24 February Daily market report

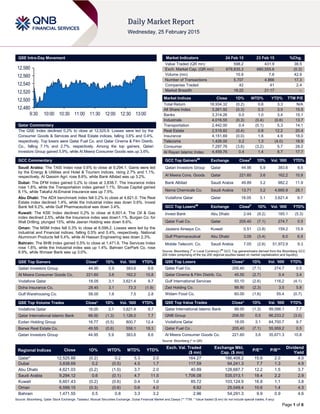

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.2% to close at 12,525.9. Losses were led by the Consumer Goods & Services and Real Estate indices, falling 3.6% and 0.4%, respectively. Top losers were Qatar Fuel Co. and Qatar Cinema & Film Distrib. Co., falling 7.1% and 2.7%, respectively. Among the top gainers, Qatari Investors Group gained 5.9%, while Al Meera Consumer Goods was up 3.6%. GCC Commentary Saudi Arabia: The TASI Index rose 0.6% to close at 9,294.1. Gains were led by the Energy & Utilities and Hotel & Tourism indices, rising 2.7% and 1.1%, respectively. Al Qassim Agri. rose 8.6%, while Bank Albilad was up 3.2%. Dubai: The DFM Index gained 0.2% to close at 3,838.7. The Insurance index rose 1.8%, while the Transportation index gained 1.1%. Shuaa Capital gained 8.1%, while Takaful Al-Emarat Insurance was up 7.5%. Abu Dhabi: The ADX benchmark index fell 0.2% to close at 4,621.0. The Real Estate index declined 1.4%, while the Industrial index was down 0.6%. Invest Bank fell 9.2%, while Gulf Pharmaceutical was down 3.4%. Kuwait: The KSE Index declined 0.2% to close at 6,601.4. The Oil & Gas index declined 2.5%, while the Insurance index was down1.1%. Burgan Co. for Well Drilling. plunged 15%, while Jeeran Holding was down 8.6%. Oman: The MSM Index fell 0.3% to close at 6,599.2. Losses were led by the Industrial and Financial indices, falling 0.5% and 0.4%, respectively. National Aluminium Products fell 5.4%, while Al Hassan Engineering was down 2.3%. Bahrain: The BHB Index gained 0.5% to close at 1,471.6. The Services Index rose 1.6%, while the Industrial index was up 1.4%. Bahrain CarPark Co. rose 8.9%, while Ithmaar Bank was up 3.0%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatari Investors Group 44.95 5.9 383.6 8.6 Al Meera Consumer Goods Co. 221.60 3.6 162.2 10.8 Vodafone Qatar 18.05 3.1 3,621.4 9.7 Doha Insurance Co. 28.45 3.1 73.3 (1.9) Gulf Warehousing Co. 58.00 1.6 7.5 2.8 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 18.05 3.1 3,621.4 9.7 Qatar International Islamic Bank 88.00 (1.3) 1,126.0 7.7 Ezdan Holding Group 16.77 (0.5) 800.7 12.4 Barwa Real Estate Co. 49.55 (0.6) 558.1 18.3 Qatari Investors Group 44.95 5.9 383.6 8.6 Market Indicators 24 Feb 15 23 Feb 15 %Chg. Value Traded (QR mn) 598.2 431.9 38.5 Exch. Market Cap. (QR mn) 678,835.3 680,555.6 (0.3) Volume (mn) 10.9 7.6 42.9 Number of Transactions 5,707 4,866 17.3 Companies Traded 42 41 2.4 Market Breadth 18:22 21:17 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,934.32 (0.2) 0.6 3.3 N/A All Share Index 3,261.92 (0.3) 0.3 3.5 15.5 Banks 3,314.26 0.0 1.0 3.4 15.1 Industrials 4,016.55 (0.3) (0.4) (0.6) 13.7 Transportation 2,442.00 0.4 (0.1) 5.3 14.1 Real Estate 2,518.82 (0.4) 0.8 12.2 20.4 Insurance 4,151.69 (0.0) 1.6 4.9 18.0 Telecoms 1,426.00 0.2 1.3 (4.0) 18.9 Consumer 7,297.76 (3.6) (3.2) 5.7 28.0 Al Rayan Islamic Index 4,459.76 0.4 1.4 8.7 17.7 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Qatari Investors Group Qatar 44.95 5.9 383.6 8.6 Al Meera Cons. Goods Qatar 221.60 3.6 162.2 10.8 Bank Albilad Saudi Arabia 49.89 3.2 982.2 11.9 Nama Chemicals Co. Saudi Arabia 13.71 3.2 4,665.9 28.1 Vodafone Qatar Qatar 18.05 3.1 3,621.4 9.7 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Invest Bank Abu Dhabi 2.44 (9.2) 165.1 (5.3) Qatar Fuel Co. Qatar 205.40 (7.1) 274.7 0.5 Jazeera Airways Co. Kuwait 0.51 (3.8) 159.2 15.9 Gulf Pharmaceutical Abu Dhabi 3.09 (3.4) 8.0 6.9 Mobile Telecom. Co. Saudi Arabia 7.05 (2.6) 51,972.9 9.3 Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Fuel Co. 205.40 (7.1) 274.7 0.5 Qatar Cinema & Film Distrib. Co. 45.50 (2.7) 0.4 3.4 Gulf International Services 93.10 (2.6) 116.2 (4.1) Zad Holding Co. 88.90 (2.3) 3.5 5.8 Widam Food Co. 60.00 (1.6) 55.4 (0.7) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Qatar International Islamic Bank 88.00 (1.3) 99,096.1 7.7 QNB Group 206.50 0.5 66,233.2 (3.0) Vodafone Qatar 18.05 3.1 64,700.7 9.7 Qatar Fuel Co . 