2 April Daily market report

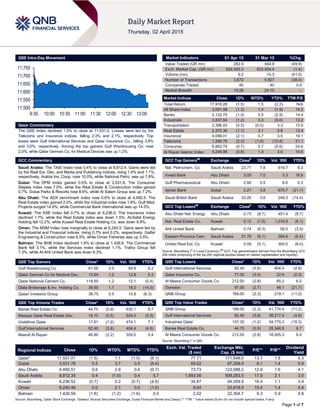

- 1. Page 1 of 7 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 1.5% to close at 11,531.0. Losses were led by the Telecoms and Insurance indices, falling 2.3% and 2.1%, respectively. Top losers were Gulf International Services and Qatar Insurance Co., falling 3.8% and 3.0%, respectively. Among the top gainers Gulf Warehousing Co. rose 2.0%, while Qatar German Co. for Medical Devices was up 1.2%. GCC Commentary Saudi Arabia: The TASI Index rose 0.4% to close at 8,812.4. Gains were led by the Real Est. Dev. and Media and Publishing indices, rising 1.4% and 1.1%, respectively. Arabia Ins. Coop. rose 10.0%, while National Petro. was up 7.8%. Dubai: The DFM Index gained 0.5% to close at 3,531.8. The Consumer Staples index rose 7.0%, while the Real Estate & Construction index gained 0.7%. Dubai Parks & Resorts rose 8.6%, while Al Salam Group was up 7.2%. Abu Dhabi: The ADX benchmark index rose 0.6% to close at 4,495.5. The Real Estate index gained 2.0%, while the Industrial index rose 1.8%. Gulf Med. Projects surged 14.6%, while Commercial Bank International was up 14.5%. Kuwait: The KSE Index fell 0.7% to close at 6,236.5. The Insurance index declined 1.7%, while the Real Estate index was down 1.5%. Al-Safat Energy Holding fell 12.2%, while Kuwait Real Estate Holding Co. was down 9.8%. Oman: The MSM Index rose marginally to close at 6,240.5. Gains were led by the Industrial and Financial indices, rising 0.7% and 0.2%, respectively. Galfar Engineering & Construction rose 6.5%, while Oman Fisheries was up 3.5%. Bahrain: The BHB Index declined 1.6% to close at 1,426.6. The Commercial Bank fell 3.1%, while the Services index declined 1.1%. Trafco Group fell 7.3%, while Al-Ahli United Bank was down 6.3%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Gulf Warehousing Co. 61.00 2.0 59.9 8.2 Qatar German Co for Medical Dev. 10.69 1.2 12.8 5.3 Qatar National Cement Co. 119.50 1.2 12.1 (0.4) Dlala Brokerage & Inv. Holding Co. 36.60 1.1 18.0 (14.5) Qatari Investors Group 38.75 0.5 10.8 (6.3) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Barwa Real Estate Co. 44.70 (0.9) 630.1 6.7 Mazaya Qatar Real Estate Dev. 18.10 (0.5) 624.0 (5.5) Vodafone Qatar 17.61 (1.2) 474.1 7.1 Gulf International Services 92.40 (3.8) 404.4 (4.8) Masraf Al Rayan 46.60 (2.2) 359.0 5.4 Market Indicators 01 Apr 15 31 Mar 15 %Chg. Value Traded (QR mn) 282.9 564.9 (49.9) Exch. Market Cap. (QR mn) 624,492.3 633,454.4 (1.4) Volume (mn) 5.0 10.3 (51.5) Number of Transactions 3,672 5,927 (38.0) Companies Traded 40 40 0.0 Market Breadth 10:28 24:15 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,918.28 (1.5) 1.5 (2.2) N/A All Share Index 3,091.98 (1.3) 1.4 (1.9) 14.2 Banks 3,122.75 (1.5) 0.5 (2.5) 14.4 Industrials 3,837.64 (1.2) 3.3 (5.0) 13.2 Transportation 2,396.03 (0.5) (0.0) 3.3 13.5 Real Estate 2,370.36 (1.1) 3.1 5.6 13.4 Insurance 4,098.01 (2.1) 0.7 3.5 19.1 Telecoms 1,295.78 (2.3) (1.0) (12.8) 21.1 Consumer 6,863.74 (0.7) 0.7 (0.6) 24.6 Al Rayan Islamic Index 4,248.96 (0.6) 1.9 3.6 14.6 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Nat. Petrochem. Co. Saudi Arabia 23.71 7.8 916.7 8.3 Invest Bank Abu Dhabi 3.05 7.0 0.3 18.6 Gulf Pharmaceutical Abu Dhabi 2.90 5.5 8.6 0.3 Ajman Bank Dubai 2.21 3.8 675.7 (21.1) Saudi British Bank Saudi Arabia 33.29 3.6 249.3 (14.4) GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Abu Dhabi Nat. Energy Abu Dhabi 0.73 (8.7) 451.4 (8.7) Nat. Real Estate Co. Kuwait 0.12 (7.5) 1,019.9 (6.1) Ahli United Bank Bahrain 0.74 (6.3) 58.0 (3.5) Eastern Province Cem. Saudi Arabia 51.78 (6.1) 394.6 (6.4) United Real Est. Co. Kuwait 0.09 (5.1) 300.0 (6.0) Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Gulf International Services 92.40 (3.8) 404.4 (4.8) Qatar Insurance Co. 77.00 (3.0) 22.6 (2.3) Al Meera Consumer Goods Co. 212.00 (2.8) 85.2 6.0 Ooredoo 97.00 (2.7) 48.1 (21.7) QNB Group 189.00 (2.3) 219.1 (11.2) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 189.00 (2.3) 41,774.4 (11.2) Gulf International Services 92.40 (3.8) 38,217.4 (4.8) Industries Qatar 137.30 (1.2) 34,775.3 (18.3) Barwa Real Estate Co. 44.70 (0.9) 28,346.9 6.7 Al Meera Consumer Goods