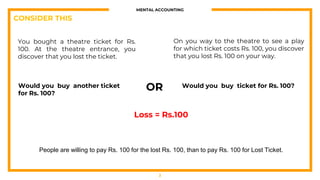

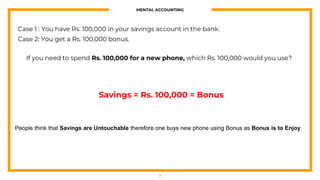

Mental accounting refers to how people separate and evaluate their money mentally based on subjective factors like the source of funds, intended use, and whether gains or losses are being realized. People do not always treat money as fungible or interchangeable due to mental accounting biases. For example, people are more willing to spend windfall gains like bonuses on unnecessary purchases rather than important expenses. They also take more risks with investment accounts than savings earmarked for emergencies. To avoid suboptimal financial decisions due to mental accounting biases, people should treat all funds interchangeably, have a coherent investment strategy, and avoid overspending leftover budgets.