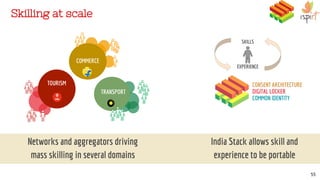

The document outlines the India Stack, a digital infrastructure aimed at enabling paperless, cashless, and presence-less service delivery through technology like Aadhaar, UPI, and e-signatures. It describes innovations in payment systems, identity verification, and digital lockers, emphasizing their potential for improving access to services and facilitating financial inclusion in India. Additionally, it highlights the impact of these technologies on various sectors, including banking, e-commerce, and skill development.