Annie Williams Real Estate Report - August 2021

•

0 likes•112 views

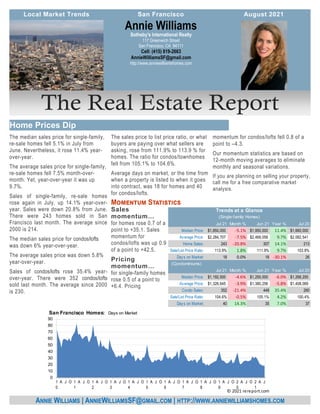

The median sales price for single-family, re-sale homes fell 5.1% in July from June. Nevertheless, it rose 11.4% year-over-year. The average sales price for single-family, re-sale homes fell 7.5% month-overmonth. Yet, year-over-year it was up 9.7%. Sales of single-family, re-sale homes rose again in July, up 14.1% year-over-year. Sales were down 20.8% from June. There were 243 homes sold in San Francisco last month. The average since 2000 is 214.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

What's hot

What's hot (20)

Annie Williams Real Estate Report - September 2020

Annie Williams Real Estate Report - September 2020

Mortgages Easier to Get - July/August Real Estate Report

Mortgages Easier to Get - July/August Real Estate Report

Zillow Sued Over Zestimates - June/July Real Estate Report

Zillow Sued Over Zestimates - June/July Real Estate Report

Home Prices Resume Upward Trend - May/June Real Estate Report

Home Prices Resume Upward Trend - May/June Real Estate Report

Real Estate’s New Normal - April/May Real Estate Report

Real Estate’s New Normal - April/May Real Estate Report

Similar to Annie Williams Real Estate Report - August 2021

Similar to Annie Williams Real Estate Report - August 2021 (17)

Annie Williams Real Estate Report - September 2021

Annie Williams Real Estate Report - September 2021

Annie Williams Real Estate Report-September 2023-9.pdf

Annie Williams Real Estate Report-September 2023-9.pdf

More from Annie Williams

More from Annie Williams (11)

Annie Williams - San Francisco Demographics - Household Expenditures

Annie Williams - San Francisco Demographics - Household Expenditures

Annie Williams - San Francisco Demographics - Commuting

Annie Williams - San Francisco Demographics - Commuting

Annie Williams - San Francisco Demographics - Employment

Annie Williams - San Francisco Demographics - Employment

Annie Williams - San Francisco Demographics - Median Income by Education & Sex

Annie Williams - San Francisco Demographics - Median Income by Education & Sex

Annie Williams - San Francisco Demographics - Education

Annie Williams - San Francisco Demographics - Education

Annie Williams - San Francisco Demographics - Beliefs & Practices

Annie Williams - San Francisco Demographics - Beliefs & Practices

Annie Williams - San Francisco Demographics - Religion or Lack Thereof

Annie Williams - San Francisco Demographics - Religion or Lack Thereof

Recently uploaded

Recently uploaded (20)

Low Rate ✨➥9711108085▻✨Call Girls In East Of Kailash (E.K) (Delhi)

Low Rate ✨➥9711108085▻✨Call Girls In East Of Kailash (E.K) (Delhi)

MEQ Mainstreet Equity Corp Q2 2024 Investor Presentation

MEQ Mainstreet Equity Corp Q2 2024 Investor Presentation

Bptp The Amaario Launch Luxury Project Sector 37D Gurgaon Dwarka Expressway...

Bptp The Amaario Launch Luxury Project Sector 37D Gurgaon Dwarka Expressway...

Call Girls in Maurice Nagar (Delhi) ꧁8447779280꧂ Female Escorts Service in De...

Call Girls in Maurice Nagar (Delhi) ꧁8447779280꧂ Female Escorts Service in De...

Kohinoor Courtyard One Wakad Pune | Elegant Living Spaces

Kohinoor Courtyard One Wakad Pune | Elegant Living Spaces

Low Density Living New Project in BPTP THE AMAARIO Sector 37D Gurgaon Haryana...

Low Density Living New Project in BPTP THE AMAARIO Sector 37D Gurgaon Haryana...

Cheap Rate ✨➥9582086666▻✨Call Girls In Gurgaon Sector 1 (Gurgaon)

Cheap Rate ✨➥9582086666▻✨Call Girls In Gurgaon Sector 1 (Gurgaon)

BPTP THE AMAARIO Luxury Project Invest Like Royalty in Sector 37D Gurgaon Dwa...

BPTP THE AMAARIO Luxury Project Invest Like Royalty in Sector 37D Gurgaon Dwa...

