Saudi hydrocarbon sector investment outlook improves as oil prices impact business

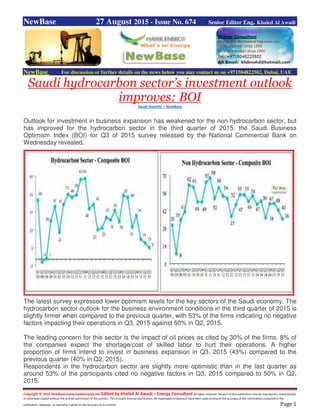

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase 27 August 2015 - Issue No. 674 Senior Editor Eng. Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Saudi hydrocarbon sector’s investment outlook improves: BOI Saudi Gazette + NewBase Outlook for investment in business expansion has weakened for the non-hydrocarbon sector, but has improved for the hydrocarbon sector in the third quarter of 2015, the Saudi Business Optimism Index (BOI) for Q3 of 2015 survey released by the National Commercial Bank on Wednesday revealed. The latest survey expressed lower optimism levels for the key sectors of the Saudi economy. The hydrocarbon sector outlook for the business environment conditions in the third quarter of 2015 is slightly firmer when compared to the previous quarter, with 53% of the firms indicating no negative factors impacting their operations in Q3, 2015 against 50% in Q2, 2015. The leading concern for this sector is the impact of oil prices as cited by 30% of the firms. 8% of the companies expect the shortage/cost of skilled labor to hurt their operations. A higher proportion of firms intend to invest in business expansion in Q3, 2015 (43%) compared to the previous quarter (40% in Q2, 2015). Respondents in the hydrocarbon sector are slightly more optimistic than in the last quarter as around 53% of the participants cited no negative factors in Q3, 2015 compared to 50% in Q2, 2015.

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 The impact of fluctuating oil prices is the topmost concern impacting business operations amongst hydrocarbon sector firms followed by the lack of, and increasing cost of skilled labor (8%). Other hindrances include slow market conditions, low demand for products/services and competition as indicated by 3% of the respondents in each case. In terms of business expansion plans, 43% of the hydrocarbon sector firms will invest in such activities compared to last quarter’s 40%. On the other hand, a higher proportion (50%) is cautious and will not undertake any expansion plans in the current quarter. Oil & gas firms in Saudi Arabia have further moderated their business outlook. The composite BOI has retreated to 9 for Q3, 2015 from 13 in Q2, 2015 and 25 in Q3, 2014. This is the lowest reading for the composite BOI since the third quarter of 2009, with the index for Selling Prices dropping below the 0 mark. 77% of the respondents expect their Selling Prices to remain unchanged, while 13% anticipate a drop and the remaining 10% foresee a rise, resulting in a BOI of negative 3 versus 0 in Q2, 2015 and 13 in Q3, 2014. Consistent with the decline in Selling Prices optimism, the forecast for Profits and hiring has also retreated. The Net Profits index is lower by 2 points q-o-q and 12 points lower y-o-y (23 in Q3, 2015, 25 in Q2, 2015 and 35 in Q3, 2014). The BOI for Number of Employees stands at 20 in Q3, 2015 versus 27 in Q2, 2015 and 40 in Q3, 2014. Meanwhile, the non-hydrocarbon sector’s outlook for Q3, 2015 is at the same level as a year ago (composite BOI of 36), but lower than the optimism level recorded in the previous quarter (composite BOI of 43 in Q2 2015). When compared to Q2, 2015, all five parameters constituting the index have shown moderation in Q3 due to low demand, holiday/festival season, competition, no new projects and political tensions in the region. The BOI for Volume of Sales stands at 42 in Q3, 2015 against 53 in Q2, 2015, while the BOI for New Orders has dipped by 8 points to 47 in Q3, 2015. The index for Selling Prices has shown a marginal decline from 14 in Q2, 2015 to 12 in Q3, 2015. The profitability and hiring outlook is also weaker, with the BOI for Net Profits slipping by 10 points to 39 and that for Number of Employees decreasing by 4 points to 38. The non-hydrocarbon sector participants are positive about the business environment for Q3, 2015; 69% of the respondents compared to last quarter’s 52% have cited no negative factors impacting business operations. Availability/cost of skilled labor (8%) and competition (7%) are the key concerns impacting business operations in Q3, 2015. Sentiments in the non-hydrocarbon sector have moderated as 37% of the participants intend to invest in business expansion plans in Q3, 2015, compared to 49% in the last quarter. Construction and trade & hospitality firms are very optimistic in this regard.

