QNBFS Daily Market Report April 08, 2018

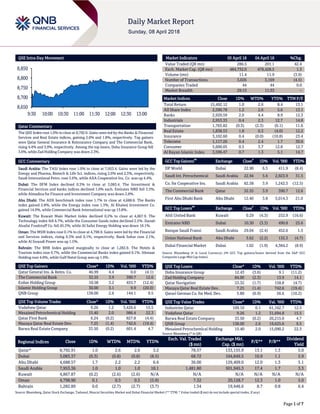

- 1. Page 1 of 7 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 1.0% to close at 8,792.9. Gains were led by the Banks & Financial Services and Real Estate indices, gaining 2.0% and 1.8%, respectively. Top gainers were Qatar General Insurance & Reinsurance Company and The Commercial Bank, rising 4.4% and 3.9%, respectively. Among the top losers, Doha Insurance Group fell 3.6%, while Zad Holding Company was down 2.3%. GCC Commentary Saudi Arabia: The TASI Index rose 1.0% to close at 7,953.4. Gains were led by the Energy and Pharma, Biotech & Life Sci. indices, rising 2.6% and 2.3%, respectively. Saudi International Petro. rose 5.6%, while AXA Cooperative Ins. Co. was up 4.4%. Dubai: The DFM Index declined 0.3% to close at 3,083.4. The Investment & Financial Services and banks indices declined 1.0% each. Emirates NBD fell 3.3%, while Almadina for Finance and Investment Company was down 2.8%. Abu Dhabi: The ADX benchmark index rose 1.7% to close at 4,688.6. The Banks index gained 2.8%, while the Energy index rose 1.3%. Al Khaleej Investment Co. gained 14.9%, while Commercial Bank International was up 13.8%. Kuwait: The Kuwait Main Market Index declined 0.2% to close at 4,867.9. The Technology index fell 6.7%, while the Consumer Goods index declined 2.5%. Danah Alsafat Foodstuff Co. fell 45.3%, while Al Safat Energy Holding was down 18.1%. Oman: The MSM Index rose 0.1% to close at 4,798.9. Gains were led by the Financial and Services indices, rising 0.3% and 0.1%, respectively. Bank Sohar rose 2.1%, while Al Suwadi Power was up 1.5%. Bahrain: The BHB Index gained marginally to close at 1,282.9. The Hotels & Tourism index rose 0.7%, while the Commercial Banks index gained 0.1%. Ithmaar Holding rose 4.8%, while Gulf Hotel Group was up 1.0%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar General Ins. & Reins. Co. 46.99 4.4 0.0 (4.1) The Commercial Bank 32.55 3.9 390.7 12.6 Ezdan Holding Group 10.58 3.2 455.7 (12.4) Islamic Holding Group 30.00 3.1 9.9 (20.0) QNB Group 138.00 2.6 144.1 9.5 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 9.26 1.2 3,426.6 15.5 Mesaieed Petrochemical Holding 15.40 2.0 986.4 22.3 Qatar First Bank 6.24 (0.2) 827.8 (4.4) Mazaya Qatar Real Estate Dev. 7.25 (1.4) 742.6 (19.4) Barwa Real Estate Company 33.50 (0.2) 601.4 4.7 Market Indicators 05 April 18 04 April 18 %Chg. Value Traded (QR mn) 286.5 201.1 42.4 Exch. Market Cap. (QR mn) 484,732.0 478,428.5 1.3 Volume (mn) 11.4 11.9 (3.9) Number of Transactions 3,026 3,169 (4.5) Companies Traded 44 44 0.0 Market Breadth 29:13 11:33 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 15,492.12 1.0 2.6 8.4 13.1 All Share Index 2,590.78 1.2 2.6 5.6 13.1 Banks 2,920.59 2.0 4.4 8.9 12.3 Industrials 2,953.33 0.4 2.3 12.7 14.8 Transportation 1,765.82 (0.3) (2.3) (0.1) 11.6 Real Estate 1,838.53 1.8 0.3 (4.0) 12.2 Insurance 3,102.60 0.4 (0.0) (10.8) 23.4 Telecoms 1,117.26 0.4 2.4 1.7 30.6 Consumer 5,600.05 0.5 3.7 12.8 12.7 Al Rayan Islamic Index 3,596.47 0.7 1.3 5.1 14.7 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% DP World Dubai 22.90 6.5 411.9 (8.4) Saudi Int. Petrochemical Saudi Arabia 22.94 5.6 2,923.9 31.5 Co. for Cooperative Ins. Saudi Arabia 82.58 3.9 1,242.3 (12.5) The Commercial Bank Qatar 32.55 3.9 390.7 12.6 First Abu Dhabi Bank Abu Dhabi 12.40 3.8 5,014.3 21.0 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Ahli United Bank Kuwait 0.29 (4.3) 252.9 (16.6) Emirates NBD Dubai 10.30 (3.3) 490.8 25.6 Banque Saudi Fransi Saudi Arabia 29.04 (2.4) 452.6 1.5 Union National Bank Abu Dhabi 3.62 (2.2) 132.3 (4.7) Dubai Financial Market Dubai 1.02 (1.9) 4,384.2 (8.9) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Doha Insurance Group 12.43 (3.6) 9.1 (11.2) Zad Holding Company 84.00 (2.3) 13.9 14.1 Qatar Navigation 53.32 (1.7) 158.8 (4.7) Mazaya Qatar Real Estate Dev. 7.25 (1.4) 742.6 (19.4) Qatari German Co. for Med. Dev. 5.80 (0.9) 56.6 (10.2) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Industries Qatar 109.10 0.1 61,162.7 12.5 Vodafone Qatar 9.26 1.2 31,694.8 15.5 Barwa Real Estate Company 33.50 (0.2) 20,215.0 4.7 QNB Group 138.00 2.6 19,625.6 9.5 Mesaieed Petrochemical Holding 15.40 2.0 15,090.2 