~Call Girls In Roop Nagar {8447779280}(Low Price) Escort Service In Delhi

~Call Girls In Roop Nagar {8447779280}(Low Price) Escort Service In Delhi

BPTP THE AMAARIO For The Royals Of Tomorrow in Sector 37D Gurgaon Dwarka Expr...

BPTP THE AMAARIO For The Royals Of Tomorrow in Sector 37D Gurgaon Dwarka Expr...

Low Rate Call girls in Sant Nagar{Delhi }8447779280} Service Escorts In South...

Low Rate Call girls in Sant Nagar{Delhi }8447779280} Service Escorts In South...

Annie Williams Real Estate Report - August 2021

- 1. momentum for condos/lofts fell 0.8 of a point to –4.3. Our momentum statistics are based on 12-month moving averages to eliminate monthly and seasonal variations. If you are planning on selling your property, call me for a free comparative market analysis. The median sales price for single-family, re-sale homes fell 5.1% in July from June. Nevertheless, it rose 11.4% year- over-year. The average sales price for single-family, re-sale homes fell 7.5% month-over- month. Yet, year-over-year it was up 9.7%. Sales of single-family, re-sale homes rose again in July, up 14.1% year-over- year. Sales were down 20.8% from June. There were 243 homes sold in San Francisco last month. The average since 2000 is 214. The median sales price for condos/lofts was down 6% year-over-year. The average sales price was down 5.8% year-over-year. Sales of condos/lofts rose 35.4% year- over-year. There were 352 condos/lofts sold last month. The average since 2000 is 230. The sales price to list price ratio, or what buyers are paying over what sellers are asking, rose from 111.9% to 113.9 % for homes. The ratio for condos/townhomes fell from 105.1% to 104.6%. Average days on market, or the time from when a property is listed to when it goes into contract, was 18 for homes and 40 for condos/lofts. for homes rose 0.7 of a point to +35.1. Sales momentum for condos/lofts was up 0.9 of a point to +42.5. for single-family homes rose 0.5 of a point to +6.4. Pricing Sotheby's International Realty 117 Greenwich Street San Francisco, CA 94111 Cell: (415) 819-2663 AnnieWilliamsSF@gmail.com http://www.anniewilliamshomes.com Annie Williams ANNIE WILLIAMS | ANNIEWILLIAMSSF@GMAIL.COM | HTTP://WWW.ANNIEWILLIAMSHOMES.COM Jul 21 Month % Jun 21 Year % Jul 20 Median Price: 1,850,000 $ -5.1% 1,950,000 $ 11.4% 1,660,000 $ Average Price: 2,284,707 $ -7.5% 2,469,058 $ 9.7% 2,082,541 $ Home Sales: 243 -20.8% 307 14.1% 213 Sale/List Price Ratio: 113.9% 1.8% 111.9% 9.7% 103.8% Days on Market: 18 0.0% 18 -30.1% 26 (Condominiums) Jul 21 Month % Jun 21 Year % Jul 20 Median Price: 1,192,500 $ -4.6% 1,250,000 $ -6.0% 1,268,200 $ Average Price: 1,326,645 $ -3.9% 1,380,256 $ -5.8% 1,408,069 $ Condo Sales: 352 -21.4% 448 35.4% 260 Sale/List Price Ratio: 104.6% -0.5% 105.1% 4.2% 100.4% Days on Market: 40 14.3% 35 7.0% 37 Trends at a Glance (Single-family Homes) 0 10 20 30 40 50 60 70 80 90 1 0 A J O 1 1 A J O 1 2 A J O 1 3 A J O 1 4 A J O 1 5 A J O 1 6 A J O 1 7 A J O 1 8 A J O 1 9 A J O 2 0 A J O 2 1 A J San Francisco Homes: Days on Market © 2021 rereport.com