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Commenting on the findings of the survey, Mrs. Sharihan Al-Manzalawi, economist at the National Commercial Bank, said “with the continuation of lower oil prices, the level of optimism for the hydrocarbon and non- hydrocarbon sectors weakened, as the hydrocarbon sector’s composite BOI has retreated to 9 points for Q3, 2015, which is the lowest reading for the composite BOI since 2009. However, the Kingdom of Saudi Arabia has maintained it production of crude above 9 million bpd level, rising from 9.9 million bpd in Q1, 2015 to 10.4 million bpd during Q2, 2015. The outlook for the business environment conditions and investment for the third quarter of 2015 is slightly firmer when compared to the previous quarter, with 53% of the firms in the hydrocarbon sectors indicating no negative factors impacting their operations in Q3, 2015 against 50% in Q2, 2015, with a higher proportion of firms intending to invest in business expansion in Q3, 2015 (43%) compared to the previous quarter (40% in Q2, 2015).” Meanwhile, the impact of the lower oil prices has been rather limited on the non-oil sectors, where the optimism level of non-oil companies is still at the same level recorded the year before, though it came lower than the level recorded in the previous quarter (43 points Q2 versus 36 points for Q3,2015). “With the government drawing down $59 billion from its huge reserves, and recently announcing its intention to issue Saudi Government Development Bond (SGDB) to finance budget deficit, and accordingly maintain economic growth, these policies contributed to lessening the decline in the optimism level of non-hydrocarbon sectors. The non-hydrocarbon sector participants are positive about the business environment for Q3, 2015, as 69% of the respondents compared to last quarter’s 52% have cited no negative factors impacting business operations. But regarding investment in the non-hydrocarbon sector, it has moderated as 37% of the participants intend to invest in business expansion in Q3, 2015, compared to 49% in the last quarter.”

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 Saudi investors may have got what’s needed to hold rating Bloomberg If investors were looking for a sign that Saudi Arabia is doing more than just pumping oil at a record pace to shore up its finances, they may have just got it. The world’s biggest crude exporter is seeking advice on how to cut billions of dollars from next year’s budget because of the slump in crude prices, two people familiar with the matter said on Tuesday. The cost of insuring Saudi bonds against default fell for the first time in six days after the report. “Saudi Arabia is moving in the right direction at this point,” Steven Hess, senior vice president at Moody’s Investors Service, said by phone from New York on Tuesday. “We think that’s positive. We’ll have to see how that pans out over the next year or two.” The kingdom is eating into $664bn of reserves as plunging oil prices and fighting in Yemen threatens to saddle the country with its biggest budget deficit in almost three decades. Brent oil is near a six-year low just as Saudi Arabia starts to tap the domestic bond market for the first time in eight years. Fitch Ratings Ltd cut its credit outlook on the country to negative last week, citing falling oil prices and lack of spending cuts. Saudi credit-default swaps retreated to 100 basis points after the report that the government is studying spending cuts. The measure of how much investors must pay to insure against a Saudi default had doubled over five days to August 24, according to prices compiled by CMA. That compares with an average 43 basis-point gain for government debt in the six-member Gulf Cooperation Council, which includes Saudi Arabia. The Arab world’s largest economy is expected to post a budget deficit of $97bn in 2015, Fitch estimates. Last year, the gap was $17.5bn, according to data compiled by Bloomberg. The country sold at least 35bn riyals ($9.3bn) of bonds on local markets this year, turning to the capital markets for the first time since 2007.

