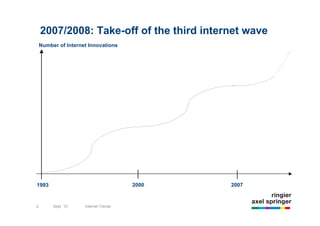

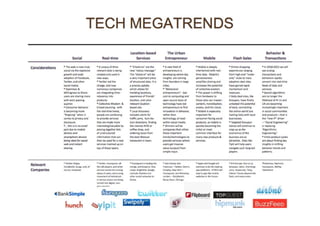

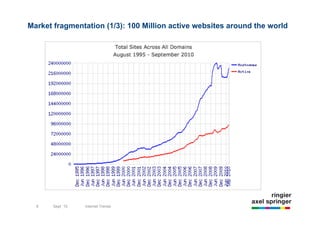

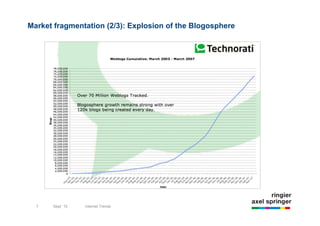

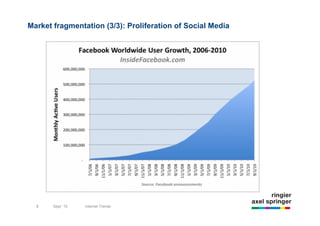

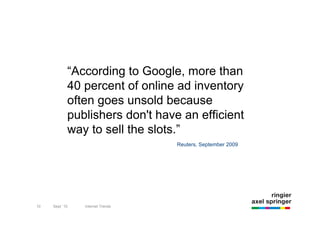

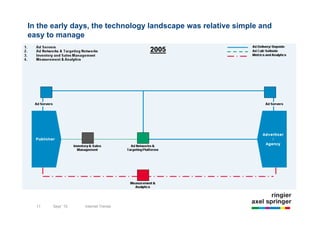

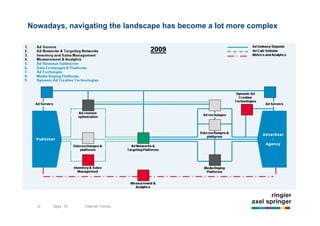

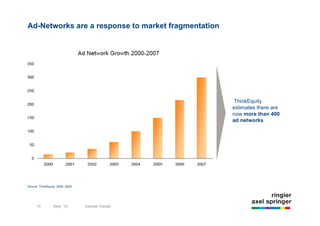

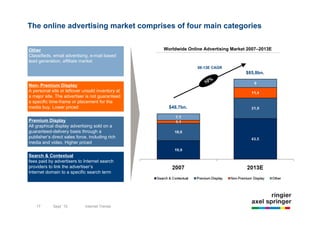

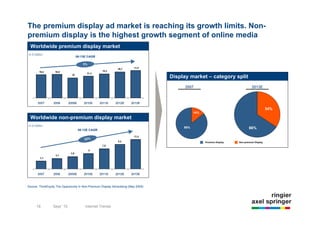

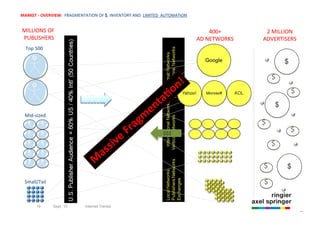

The document discusses trends in the internet from 2010. It notes that the third wave of the internet was taking off around 2007-2008, marked by an explosion of internet innovations. The internet landscape had become highly fragmented, with over 100 million active websites and the proliferation of blogs and social media. This fragmentation led to substantial changes in the internet economy, including how online advertising works. Specifically, ad networks emerged as a way for publishers to more efficiently sell their unused ad inventory, and the largest players were focused on performance-based advertising. The online advertising market was categorized into premium display, non-premium display, search/contextual, and other forms like email. Non-premium display was experiencing the highest growth.