205.40 (7.1) 55,959.2 0.5 Al Meera Consumer Goods Co. 221.60 3.6 35,671.3 10.8 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 12,525.88 (0.2) 0.2 5.3 2.0 164.27 186,408.2 15.6 2.0 4.0 Dubai 3,838.69 0.2 (0.5) 4.5 1.7 117.59 94,241.3 7.7 1.3 4.9 Abu Dhabi 4,621.03 (0.2) (1.0) 3.7 2.0 40.89 128,687.7 12.2 1.5 3.7 Saudi Arabia 9,294.12 0.6 (0.1) 4.7 11.5 1,706.08 535,013.1 18.4 2.2 2.9 Kuwait 6,601.43 (0.2) (0.6) 0.4 1.0 85.72 103,124.9 16.8 1.1 3.8 Oman 6,599.15 (0.3) (0.6) 0.6 4.0 8.82 25,049.4 10.6 1.4 4.3 Bahrain 1,471.55 0.5 0.8 3.3 3.2 2.96 54,291.3 9.9 0.9 4.6 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 12,480 12,500 12,520 12,540 12,560 12,580 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index declined 0.2% to close at 12,525.9. The Cons. Goods & Ser. and Real Estate indices led the losses. The index fell on the back of selling pressure from Qatari shareholders despite buying support from non-Qatari shareholders. Qatar Fuel Co. and Qatar Cinema & Film Distribution Co. were the top losers, falling 7.1% and 2.7%, respectively. Among the top gainers, Qatari Investors Group gained 5.9%, while Al Meera Consumer Goods Co. was up 3.6%. Volume of shares traded on Tuesday rose by 42.9% to 10.9mn from 7.6mn on Monday. However, as compared to the 30-day moving average of 14.9mn, volume for the day was 26.5% lower. Vodafone Qatar and Qatar International Islamic Bank were the most active stocks, contributing 33.2% and 10.3% to the total volume respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings and Global Economic Data Earnings Releases Company Market Currency Revenue (mn) 4Q2014 % Change YoY Operating Profit (mn) 4Q2014 % Change YoY Net Profit (mn) 4Q2014 % Change YoY Abu Dhabi National Company for Building Materials* Abu Dhabi AED 25.3 -55.1% – – 4.7 NA Oman Ceramic Co. (OCC)* Oman OMR 4.1 8.6% – – 0.2 1551.6% National Aluminium Products Co. (NAPCO)* Oman OMR 19.4 4.0% – – 0.7 -42.2% Al Madina Insurance Co. (Al Madina Takaful)* Oman OMR 23.1 30.6% – – 1.0 -56.4% Asaffa Foods* Oman OMR 30.2 6.0% – – 6.4 -10.3% Takaful International Co.* Bahrain BHD 20.8 2.7% – – -0.8 NA Bahrain Family Leisure Co (BFLC)* Bahrain BHD 1.3 -9.4% – – 2.0 69.6% Source: Company data, DFM, ADX, MSM (*FY2014 resutlts) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 02/24 US S&P/Case-Shiller S&P/Case-Shiller US HPI MoM December 0.73% – 0.76% 02/24 US S&P/Case-Shiller S&P/Case-Shiller US HPI YoY December 4.62% – 4.66% 02/24 US S&P/Case-Shiller S&P/Case-Shiller US HPI NSA December 166.82 – 166.96 02/24 EU Conference Board CPI MoM January -1.60% -1.60% -0.10% 02/24 France Eurostat Business Confidence February 94 95 94 02/24 France INSEE Manufacturing Confidence February 99 99 100 02/24 Germany INSEE Private Consumption QoQ 4Q2014 0.80% 0.70% 0.80% 02/24 Germany Federal Statistical Off. Government Spending QoQ 4Q2014 0.20% 0.20% 0.60% 02/24 Germany Federal Statistical Off. Capital Investment QoQ 4Q2014 1.20% 0.80% -1.20% 02/24 Germany Federal Statistical Off. Construction Investment QoQ 4Q2014 2.10% 1.00% -1.50% 02/24 Germany Federal Statistical Off. Domestic Demand QoQ 4Q2014 0.50% 0.60% -0.40% 02/24 Germany Federal Statistical Off. Exports QoQ 4Q2014 1.30% 1.20% 2.00% 02/24 Germany Federal Statistical Off. Imports QoQ 4Q2014 1.00% 1.00% 1.30% 02/24 Italy Federal Statistical Off. Current Account Balance December 5,177M – 3,378M Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari 66.07% 72.73% (39,860,959.54) Non-Qatari 33.93% 27.26% 39,860,959.54