- 2. July 30, 2021 -- The Federal Reserve held its mid- summer meeting this week. No policy changes were expected, and none came to surprise the markets. The Fed did note that since December 2020, the economy has "made progress" toward the central bank's goals of full employment and core inflation that averages 2% over time, but at the post-meeting press conference Fed Chair Powell said that there remains "some ground to cover" in regard to reaching these outcomes. The Fed continues to expect that the significant out- break of price pressure will prove transitory, simply stating that "Inflation has risen, largely reflecting tran- sitory factors" in the statement that closed the meet- ing. At the press conference, Mr. Powell could not provide a sense of how long a transition to more benign inflation we might expect, noting that the Fed does "not currently have much confidence in the timing" of when inflationary pressures will subside. The Fed's bond buying programs help to improve liquidity in financial markets, and help to keep long- term interest rates lower than they might otherwise be. MBS purchases by themselves are probably helping mortgage rates to be perhaps an eighth of a percentage point or so lower than they would be absent this direct manipulation. Those lower mort- gage rates have helped to fuel a very strong housing market that has been beset by shortages of home to buy and sharply rising costs. These effects of course don't happen in a vacuum. As we expected at the turn of the year, sales of new homes have settled back to trend after a fairly hot stretch to close 2020. Prices of new homes hit a record high a month ago, and with mortgage rates mostly steady, affordability has taken a bit of a hit. As well, much new construction takes place at distances farther from center cities, where most of the jobs are, and with companies now starting to call folks back from remote outposts and into offices, commuting distances may again be a greater consideration when contemplating a move to a new construction home. In June, sales of new homes declined by 6.6%, fall- ing to a 676,000 annualized rate of sale. May sales were revised down, too, to 724K, and the trend in sales has been generally softer since a December peak. Supplies of homes are not an issue in the new construction market; presently, there are about 6.3 months of supply available, with the 353,000 actual units the highest figure since December 2008. If (Continued on page 4) ANNIE WILLIAMS SOTHEBY'S INTERNATIONAL REALTY ANNIEWILLIAMSSF@GMAIL.COM The chart above shows the National monthly average for 30-year fixed rate mortgages as compiled by http://www.freddiemac.com/. 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 01-10 07-10 01-11 07-11 01-12 07-12 01-13 07-13 01-14 07-14 01-15 07-15 01-16 07-16 01-17 07-17 01-18 07-18 01-19 07-19 01-20 07-20 01-21 07-21 30-Year Fixed Mortgage Rates 0 50 100 150 200 250 300 350 $300 $800 $1,300 $1,800 $2,300 $2,800 1 0 A J O 1 1 A J O 1 2 A J O 1 3 A J O 1 4 A J O 1 5 A J O 1 6 A J O 1 7 A J O 1 8 A J O 1 9 A J O 2 0 A J O 2 1 A J San Francisco Homes: Sold Prices & Unit Sales (3-month moving average — $000's) Ave Med Units © 2021 rereport.com Unit Median Average Sales DOM SP/LP Median Average Sales Median Average Sales San Francisco $1,850,000 $2,284,707 243 18 113.9% 11.4% 9.7% 14.1% -5.1% -7.5% -20.8% D1: Northwest $2,900,000 $2,818,299 13 5 74.3% 56.9% 26.3% -31.6% 28.9% 14.6% -48.0% D2: Central West $1,820,000 $1,957,820 51 11 130.5% 25.5% 21.7% 75.9% -1.0% 1.9% 2.0% D3: Southwest $1,600,000 $1,703,643 14 18 112.3% 36.8% 41.3% 7.7% 13.9% 16.6% -6.7% D4: Twin Peaks $1,912,500 $2,051,079 28 20 116.0% 16.8% 12.0% -3.4% -11.0% -13.3% -42.9% D5: Central $2,901,000 $3,259,669 38 17 109.0% 21.1% 29.7% -15.6% -6.8% -7.0% -17.4% D6: Central North $4,800,000 $4,911,250 4 13 101.5% 84.6% 83.6% -20.0% 115.7% 12.6% -20.0% D7: North $4,000,000 $4,391,333 15 24 102.1% -6.3% -16.7% 36.4% -26.8% -29.1% -31.8% D8: Northeast $2,850,000 $4,383,333 3 55 106.3% -32.3% 4.1% 50.0% n/a n/a n/a D9: Central East $1,795,000 $1,992,250 30 17 118.0% 4.1% 9.4% 20.0% 5.5% 11.5% -9.1% D10: Southeast $1,200,000 $1,172,678 47 26 118.4% 0.0% -2.0% 51.6% -7.8% -7.0% -9.6% July Sales Statistics (Single-family Homes) Prices Yearly Change Monthly Change