22.3 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 8,792.91 1.0 2.6 2.6 3.2 78.57 133,155.9 13.1 1.3 5.0 Dubai 3,083.37 (0.3) (0.8) (0.8) (8.5) 68.72 104,849.5 10.9 1.1 5.9 Abu Dhabi 4,688.57 1.7 2.2 2.2 6.6 36.00 129,409.0 12.0 1.3 5.1 Saudi Arabia 7,953.36 1.0 1.0 1.0 10.1 1,481.80 501,945.3 17.4 1.7 3.3 Kuwait 4,867.87 (0.2) (2.6) (2.6) N/A N/A N/A N/A N/A N/A Oman 4,798.90 0.1 0.5 0.5 (5.9) 7.32 20,128.7 12.3 1.0 5.0 Bahrain 1,282.89 0.0 (2.7) (2.7) (3.7) 1.34 19,446.6 8.7 0.8 6.4 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 8,650 8,700 8,750 8,800 8,850 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QSE Index rose 1.0% to close at 8,792.9. The Banks & Financial Services and Real Estate indices led the gains. The index rose on the back of buying support from GCC and non-Qatari shareholders despite selling pressure from Qatari shareholders. Qatar General Insurance & Reinsurance Company and The Commercial Bank were the top gainers, rising 4.4% and 3.9%, respectively. Among the top losers, Doha Insurance Group fell 3.6%, while Zad Holding Company was down 2.3%. Volume of shares traded on Thursday fell by 3.9% to 11.4mn from 11.9mn on Wednesday. Further, as compared to the 30-day moving average of 12.2mn, volume for the day was 6.2% lower. Vodafone Qatar and Mesaieed Petrochemical Holding Company were the most active stocks, contributing 30.1% and 8.7% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Ratings, Earnings Releases, Global Economic Data and Earnings Calendar Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change Ahli Bank Fitch Qatar LT-IDR/ST- IDR/VR/SRF/SR A/F1/bbb-/A/1 A/F1/bbb-/A/1 – Negative – Al Khalij Commercial Bank Fitch Qatar LT-IDR/ST- IDR/VR/SRF/SR A/F1/bb+/A/1 A/F1/bb/A/1 Negative – Barwa Bank Fitch Qatar LT-IDR/ST- IDR/VR/SRF/SR A/F1/bb+/A/1 A/F1/bb+/A/1 – Negative – QNB Group Fitch Qatar LT-IDR/ST- IDR/VR/SRF/SR A+/F1/bbb+/ A+/1 A+/F1/bbb+/ A+/1 – Negative – The Commercial Bank Fitch Qatar LT-IDR/ST- IDR/VR/SRF/SR A/F1/bbb-/A/1 A/F1/bbb-/A/1 – Negative – Doha Bank Fitch Qatar LT-IDR/ST- IDR/VR/SRF/SR A/F1/bbb-/A/1 A/F1/bb+/A/1 Negative – Qatar Islamic Bank Fitch Qatar LT-IDR/ST- IDR/VR/SRF/SR A/F1/bbb-/A/1 A/F1/bbb-/A/1 – Negative – Qatar International Islamic Bank Fitch Qatar LT-IDR/ST- IDR/VR/SRF/SR A/F1/bb+/A/1 A/F1/bb+/A/1 – Negative – International Bank of Qatar Fitch Qatar LT-IDR/ST- IDR/VR/SRF/SR A/F1/bb+/A/1 A/F1/bb+/A/1 – Negative – National Bank of Bahrain CI Bahrain FLT BB+ BB – – Source: News reports (* LT – Long Term, ST – Short Term, FSR- Financial Strength Rating, FCR – Foreign Currency Rating, LCR – Local Currency Rating, IDR – Issuer Default Rating, SR – Support Rating, LC – Local Currency, VR – Viability Rating, FLT – Foreign Long Term, Support Rating Floor – SRF) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 04/05 US Department of Labor Initial Jobless Claims 31- March 242k 225k 218k 04/05 US Department of Labor Continuing Claims 24-March 1,808k 1,843k 1,872k 04/05 US US Census Bureau Trade Balance February -$57.6bn -$56.8bn -$56.7bn 04/05 EC Eurostat PPI MoM February 0.1% 0.0% 0.4% 04/05 EC Eurostat PPI YoY February 1.6% 1.5% 1.6% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 1Q2018 results No. of days remaining Status QNBK QNB Group 10-Apr-18 2 Due NLCS Alijarah Holding 12-Apr-18 4 Due QIBK Qatar Islamic Bank 15-Apr-18 7 Due QISI Qatar Islamic Insurance Company 16-Apr-18 8 Due MCGS Medicare Group 16-Apr-18 8 Due GWCS Gulf Warehousing Company 16-Apr-18 8 Due MARK Masraf Al Rayan 16-Apr-18 8 Due Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 41.91% 37.34% 13,092,352.85 Qatari Institutions 14.78% 28.51% (39,333,653.90) Qatari 56.69% 65.85% (26,241,301.05) GCC Individuals 0.61% 0.48% 372,532.13 GCC Institutions 3.16% 0.58% 7,375,672.09 GCC 3.77% 1.06% 7,748,204.22 Non-Qatari Individuals 9.29% 8.44% 2,451,130.21 Non-Qatari Institutions 30.25% 24.65% 16,041,966.62 Non-Qatari 39.54% 33.09% 18,493,096.83

