The document discusses key aspects of joint ventures including:

1) It defines a joint venture as a strategic alliance between two or more firms to share resources and capabilities.

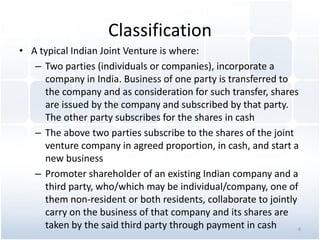

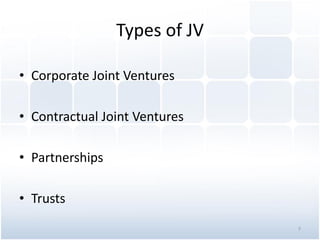

2) It covers classification of joint ventures under Indian law and primary goals such as extending market reach.

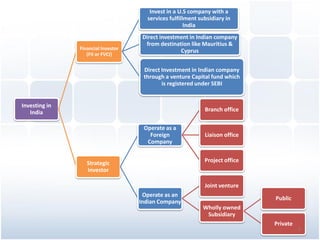

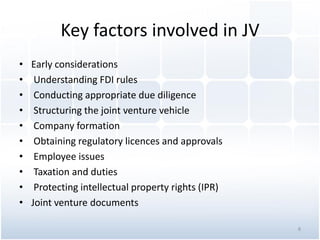

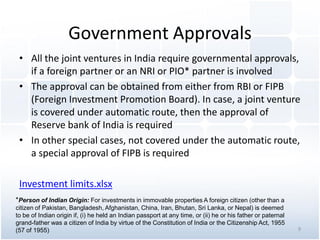

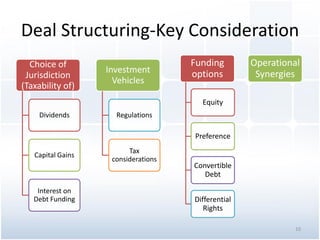

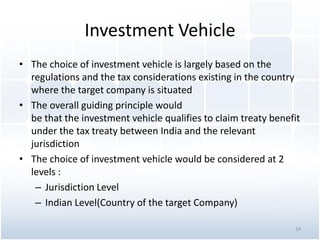

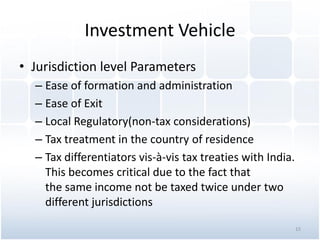

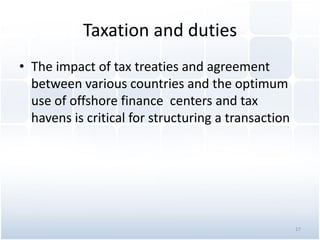

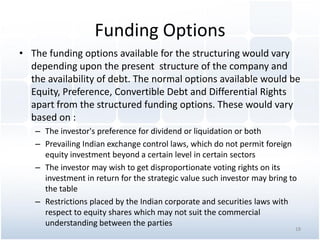

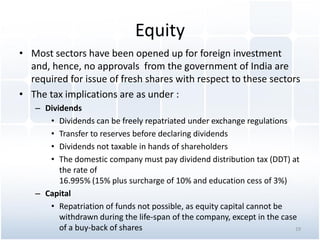

3) Key factors involved in structuring a joint venture deal are discussed such as understanding FDI rules, conducting due diligence, and obtaining necessary regulatory approvals.