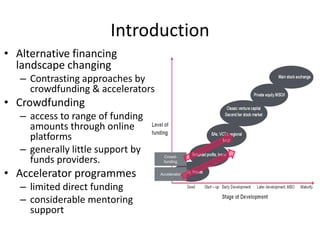

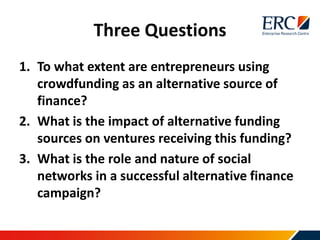

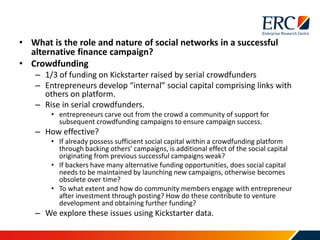

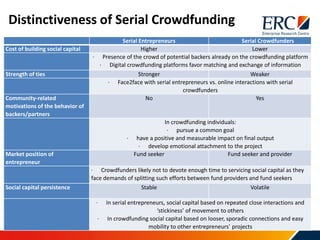

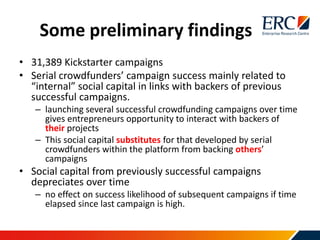

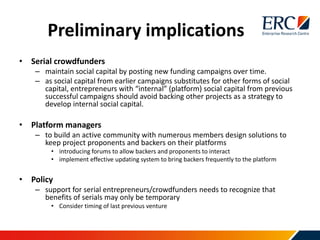

The document discusses alternative financing options for entrepreneurs, specifically crowdfunding and accelerator programs. It poses three questions: 1) the extent entrepreneurs use crowdfunding as financing, 2) the impact of alternative financing on ventures, and 3) the role of social networks in crowdfunding campaigns. For question 1, it will analyze UK SME data and characteristics of crowdfunding users. For question 2, it examines relationships between crowdfunding, outcomes, and other financing. For question 3, it explores the importance of social capital for serial crowdfunders on Kickstarter and the longevity of accelerators using other data sources. Preliminary findings suggest serial crowdfunders' success relies on maintaining social capital