- 3. Page 3 of 7 CBQK The Commercial Bank 17-Apr-18 9 Due QNCD Qatar National Cement Company 18-Apr-18 10 Due QEWS Qatar Electricity & Water Company 18-Apr-18 10 Due DOHI Doha Insurance Group 18-Apr-18 10 Due KCBK Al Khalij Commercial Bank 19-Apr-18 11 Due ABQK Ahli Bank 19-Apr-18 11 Due DHBK Doha Bank 22-Apr-18 14 Due SIIS Salam International Investment Limited 23-Apr-18 15 Due QIMD Qatar Industrial Manufacturing Company 25-Apr-18 17 Due ORDS Ooredoo 25-Apr-18 17 Due UDCD United Development Company 25-Apr-18 17 Due AKHI Al Khaleej Takaful Insurance Company 29-Apr-18 21 Due QFLS Qatar Fuel Company 29-Apr-18 21 Due Source: QSE News Qatar QCB sells QR1bn worth of Treasury bills – Qatar Central Bank (QCB) sold QR1bn of Treasury bills this week, according to the banking regulators. It sold QR550mn of three-month bills at a yield of 2.65%, QR300mn of six month bills with 2.8% yield, and QR150mn of nine month bills at 3%. (Peninsula Qatar) Qatar Industrial Manufacturing Company to disclose its 1Q2018 financial results on April 25 – Qatar Industrial Manufacturing Company announced its intention to disclose its 1Q2018 financial results on April 25, 2018. (QSE) The Commercial Bank hosts NBO investor roadshow in Doha – The Commercial Bank recently hosted a high-level delegation from the National Bank of Oman (NBO) for a roadshow attended by Qatari businessmen, including the bank’s VIP clients. The Commercial Bank has a strategic alliance with NBO, Oman’s second largest bank, and holds a 34.9% stake in it. The purpose of the roadshow was to promote NBO’s capabilities and services to the Commercial Bank customers with existing and potential business interests in Oman. For the businessmen in attendance, the roadshow served as an opportunity for The Commercial Bank to present its credentials and explore potential investment opportunities in Qatar. (Gulf-Times.com) Fitch & Capital Intelligence affirm QIIK’s ratings at ‘A’ – Ratings agencies Fitch and Capital Intelligence affirmed Qatar International Islamic Bank’s (QIIK) ratings at ‘A’, reflecting the bank’s strong financial position. Fitch based QIIK’s Long-Term Issuer Default Rating (IDR) at ‘A’ reflect Fitch’s expectation of an extremely high probability of support from the government’s in case of need, in comparison to previous cases, where the government has shown strong commitment to the banking sector and key public sector companies, especially as the state is able to support the banking sector backed by its large sovereign reserves and revenues. Fitch noted that QIIK has a stake in the local Islamic banking segment, reaching 13% by the end of 2017 and a considerable strength, especially in the retail segment. The bank is looking to eventually expand its franchise internationally and recently established a bank in Morocco In addition, the bank maintains a strong capital adequacy ratio at 17.9% and Liquid assets accounted for a high 28% of deposits at end-2017. Capital Intelligence stated that it has based QIIK’s financing strength rating (FSR) rating on the strength of capital adequacy and the healthy growth of the bank’s profits, which confirms its firm position that can be strengthened at the medium term with the opening of a bank by QIIK in Morocco. The CI agency confirmed that “the rating is also based on the fact that the QIIK funding was largely from domestic sources; direct impacts from the blockade were minimal, especially in view of the strong liquidity support from the government for the sector as a whole”. (Peninsula Qatar) QNB Group: Qatar’s GDP forecasts revised up for 2018 – Qatar’s overall real GDP growth will exceed 2.8% this year from the earlier forecast of 2.5%, QNB Group stated in an economic commentary. QNB Group stated it was revising up its Qatar’s GDP growth forecasts for three main reasons. First, QNB Group recently raised its forecast for oil prices from $55 a barrel to $63 a barrel, which will lead to higher incomes and spending in the non-hydrocarbon sector. Second, it now expects a sharper rebound in hydrocarbon output as maintenance on LNG production facilities appears to have been dragged out in 2017, but should now be completed. Third, the economic impact of the blockade has been less than expected and QNB Group has, therefore, reduced the expected drag from the blockade on 2018 GDP. As a result, QNB Group is now forecasting overall real GDP growth of 2.8% in 2018 from 2.5% previously. According to QNB Group, Qatar’s GDP growth in 4Q2017 was held back by the hydrocarbon sector. The latest data showed