- 3. Page 3 of 6 News Qatar QNNS reports 10% YoY increase in FY2014 net profit – Qatar Navigation (QNNS) recorded a rise of 10% YoY in its FY2014 bottom-line to QR1.05bn (in-line with our estimate of QR983mn) from QR950mn in FY2013. Operating revenue was up 14% YoY to QR2.63bn while operating profit was almost flat at QR648mn in FY2014 versus QR644mn in FY2013. EPS increased to QR9.23 in FY2014 from QR8.36 in FY2013. Meanwhile, the board of directors has proposed to distribute QR5.50/share cash dividend, which translates into a yield of 5.3%. (QSE, QNBFS Research) ERES reports QR1.3bn net profit in FY2014 – Ezdan Holding Group (ERES) reported a net profit of QR1.3bn in FY2014 as compared to QR1.1bn in FY2013. EPS in FY2014 totaled QR0.51 as compared to QR0.40 in FY2013. Meanwhile, the board of directors has recommended a cash dividend of 4% (QR0.4 per share), subject to approval in the annual general meeting. (QSE) Ashghal awards QR1.25bn contracts for building 23 schools – The Public Works Authority (Ashghal) has awarded contracts worth QR1.25bn for the construction of 23 schools, including six kindergartens, across Qatar. The contracts awarded are part of a package worth QR3bn, while the remaining works already are in progress in different parts of the country. The new buildings are to be completed by 3Q2016. The new schools will come up in Al Wajbah (three schools), Al Rayyan, Al-Kabaan (two each), Al Dhakira, Al Karaana, Al Shahaniya, Onaiza, Al Ruwais, Mesaieed (two each), Mesaimeer and Umm al Saneem (three each). Meanwhile, Ashghal’s President Nasser Ali al-Mawlawi said that thirty-three new schools and kindergartens will be able to start functioning in their new complexes in the forthcoming academic year. He said that the work of the new schools to be opened next academic year is in the final stages, and a sum of QR1.78bn was earmarked for their construction. Almost 98% of the work on the 23 of those 33 schools to be opened shortly is completed. (Gulf- Times.com) CMC calls for permanent Woqod fuel stations at Al Shamal – The Central Municipal Council (CMC) has recommended that permanent Woqod (QFLS) fuel stations need to be established at Al Shamal to cater for the rising demand of fuel. The CMC also recommended that more mobile stations should be distributed across the country due to the lack of an adequate number of fuel stations. (Gulf-Times.com) Louis Berger Egis Rail JV bags Doha Metro contract – The Louis Berger Egis Rail Joint Venture (JV) has been commissioned by Qatar Railways Company to provide project management consultancy services for all elevated and at-grade sections of the Doha Metro project. The value of the contract is $79mn. (Qatar Tribune) QSE suspends trading of KCBK shares on February 25 – The Qatar Stock Exchange (QSE) has announced a suspension of trading in Al Khalij Commercial Bank’s (KCBK) shares on February 25, 2015 due to the company’s AGM and EGM being held on that day. (QSE) SIIS announces agenda for AGM; QSE suspends share trading – Salam International Investment Ltd (SIIS) has announced the agenda for its annual general assembly meeting (AGM). The agenda includes renewing the