt purchases of Iranian crude. India has so far sent mixed signals. While the South Asian country has said it plans to seek exemptions and is also looking at alternate payment mechanisms, the government’s also asked refiners to brace for all eventualities, including zero imports. The Trump administration is putting pressure on nations to entirely stop purchases of Iranian supplies, as it targets the economic lifeline of OPEC’s third-largest producer. At the heart of the problem for buyers is a U.S. threat to cut off access to the American banking system for foreign financial institutions that settle trades with the Middle East nation’s central bank.

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 NewBase Special Coverage News Agencies News Release 12July 2018 Global Markets Are Shaking Off China’s Flashback to 2015 By Luke Kawa It’s going to take more than a dose of yuan weakness and softer metal prices to wreak havoc on global markets this time around. Investors are having flashbacks to 2015-16 amid fears over China’s industrial complex while the nation gets dragged into a trade war. But markets are unlikely to be revisited by the deflationary monster of years past. From a solid U.S. manufacturing trajectory to a resilient credit cycle, here’s why. Oil’s Well That Ends Well For one, crude prices are on a tear compared to three years ago, juicing commodity-linked assets and sending benign signals about the global growth cycle. In 2015, producers reticent to address a supply glut kept crude depressed. Today, the shoe is on the other foot, with stockpile drawdowns and rising prices despite ever-increasing domestic production. Firm oil prices are here to stay, according to Bank of America Corp., which projects the market will remain in structural deficit for most of the next six quarters.

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 In turn, oil’s rise is buoying junk bonds, an asset class dubbed the canary in the coal mine for the U.S. business cycle. The iShares iBoxx High Yield Corporate Bond ETF is in the green this year -- in 2015, it gave back 5 percent. The “chances of a credit cycle playing out are lower today than immediately after the meltdown in energy/commodities/EM and going into Brexit uncertainty in the middle of 2016,” BofA strategists wrote in a note.

- 16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 And the resilience in high-yield credit is broad-based: premiums have tightened across a slew of sectors so far this year, in contrast to spiking spreads in 2015. While global growth may have come off the boil, manufacturing sectors around the world -- particularly the U.S. -- are on a much firmer footing. Monthly purchasing managers’ indexes point to a solid expansion in factory activity, while in early 2016, the global gauge bottomed at 50, implying stagnation.

- 17. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 Meanwhile, the bar for China to export disinflation via currency depreciation has also been raised, according to Neil Dutta, head of U.S. economics at Renaissance Macro Research. “In the second half of 2015, core PCE inflation ran just 1.3 percent annualized,” he said. “It is north of 2 percent on a six month basis now, which implies there is some room to deal with the deflationary consequences of a strengthening in the U.S. dollar.” And investors are sanguine. The low cost of options that pay out should the Consumer Price Index average an annual rise of less than zero over the next two years shows just how different the domestic backdrop is compared to 2015. Stemming the Outflows The Made in China risk shouldn’t be overstated, either. In early 2016, fears over the country’s financial stability took center stage amid accelerating outflows and rampant expectations for continued currency depreciation while corporates scrambled to cover mismatches between their assets and liabilities. That same dynamic has yet to rear its head. “The real capital outflows are manageable as the RMB depreciation expectation remains largely stable,” said Macquarie strategist Teresa Lam in a note. “This should ease the market‘s worry that the weakness of RMB was triggered by significant portfolio outflows.” In addition, investors have reason to downplay tentative signs of a cooling in Chinese growth, chalking it up to seasonal factors and delays on big-ticket purchases ahead of cuts to levies on imported vehicles. The six-month moving average of Bloomberg’s estimate for annual expansion sits at 7 percent in May -- a half a percentage point better than it was ahead of the August 2015 shock devaluation of the yuan.

- 18. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 For a true repeat of 2015, the carnage in Chinese and emerging market equities will need to intensify. Back then, the Shanghai Composite ultimately fell 50 percent from peak to intermediate trough. Roughly five and a half months removed from its recent high, the index is down 21 percent. Likewise, the MSCI Emerging Market Index has suffered a less-punitive drawdown. America First

- 19. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 The U.S. equity resilience is even more striking. The S&P 500 Index is 2.8 percent away from its all-time high, and up almost 5 percent since the dollar began to rise against the yuan in mid-April. In August 2015, the benchmark U.S. stock gauge abruptly fell 10 percent as markets reacted to China’s currency surprise. The earnings trend is helping to fortify investors’ resolve that American companies are better able to withstand exogenous shocks compared with three years ago. Still, in case you need reminding: one potentially massive risk absent in 2015 threatens to shake the firmament of global markets.

- 20. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 27 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels.

- 21. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 21 NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase K. Al Awadi