an unexpected drop of 6.4% in hydrocarbon production in 4Q2017 from the previous quarter. Given that crude oil production increased by 3.2% over this period, the drop in hydrocarbon GDP must be due to gas production, most likely as a consequence of temporary shutdowns for routine maintenance on LNG facilities. For the full year 2017, overall real GDP growth was 1.6% with the non- hydrocarbon sector growing 4.2% and the hydrocarbon sector contracting 1.1%. Lower oil and gas output in 2017 was due to both lower crude oil production and maintenance on LNG facilities. (Gulf-Times.com) Umm Al Houl power plant 99% complete – The Prime Minister and Minister of Interior, HE Sheikh Abdullah Bin Nasser Bin Khalifa Al Thani visited the under-construction Umm Al Houl Power Plant of the Qatar Electricity and Water Company (QEWS). The plant is set to be officially opened soon. At the end of the visit, Sheikh Abdullah Bin Nasser praised the achievements made in the huge project, whose operation

- 4. Page 4 of 7 depends on highly efficient and skilled Qatari engineers and technicians, and lauded the company’s Qatarisation efforts. Umm Al Houl Power Plant is one of the largest desalination and power generation plants in the region. Built at a cost of QR11bn, the plant would have a daily production capacity of 136mn gallons of water and 2,520MW of electricity. Once completed, Umm Al Houl Power Plant will provide 25% of Qatar’s electricity and 30% of water needs. The project has the participation of QEWS (60%), Qatar Petroleum (5%), Qatar Foundation (5%), and a consortium of Japanese companies Mitsubishi Corporation and Tepco (30%). (Gulf-Times.com) International trade and investment key to Qatar’s future growth – The Minister of Economy and Commerce, HE Sheikh Ahmed Bin Jassim Bin Mohamed Al Thani said international trade and investment are a key part of Qatar’s future growth and economic diversification policy. The US was the primary source of the Qatari imports in 2017, he said in his opening address to the Qatar-US Economic Forum in Miami. He said Qatar imported 16% of its imports from the US. He noted that over the past ten years, trade between the two countries has doubled from $3bn to $6bn. Sheikh Ahmed noted the role of the Qatar Investment Authority, which has allocated $45bn of investments between 2015 and 2020, of which $10bn will be directed to invest in the infrastructure sector in the US. He noted that these investments constitute 23% of Qatar’s GDP. (Gulf-Times.com) Qatar, Miami explore cooperation in aviation and maritime growth – Qatar and the US county of Miami are exploring options for joint cooperation in the fields of aviation and maritime as part of efforts to strengthen the bilateral economic and business relations between Qatar and the US. In this regard, Qatar’s Minister of Economy and Commerce, HE Sheikh Ahmed Bin Jassim Bin Mohamed Al Thani met Lester Sola, Director and CEO, of the Miami-Dade Aviation Department, and Juan Kuryla, Director of the Port of Miami. The Miami International Airport has about 44mn passenger’s count annually and Qatar Airways operates to Miami with its passengers or cargo flights. Sheikh Ahmed noted that the city of Miami is one of the most important tourist destinations for Qatari tourists in the US. Expressing Qatar’s keenness to develop maritime tourism, he said Doha Port receives a number of the largest cruise ships. (Gulf-Times.com) Qatar Chamber discusses trade ties with Iranian delegation – Qatar Chamber met with an Iranian business delegation currently visiting Qatar, led by Fars Governorate General for coordination economic affairs and resources development Yadollah Rahmani, with both parties discussing the aspects of promoting mutual cooperation and ways to benefit from trade opportunities in both countries. Qatar Chamber’s Vice Chairman, Mohamed Bin Ahmed Bin Tawar said the trade relations between the private sectors in both countries have witnessed great development recently. He added that there is a desire from both sides to promote mutual cooperation which benefits the economies of both countries. The Vice Chairman said there are promising opportunities in the business sectors of both countries to expand effective partnerships and