approval of the board of director’s authorization on trading of real estate properties as well as applying for loans. The company’s shareholders will also renew the approval for the joint venture projects with sister company Salam Bounian and hold loans along with the issuance of letters of credit & guarantees as required. Meanwhile, the Qatar Stock Exchange (QSE) has announced a suspension of trading in SIIS’ shares on February 25, 2015 due to the company’s AGM being held on that day. (QSE) AHCS to hold AGM, EGM on March 16 – Aamal Company (AHCS) has invited its shareholders to attend company’s annual ordinary and extra-ordinary general assembly meeting (AGM and EGM) on March 16, 2015. In case required quorum is not met, the second meeting will be held on March 23, 2015. Shareholders in AGM will approve the board of director’s (BoD) proposal to distribute 10% cash dividend and 5% bonus shares of the company’s shares nominal value. Shareholders in EGM will discuss BoD’s proposal to raise foreign ownership limit up to 49%. Shareholders will also approve the suggestion of AGM to increase share capital by 5% aggregating 30mn shares to become 630mn shares and amend the Articles of Association accordingly. (Gulf-Times.com) MRDS BoD to meet on March 12 – Mazaya Qatar Real Estate Development Company’s (MRDS) board of directors has called for a meeting on March 12, 2015 to discuss the audited financial results of the year ended December 31, 2014. (QSE) QIGD postpones AGM – Qatari Investors Group’s (QIGD) board of directors has postponed the ordinary and extra-ordinary general assembly meeting due to lack of quorum. The company will hold its second meeting on March 1, 2015 at 4:00pm. (QSE) QCB announces holiday on March 1 – Qatar Central Bank (QCB) has announced that March 1, 2015 will be an official holiday for banks and financial institutions under its jurisdiction. The closure of banks, exchange outlets, investment companies and financing firms on that date comes in line with cabinet decision No. 33 of 2009. (Peninsula Qatar) QIF: GCC, MENA firms listing on QSE likely – The Qatar Stock Exchange (QSE) is likely to see listing of companies from across the GCC and MENA region, as part of its three-phase development program to make Qatar an attractive investment destination for global fund managers. Qatar Investment Fund (QIF) noted that QSE is expected to introduce securities lending and borrowing, margin trading and central counterparties for attracting foreign investors and improving operational efficiency. Meanwhile, the market regulator, the Qatar Financial Markets Authority has set the guidelines for investors looking to undertake margin trading on QSE. (Peninsula Qatar) QA denies withdrawing from Japan, adds code-share routes with Bangkok Airways – Qatar Airways (QA) has denied rumors that it is withdrawing from Japan and reiterated its commitment to continue with its three routes to the country. QA Group CEO Akbar al-Baker said the airline is looking forward to enhancing its operations in Japan. Meanwhile, the airline has added more code-share routes with Bangkok Airways. Now, passengers travelling toward code-share destinations from Bangkok can fly QA’s A380 aircraft, which commenced service to the city in December 2014, while those travelling onward from Phuket will also benefit from the airline’s direct daily service from Doha. (Gulf-Times.com) International US consumer confidence pulls back from multi-year high; services activity rises – According to a report by the Conference Board, a private industry group, consumer confidence in the US fell more than expected in February, pulling back from a multi-year high. The report said its index of consumer attitudes fell to 96.4 from an upwardly revised 103.8

