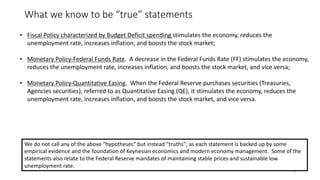

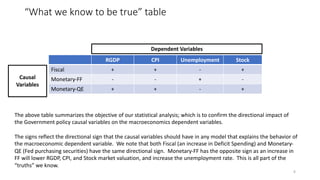

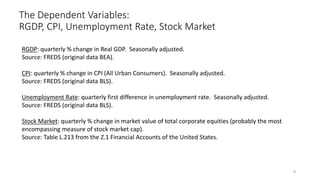

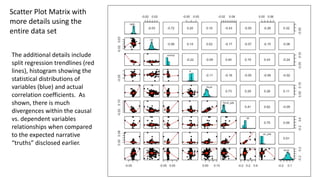

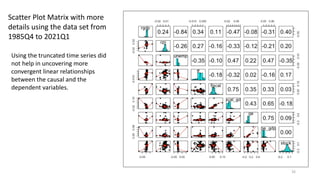

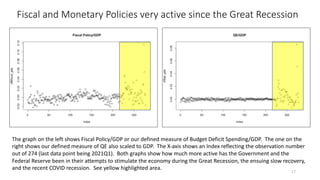

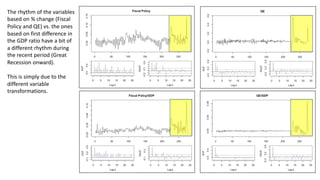

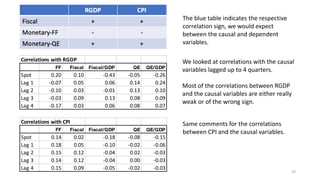

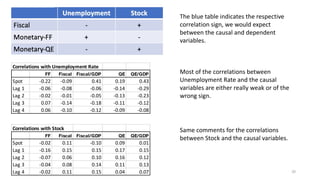

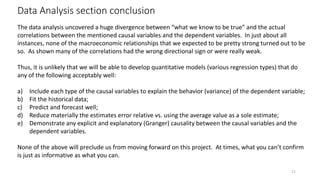

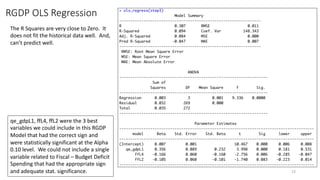

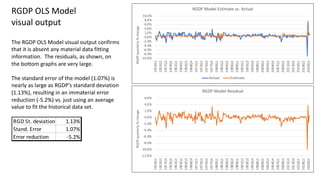

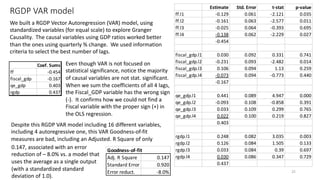

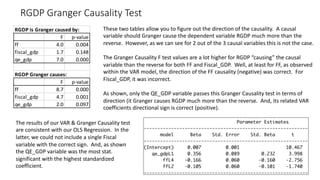

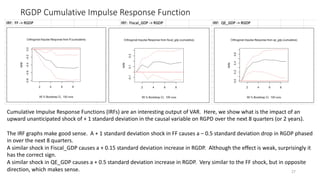

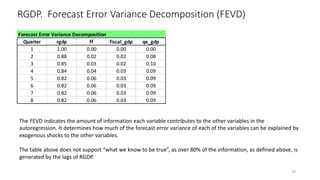

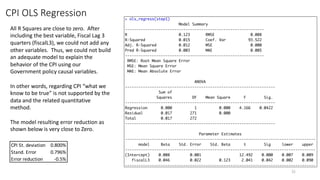

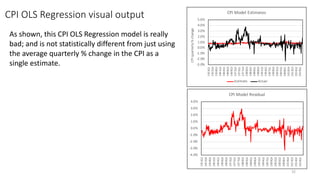

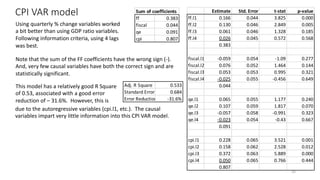

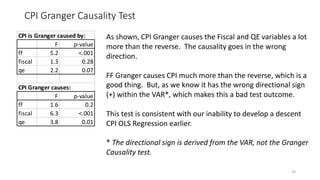

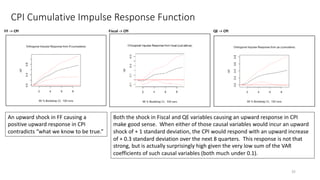

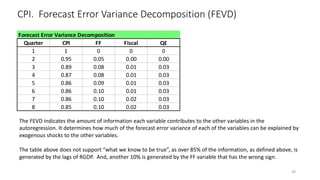

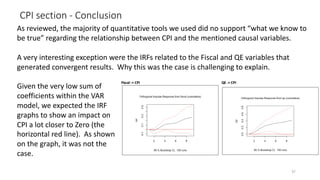

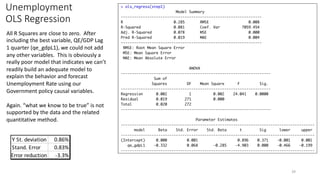

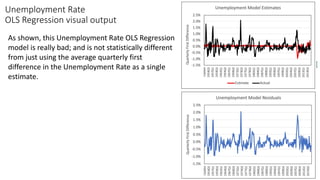

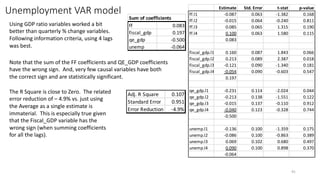

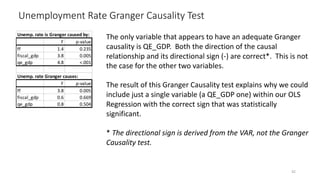

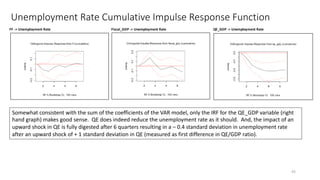

