Annie Williams Real Estate Report - September 2020

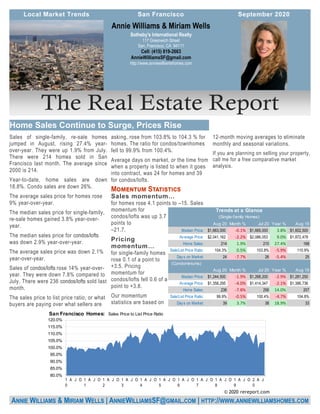

- 1. 12-month moving averages to eliminate monthly and seasonal variations. If you are planning on selling your property, call me for a free comparative market analysis. Sales of single-family, re-sale homes jumped in August, rising 27.4% year- over-year. They were up 1.9% from July. There were 214 homes sold in San Francisco last month. The average since 2000 is 214. Year-to-date, home sales are down 18.8%. Condo sales are down 26%. The average sales price for homes rose 9% year-over-year. The median sales price for single-family, re-sale homes gained 3.8% year-over- year. The median sales price for condos/lofts was down 2.9% year-over-year. The average sales price was down 2.1% year-over-year. Sales of condos/lofts rose 14% year-over- year. They were down 7.8% compared to July. There were 236 condos/lofts sold last month. The sales price to list price ratio, or what buyers are paying over what sellers are asking, rose from 103.8% to 104.3 % for homes. The ratio for condos/townhomes fell to 99.9% from 100.4%. Average days on market, or the time from when a property is listed to when it goes into contract, was 24 for homes and 39 for condos/lofts. for homes rose 4.1 points to –15. Sales momentum for condos/lofts was up 3.7 points to –21.7. for single-family homes rose 0.1 of a point to +3.5. Pricing momentum for condos/lofts fell 0.6 of a point to +3.8. Our momentum statistics are based on Sotheby's International Realty 117 Greenwich Street San, Francisco, CA 94111 Cell: (415) 819-2663 AnnieWilliamsSF@gmail.com http://www.anniewilliamshomes.com Annie Williams & Miriam Wells ANNIE WILLIAMS & MIRIAM WELLS | ANNIEWILLIAMSSF@GMAIL.COM | HTTP://WWW.ANNIEWILLIAMSHOMES.COM Aug 20 Month % Jul 20 Year % Aug 19 Median Price: 1,663,000$ -0.1% 1,665,000$ 3.8% 1,602,500$ Average Price: 2,041,162$ -2.2% 2,086,053$ 9.0% 1,872,478$ Home Sales: 214 1.9% 210 27.4% 168 Sale/List Price Ratio: 104.3% 0.5% 103.8% -5.9% 110.9% Days on Market: 24 -7.7% 26 -5.4% 25 (Condominiums) Aug 20 Month % Jul 20 Year % Aug 19 Median Price: 1,244,500$ -1.9% 1,268,200$ -2.9% 1,281,250$ Average Price: 1,358,295$ -4.0% 1,414,347$ -2.1% 1,386,736$ Home Sales: 236 -7.8% 256 14.0% 207 Sale/List Price Ratio: 99.9% -0.5% 100.4% -4.7% 104.8% Days on Market: 39 3.7% 38 18.9% 33 Trends at a Glance (Single-family Homes) 80.0% 85.0% 90.0% 95.0% 100.0% 105.0% 110.0% 115.0% 120.0% 1 0 A J O 1 1 A J O 1 2 A J O 1 3 A J O 1 4 A J O 1 5 A J O 1 6 A J O 1 7 A J O 1 8 A J O 1 9 A J O 2 0 A J San Francisco Homes: Sales Price to List Price Ratio © 2020 rereport.com