launch new economic alliances in all sectors. He said that the proximity between both countries helped develop their trade together and the development of the sea ports in both countries contributed to the flow of goods and products between them. (Gulf- Times.com) Total 2.7% rise in number of on-arrival visas in February – The total number of on-arrival-visas granted to citizens from 90 countries reached 72,110 in February this year, which is an increase of 2.7% when compared to January 2108. The majority of visitors were from India, the UK, the US, France, Lebanon and China according to the Ministry of Interior. The increase of the number of tourists indicates the status of Qatar in the world and also reflects the good services being provided by Qatar in terms of security and stability, economic status which attract tourists. (Peninsula Qatar) International US job gains smallest in six months, wage growth firming – The US economy created the fewest jobs in six months in March as a boost from milder temperatures faded, but a pickup in wage gains pointed to a tightening labor market, which should allow the Federal Reserve to further raise interest rates this year. Nonfarm payrolls increased by 103,000 last month, with construction and retail sectors shedding jobs, the Labor Department said. That was the smallest gain since last September and followed a 326,000 increase in February, which was the largest in more than two years. Temperatures returned to normal in March, with snowstorms in some parts of the country. The pullback in job gains is likely temporary as layoffs are at historic lows and other independent labor market indicators were strong in March. Employment gains averaged 202,000 jobs per month in the first quarter, highlighting underlying labor market strength. The economy needs to create roughly 100,000 jobs per month to keep up with growth in the working-age population. The unemployment rate held steady at 4.1% for a sixth straight month. Economists polled by Reuters had forecast the economy adding 193,000 jobs in March and the unemployment rate dropping to 4.0%. (Reuters) US trade deficit rises to near nine-and-a-half-year high in February – The US trade deficit increased to a near 9-1/2-year high in February, with both imports and exports rising to record highs in a sign of strong domestic and global demand. News on April 05, of the worsening trade deficit came as the US and China were embroiled in tit-for-tat tariffs which escalated trade war fears and rattled financial markets. President Donald Trump’s administration is pursuing import duties to eradicate the deficit and protect domestic industries from what he says is unfair foreign competition. But economists say the trade penalties will not reverse the deficit. The Commerce Department said the trade gap increased 1.6% to $57.6 bn in February, the highest level since October 2008. The deficit has now increased for six straight months. Most of the rise in the trade deficit in February reflected commodity price increases. Economists polled by Reuters had forecast the trade gap widening to $56.8bn in February. The goods trade deficit was the highest since July 2008 and the surplus on services was the lowest since December 2012. (Reuters) UK productivity picks up strongly in second half of 2017 – Britain recorded its strongest productivity growth in more than a decade in the second half of 2017, helped by a strong fourth quarter, but economists said the improvement was unlikely to

- 5. Page 5 of 7 prove a turning point for one of the economy’s key weak spots. Productivity growth in most advanced economies has been poor since the 2008 financial crisis and in Britain it has been particularly weak, growing by less than 2% in total over the past decade and acting as a major drags on wages. Figures from the Office for National Statistics show a marked improvement from the previous trend. Economic output per hour worked rose by 0.7% in the fourth quarter of 2017, above its long-run average though a shade less than first estimated in February. Third-quarter productivity growth was revised up slightly to 1.0%. Together the two quarters show the strongest growth since the second half of 2005. (Reuters) Eurozone February retail