Co. 212.00 (2.8) 18,005.3 6.0 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 11,531.01 (1.5) 1.1 (1.5) (6.1) 77.71 171,548.0 13.7 1.8 4.3 Dubai 3,531.78 0.5 3.7 0.5 (6.4) 69.02 87,209.5 8.1 1.4 5.9 Abu Dhabi 4,495.51 0.6 2.8 0.6 (0.7) 73.73 123,588.2 12.9 1.6 4.1 Saudi Arabia 8,812.35 0.4 (1.0) 0.4 5.7 1,693.06 508,293.5 17.5 2.1 3.0 Kuwait 6,236.52 (0.7) 0.2 (0.7) (4.6) 34.87 94,359.9 16.4 1.1 3.9 Oman 6,240.46 0.0 2.1 0.0 (1.6) 8.04 23,819.5 10.4 1.4 4.4 Bahrain 1,426.59 (1.6) (1.2) (1.6) 0.0 2.02 22,304.7 9.3 0.9 4.8 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 11,500 11,550 11,600 11,650 11,700 11,750 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QSE Index declined 1.5% to close at 11,531.0. The Telecoms and Insurance indices led the losses. The index fell on the back of selling pressure from Qatari shareholders despite buying support from non-Qatari and GCC shareholders. Gulf International Services and Qatar Insurance Co. were the top losers, falling 3.8% and 3.0%, respectively. Among the top gainers Gulf Warehousing Co. rose 2.0%, while Qatar German Co for Medical Devices was up 1.2%. Volume of shares traded on Wednesday fell by 51.5% to 5.0mn from 10.3mn on Tuesday. Further, as compared to the 30-day moving average of 8.6mn, volume for the day was 41.9% lower. Barwa Real Estate Co. and Mazaya Qatar Real Estate Development were the most active stocks, contributing 12.6% and 12.5% to the total volume respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings and Global Economic Data Earnings Releases Company Market Currency Revenue (mn) 4Q2014 % Change YoY Operating Profit (mn) 4Q2014 % Change YoY Net Profit (mn) 4Q2014 % Change YoY Islamic Arab Insurance Co. (Salama)* Dubai AED 730.8 -29.0% 163.2 28.1% 38.8 NA National Industries Group Holding (NI Group)* Dubai KD 126.6 8.3% – – 28.3 177.9% Al Qudra Holding* Abu Dhabi AED 1,557.00 124.4% – – 104.0 65.1% Kuwait Telecommunications Co. (VIVA)* Kuwait KD 239.0 NA – – 40.3 66.5% Source: Company data, DFM, ADX, MSM (*FY2014 results) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 04/01 US Mortgage Bankers Asso. MBA Mortgage Applications 27-March 4.60% – 9.50% 04/01 US Mortgage Bankers Asso. MBA Mortgage Applications 27-March 4.60% – 9.50% 04/01 US Census Bureau Construction Spending MoM February -0.10% -0.10% -1.10% 04/01 US Inst. for Supply Manag. ISM Manufacturing March 51.5 52.5 52.9 04/01 US Inst. for Supply Manag. ISM Prices Paid March 39.0 38.0 35.0 04/01 UK Markit Markit UK PMI Manufacturing SA March 54.4 54.4 54.1 04/01 Spain Markit Markit Spain Manufacturing PMI March 54.3 54.8 54.2 04/01 Italy Markit Markit/ADACI Italy Manufacturing PMI March 53.3 52.1 51.9 04/01 China Federation of Logistics Manufacturing PMI March 50.1 49.7 49.9 04/01 China Federation of Logistics Non-manufacturing PMI March 53.7 – 53.9 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar QCB auctions T-bills worth QR4bn on April 1 – The Qatar Central Bank (QCB) has auctioned treasury bills worth QR4bn on April 1, 2015, for which it received bids totaling QR 6.37bn. T-bills worth QR2bn with a three-month maturity period were auctioned at a yield of 0.93%. T-bills worth QR1bn with a six- month maturity period were sold at a yield of 1.07%, while T-bills worth QR1bn with a nine-month maturity period were auctioned at a yield of 1.20%. (QCB) DHBK completes amalgamation of India operations of HSBC Bank Oman – HE Sheikh Fahad Bin Mohamed Bin Jabor Al Thani, chairman of the board of directors of Doha Bank (DHBK) has informed that DHBK has completed the amalgamation of India operations of HSBC Bank Oman at the close of business on March 31, 2015 and has taken over the operations of their two branches in Mumbai (in state of Maharastra), and Kochi (in state of Kerala) on a going concern basis. He also stated that the scheme of amalgamation was in line with the approval accorded by the regulatory authorities in Qatar, Sultanate of Oman and India viz. Qatar Central Bank, Central Bank of Oman and Reserve Bank of India, respectively. (QSE) MDPS: Qatar’s population rises to 2.35mn in March – According to the Ministry of Development Planning & Statistics (MDPS), Qatar’s population has grown