- 2. August 28, 2020 -- After several years reviewing and considering how it shapes monetary policy, the Fed this week formally abandoned a rigid inflation target in favor of an average level of inflation over time. For a long stretch of years, the Fed used an implicit inflation target, and starting in 2012 an explicit inflation target, where it would not allow core Personal Consumption Expenditure (PCE) inflation to surpass the two percent mark. The central bank's change in thinking encompasses two related components. To start, the Fed will no long- er look to start raising interest rates simply because unemployment falls below some arbitrary level. For a long while, it was thought that unemployment below 5% would foster inflation... then 4.5%... then 4%... and the reality is that the Fed simply doesn't know what level might cause inflation, and so will stop preemp- tively raising the federal funds target rate to counter anticipated inflation, as it did back in 2015 through 2018. At the time, unemployment was about 5%; as it continued to decrease, the Fed began to accelerate its pace of rate increases, which slowed economic growth to a crawl by the end of 2018. Even then, the labor market remained very strong, and inflation still re- mained at bay. So, the change in this component of policy essentially puts to bed the Phillips Curve model, and markets will no longer start to expect higher interest rates even if unemployment returns to 50 year lows or more at some point. With this in place, the Fed is less likely to tighten rates even in good economic times, and sup- ports its mandate for "full employment". The other component means a bit more for mortgag- es. The Fed will no longer target a specific inflation rate, but rather an average rate of inflation over some unknown time period. Following periods where infla- tion has run below its preferred 2% level, it will allow inflation to run above 2% for some length of time as a counterbalance. What's not clear yet (and may not be clear) is exactly how much higher inflation might be allowed to run, and for how long, before the Fed would feel compelled to act. For example, would three quar- ters of core PCE at 1.75% be allowed to be countered by three quarters at 2.25%? Alternately, is this tem- pered by the trajectory for inflation, with a quarter at 2.1%, then one at 2.5% a policy-triggering event? The Fed has provided no guidance in this way but may have to at some point, else it may risk a sudden policy adjustment for which the markets are unprepared. Of (Continued on page 4) ANNIE WILLIAMS & MIRIAM WELLS SOTHEBY'S INTERNATIONAL REALTY ANNIEWILLIAMSSF@GMAIL.COM The chart above shows the National month- ly average for 30-year fixed rate mortgages as compiled by http:// 3.0% 4.0% 5.0% 6.0% 01-10 07-10 01-11 07-11 01-12 07-12 01-13 07-13 01-14 07-14 01-15 07-15 01-16 07-16 01-17 07-17 01-18 07-18 01-19 07-19 01-20 07-20 30-Year Fixed Mortgage Rates Unit Median Average Sales DOM SP/LP Median Average Sales Median Average Sales San Francisco $1,663,000 $2,041,162 214 24 104.3% 3.8% 9.0% 27.4% -0.1% -2.2% 1.9% D1: Northwest $2,258,000 $2,367,440 25 16 103.7% 5.0% 0.3% 212.5% -1.8% -0.3% 19.0% D2: Central West $1,526,500 $1,679,178 32 19 110.7% -3.5% 0.5% 0.0% 3.5% 3.9% 14.3% D3: Southwest $1,100,000 $1,184,231 13 26 109.5% -10.6% -14.4% -13.3% -4.8% -2.0% 8.3% D4: Twin Peaks $1,810,000 $2,003,048 21 21 103.1% 11.4% 13.0% 10.5% 7.1% 6.1% -16.0% D5: Central $2,512,500 $2,812,333 30 43 100.8% -1.5% 13.9% 25.0% 4.9% 11.9% -33.3% D6: Central North $2,922,500 $3,117,500 4 27 99.3% 1.7% -3.8% 33.3% 12.4% 16.5% -20.0% D7: North $4,200,000 $5,543,333 9 34 96.6% 15.1% 36.0% 80.0% -1.6% 5.2% -18.2% D8: Northeast $2,300,000 $2,333,333 3 42 104.7% -31.9% -30.9% 50.0% -45.4% -44.6% 50.0% D9: Central East $1,675,000 $1,756,864 33 15 107.0% 4.4% -0.8% 73.7% -2.2% -1.1% 37.5% D10: Southeast $1,243,900 $1,279,591 33 17 112.0% 1.1% 2.5% -15.4% 3.7% 6.9% 6.5% August Sales Statistics (Single-family Homes) Prices Yearly Change Monthly Change 0 50 100 150 200 250 300 350 $300 $800 $1,300 $1,800 $2,300 1 0 A J O 1 1 A J O 1 2 A J O 1 3 A J O 1 4 A J O 1 5 A J O 1 6 A J O 1 7 A J O 1 8 A J O 1 9 A J O 2 0 A J San Francisco Homes: Sold Prices & Unit Sales (3-month moving average — $000's) Ave Med Units © 2020 rereport.com