- 4. Page 4 of 6 in January. According to Reuters, the February reading was the lowest for the index since September 2014, and was below economist expectations for a reading of 99.6. The January figure was the highest since August 2007. Meanwhile, financial data firm Markit said the US services sector expanded in February at its fastest pace since October, with businesses reporting rising orders due to improving economic conditions. Markit said its preliminary reading of the Purchasing Managers Index (PMI) for the service sector rose to 57.0 in February from a final reading of 54.2 in January. Markit's reading of new business among service companies in February surged to 56.7 from 51.7 in January, which was the lowest reading in the Markit services sector series since October 2009. (Reuters) OECD: UK should press on with austerity plans – The Organization for Economic Cooperation & Development (OECD) said that Britain should continue to cut its budget deficit after the national election in May 2015, and might need to rethink plans to shield healthcare and schools spending. With the coming elections shaping up to be one of the most unpredictable elections in modern British history, all main parties have promised to maintain spending on schools and health. However, the Paris-based think-tank said this continuation might impose unacceptably high cuts in other areas. The opposition Labor party plans to balance the government's books, excluding investment spending, within the next parliament. The ruling Conservative Party says it intends to balance the budget completely and return a small surplus. The OECD cited research suggesting that protecting areas such as health and education from spending cuts would imply average spending cuts elsewhere of almost 40% until 2019-20. (Reuters) Plunging energy costs deflate Eurozone prices in January – A sharp drop in energy prices pulled down the Eurozone consumer prices in January to levels last seen during the global financial crisis, with only Malta and Austria escaping deflation. The EU's statistics office Eurostat said prices in the Eurozone were 0.6% lower YoY, confirming its earlier flash estimate. Deflation was the deepest in Greece in January, followed by Spain, while almost all Eurozone countries had negative inflation rates, hurt by the biggest drop in energy prices since September 2009. Back then, the Eurozone was suffering from the financial crisis that morphed into its own debt crisis. Inflation was negative from June to October 2009. The 0.6% decline in January matched the lowest figure last seen in July 2009. (Reuters) Eurozone backs Greek reform plan, four-month aid extension – Greece secured a four-month extension of its financial rescue when its Eurozone partners approved a reform plan that backed down on key leftist measures and promised that spending to alleviate social distress would not derail its budget. Finance ministers sealed the deal during a conference convened by Eurozone Chairman Jeroen Dijsselbloem after the new Athens government sent him a detailed list of reforms it plans to implement by July 2015. The ministers reviewed a document signed by Marxist Finance Minister Yanis Varoufakis that watered down campaign promises to halt privatization, boost welfare spending and raise the minimum wage, vowing to consult partners before key reforms and to keep them