sales muted as non-food purchases cut – Eurozone sales increased at a slower rate than expected in February as shoppers cut back on non-food purchases and figures for January were revised down, indicating a slowdown of business in the bloc’s high streets at the start of the year. The European Union’s statistics office Eurostat said on Thursday that retail sales in the 19 countries sharing the euro rose by just 0.1% month-on-month for a 1.8% YoY increase. Economists polled by Reuters had expected a 0.5% monthly rise and a 2.1% annual gain. Eurostat also cut its figures for January to -0.3% on the month and to 1.5% YoY from the previous estimates of -0.1 and 2.3% respectively. Food, drink and tobacco sales grew after a month-on-month contraction and YoY stagnation in January. Sales of pharmaceutical and medical goods and of automotive fuel rose during February after declines in January, but other non-food products either rose by less than in January or fell. These included clothing, electrical goods and furniture, computer equipment and books as well as mail order and internet sales. (Reuters) German industrial output slumps as protectionism angst grows – German industrial output fell by the most in more than two years in February and the sector is losing momentum, the Economy Ministry said, as factories in Europe’s largest economy throttle back in the face of the rising threat of protectionism. Output fell by 1.6% after rising by a revised 0.1% in January, data from the Economy Ministry showed. February’s drop was the biggest since August 2015 and compared with a Reuters consensus forecast for a rise of 0.3%. A breakdown of the data showed a big slump in the production of capital goods, down 3.1% on the month, with output of consumer goods falling 1.5% and intermediate goods down 0.7%. Construction activity was also weaker overall. UniCredit economist Andreas Rees said the weakness across industries suggested a wave of flu might have hit production. The ministry said industry was losing some of its drive. (Reuters) Japan’s long growth run faces turning point as wages, spending fall – Japan’s longest run of economic expansion since the 1980s asset bubble may be entering a turning point, with data out on Friday suggesting consumption will fail to drive growth if trade frictions undermine exports. Household spending shrank 0.9% in February from a year earlier, the biggest drop since a 1.4% fall in April last year, while inflation-adjusted real wages fell for a third straight month in February, undercutting consumer buying power. A slowdown in consumption would be an additional headache for Japanese policymakers, who fret the yen’s recent rises and fears of a trade war hurt the export- reliant economy. (Reuters) Regional IATA: Middle East carriers’ YoY freight volumes increase 7.4% in February – Middle Eastern carriers’ YoY freight volumes increased 7.4% and capacity increased 7.6% in February, the International Air Transport Association (IATA) noted in a report. Seasonally adjusted freight volumes continue to trend upwards, however, they have slowed to an annualized rate of 4% since late 2017, IATA stated. This largely reflects the weak conditions on the Middle Eastern routes to and from Europe, which have seen demand trend downwards at a double-digit rate over the past five months. (Gulf-Times.com) Qatar says too early to exit OPEC oil cuts as investment still low – OPEC and its allies should maintain oil supply curbs to guarantee healthy price levels which will allow increased investment in the industry and help avoid a big supply and price shock in the long run, Qatar’s Energy Minister Mohammed Al-Sada said. He also supported the idea of creating a permanent platform for OPEC’s cooperation with Russia even after the current round of joint oil supply cuts ends. “There is a clear recovery in oil prices. But it has not been met with an increase in investments. Investment has been very low. My concern is that medium- to long-term demand is met comfortably. Investors are still cautious and over- conservative,” Sada said. (Zawya) BCG: GCC banks report 6% profit growth in 2017 – Lower loan loss provisions (LLPs) and better cost management helped mitigate the slowdown in revenues as the GCC