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 Oil prices have dropped 58% in the past year as the 12-country Organisation of Petroleum Exporting Countries exceeded its production target at a time when the US hasn’t cut back. Saudi Arabia will probably keep output close to current levels to support government income, Fitch said in an August 24 report. The country pumped a record 10.48mn bpd in June. Moody’s rates Saudi debt Aa3, the fifth-highest investment grade, and has a stable outlook for the country. It can rely on government reserves and bond sales for a year or two before risking a downgrade, Hess said. That assumes oil prices stay at the current level of about $45 a barrel. Spending cuts could support the credit rating, he said. Fitch on August 21 revised the outlook for the country to negative for the first time, from stable. Jan Friederich, a senior director at the ratings company, said he needed more details on the possible spending cuts to comment if it changes the outlook. “In the situation of a declining oil price, a challenge for the government is can they make a significant effort to address that by cutting expenditures,” Friederich said. “So that’s what we are quite focused on. Are there going to be more substantial reactions in terms of expenditure adjustment over the next year?” The outlook for the Saudi Arabian banking system remains stable, unchanged since September 2009, said Moody’s Investors Service

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Oman Norway’s DNO exits Oman Blocks 30 and 31 Oman Observer Norwegian oil and gas operator DNO International ASA has confirmed that it has pulled out of two oil and gas blocks in the Sultanate. The company said in its second quarter earnings report that it had withdrawn from Block 30 and Block 31 in northwestern part of Oman. With its departure from the two concessions, DNO has seen its portfolio of Omani hydrocarbon assets shrink to two blocks: Block 8 offshore Oman, and Block 36 onshore Oman. DNO’s decision to vacate the two concessions is in line with a period of “consolidation and rationalisation” under way across its international portfolio since the start of the year, it said in a review of the company’s operational performance during Q2 2015.

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 A key priority for the current year, it noted, is to align its spending with earnings. Accordingly, the 2015 capital expenditure programme has been scaled back to $80 million, of which $49 million was already expended in the first half of the year. Besides, reductions in operating costs, including staff levels, have led to annual savings of $50 million from mid-2015, it said. Furthermore, the company is high-grading its overall portfolio by “focusing on core assets while shedding others”, the oil firm stated. Block 31, also known as the Sunainah North Block, was the first to be relinquished by DNO, a process that was formalised last year, it is learnt. Earlier this year, the company withdrew from Block 30, a small concession which is home to the Nadir, Al Sahwa and Hafar gas field, collectively dubbed the ‘NASH Trend’, besides the Hamrat Duru field. Attention will now be focused on DNO’s flagship concession, Block 8, which contains the nation’s only offshore producing fields at Bukha and West Bukha offshore Musandam Governorate. DNO is the operator of the block with a 50 per cent participation interest. The balance is held by LG International Corp. Gross production from the two fields averaged 9,076 barrels of oil equivalent per day (boepd) in Q2 2015, of which the company’s working interest (CWI) production was 4,538 boepd. DNO says it is also weighing plans to drill a new development well to boost oil and gas output from the West Bukha field. DNO’s onshore Block 36, located in the Rub Al Khali basin, is the subject of an early stage exploration programme. DNO has a 75 per cent participating interest in the 18,000 sq km concession, which it acquired in 2013 via a farm-in agreement concluded with the previous operator, Allied Petroleum. It is currently identifying targets for an exploration well planned to be drilled in 2016, it added in its Q2 operational review. Founded in 1971 and listed on the Oslo Stock Exchange, DNO holds stakes in onshore and offshore licenses at various stages of exploration, development and production in the Kurdistan region of Iraq, Yemen, Oman, the United Arab Emirates, Tunisia and Somaliland.