budget- neutral. Both the European Commission and the International Monetary Fund called the Greek document sufficiently comprehensive to be a valid starting point for a successful conclusion of the review. The Eurozone urged Greece to broaden the list of reform measures based on the current arrangement – a euphemism for the bailout agreement which Prime Minister Alexis Tsipras had vowed to scrap. Meanwhile, the IMF Chief Christine Lagarde said the Greek reform plan is sufficient to continue giving the country aid, but is lacking necessary details. (Reuters) China February flash HSBC PMI at 4-month high, export orders contract – A private survey showed activity in the Chinese factory sector edged up to a four-month high in February, but export orders shrank at their fastest rate in 20 months, painting a murky outlook that argues for more policy support. The flash HSBC/Markit Purchasing Managers' Index (PMI) inched up to 50.1 in February, a whisker above the 50- point level on a monthly basis. Reuters had forecast a reading of 49.5, little changed from January's final PMI of 49.7. However, even as factory activity grew marginally, the survey suggested that manufacturers still faced considerable risks from weak foreign demand and deepening deflationary pressures. While domestic demand picked up slightly, the sub-index for new export orders shed 3 points from January to skid to 47.1, the sharpest rate of contraction since June 2013. (Reuters) Regional Mobily chairman quits – Etihad Etisalat Company’s (Mobily) Chairman Abdulaziz Al-Saghyir has stepped down from his position due to health reasons, but will remain on Mobily's board. Meanwhile, the company has appointed Suliman bin Abdulrahman Al-Gwaiz as chairman, effective from February 23, 2015. (Reuters) IDB picks arrangers for dollar Sukuk offering – Islamic Development Bank (IDB) is set to meet fixed income investors ahead of a potential dollar-denominated Sukuk transaction. The AAA-rated IDB has chosen nine banks namely CIMB, Dubai Islamic Bank, GIB Capital, HSBC, Natixis, NCB Capital, National Bank of Abu Dhabi, RHB Islamic Bank and Standard Chartered to arrange the Sukuk sale. (Reuters) RAKBANK raises additional $300mn in bonds – National Bank of Ras Al Khaimah (RAKBANK) has successfully raised an additional $300mn funding as an add-on to its existing $500mn 3.25% bond due in June 2019. The funding falls under RAKBANK’s $1bn Euro Medium Term Note (EMTN) program, which was set up in June 2014. (GulfBase.com) DAE to sell StandardAero – According to sources, Dubai Aerospace Enterprise (DAE), an aircraft leasing and maintenance company controlled by the government of Dubai, is looking to sell its aviation services unit, StandardAero, for more than $1.8bn. DAE is working with investment bank Moelis & Company on an auction for StandardAero that is expected to start later in 2015. (Reuters) Al Ain Insurance AGM approves AED60mn cash dividends – Al Ain Al Ahlia Insurance Company’s ordinary general assembly meeting (AGM) has approved the distribution of cash dividend representing 40% of the capital, totaling AED60mn. The board had previously recommended a cash dividend of 35% amounting to AED52.5mn for 2014. (ADX) ADA revenues reach AED1bn in 2014 – Abu Dhabi Airports (ADA) has announced that Abu Dhabi Airport Duty Free achieved sales exceeding AED1bn in 2014, representing a rise of 10.5% YoY. Beauty and Fragrance emerged as the biggest selling product categories in 2014, with a 31% share of Duty Free turnover increasing sales by 9.7% over 2013. Indian, Chinese and Emirati passengers continued to account for the highest share of sales at the airport (36%). In addition, passenger spending registered an increase throughout the year. (GulfBase.com) Zain seeks to repatriate $280mn from Sudan – Mobile Telecommunications Company’s (Zain) Chaiman, Asaad Ahmad