to 2.35mn in March 2015, the highest-ever in Qatar. In March, the YoY increased was more than 10%, rising over the population of 2.14mn in March 2014. Further, there has been a marginal fall (582,374) in the number of women as compared to February 2015, which stood at 584,427. The male population went up by around 15,000, while there were 1.76mn men on March 31, the number on February 28 stood at 1.75mn. As per the latest figures, there has been a 46 % rise in population since November 2008. (Gulf- Times.com) KPMG: PPP projects in Qatar see major interest – According to KPMG in Qatar, the Qatari government is showing an increasing appetite to enter into public private partnerships (PPPs) to deliver infrastructure projects and drive growth in the Overall Activity Buy %* Sell %* Net (QR) Qatari 50.60% 58.92% (23,523,346.71) GCC 8.99% 5.06% 11,110,067.29 Non-Qatari 40.41% 36.03% 12,413,279.42

- 3. Page 3 of 7 country. The scale of Qatar’s infrastructure plans and the government’s commitment to increase the role of the private sector in the nation’s economic growth have led to an increase in the number of infrastructure assets being considered for development through the PPP model. This strategy is in line with the desire to carve out a larger role for the private sector in the economic diversification process. According to the World Bank, over the last few years, the private sector’s contribution to public infrastructure through PPPs in emerging economies has averaged about $180bn a year. (Peninsula Qatar) Qatar Rail signs cooperation pact with Moroccan Railways – Qatar Railways Company (Qatar Rail) and the National Office of Railways of Morocco have signed a cooperation agreement in Doha. The agreement aims at developing relations between Qatar and Morocco in rail transport through the activation of a partnership between the two sides. Meanwhile, HE the Minister of Transport Jassim Seif Ahmed Al-Sulaiti held separate talks with the Moroccan Minister of Equipment, Transport and Logistics Aziz Rabbah. They discussed the aspects of cooperation and promotion of bilateral relations in the transport sector. (Gulf-Times.com) Al Rayan Bank launches 12 month fixed term ISA – Masraf Al Rayan’s (MARK) UK based subsidiary Al Rayan Bank PLC, formerly known as Islamic Bank of Britain (IBB), has launched a 12 Month Fixed Term Deposit (FTD) ISA, for savers looking to make a tax free, lump-sum investment over a fixed period of time. The expected profit rate for this account is 1.90%. A minimum deposit of GBP1,000 is required to open the 12 Month FTD ISA while profit will be paid to savers either quarterly or on maturity and transfers-in are allowed for up to 30 days after the account has been opened. (Bloomberg) QGRI subsidiary acquires Oriental Enterprises – General Real Estate Company, a wholly owned subsidiary of Qatar General Holding Company (QGH), which is wholly owned by Qatar General Insurance & Reinsurance Company (QGRI), has acquired the entire share capital of Oriental Enterprises Company. However, this transaction is subject to the approval of the regulatory authorities, including Qatar Central Bank. This acquisition will support the company's real estate activities, as well as diversifying the sources of income of the parent company, QGRI. (QSE) QGRI subsidiary completes initial designs of “MOZOON TOWERS” project – Mozoon Real Estate, a subsidiary company of Qatar General Holding Company (QGH), which is wholly owned by Qatar General Insurance & Reinsurance Company (QGRI), has completed the initial designs of “MOZOON TOWERS” project. The project comprising four hotel and apartment towers and 3,485 square meters of quality retail space, is located in the Doha City- Al-Dafnah area. General Real Estate Company, wholly owned by QGRI has been appointed to manage the project. OBEROI & MARRIOTT will operate the hotels and serviced apartments. General Real Estate Company will commence the work during April 2015. (QSE) QCSD deposits QCFS’ bonus shares – The Qatar Central Securities Depository (QCSD) has announced the addition of bonus shares into the shareholders’ accounts of the Qatar Cinema & Film Distribution Company (QCFS). With this addition, QCFS’ new capital stands at QR62.81mn distributed across to 6.28mn shares. The shareholders may trade these shares from today onwards. (QSE) QIIK opens new corporate branch – Qatar International Islamic Bank (QIIK) has opened a new corporate branch at Grand Hamad Street, Doha in line with its local outreach strategy. The branch is equipped with a dedicated service platform for small & medium enterprises (SMEs). The branch will offer a wide range of services such as funding working capital, supportive funding, financing fixed assets, construction works including bidding and managing tenders and following up construction stages with contractors to ensure timely completion of projects. The corporate branch also funds contractors in order to meet their various requirements for equipment and infrastructure. (Peninsula Qatar) WDAM postpones AGM to April 6 – Widam Food Company’s (WDAM) general assembly meeting (AGM) has been postponed to April 6, 2015 due to a lack of legal quorum for the meeting. (QSE) IHGS to disclose 1Q2015 results on April 8 – Islamic Holding Group (IHGS) will announce its financial results for 1Q2015 on April 8, 2015. (QSE) ABQK to disclose 1Q2015 results on April 16 – Ahli Bank (ABQK) will announce its financial results for 1Q2015 on April 16, 2015. (QSE) QFLS to disclose 1Q2015 results on April 20 – Woqod (QFLS) will announce its financial results for 1Q2015 on April 20, 2015. (QSE) QGRI to disclose 1Q2015 results on April 19 – Qatar General Insurance & Reinsurance Company (QGRI) will announce its financial results for 1Q2015 on April 19, 2015. (QSE) International Markit: US factory activity at five-month high in March, ISM says national factory activity fell to 51.5 in March – Financial data firm Markit said its final US Manufacturing Purchasing Managers' Index (PMI) rose to 55.7 in March from 55.1 in February and to its highest since October, when the PMI was 55.9. It also came above the preliminary reading of 55.3. The index's output component rose to 58.8 in March from 57.3 in February and better than the flash reading of 58.2. The index measuring employment growth rose in March to 53.8, just over the preliminary 53.7 reading and above the final 52.8 in February. Input prices fell at the fastest pace since June 2009. Meanwhile, the Institute for Supply Management (ISM) said its index of national factory activity fell to 51.5 in March from 52.9 in February. The reading was shy of Reuters’ expectations of 52.5 and was the lowest reading since May 2013. This was the 28th- consecutive headline reading at or above 50. The new orders index eased to 51.8 in March from 52.5 in February, and the employment index was at 50 from 51.4, both also at a 22-month low. The prices paid index rose to 39 from 35 for the fourth consecutive month below 40. (Reuters) US construction spending falls for second straight month – Construction spending in the US unexpectedly fell in February and March outlays were revised to show a steeper decline than previously estimated, which could see economists further mark down their 1Q2015 growth forecasts. The Commerce Department said construction spending dipped 0.1% to an annual rate of $967.2bn. January's outlays were revised to show a 1.7% decline instead of the previously reported 1.1% drop. Economists polled by Reuters had forecast construction spending being flat in February. The economic growth slowed markedly in 1Q2015, held back by bad weather, a strong dollar, weaker overseas demand and a now-settled labor dispute at the country's busy West Coast ports. The estimates for 1Q2015 GDP range between a 0.8% and 1.2% annual pace. The economy expanded at a 2.2% rate in 4Q2014. Construction spending in February was restrained by a 0.8% drop in public construction outlays. (Reuters)

