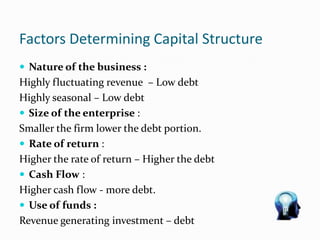

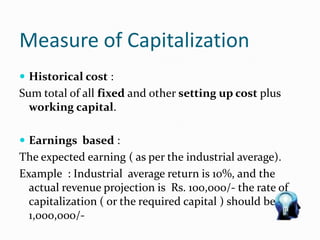

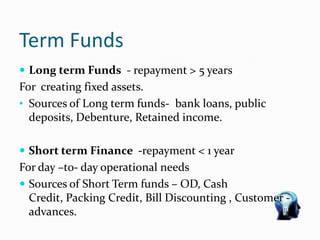

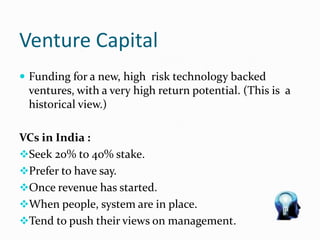

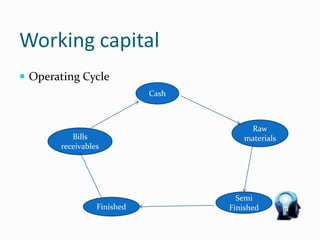

The document discusses various topics related to business financing including forms of business ownership, financial planning, sources and types of capital, capital structure, factors determining capital structure, measures of capitalization, term and working capital, venture capital, angel financing, export finance, crowd funding, sources of working capital, assessment of working capital needs, importance of working capital management, institutional sources of finance, lease financing, tax benefits, and negotiations with financiers.