- 5. Page 5 of 6 Al-Banwan said that Kuwait and Sudan are in talks to help telecom operator repatriate $280mn worth of Sudanese pounds. Zain has long faced difficulties changing revenue earned in Sudanese pounds into other currencies. (Reuters) Burgan Bank 4Q2014 net profit surges 424% – Kuwait’s Burgan Bank reported a net profit of KD13.1mn in 4Q2014, up 424% as compared to KD2.5mn in 4Q2013. The bank’s annual profit was KD61.8mn in 2014 as compared to KD20.1mn in 2013. Burgan Bank has proposed a dividend of KD0.015 per share and 5% bonus share issue for 2014. (Reuters) OCC seeks shareholders’ nod for 30% cash dividend – Oman Cement Company (OCC) has invited its shareholders to consider and approve the board of directors’ recommendation to distribute cash dividends of 30% of the capital, i.e. baizas 30 per share. (MSM) Gulf Hotels (Oman) BoD recommends 35% cash dividend – Gulf Hotels (Oman) Company’s board of directors (BoD) has recommended a cash dividend of 35% of the paid-up share capital i.e. baizas 350 per share for the financial year ended December 31, 2014. This proposal is subject to approval at the forthcoming annual general meeting of shareholders. (MSM) NBI seeks shareholders’ nod for 15% cash dividend – National Biscuit Industries (NBI) has invited its shareholders to consider and approve the board of directors’ recommendation to distribute cash dividends of 15% of the paid-up share capital, i.e. baizas 150 per share. (MSM) Sharqiyah Desalination Company’s BoD proposes 6% dividend – Sharqiyah Desalination Company’s board of directors has proposed a dividend distribution of 6% of the share capital (baizas 60 per share) amounting to OMR586,813 for 2014. (MSM) UPC seeks shareholders’ nod for dividend issuance, capital reduction – United Power Company (UPC) has invited its shareholders to approve the reduction of the company’s capital from OMR5mn to OMR2mn and to authorize the board of directors to act accordingly. The shareholders will also consider BoD’s recommendation to distribute cash dividends of 30% of the nominal value i.e., baizas 300 per share to holders of ordinary shares and 32.8% of the nominal value i.e., baizas 328 per share to preference shareholders. (MSM) Duqm-Jebel Ali feeder service expected to commence in April 2015 – Port of Duqm CEO Reggy Vermeulen said that a feeder container shipping service is being planned between Jebel Ali and Duqm in April 2015 to meet the growing demand for shipping goods to the Al Wusta region in south-east Oman. The new service is aimed at transporting operational cargo for the oil & gas industry as well as support the development of the Oman drydock and consumer goods needed in the Al Wusta region. (GulfBase.com) GCC Stat: Oman’s inflation lowest in GCC region – According to the latest report released by the Statistical Centre for the Cooperation Council for the Arab Countries of the Gulf (GCC Stat), inflation rates across the GCC region ranged between 3.1% and 0.8% over a 12-month period ended December 2014. The highest annual inflation rise was registered in the UAE with 3.1%, followed by 3.04% in Kuwait, 2.7% in Qatar, 2.5% in Bahrain and 2.4% in Saudi Arabia. Oman registered the lowest rise, as compared to the other GCC countries, by 0.08%. (GulfBase.com) CBB