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 Russia plans to supply fuel to Iranian nuclear plant The National - Anthony McAuley Russia’s state nuclear company said it was planning to supply new fuel to Iran’s controversial Bushehr nuclear power plant before the end of the month, moving quickly to keep power supply from the plant flowing. Russia was one of six world powers that reached a deal last month with Iran to lift nuclear-related sanctions in return for an oversight regime that will curb Iran’s nuclear programme over the next decade. Russia has been Iran’s partner in developing its nuclear energy plant at Bushehr, on Iran’s Arabian Gulf coast, having taken over from German firms to complete the protracted project and bring the first reactor online in 2011. TVEL, the nuclear fuel-making unit of Russia’s Rosatom, on Tuesday said that last month’s deal on sanctions cleared the way to reestablish a banking relationship with the Atomic Energy Organisation of Iran, the joint operator of Bushehr with the Russians, thus allowing TVEL to restart nuclear fuel deliveries. “The deal [means] that Iran’s nuclear reactor will be connected to the country’s energy system on time,” said a TVEL spokesman.

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 “Loading of fresh fuel with the presence of international experts during a planned maintenance of the plant is scheduled for September.” TVEL said Russia’s support of Bushehr, the first nuclear plant to go online in the Middle East, “serves as a benchmark for the further development of a peaceful nuclear energy production across the region”. Indeed, Russia has shown that it is keen to play a major role in the development of nuclear power in the region. It has been making diplomatic efforts this month to push this agenda, including during state visits from the leaders of Saudi Arabia, Egypt, and the UAE that included discussions of nuclear energy. Russia has already secured a number of firm deals in the region, as well as initial cooperation agreements. TVEL is, for example, a key supplier for the UAE’s nuclear programme, the most advanced in the region outside Iran. The Russian nuclear fuel company was the largest of six companies to sign a US$3 billion deal with the UAE in 2012, agreeing to supply fuel for 15 years starting last year. This year, Saudi Arabia and Russia signed an agreement to cooperate on the development of nuclear energy. Although the deal covers only various types of information sharing, Russia has expressed a desire to play a part in building up to 16 reactors by 2030 in Saudi Arabia, which shares the UAE’s ambition of meeting growing electricity demand and freeing up hydrocarbon resources for export and industrial use. Russia is keen to sell Saudi Arabia its VVER (water-water energetic reactor) design, which is used at Bushehr. It is already building the Akkuyu plant on Turkey’s Mediterranean coast. The project is expected to start commissioning the first of four planned reactors in 2020. Also, as part of Russia’s active nuclear energy diplomacy this year, the president Vladimir Putin and his Egyptian counterpart, Abdel Fattah El Sisi, signed a deal in February to fulfil the long-held desire of Egypt to build a plant on its Mediterranean coast.

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 First Gas from Kiliwani North Licence in Tanzania Expected This Quarter …Aminex + NewBase Aminex on Wednesday said first gas production from Kiliwani North in Tanzania is expected during current quarter. This is in line with the timetable issued by the Tanzanian authorities following the commencement of production into the new main gas pipeline in the south of the country, the company said. The signing of the Kiliwani North gas sales agreement, expected in the near future, should also assist the acceleration of the company’s other activities, particularly appraisal drilling at Ntorya,” Aminex CEO Jay Bhattacherjee commented. The Kiliwani North-1 gas well, which tested at 40 mmscfd, has been completed and is now ready to produce. Initial gas production will enable the pipeline operator to pressure- test the short spur line between the wellhead and the new gas plant with gas sales expected in third quarter 2015. First commercial gas from Kiliwani North will be delivered into a 36-inch regional pipeline system, the construction and pressure testing of which is now complete, Solo Oil, a joint venture partner in the development program said. Kiliwani North Development Licence are currently are Ndovu Resources Ltd (Aminex) 58.5% (operator), RAK Gas LLC 25%, Solo Oil plc 6.5% and Bounty Oil & Gas NL 10%.