- 4. Page 4 of 7 European factories buoyant but weak Asia adds to stimulus calls – Companies struggled in China and much of the rest of Asia in March, suggesting central banks may have to resort to more stimulus, just as factories in the Eurozone begin to reap rewards from ultra-easy policy there. Any indication of recovery will delight the European Central Bank which embarked on a quantitative easing program in March, aiming to buy around €60bn of bonds every month to drive up inflation and spur the recovery. However, the three separate surveys of China's factory and services sectors showed stubborn weakness in the world's second-biggest economy, putting the government's newly minted growth target of around 7% YoY at risk. Markit's final March Manufacturing Purchasing Managers' Index (PMI) for the Eurozone was at a ten-month high of 52.2, up from 51.0 in February and the 21st month in a row it has been above the 50 mark. (Reuters) Greece says sent more details on reforms to lenders – A Greek finance ministry official said the country has sent more details on its proposed reforms to Eurozone and International Monetary Fund lenders but the two sides remain at loggerheads on the issues of pension and labor reforms. Eurozone deputy finance ministers discussed the cash-strapped country's proposed reforms which it must have approved to unlock the much needed aid. Meanwhile, the deputy ministers (Euro Working Group) have prepared the meetings of Eurozone finance ministers that can decide whether to disburse new loans to Greece, which is running out of cash and could be bankrupt by the end of April 2015. In order to release funds to Athens, Eurozone ministers have asked for a series of reforms that would make Greek public finances sustainable and its economy competitive. (Reuters) Regional EPC AGM approves SR2.50 per share dividend – Eastern Province Cement Company’s (EPC) ordinary general assembly meeting (AGM) has approved the distribution of SR2.50 per share dividend equivalent to 25% of the nominal share value. Shareholders enrolled the company's shares according to the records of the Securities Depository Center (Tadawul) at the end of the trading date of AGM i.e. March 31, 2015 will be entitled to receive the dividend. (Tadawul) NADEC announces dividend distribution date – The National Agricultural Development Company (NADEC) announced that the cash dividend amounting to SR0.50 per share for FY2014 will be distributed on April 15, 2015 through AlRajhi bank. Shareholders listed at the end of the trading day of the general assembly meeting i.e. on March 17 2015 will be eligible to receive the dividend. (Tadawul) SPC to launch trial operations of Butanol plant in 3Q2015 – Sahara Petrochemicals Company (SPC) announced that the construction work in the Butanol plant is going on, and based on the evaluation of the level of progress, the plant is expected to commence its trail start up in 3Q2015 and will last for three to six months subject to the performance test of the plant and efficiency of production in accordance with the technology licenser and EPC contracts. The project is equally owned by Sadara Chemicals Company, Saudi Kayan Petrochemicals Company and Saudi Acrylic Acid Company (SAAC) to own and finance a plant to produce Butanol with a capacity of 330,000 metric tons per annum of n-butanol and 11,000 metric tons per annum of iso-butanol, and SPC owns 43.16% of SAAC. (Tadawul) Dallah announces termination of Bagedo purchase agreement– Dallah Healthcare Holding Company has announced the termination of its sale and purchase (SPA) agreement to acquire Bagedo & Dr. Erfan General Hospital Company from Bagedo Trading Holding Company and Mohamed Ahmed Erfan & Sons Holding Company. The SPA was terminated and its provisions, except for certain provisions such as confidentiality and applicable law provisions, have ceased to have effect from March 31, 2015 as a result of non- satisfaction of a number of completion conditions by the long stop date. (Tadawul) ANB Insurance finalizes transfer of protection and saving portfolio of ALIC – MetLife AIG ANB Cooperative Insurance Company (ANB Insurance) has finalized the agreement of transferring the protection and saving portfolio of American Life Insurance Company (ALIC). The company has also finalized the agreement of reinsurance of the entire portfolio with ALIC. (Tadawul) Saudi Polymers Company completes all financing obligations with lenders – Saudi Industrial Investment Group (SIIG) said that the Saudi Polymers Company, the project of its 50% owned subsidiary National Petrochemical Company (Petrochems), has completed all