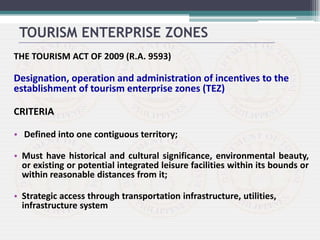

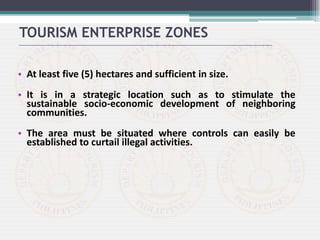

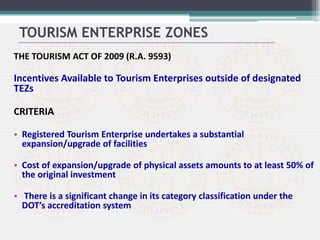

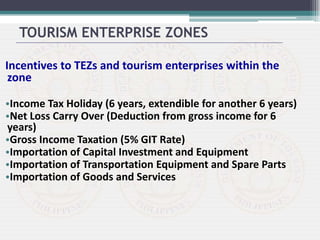

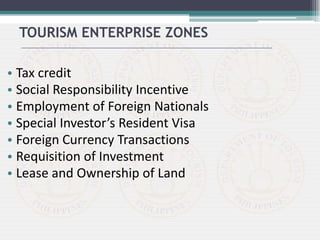

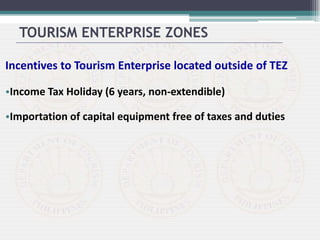

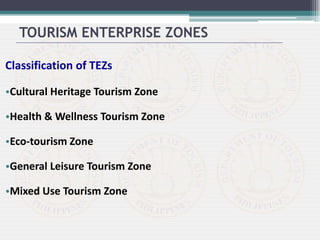

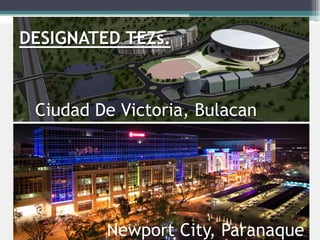

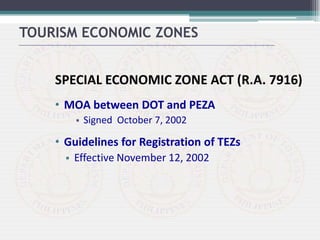

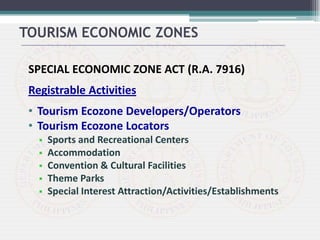

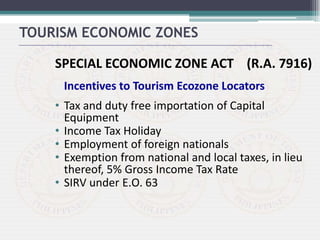

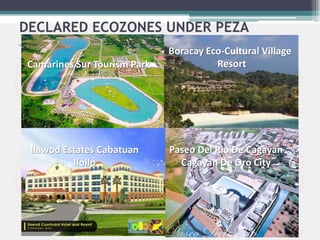

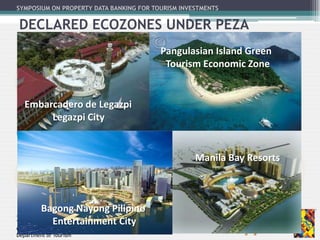

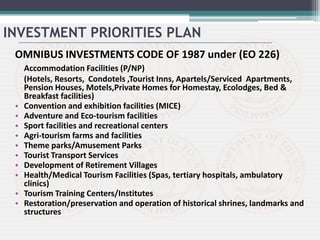

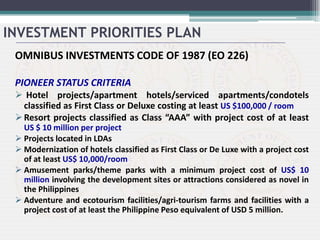

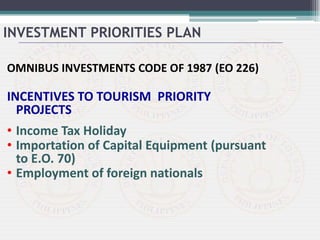

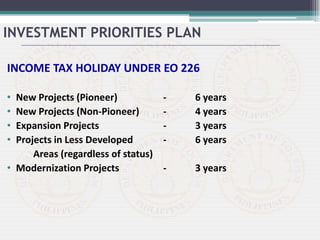

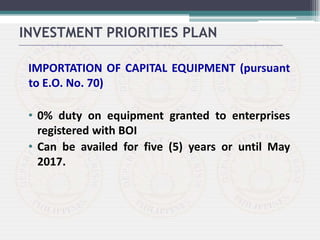

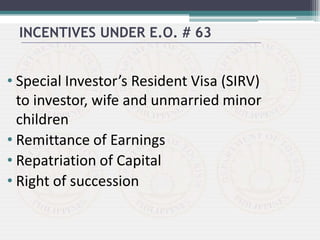

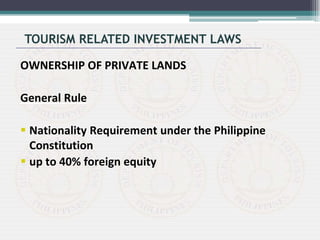

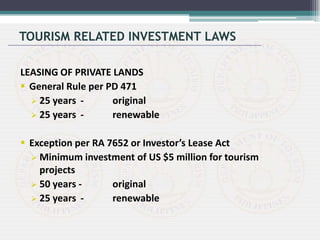

The document discusses various laws related to tourism investment in the Philippines, including the Tourism Act of 2009, Special Economic Zone Act, Omnibus Investment Code, and others. It outlines the criteria and incentives for establishing Tourism Enterprise Zones and Tourism Economic Zones, including income tax holidays and import duty exemptions. Priority tourism investment projects are also identified, such as accommodation facilities, convention centers, eco-tourism, and medical tourism. Overall, the Philippines seeks to attract more tourism investment to sustain its growing industry.