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 India’s coal industry in flux as government sets ambitious coal production targets Source: Energy Statistics 2015, Government of India, Ministry of Statistics and Programme Implementation; Coal consumption in India, particularly in the electric power sector, is outpacing India's domestic production. From 2005 to 2012, India's coal production grew by only 4.7% per year to about 600 million metric tons while the country's coal-fired electric power capacity grew by a much faster rate (about 9.4% per year), reaching 150 gigawatts. To help resolve the shortfall in coal supply and to support expanded coal-fired generation, India has set a coal production target of 1.5 billion metric tons by 2020. Recent shifts in government policies and practices may play a key role in India's ability to meet this coal production goal. Increasing coal production from its national coal producer. Coal India Limited (CIL), the national coal producer responsible for more than 80% of India's current production, initially planned to produce 1 billion metric tons of coal by FY2020, almost double its FY2015 production. Although CIL revised its current expectations downward to about 900 million metric tons, its annual production must still rise faster than the current rate of increase to achieve its new goal. Since 2012, CIL has increased coal production by outsourcing production operations to private and foreign companies in an effort to improve mechanization and mining expertise and by working to adhere to detailed mine plans for achieving its 2020 production target. Encouraging greater private and foreign participation. In August 2014, allegations of impropriety, hoarding of coal resources, lost government revenue, and a lack of transparency led India's Supreme Court to cancel 214 coal licenses allocated to the private and public sector, representing 9% of FY2013's production. The Ministry of Coal quickly reauctioned many of these properties to help minimize the disruption from the cancellation, but the impact of this redistribution of coal properties on production is uncertain.

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 Private mining may be expanded further as a result of the Coal Mines Special Provision Bill passed in March. This law opens the door to commercial coal mining by both private companies and foreign companies having an Indian subsidiary. The government is now evaluating the effect of a coal block auction to allocate properties for commercial development—a significant change for a coal industry that has been nationalized for 40 years. Easing environmental restrictions, permiting processes, and land acquisition. Forest clearances, environmental permits, and land acquisition challenges remain obstacles to the rapid development of India's coal industry. In 2012, the government dropped a forestry policy that had blocked 660 million tons of potential coal production, and drafts of its replacement suggest a forest policy that may be more lenient toward mining. The Ministry of Coal is tracking mine projects in the preproduction stage to monitor the speed of permit processing and environmental clearances, and it may intervene if there are significant delays. If passed, the Land Acquisition Reform Act pending in India's Parliament could make it easier to acquire land for coal mining activity, potentially displacing farmers and landowners in coal-producing regions. Focusing attention on coal transportation expansion. In 2014, 50 million tons of coal were stranded at mines because of rail limitations, including line congestion and a shortage of railcars. Several coal-rail projects have stalled over the past decade, including the 93-kilometer Tori- Shivpur-Kathautia line to connect coal mines in Jharkhand in eastern India. Begun in 1999 and scheduled to be completed in 2005, this project is still only halfway done. Lately, the government is concentrating on three key rail projects that together could facilitate an additional 100 million metric tons of coal production. The earliest of these is the Jharsuguda-Barpali railway link scheduled to be completed in 2017 in Odisha, a key coal-producing state directly south of Jharkhand.

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 UK: UK Oil & Gas Investments announces Schlumberger independent assessment of Horse Hill licence area, onshore UK . Source: UKOG AIM-listed UK Oil & Gas Investments (UKOG) has announced that a mean Oil in Place ('OIP') of 10.993 billion barrels has been independently calculated by Schlumberger to lie within the 55 square miles of the PEDL137 and PEDL246 Horse Hill licences in the Weald Basin, located in the South East of England. UKOG has a net attributable interest of 20.358% in the Licence Area. The tight Jurassic limestones and shales of the Kimmeridge Clay Formation in the Licence Area are calculated to contain a total OIP of 8.262 billion barrels, with the shales of the Oxford Clay and Lias Formations containing an aggregate OIP of 2.731 billion barrels, as shown in Table 1. Table 1: Licence Area mean OIP estimates, millions of barrels ('MMBO) Schlumberger acquired the Horse Hill-1 well ('HH-1') electric logs during the drilling of HH-1. This analysis builds on their previous petrophysical evaluation of HH-1, located in PEDL137 near to London Gatwick Airport, as announced on 5 June 2015. In that previous HH-1 analysis, a total mean OIP, excluding the Upper Portland sandstone oil discovery, of 255 million barrels of oil per square mile was calculated. The current report incorporates the analysis of a further nine wells located within and beyond the Licence Area. It should be noted, as previously reported, that the HH-1 Upper Portland sandstone oil discovery is a geologically separate oil accumulation from, and additional to, the identified underlying Jurassic tight oil plays. As previously stated by the Company, the above estimated OIP hydrocarbon volumes should not be construed as recoverable resources or reserves and also should not be construed in any way to reflect potential producibility of hydrocarbons from the formations evaluated. The Company would expect to report estimated recoverable resources following a successful well flow test, in order to comply with the standards of the Society of Petroleum Engineers' 2007 Petroleum Resources Management System. The Company will integrate the report's findings into the planned flow test of the HH-1 well expected later this year subject to approval by the Environment Agency. This is another key step in the proof of concept process for Jurassic tight oil and the Kimmeridge limestone reservoirs in particular. The Company is now well advanced with additional internal and external technical studies to fully understand the possible implications of the report's key findings upon the hydrocarbon potential of UKOG's other Weald interests.