Sukuk Al-Salam securities oversubscribed by 235% – The Central Bank of Bahrain (CBB) announced that the monthly issue of the Sukuk Al-Salam Islamic securities for the BHD36mn issue, which carries a maturity of 91 days, has been oversubscribed by 235%. The expected return on the issue, which matures on May 25, 2015, is 0.72%. The securities are issued by the CBB on behalf of the Government of Bahrain. (GulfBase.com) BFLC not to distribute dividends for 2014 – Bahrain Family Leisure Company’s (BFLC) board of directors has decided not to distribute dividends to its shareholders for the financial year ended December 31, 2014. (Bahrain Bourse) TIC not to distribute dividends for 2014 – Takaful International Company’s (TIC) board of directors has decided not to distribute dividends for the financial year ended December 31, 2014. (Bahrain Bourse) ASSB AGM approves 5% cash dividend – Al Salam Bank – Bahrain’s (ASSB) annual general meeting (AGM) has approved the distribution of 5% cash dividend (5 fils per share) of the paid- up capital. (Bahrain Bourse) SIB successfully exits UK financing transaction – Seera Investment Bank (SIB), a Bahrain-based Islamic investment bank, has successfully exited a Shari’ah-compliant financing transaction to develop a student accommodation property in London, UK. The property consists of 346 student rooms and 37,000 square feet of commercial space and has been fully let on a long-term basis to a prominent higher education institution. The financing generated a total return on investment of around 50% over a holding period of two-and-a-half years and an internal rate of return (IRR) close to 20%. (GulfBase.com)

- 6. Contacts Saugata Sarkar Abdullah Amin, CFA Shahan Keushgerian Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6569 Tel: (+974) 4476 6509 saugata.sarkar@qnbfs.com.qa abdullah.amin@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa Badar Husain Sahbi Kasraoui Ahmed Al-Khoudary Head of Trading Manager – HNWI Head of Sales Trading – Institutional Tel: (+974) 4476 6547 Tel: (+974) 4476 6544 Tel: (+974) 4476 6548 badar.husain@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa ahmed.alkhoudary@qnbfs.com.qa QNB Financial Services SPC Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns; # Market closed on 24 February 2015) 80.0 100.0 120.0 140.0 160.0 180.0 200.0 220.0 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 QSE Index S&P Pan Arab S&P GCC 0.6% (0.2%) (0.2%) 0.5% (0.3%) (0.2%) 0.2% (0.6%) 0.0% 0.6% 1.2% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,200.44 (0.1) (0.1) 1.3 MSCI World Index 1,774.92 0.3 0.4 3.8 Silver/Ounce 16.29 (0.3) 0.3 3.7 DJ Industrial 18,209.19 0.5 0.4 2.2 Crude Oil (Brent)/Barrel (FM Future) 58.66 (0.4) (2.6) 2.3 S&P 500 2,115.48 0.3 0.2 2.7 Crude Oil (WTI)/Barrel (FM Future) 49.28 (0.3) (2.1) (7.5) NASDAQ 100 4,968.12 0.1 0.2 4.9 Natural Gas (Henry Hub)/MMBtu 3.13 (2.0) 4.6 4.4 STOXX 600 387.25 0.6 0.8 5.9 LPG Propane (Arab Gulf)/Ton 59.63 0.8 0.4 21.7 DAX 11,205.74 0.7 0.9 6.6 LPG Butane (Arab Gulf)/Ton 65.25 0.4 (0.4) 4.0 FTSE 100 6,949.63 0.6 0.9 5.0 Euro 1.13 0.0 (0.4) (6.3) CAC 40 4,886.44 0.5 0.6 7.1 Yen 118.97 0.1 (0.1) (0.7) Nikkei 18,603.48 0.7 1.4 7.1 GBP 1.55 (0.0) 0.4 (0.8) MSCI EM 987.89 0.4 0.4 3.3 CHF 1.05 (0.1) (1.3) 4.6 SHANGHAI SE Composite# 3,246.91 0.0 0.0 (0.4) AUD 0.78 0.4 (0.1) (4.2) HANG SENG 24,750.07 (0.3) (0.3) 4.8 USD Index 94.49 (0.1) 0.3 4.7 BSE SENSEX 29,004.66 0.5 (0.3) 7.6 RUB 62.90 (1.3) 1.4 3.6 Bovespa 51,874.17 2.6 2.8 (3.1) BRL 0.35 1.6 1.2 (6.4) RTS 888.69 (2.4) (2.4) 12.4 180.0 140.9 128.8