- 3. ANNIE WILLIAMS SOTHEBY'S INTERNATIONAL REALTY ANNIEWILLIAMSSF@GMAIL.COM 80.0% 85.0% 90.0% 95.0% 100.0% 105.0% 110.0% 115.0% 120.0% 1 0 A J O 1 1 A J O 1 2 A J O 1 3 A J O 1 4 A J O 1 5 A J O 1 6 A J O 1 7 A J O 1 8 A J O 1 9 A J O 2 0 A J O 2 1 A J San Francisco Homes: Sales Price to List Price Ratio © 2021 rereport.com -30.0 -20.0 -10.0 0.0 10.0 20.0 30.0 40.0 0 6 A J O 0 7 A J O 0 8 A J O 0 9 A J O 1 0 A J O 1 1 A J O 1 2 A J O 1 3 A J O 1 4 A J O 1 5 A J O 1 6 A J O 1 7 A J O 1 8 A J O 1 9 A J O 2 0 A J O 2 1 A J San Francisco Homes: Sales Momentum Sales Pricing © 2021 rereport.com 0 100 200 300 400 500 $300 $500 $700 $900 $1,100 $1,300 $1,500 1 0 A J O 1 1 A J O 1 2 A J O 1 3 A J O 1 4 A J O 1 5 A J O 1 6 A J O 1 7 A J O 1 8 A J O 1 9 A J O 2 0 A J O 2 1 A J San Francisco Condos: Sold Prices & Unit Sales (3-month moving average — $000's) Ave Med Units © 2021 rereport.com Unit Median Average Sales DOM SP/LP Median Average Sales Median Average Sales San Francisco $1,192,500 $1,326,645 352 40 104.6% -6.0% -5.8% 35.4% -4.6% -3.9% -21.4% D1: Northwest $1,322,500 $1,398,500 16 10 118.2% -1.5% -0.4% 14.3% -13.8% -11.8% -20.0% D2: Central West $1,372,500 $1,246,072 7 30 145.7% 1.1% -9.5% 16.7% 9.4% 1.8% 16.7% D3: Southwest $710,000 $710,000 2 19 106.9% -27.0% -27.0% 0.0% -24.1% -33.0% -71.4% D4: Twin Peaks $895,000 $1,045,000 5 24 108.1% 32.6% 22.4% 0.0% 23.4% 3.6% 66.7% D5: Central $1,420,000 $1,427,198 50 21 111.7% -3.7% -3.2% 6.4% -4.7% -1.0% -20.6% D6: Central North $1,274,100 $1,391,650 39 28 109.9% 7.5% 14.8% 77.3% -10.8% -6.0% -31.6% D7: North $1,565,000 $1,745,713 40 25 104.1% -7.9% -11.3% 29.0% 3.1% -0.7% -13.0% D8: Northeast $987,500 $1,090,625 66 48 99.6% -17.5% -26.2% 73.7% -3.7% -18.2% -5.7% D9: Central East $1,092,500 $1,300,878 118 57 100.1% -2.5% 1.7% 45.7% -0.7% 1.7% -28.0% D10: Southeast $915,000 $834,714 7 59 105.3% -6.0% -14.2% 40.0% 20.4% 4.0% -36.4% July Sales Statistics (Condos/TICs/Co-ops/Lofts) Prices Yearly Change Monthly Change

- 4. Annie Williams Sotheby's International Realty 117 Greenwich Street San Francisco, CA 94111 sales don't pick up, it seems likely that home build- ing will start to settle back a bit, although the funda- mentals for housing remain solid. At least prices of new housing stock eased a bit, sliding about 5% from May's record high to $361,800 in June. Re- treating lumber prices probably helped a bit here. Existing home sales have been beset by inventory issues for an extended period of time. There is plenty of demand but supply continues to only come onto the market at a metered pace, keeping sales from rising. In turn, this limited supply has sparked strong in- creases in the costs of existing homes, and with mortgage rates no longer falling to help offset these increases, some buy- ers are no doubt retreating to the side- lines to await more favorable conditions. Reflecting this, the National Association of Realtors Pending Home Sales Index retreated by 1.% in June from May, and this indicator of contracts signed for the purchase of an existing home saw de- clines in 4 of the first 6 months of 2021. With the "spring homebuying season" fading in the rearview mirror, it seems unlikely that a new flare for purchases will (Continued from page 2) come anytime soon, but steady demand should continue for a good while yet. Applications for mortgage credit responded to the recent dip in mortgage rates, rising by 5.7% in the week ending July 23. The Mortgage Bankers Asso- ciation reported that requests for purchase-money mortgages declined by 1.6% -- the trend here pretty soggy for the past month -- but requests for refi- nancing kicked 9.3% higher, a second strong bounce in the last three weeks. Mortgage rates are not only closer to record lows than not, but Fannie Mae and Freddie Mac dropping the "adverse mar- ket refinance fee" starting August 1 helps to pass lower costs to homeowners, too. 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Condos 943 1,426 1,549 1,817 1,905 1,852 1,719 1,564 1,659 1,817 1,703 1,219 2,586 Homes 1,074 1,368 1,389 1,474 1,626 1,323 1,501 1,430 1,250 1,264 1,252 961 1,629 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 Property Sales (Year-to-Date) © 2021 rereport.com