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 Stephen Sanderson, UKOG's Chairman, commented: 'The independent analysis has further tested and given support to our geological model which predicts that the significant volumes of OIP calculated within the tight Jurassic section of HH-1 extend across the Licence Area. The report is thus a further step towards establishing proof of concept for the Jurassic tight oil play potential of Horse Hill and the Weald Basin.' Future Plans: In parallel with its subsurface and HH-1 flow test studies for the Portland sandstone and underlying tight Jurassic oil zones, the Company has also commissioned related engineering and environmental studies to investigate a conceptual Weald Jurassic field development, with the prime objective that it must respect and preserve the rural beauty and way of life of the area, with minimal environmental impact, while at the same time providing a valuable contribution to the area's economy. This is fundamental to the Company's operating philosophy and policy. UKOG's interest in the Licence Area and Horse Hill: The Licence Area, comprising licences PEDL137 and PEDL246, is located on the northern side of the Weald Basin of South East England near Gatwick Airport. The HH-1 discovery well is located in PEDL137. UKOG owns a 30% direct interest in Horse Hill Developments Ltd ('HHDL') and a 1.32% interest in HHDL via its 6% interest in Angus Energy Limited. HHDL is a special purpose company that owns a 65% participating interest and is the operator of the Licence Area. The remaining 35% participating interest in the Licence Area is held by Magellan Petroleum Corporation.

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 Norway: Faroe Petroleum announces spudding of Portrush exploration well 6407/10-5 in the Norwegian Sea Faroe Petroleum, the independent oil and gas company focusing principally on exploration, appraisal and production opportunities in Norway and the UK, has announced the commencement of the Portrush exploration well 6407/10-5 (Faroe 20%). The Portrush Prospect is located in the Norwegian Sea in licence PL793 and approx. 10 kms south east of the producing Statoil-operated Njord field (Faroe 7.5%) and 20 kms west of the Shell- operated Draugen field. The exploration well will target prospective resources along the Vingleia fault in Upper Jurassic reservoirs, analogous to the reservoirs found in Pil, Bue and Draugen. The exploration licence PL793 was awarded to Faroe in January 2015 as part of the 2014 APA licensing round in a joint venture with Norske Shell (40% and operator), VNG Norge (20%) and Petoro (20%). The Portrush well will be drilled by the Transocean Barents semi-submersible drilling rig. Graham Stewart, CEO of Faroe Petroleum commented: 'I am very pleased to announce the spudding of the Shell operated Portrush exploration well located in proximity to our Pil and Bue discoveries and the Njord and Draugen fields. 'In addition, drilling operations on the Boomerang prospect continue. The Company will announce the results from the Boomerang well when drilling operations are complete, which is expected in September 2015. The Company's exciting 2015 exploration drilling campaign, focuses entirely on this area in the Norwegian Sea, and has the potential to add considerable additional value.' Source: Faroe Petroleum