- 3. ANNIE WILLIAMS & MIRIAM WELLS SOTHEBY'S INTERNATIONAL REALTY ANNIEWILLIAMSSF@GMAIL.COM Unit Median Average Sales DOM SP/LP Median Average Sales Median Average Sales San Francisco $1,244,500 $1,358,295 236 39 99.9% -2.9% -2.1% 14.0% -1.9% -4.0% -7.8% D1: Northwest $1,450,000 $1,356,182 11 33 99.7% 0.0% -9.0% -15.4% 13.7% 2.0% -42.1% D2: Central West $1,480,000 $1,496,250 4 33 100.7% 64.4% 72.5% -20.0% 9.0% 8.7% -33.3% D3: Southwest $1,200,000 $1,191,333 3 34 104.1% -9.5% -1.1% 0.0% 23.4% 22.5% 50.0% D4: Twin Peaks $1,710,000 $1,396,667 3 16 110.5% 53.4% 26.7% -25.0% 153.3% 63.5% -40.0% D5: Central $1,497,500 $1,475,709 50 30 102.0% 3.0% -7.4% 92.3% 1.5% 0.1% 6.4% D6: Central North $1,227,000 $1,478,667 21 23 100.4% -4.5% 10.1% -4.5% 3.5% 22.0% -4.5% D7: North $1,476,250 $1,764,235 34 28 99.6% -19.1% -9.0% 25.9% -13.2% -10.3% 9.7% D8: Northeast $915,000 $966,969 32 49 97.9% -29.6% -38.1% 52.4% -24.8% -35.4% -15.8% D9: Central East $1,162,000 $1,276,593 72 50 98.6% 8.3% 4.6% 7.5% 3.8% -0.2% -11.1% D10: Southeast $737,000 $701,917 6 89 0.0% 0.4% 0.2% 0.0% -24.3% -27.8% 20.0% August Sales Statistics (Condos/TICs/Co-ops/Lofts) Prices Yearly Change Monthly Change 80.0% 85.0% 90.0% 95.0% 100.0% 105.0% 110.0% 115.0% 120.0% 1 0 A J O 1 1 A J O 1 2 A J O 1 3 A J O 1 4 A J O 1 5 A J O 1 6 A J O 1 7 A J O 1 8 A J O 1 9 A J O 2 0 A J San Francisco Homes: Sales Price to List Price Ratio © 2020 rereport.com -50.0 -40.0 -30.0 -20.0 -10.0 0.0 10.0 20.0 30.0 40.0 0 6 A J O 0 7 A J O 0 8 A J O 0 9 A J O 1 0 A J O 1 1 A J O 1 2 A J O 1 3 A J O 1 4 A J O 1 5 A J O 1 6 A J O 1 7 A J O 1 8 A J O 1 9 A J O 2 0 A J San Francisco Condos/Lofts: SalesMomentum Sales Pricing © 2020 rereport.com 0 50 100 150 200 250 300 350 $300 $500 $700 $900 $1,100 $1,300 $1,500 1 0 A J O 1 1 A J O 1 2 A J O 1 3 A J O 1 4 A J O 1 5 A J O 1 6 A J O 1 7 A J O 1 8 A J O 1 9 A J O 2 0 A J San Francisco Condos: Sold Prices & Unit Sales (3-month moving average — $000's) Ave Med Units © 2020 rereport.com

- 4. Annie Williams & Miriam Wells Sotheby's International Realty 117 Greenwich Street San, Francisco, CA 94111 course, this "how long above target" isn't much of a problem today; getting core PCE inflation reliably back up to 2% (let alone beyond) has proven elusive and so this is more of a tomorrow's problem than today's. But it does have implications for mortgage rates, or at least will eventually, when the Fed is no longer involved in the mortgage market directly, buying up MBS and long-dated Treasuries. When investors again drive rates in the marketplace, both current and expected levels of future inflation factor into decisions of what investments will be purchased, and at what required level of return. In this equation, there is a big difference between 1.75% inflation and 2.25% inflation, and if inflation will be tolerated by the Fed at higher levels, the compensation (yield) to the investor must also be higher to achieve an ac- ceptable or desired "real" rate of return. Higher re- quired yields on mortgage bonds ultimately mean higher mortgage rates for consumers. Also of import to mortgage borrowers this week was the FHFA's decision not to implement it's new 0.5% fee on refinancing until December 1, three months later than announced just a couple of weeks ago. Although detailing an expected $6 billion hit for Fan- nie Mae and Freddie due to CARES Act forbearance costs, the FHFA nonetheless bowed to considerable (Continued from page 2) industry and political pressure to hold off. The GSE regulator also took into account the impact on low and moderate-income borrowers hoping to re- finance, and exempted loans below $125,000 from the fee altogether. Last week, we saw that homebuilding continued a strong post-shutdown resurgence, and learned that the nation's homebuilders were ebullient. This week, we learned more about why they are so happy; sales of newly-constructed homes leapt by 13.9% in July to an annual 901,000 pace, besting forecasts by a wide margin and a returning to a sales pace last seen at the end of 2006. The surge in sales drew down supplies of homes available to buy, which declined to 4 months worth of built and ready to sell stock. At 299,000 actual units available, this is the thinnest stockpiles have been since March 2018 and will likely allow for a strong pace of homebuilding to continue, providing a key bit of support for the econ- omy. As well, and although more expensive to start with than existing homes, prices for new homes were actually 2.7% lower in July than June; coupled with lower mortgage rates during the month, afforda- bility of new homes was actually improved a bit, too. Sales of existing homes have also been strong, if tempered by surging prices and a lack of homes available to buy. The National Association of Real- tors advance Pending Home Sales Index climbed another 5.9% in July, and so existing home sales should have some upward strength yet to be seen, if perhaps less so than in recent months, as gains have been 44.3% in May, 15.8% in June and now 5.9% in July, a diminishing pattern of activity as we head into the end of summer. That said, if the per- centage increase for July over June translates di- rectly into sales for August, we could see existing home sales crack the 6 million mark, something that hasn't happened in close to 15 years.