the obligations required under the financing agreements with its local and international lenders. Therefore, certain financial obligations and recourse have been transferred from the project sponsors to Saudi Polymers Company. Upon reaching the important milestone, the project sponsors (including SIIG) guarantees are released and the obligations of Saudi Polymers Company under the financing agreements are to be covered solely, using the proceeds from its operations. Saudi Polymers Company is owned 65% by Petrochem, and 35% by Arabian Chevron Phillips Petrochemical Company Limited. (Tadawul) Ma’aden’s MPC resumes commercial operations at ammonia plant – Saudi Arabian Mining Company (Ma’aden) has announced that its subsidiary Maaden Phosphate Company (MPC) has completed the technical repairs of the cooling facility and successfully resumed commercial operations of the ammonia plant located in Ma’aden’s complex at Ras Al Khair city on April 1, 2015. (Tadawul) Swicorp raises SR112mn in equity, arranges SR132mn loan facility for Ewan Al-Qayrawan Real Estate Development Fund – Swicorp, a Saudi-based private equity and investment banking firm, has successfully raised SR112mn in equity, and arranged a SR132mn loan facility from a local bank for Ewan Al- Qayrawan Real Estate Development Fund. The Fund was established by Swicorp in partnership with Retal Urban Development Company. (GulfBase.com) KHC AGM approves SR655mn quarterly dividend for 2014 – Kingdom Holding Company’s (KHC) annual general meeting (AGM) has approved the distribution of SR655mn quarterly dividend for 2014. (Tadawul) Oil accounts for less than third of UAE GDP – The UAE’s Minister of Economy (MoE), Sultan Al Mansouri said that oil used to account for more than 90% of the UAE gross domestic product (GDP) in the 1970s. However, the contribution of non-oil sectors to the GDP rose to 69% at the end of 2014. Today, oil accounts for less than a third of the UAE’s GDP. He further added that the UAE has been able to secure a leading position as an attractive destination for foreign investments and is ranked first among Arab countries and 22nd globally in the Global Investment Index for 2015. (GulfBase.com) UAE companies law eases flotation, seeks more investments – The UAE has issued a long-awaited companies law that loosens rules covering stock market flotations and aims to attract more investment by moving corporate regulation closer

- 5. Page 5 of 7 to international standards. The law reduces the minimum free float of shares in company flotation on the UAE's two main stock markets to 30% from 55%, aiming to encourage the company owners to go public. Previously, they could only sell less than 55% of their firms if they had obtained a waiver from regulators or by listing on the smaller NASDAQ Dubai. The new law also contains dozens of articles seeking to make limited liability and joint stock firms simpler to manage and more attractive to investors, while strengthening corporate governance in areas such as company loans to directors. (Reuters) Salama recommends not to distribute dividend for FY2014 – Islamic Arab Insurance Company’s (Salama) board of directors has recommended not to distribute dividend for the financial year ended December 31, 2014. (DFM) DIB makes offer for remaining Tamweel shares – Dubai Islamic Bank (DIB) has offered AED1.25 per share in cash to buy the remaining shares in its mortgage unit, Tamweel. The bank currently holds 86.5% shares in the company and is initiating the process of acquiring the remaining 13.5% shares. This off¬er will be open for a period of one month commencing from April 1, 2015. Following the acquisition of majority stake by DIB in 2013, the company has been converted into a private joint stock company and delisted from the Dubai Financial Market. (DFM, Reuters) CBD to acquire AED3bn of UAE company loans from RBS – Commercial Bank of Dubai (CBD) has agreed to acquire around AED3bn of corporate loans from the Royal Bank of Scotland (RBS). The transaction is expected to be completed during April 2015, with the bank using its own funds for the acquisition. (Reuters) UP seeks AED700mn loans to fund new projects – Union Properties (UP) is engaged