This document defines and provides examples of different types of cheques:

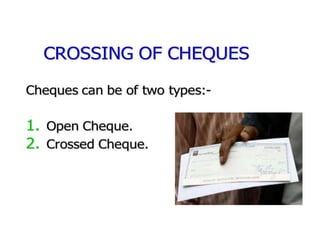

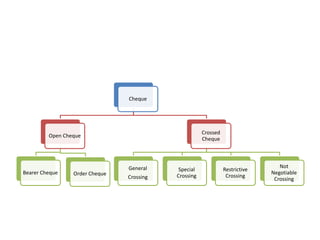

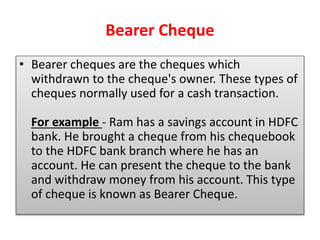

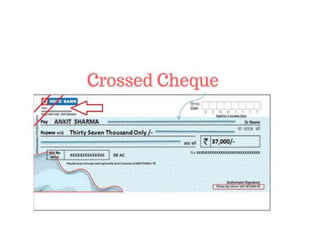

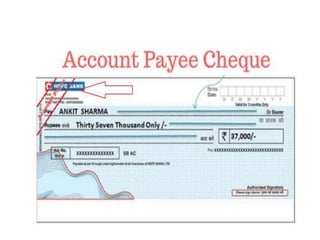

1. Bearer cheques can be cashed by anyone holding the cheque, while order cheques must be deposited into the payee's account. Crossed cheques and account payee cheques can only be deposited, not cashed.

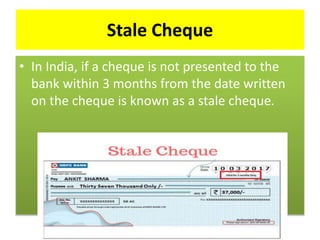

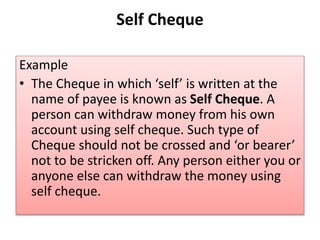

2. A stale cheque is one that is over 3 months old. An ante-dated cheque has a date written prior to the current date. A self cheque can be cashed or deposited by the account holder.

3. Blank cheques and travelers cheques provide additional forms of payment, while gift cheques are decorative cheques given as presents.