- 16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 US: EIA expects near-term decline in natural gas production in major shale regions Source: U.S. Energy Information Administration, Natural gas production across all major shale regions in EIA's Drilling Productivity Report (DPR) is projected to decrease for the first time in September. Production from these seven shale regions reached a high in May at 45.6 billion cubic feet per day (Bcf/d) and is expected to decline to 44.9 Bcf/d in September. In each region, production from new wells is not large enough to offset production declines from existing, legacy wells. The DPR provides a month-ahead forecast of natural gas and crude oil production for the seven most significant shale formations in the United States. In order to estimate total natural gas production within a DPR region in a given month, production from both new wells and legacy wells must be taken into account. New-well production is estimated by multiplying estimated rig productivity by the number of rigs operating in the region, lagged by two months. Production from new wells is then compared to the anticipated production declines from legacy wells, which are typically based on well depletion rates, to estimate net production. In any given month, new-well production depends on the number of drilling rigs and the productivity of those rigs and the wells added through their use. As rig counts fall, increases in rig productivity are necessary not only to compensate for the reduced rig total, but also for rising levels of legacy-well declines. Given the substantial drop in rig counts since the fourth quarter of 2014 in each of the DPR regions and growing declines in production from legacy wells, productivity increases are less able to completely offset lower rig counts and legacy-well declines.

- 17. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 The Utica region in eastern Ohio is the only DPR region expected to show production increases in June, July, and August. Production declines from legacy wells in the Utica are estimated to total 55.6 million cubic feet per day (MMcf/d) in September. Partially countering this decline is expected production from new wells of 52.2 MMcf/d in September. New-well natural gas production per rig is estimated to be about 7 MMcf/d, an increase of 47% from September 2014. Seven rigs were drilling in the Utica in July (the most recent data available). Multiplying the seven rigs by the estimated new-well gas production per rig yields the total new-well production estimate for September. Because this value is lower than the decline from legacy wells, total production is expected to fall by 3.4 MMcf/d. A year ago, the higher number of rigs operating in the Utica meant that new-well production more than offset the 26.5 MMcf/d in legacy-well declines, resulting in a net production increase of 116.5 MMcf/d. Since then, falling rig counts and increasing legacy-well declines mean the increase in Utica new-well productivity is insufficient to overcome legacy-well production declines. Several external factors could affect the estimates, such as bad weather, shut-ins based on environmental or economic issues, variations in the quality and frequency of state production data, and infrastructure constraints. These factors are not accounted for in the DPR. For example, on August 1, the Rockies Express Pipeline started to deliver 1.8 Bcf/d of Appalachian natural gas production west on its existing mainline as part of the Zone 3 East-to-West Project. This increase in takeaway capacity may encourage increased production from regions such as the Marcellus and Utica. The DPR provides a very near-term forecast in specific plays based on the most current information. Longer term outlooks that include play-level detail, such as the Annual Energy Outlook, reflect resource and technology assumptions and projected prices and often move in different directions than the DPR, which reflects short-term factors.

- 18. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 NewBase 27 August- 2015 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Brent climbs by over $1 on crude stock draw, U.S. economic data Brent crude climbed by more than $1 a barrel on Thursday on an unexpected fall in U.S. crude inventories and a rally in global equity markets, but a stronger dollar capped gains. Front-month Brent LCOc1, the global oil benchmark, had gained $1.10 to $44.24 a barrel by 0300 GMT (11.00 p.m. EDT), having ended down 7 cents at $43.14 on Wednesday. U.S. crude's front-month contract CLc1 rose 91 cents to $39.51 a barrel, after settling down 71 cents, or 1.8 percent, at $38.60 a barrel. "The local region is ... shrugging off some of the currency impact, instead pricing in the draws on inventory and a better than expected industrial outlook," said Michael McCarthy, chief market strategist at CMC Markets in Australia. U.S. crude inventories USOILC=ECI fell 5.5 million barrels in the week to Aug. 21, the biggest one-week decline since early June, data from the Energy Information Administration showed on Wednesday. That was in line with the industry group the American Petroleum Institute's late- Tuesday report. Analysts had expected an increase of 1 million barrels. But some said the inventory drop may not mark the start of a trend. Oil price special coverage