banks reported a 6% profit growth in 2017, according to the Boston Consulting Group (BCG). The BCG found that the GCC banks’ revenues grew by 2.3%, down about three percentage points compared to 2016. Reinhold Leichtfuss, Senior Partner and Managing Director at BCG’s Middle East office said, “GCC banks are adapting well to a slowing revenue growth regime and profits climbed more than twice as strong through reduced loan loss provisions as well as tight cost management.” The study revealed that the GCC banking industry’s slowdown in revenues in 2017 was largely on account of major customer segments such as retail and corporate banking. This implies a significant decline in revenue growth rates for four years in a row in most countries. (Gulf-Times.com) Saudi Arabia attracts firms to increase foreign direct investment – Saudi Arabia is attracting a fresh wave of office openings from firms seeking to tap into an increase in foreign direct investment (FDI). Analysis by Arab News reveals that Saudi Arabia is already reaping dividends from Vision 2030 reforms that have opened the country to foreign enterprises and investors, boosting employment for Saudi Arabians and reducing dependence on crude. In a recent deal, Salini Impregilo clinched a $1.3bn contract with the Saudi Arabia National Guard to deliver much-needed housing and urban planning services East of Riyadh. Farouk Soussa, Head of Middle East economics at Citigroup in London, said that key aim of the Saudi Arabian diversification policy was to attract foreign direct investment to bolster investment in the non-oil sector. (GulfBase.com)

- 6. Page 6 of 7 CBUAE’s gold reserves to rise to 9mn tons – A report by the Ministry of Economy predicted that the gold reserves of Central Bank of the UAE (CBUAE) will increase to 9mn tons in 2018, a growth of 19.5%, compared to 7.53% in 2017. The majority of Central Bank’s holdings are usually in various foreign currencies, as they can be used for trading, including for selling and purchasing. The central bank sold all its gold before 2015, but it began to re-constitute its gold reserves during the same year, as well as its basket of foreign currencies, including the US Dollars. (GulfBase.com) Dubai’s house prices, rents drop in 1Q2018 – Dubai’s residential property market continued to soften in 1Q2018, in line with analysts’ forecasts, with rental values recording a more pronounced fall than sales prices. “Upcoming supply will continue to impact occupancy levels in existing stock, thus putting further pressure on rents. Housing allowances for many expats are being realigned in line with changing business activity and hence their appetite for higher ticket properties remains low,” said Manika Dhama, senior consultant at Cavendish Maxwell. The UAE property market has slowed in recent years on the back of a three-year oil slump that has caused job losses, crimped purchasing power, dampened demand and subsequently pushed sales and rental prices of residential units lower. Analysts predict the market will continue to decline, at a slower rate, for much of 2018 before bottoming out later this year. (GulfBase.com) OMV to invest in UAE’s offshore oilfields in $1.5bn deal with ADNOC – Austrian oil and gas group OMV stated that it will take a 20% interest in two oilfields off the United Arab Emirates under a $1.5bn deal agreed with Abu Dhabi National Oil Company (ADNOC). ADNOC is awarding new concessions to foreign investors in a bid to gain access to technology and funding and to secure buyers for its crude. (Reuters) Kuwait reforms lauded for unlocking next level of market – Changes to Kuwait’s equities market are taking the stock exchange to the next level, according to one of the country’s biggest investors. The Gulf nation this week activated the latest round of a market shake-up aimed at attracting investors and initial public offerings. While Kuwait’s new benchmark index has fallen each day since its April 1 debut and is set for a loss of 4% in the past four sessions, the stocks look attractive in the medium- to long-term, said Husayn Shahrur, Managing Director for Middle East and North Africa at NBK Capital. That’s because the country’s economic fundamentals are stronger than its neighbors’, he