in talks with local banks to borrow about AED700mn to fund new projects. UP’s Managing Director, Ahmad Al Marri said that UP has started talks with three banks and is expected to sign an agreement by July 2015. He said the developer is planning to start work on 226 villas and apartments in the Green Community development in July and another 271 homes will be constructed in MotorCity by 2017. The company is also planning to start building 700 homes in five towers to be completed in 2019, and is also considering other development work outside Dubai. (GulfBase.com) DME reaches significant 8bn barrel mark – Dubai Mercantile Exchange (DME) announced that it has now reached the 8bn barrel mark, with a total of 8mn contracts (equivalent 8bn barrels) traded on the exchange. The increased interest in DME’s value proposition was driven by new members from Asia and their participation has contributed to the exchange’s trading performance and enabled it to hit the new milestone in March 2015, despite the current challenging conditions for the global oil markets. (GulfBase.com) Sobha plans to expand regionally and globally – Sobha LLC, a part of Sobha Group, is planning to expand its footprint regionally and globally. The company is in the process of opening five sales offices in London, Singapore, Riyadh, Doha and Kuwait City by July 2015 to tap into the growing demand for its developments in the UAE in key international markets. The company plans to break ground on its signature villas and apartments, and its high quality infrastructure in 2Q2015. (GulfBase.com) CBI AGM approves 5% bonus share, director appointment – Commercial Bank International’s (CBI) general assembly meeting (AGM) has approved 5% bonus share dividend for FY2014. Shareholders have also approved the appointment of Ali Rashed Muhannadi as Director replacing resigned Director Fahad Abdulla AlKhalifah. (ADX) Al Qudra BoD recommends 7% cash dividend – Al Qudra Holding’s board of directors has recommended 7% cash dividend to the shareholders. (GulfBase.com) NBK sets final pricing for capital-boosting bond – National Bank of Kuwait (NBK) has set the final yield for its bond, which will boost its Tier 1 or core capital at 5.75%. The order books for the transaction, which will be of benchmark size, have a perpetual lifespan and which can only be redeemed by the bank after the sixth year, are in the vicinity of $1.4bn. HSBC and Standard Chartered are the joint global coordinators for the transaction, while Citigroup, National Bank of Abu Dhabi and NBK Capital are acting as joint lead managers for the issue. The issue would be worth around $650mn. (Reuters) Al Suwadi Power appoints new CEO – Al Suwadi Power Company has appointed Navneet Kasbekar as its new Chief Executive Officer (CEO) – he replaces Przemek Lupa effective from April 1, 2015. (MSM) Renaissance Services AGM approves 10% cash dividend – Renaissance Services’ annual general meeting (AGM) has approved the proposed cash dividend of 10% of the paid-up capital i.e. 10 baizas per share. (MSM) GIS AGM approves 6% cash dividend – Gulf Investment Services’ (GIS) annual general meeting has approved the payment of cash dividend at the rate of 6% of the nominal value of fully paid-up share i.e. 6 baizas per share. (MSM) TOI expands branch network – Takaful Oman Insurance (TOI) has opened its new branch in Sohar in a major step to expand its network across Oman. (GulfBase.com) Sharqiyah Desalination raises $42mn in new debt – Sharqiyah Desalination Company has successfully refinanced its existing debt of $120.8mn. In addition to the foregoing, the company also raised new debt of $42.7mn for funding its expansion project comprising the 10.6mn imperial gallons per day reverse osmosis water desalination facility. Veolia Middle East SAS and National Water & Power, the major shareholders of the company, played a key role as developer, investor and operators in fostering the transaction. The refinancing involved taking over the loans from the existing lenders by a consortium of international banks. (GulfBase.com) ORPIC plans pet coke storage facility – Oman Oil Refineries & Petroleum Industries Company (ORPIC) will invest in facilities for the