- 19. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 "This sudden drop in inventories should be the result of drops in US crude imports, suggesting that this week could be an anomaly," said Daniel Ang, an investment analyst at Phillip Futures Pte Ltd said. Wang Tao, a Reuters market analyst for commodities and energy, said Brent crude may approach resistance at $44.64 per barrel again, as its bounce from the Aug. 24 low of $42.23 seemed to be incomplete. In other financial markets, a rebound on Wall Street helped soothe investors' tattered nerves, while the dollar rallied as risk aversion eased. Regaining confidence after a sharp rebound on Wall Street where investors had been hit by worries over China's faltering economy, London copper futures also strengthened on Thursday. Data released on Wednesday showed U.S. non-defense capital goods orders excluding aircraft, which is a proxy for business investment, increased 2.2 percent in July, the biggest rise since June last year and handily beating expectations. "This suggests that business investment has continued to pick up at the beginning of the third quarter following a solid finish to the second quarter," ANZ said in a morning note on Thursday, referring to the U.S. core capital goods order data.

- 20. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20 NewBase Special Coverage NewBase News Release 27 Aug 2015 Qatar tops GCC corporate earnings of $34bn in H1 Gulf Times Gulf Cooperation Council corporate earnings stood at $34bn in the first half of this year (H1), driven mainly by “strong performance” from banks and real estate, Kuwait Financial Centre (Markaz) has said in a report. Among the GCC countries, Qatar had the highest earnings growth in H1 at 13%, Markaz said. However, Markaz said this was a 7.2% drop compared with the same period last year. Aggregate net profits for banks came in at $16.7bn in H1, a rise of 9% over the same period in 2014. Earnings from real estate came in at $3.7bn recording a growth of 44.5% year-on-year (YoY). Robust growth in the earnings of banking sector, which accounts for 49% of earnings, could not prevent overall corporate earnings from declining by 7.2% (YoY) in H1. The telecom sector continued its negative run from 2014, with overall profits declining by 35%.

- 21. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 21 Qatar had the highest earnings growth in H1 at 13%, with the rest of the GCC countries recording a decline. The fall in oil prices, a strengthening US dollar and company-specific issues were responsible for the poor earnings in the first half of 2015. Earnings in Kuwait and Saudi Arabia contracted by 19% and 16%, respectively in the first half on a YoY basis, while UAE, Bahrain and Oman also registered negative earnings growth of 2%, 5% and 7%, respectively. Real estate and banking sectors have been the star performers in the region in H1, registering growth of 44.5% and 9%, respectively. Despite signs of slowing down towards the end of last year, the real estate sector had a great run in the first half of 2015. The commodities sector, which is the second largest in terms of net earnings, was impacted by lower oil prices. The telecom sector, the fourth largest in terms of net earnings was affected by the reduction in ARPUs (average revenue per user), as well as company-specific losses. A real estate boom in major markets such as the UAE (Dubai and Abu Dhabi) and Qatar as well as the introduction of mortgage lending reforms in Saudi Arabia have led to significant earnings growth of the sector. The telecommunications sector’s earnings were affected by strengthening of the dollar (Ooredoo), the earnings restatement of Mobily and its continued dispute with Zain Saudi. Falling ARPU across the region was also a reason behind the fall in telecom earnings. GCC corporate earnings are expected to contract by 0.3% in 2015 compared with last year and reach $69.7bn by the end of the year. Earnings growth in the UAE, Qatar and Bahrain are expected to be robust at 8%, 6.2% and 6%, respectively, for the full year of 2015 as against 2014. Corporate earnings in other GCC countries are also expected to decline, during the same period, with earnings in Saudi declining the most at 7.9%. Corporate earnings in Kuwait and Oman are expected to fall moderately by 1.6% and 0.4% respectively.

- 22. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 22 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 27 August 2015 K. Al Awadi

- 23. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 23 6th – 8th Oct.