said. (Gulf-Times.com) Kuwait registers current account surplus for 4Q2017 – Central Bank of Kuwait (CBK) published the preliminary data of the Balance of Payments (BOP) of the State of Kuwait for 4Q2017 and the revised data of 3Q2017. The data shows that the Current Account (summing up receipts and payments between domestic economy and other economies in terms of goods, services and income) recorded a surplus of KD1,108mn against a surplus of KD488mn during the comparative period, representing a hike of KD620mn or 127.1%. The upturn in the current account surplus is due to the appreciation in the surplus of balance on goods and the depreciation in the surplus of primary income on one hand, and the contraction in the services account deficit and the increase in the secondary income deficit on the other. (GulfBase.com) CBO: New foreign investment law to boost capital inflows – Oman’s Foreign Capital Investment Law, currently the subject of a comprehensive revamp, will help enhance inflows of foreign investment, thereby helping fuel the nation’s economic growth, according to Central Bank of Oman (CBO). The CBO stated that the new law aims to, among other objectives, address major concerns regarding foreign investors’ rights and obligations. “The proposed investment law also provides dispute resolution and includes international arbitration. The open nature of the Omani economy allows remittances of equity, debt, capital, interest, dividends, profits and personal savings abroad,” a CBO report noted. (GulfBase.com) Omantel sets up investor roadshow for potential Dollar bond issue – Oman Telecommunications (Omantel) will start meeting investors ahead of a potential US Dollar bond, the company stated. Citi and Credit Suisse have been hired as global coordinators for the potential deal, alongside Bank ABC, Bank Muscat, HSBC and Standard Chartered Bank as joint lead managers to organize fixed income investor meetings in Dubai, London, New York and Boston, the company stated. (GulfBase.com) Bapco approaches banks for multibillion refinery expansion – Bahrain Petroleum Company (Bapco) approached banks to sound their appetite for the financing needed to back the capacity expansion of the existing Sitra oil refinery, a project expected to cost well in excess of $5bn, sources said. The company, advised by BNP Paribas and HSBC, has sent a teaser to commercial banks for a loan likely to be over $1bn. The rest of the project cost will be covered with equity coming from the company, expected to exceed $1bn, and with debt facilities backed by export credit agencies (ECAs), of at least $3bn. (GulfBase.com)

- 7. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mohamed Abo Daff QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mohd.abodaff@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg ( # Market closed on April 6, 2018) Source: Bloomberg (*$ adjusted returns; # Market closed on April 6, 2018) 60.0 80.0 100.0 120.0 140.0 160.0 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 QSE Index S&P Pan Arab S&P GCC 1.0% 1.0% (0.2%) 0.0% 0.1% 1.7% (0.3%)(0.5%) 0.0% 0.5% 1.0% 1.5% 2.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,333.65 0.5 0.7 2.3 MSCI World Index 2,052.78 (1.3) (0.7) (2.4) Silver/Ounce 16.39 (0.0) 0.1 (3.3) DJ Industrial 23,932.76 (2.3) (0.7) (3.2) Crude Oil (Brent)/Barrel (FM Future) 67.11 (1.8) (4.5) 0.4 S&P 500 2,604.47 (2.2) (1.4) (2.6) Crude Oil (WTI)/Barrel (FM Future) 62.06 (2.3) (4.4) 2.7 NASDAQ 100 6,915.11 (2.3) (2.1) 0.2 Natural Gas (Henry Hub)/MMBtu 2.82 0.4 0.4 (8.7) STOXX 600 374.82 (0.0) 0.9 (1.7) LPG Propane (Arab Gulf)/Ton 74.50 (0.3) (6.9) (23.8) DAX 12,241.27 (0.2) 1.1 (3.2) LPG Butane (Arab Gulf)/Ton 76.00 0.7 (2.3) (28.1) FTSE 100 7,183.64 0.5 2.3 (2.7) Euro 1.23 0.3 (0.3) 2.3 CAC 40 5,258.24 (0.0) 1.6 1.1 Yen 106.93 (0.4) 0.6 (5.1) Nikkei 21,567.52 (0.1) (0.3) (0.4) GBP 1.41 0.6 0.5 4.3 MSCI EM 1,161.97 (0.4) (0.8) 0.3 CHF 1.04 0.4 (0.6) 1.6 SHANGHAI SE Composite# 3,131.11 0.0 (1.6) (2.4) AUD# 0.77 0.0 0.1 (1.6) HANG SENG 29,844.94 1.1 (0.8) (0.7) USD Index 90.11 (0.4) 0.1 (2.2) BSE SENSEX 33,626.97 (0.0) 2.3 (2.9) RUB 58.17 0.8 1.8 0.9 Bovespa 84,820.42 (1.6) (2.5) 9.0 BRL 0.30 (0.8) (1.9) (1.7) RTS 1,236.48 (1.4) (1.0) 7.1 85.3 86.08 6.0 84.7 74.7