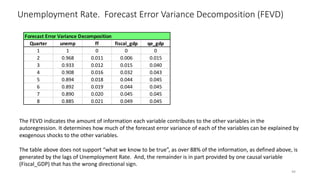

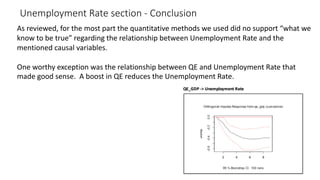

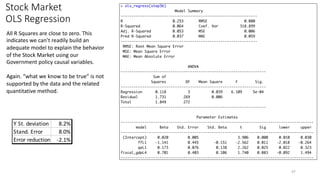

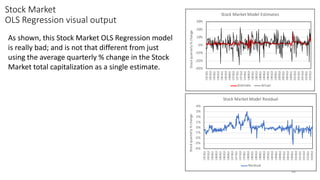

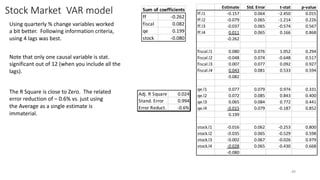

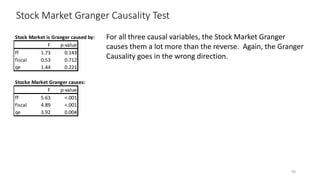

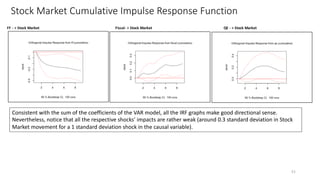

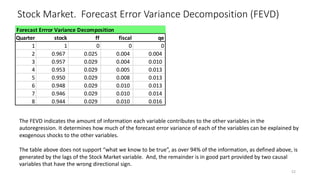

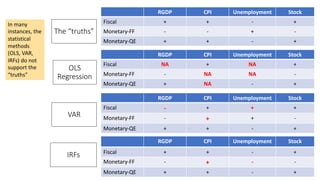

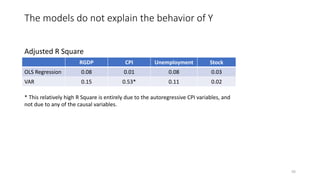

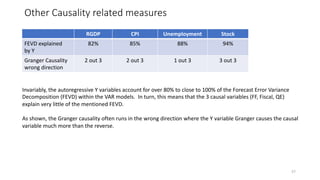

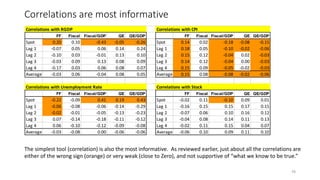

This document presents a statistical analysis examining the impact of fiscal and monetary policies on the economy and stock market, using various macroeconomic variables as dependent measures. It concludes that empirical evidence does not support previously established 'truths' regarding positive correlations between these policies and economic indicators like RGDP, CPI, unemployment, and stock performance. The analysis reveals a divergence between expected and actual relationships, showing many correlations to be weak or of the wrong sign, raising doubts about the effectiveness of traditional quantitative models in accurately predicting economic behavior.