handling and storage of petroleum coke (pet coke), large quantities of which will be produced upon the completion of the multibillion dollar Sohar Refinery Improvement Project. (GulfBase.com) WTTC: Oman to witness 11% job growth from tourism sector – According to the World Travel & Tourism Council’s (WTTC) 2015 Travel & Tourism Economic Impact Report, Oman’s push on developing the travel & tourism sector has begun to show positive effects on the economy. Oman has been placed higher than other GCC countries in most categories and the direct contribution from travel & tourism to Oman’s employment is expected to show a real growth of 11% in 2015, the second highest among the 184 countries covered by WTTC. Travel & tourism’s direct contribution to Oman’s GDP in 2014 was OMR765.1mn (2.6% of the total GDP). The report has forecast that this will rise by 5.2% in 2015 and to OMR1.45bn (3.3% of total GDP) in 2025. The sector directly supported 44,500 jobs (2.8% of total employment) in 2014. (GulfBase.com)

- 6. Page 6 of 7 Ithmaar Bank’s strategic initiatives yield results – Ithmaar Bank announced that the strategic decisions taken by the bank’s board of directors early in 2014 have already started yielding results. The decisions, which are aimed at turning the Ithmaar Group around by significantly transforming operations, included initiatives for increased revenue, improved margins, divestment of non-core assets and cost reductions across the group. (Bahrain Bourse) AUB AGM approves cash dividend, bonus issue – Ahli United Bank’s (AUB) annual general meeting (AGM) has approved the distribution of 18% cash dividend (4.5 cents per share) together with ordinary shares bonus of 5% (one share per 20 ordinary shares held) for the financial year ended December 31, 2014. Shareholders registered in the AUB’s share book on March 31, 2015 will be eligible to receive the dividend. Shareholders voted to extend for a further two years their authorization for the BoD to decide on the timing, pricing and terms of the issuance of up to $4bn in bonds, loans or any other similar subordinated financial instruments required to support the growth plans of the bank. (Bahrain Bourse) GFG inks management deal with ASDAL – Gulf Hotels Group (GFG) has signed a management agreement with ASDAL Hotel for the operation of a four-star deluxe hotel in Seef District, Bahrain. The hotel is currently undergoing refurbishment work and is expected to be opened in September 2015. Spread over four floors, the hotel features 94 luxurious rooms and suites. (Bahrain Bourse)

- 7. Contacts Saugata Sarkar Ahmed Al-Khoudary Sahbi Kasraoui Head of Research Head of Sales Trading – Institutional Manager – HNWI Tel: (+974) 4476 6534 Tel: (+974) 4476 6548 Tel: (+974) 4476 6544 saugata.sarkar@qnbfs.com.qa ahmed.alkhoudary@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa QNB Financial Services SPC Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 200.0 220.0 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 QSE Index S&P Pan Arab S&P GCC 0.4% (1.5%) (0.7%) (1.6%) 0.0% 0.6% 0.5% (2.4%) (1.6%) (0.8%) 0.0% 0.8% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,203.90 1.7 0.4 1.6 MSCI World Index 1,738.15 (0.2) (0.4) 1.7 Silver/Ounce 16.96 1.8 (0.0) 8.0 DJ Industrial 17,698.18 (0.4) (0.1) (0.7) Crude Oil (Brent)/Barrel (FM Future) 57.10 3.6 1.2 (0.4) S&P 500 2,059.69 (0.4) (0.1) 0.0 Crude Oil (WTI)/Barrel (FM Future) 50.09 5.2 2.5 (6.0) NASDAQ 100 4,880.23 (0.4) (0.2) 3.0 Natural Gas (Henry Hub)/MMBtu 2.60 (1.0) (1.3) (13.3) STOXX 600 398.52 0.8 (0.4) 3.7 LPG Propane (Arab Gulf)/Ton 53.25 3.1 (1.4) 8.7 DAX 12,001.38 0.8 (0.0) 8.5 LPG Butane (Arab Gulf)/Ton 60.25 2.1 (2.0) (4.0) FTSE 100 6,809.50 0.4 (1.0) (1.3) Euro 1.08 0.3 (1.2) (11.0) CAC 40 5,062.22 1.1 (0.6) 5.6 Yen 119.76 (0.3) 0.5 (0.0) Nikkei 19,034.84 (0.5) (1.6) 9.0 GBP 1.48 0.0 (0.4) (4.8) MSCI EM 982.93 0.9 2.6 2.8 CHF 1.03 0.6 (0.6) 2.8 SHANGHAI SE Composite 3,810.29 1.6 3.4 17.9 AUD 0.76 (0.1) (2.0) (7.0) HANG SENG 25,082.75 0.7 2.5 6.3 USD Index 98.19 (0.2) 0.9 8.8 BSE SENSEX 28,260.14 1.1 3.4 4.3 RUB 57.60 (1.0) (0.4) (5.2) Bovespa 52,321.76 3.8 6.7 (12.3) BRL 0.32 1.0 2.6 (16.2) RTS 910.41 3.4 6.3 15.1 165.7 131.0 120.2